Are you tired of holidays sneaking up on you, such as Christmas, and wishing you would’ve started saving money for gifts much earlier in the year?

There’s a better way to save money for holidays and it’s called sinking funds. Here you’ll learn everything you need to know about sinking funds for beginners and why you need them in your budget.

With sinking funds, you can save for anything you want. That means you can save up for a nice vacation, a new car, a wedding, birthday gifts, and even to upgrade your kitchen.

Instead of swiping your credit card in a panic, then figuring out how to pay for it later, you’ll use cash that you’ve been setting aside each month to cover any Christmas-related costs.

After I shared how my boyfriend and I save 50% of our income in this blog post, I’ve been getting a lot of questions about sinking funds – what exactly are sinking funds and how to use them to save money.

Today I want to discuss everything you need to know about sinking funds and how you can start using them to prevent stress.

There’s no reason to risk wrecking your budget for your next holiday or any other large expense. Keep it simple by creating sinking funds. Learn how you can get started in this quick guide to sinking funds for beginners.

Related Posts:

- How to build your emergency fund (Free Printable)

- 48 creative ways to save money on a tight budget

- Sinking funds trackers + Top sinking fund categories

Table of Contents

What is the purpose of a sinking fund?

A sinking fund means you save up a small amount of money each month for a certain period of time. This is a strategic way to save for planned expenses, such as a new car, a vacation or Christmas.

How much you need to save will be dependent on your goal. For example, you know that you’ll need to do some home repairs within the next year, but you don’t know when exactly or how much it will cost.

If you know approximately how much the expense will cost, take the total amount to be spent and divide it by the number of weeks or months you have left until you’ll need to spend the money.

For example, if you want to spend $1,000 on a vacation that’s three months away, then you’ll need to save around $330 every month until your trip’s departure date.

Why is it called a sinking fund?

I can appreciate how the word “sinking” might sound negative. Traditionally, a sinking fund is a fund that contains money set aside (or saved) to pay off a debt.

When a company issues a debt that will need to be paid off in the future, a sinking fund can help them gradually save money so it becomes less painful when paying it off.

In your own personal finances, you can follow the same strategy by setting aside money each month (or each paycheck) to ensure there is enough cash to pay off debt or save up for a purchase. This was made popular by Dave Ramsey.

Why you need a sinking fund

Having a sinking fund can help you save money, so you’ll be prepared to cover expected expenses without having to dip into your emergency fund or go into debt.

The typical budget is designed to cover expenses on a monthly basis or by paycheck (if you budget by paycheck). However, we all have expenses that occur on an annual, irregular, or sometimes unpredictable basis.

A sinking fund can help you plan for these large expenses by setting aside a small amount each month, so you’ll have the money available to pay for these expenses, without stress or worry.

Still on the fence about having a sinking fund? Here are a few more ways having a sinking fund can benefit you:

You can save for anything you want – big or small. All you need to do is come up with a goal or something you really want to buy. You can be as specific as you’d like.

You can save for fun things. Saving money doesn’t just have to be to cover bills or medical expenses.

You can also create sinking funds to save up for fun things, such as buying a new wardrobe, going on a dream vacation, starting your own business, or giving your kitchen a makeover. It’s up to you!

Sinking funds are a great option for those on a tight budget. If you’re on a strict budget, it can be hard to find any wiggle room for unexpected or large expenses. This can make you vulnerable to debt.

Setting aside just a few dollars a day for each of your sinking funds can provide a safety net. This can be easier than trying to scramble together money at the last minute for an unplanned expense.

Sinking funds provide a financial safety net for those unexpected expenses. Let’s say you know your house is going to need a new roof in the next couple of years.

You don’t know when exactly or how much it will cost, but you can create a sinking fund to start saving now so you’ll be prepared for this future cost.

This can help make these big purchases less stressful. A sinking fund can also be set up for unpredictable expenses, such as car repairs.

As you can see, there are many reasons why you need a sinking fund and how it can help alleviate some of the stress of planned or unplanned expenses. It can also help reduce those guilty feelings you might experience when making a large purchase.

Essential Sinking Funds

There are many different ways you can use a sinking fund. For example, you can create a sinking fund for a planned expense (a trip to Paris), an annual expense (back-to-school supplies), or an unplanned expense (car repairs).

Even if you don’t know the exact cost, it’s still a good idea to create sinking funds for major expenses. This can help ensure that you’ll have the money to cover most (if not all) of the expense.

For example, last year my laptop suddenly stopped working as I was in the middle of releasing a new product in the Mint Notion Shop.

I knew my laptop was older and might need to get replaced eventually, but I didn’t know when or how much it would cost exactly.

I created a sinking fund for a laptop so I would be ready to purchase it with cash when I needed a new one.

Making a big unplanned purchase can be stressful, but I was able to buy a new laptop without having to dip into my emergency fund. This is the power of having a sinking fund.

What are examples of sinking funds?

Below are some other essential sinking funds you may want to consider including in your budget:

- Medical costs

- Car repairs / maintenance

- Holidays

- Gifts

- Charity & donations

- Vacation fund

- College tutition sinking fund

- Back-to-school fund

- Pet fund

- Emergency fund

- Downpayment on a home fund

- House repairs / maintenance

- Baby fund

- Clothing fund

- Date night fund

What’s the difference between a sinking fund and an emergency fund?

A sinking fund is different than an emergency fund. An emergency fund is money set aside for unplanned or unknown expenses.

Most financial experts recommend having at least 3-6 months of living expenses saved up for in your emergency fund. However, if you can afford to do so, I recommend having at least 9-12 months’ worth of living expenses saved up.

It’s hard to predict what’s going to happen in the future (such as a job loss), but at least we can prepare by creating an emergency fund.

With a birthday sinking fund, you know exactly what the money is for and when you’ll need to use it. A sinking fund is for expected costs and an emergency fund is for unknown expenses.

What’s the difference between a sinking fund and a savings account?

A sinking fund and a savings account are very similar. The key difference is that a sinking fund is usually more specific than a regular savings account.

For example, you can create a sinking fund for a new TV that you want to purchase for Black Friday. You may not know exactly how much it will cost, but you can set a rough estimate and save up towards this purchase.

A savings account on the other hand is used to help you work towards building wealth and saving for those life experiences you want to have.

While you can lump all your savings into one account, it’ll take a lot of discipline to keep your savings separate from the money you want to use to for other important things you’re saving up for.

I recommend creating a separate line in your monthly budget, ideally under the “savings” section. Then, write down what you would like to call your sinking fund. For example, if you’re creating a sinking fund for Christmas, you may want to label it as “Christmas” or “Christmas Fund”.

You can create a separate savings account for your Christmas sinking fund to keep it safe and away from your other savings goals. Just make sure that it doesn’t require a minimum balance to maintain so you don’t have to worry about paying any extra fees.

If you prefer to keep everything in one savings account, that’s fine too. You’ll just need to be extra careful about tracking each of your major sinking funds (deposits and withdrawals) and making sure that you’re not dipping into your long-term savings.

How many sinking funds should I create?

There are no set rules on what a sinking fund should be used for or how many you should create. It all depends on your goals and lifestyle.

One thing to keep in mind though is that sinking funds are typically short-term savings goals.

These are the things that you’ll need to pay for or buy within a few months or a few years. For example, you would create a sinking fund to save money to upgrade your kitchen next year. Your retirement fund on the other hand, is not a sinking fund.

Investing your money in the short-term is not recommended. This is why your sinking fund should be easily accessible. You can keep it in a checking account or a savings account.

Most sinking funds fit into one of the following three sinking funds categories:

- Large planned purchases (new car, new phone, family vacation)

- Annual expenses that may have been overlooked (insurance bills, taxes, school tuition)

- Unexpected expenses (car repairs, home repairs, replacing a laptop, medical expenses)

Here is a sinking funds list of different categories you may want to consider including in your monthly budget, depending on your lifestyle and goals.

- Christmas

- Gifts

- Birthdays

- Holidays and special occasions (Thanksgiving, Easter, Halloween, Valentine’s Day, Fourth of July)

- Medical

- Taxes

- Wedding

- Car sinking fund

- Home sinking fund

- School and education fees

- Pets

- Kids sports and activities

- Dentist

- Utilities

- Life insurance

- Travel

- Clothes (kids clothing, work clothing, seasonal clothing)

- Furniture sinking fund

- Electronics sinking fund

- Annual membership fees and subscriptions

How to set up a sinking fund

You can save money for your sinking funds in a regular checking or savings account. I personally use a checking account to cover my regular monthly expenses and a savings account for my sinking funds.

While you may choose to open a new savings account to store all your sinking funds, there is no need to create separate savings account for each sinking fund category. It’s too much work to keep track of.

If you’re storing all your savings in one account, you’ll want to be diligent about keeping track of how much you allocate to each sinking fund category.

This can help you stay motivated to stick to your savings goals and prevent you from spending that money on something it wasn’t intended for.

Here is a general idea of how to set up your sinking funds. Of course, you’ll want to tailor it to your own personal circumstances and goals.

- Decide which sinking fund categories you’d like to create.

- Determine the amount you’re looking to save in each category.

- Write down the deadline (or due date) to save up in each category. How many months do you want to save over?

- Divide the total amount needed in each category by the number of months until you need it.

- Set up automatic transfers from your checking account to your sinking fund account every month.

For example, you want to go on a trip to Paris in eight months. You’ve budgeted $2,000 for the trip, which means you’ll need to save around $250 per month for the next eight months.

Here’s another sinking funds example:

$500 per month divided into five sinking fund categories:

- $150 for family vacation

- $100 for a new refrigerator

- $50 for Christmas gifts

- $100 for work clothes

- $100 for car repairs

At the end of the year, your sinking funds will equal:

- $1,800 for family vacation

- $1,200 for a new refrigerator

- $600 for Christmas gifts

- $1,200 for work clothes

- $1,200 for car repairs

If you want to take a family vacation, you have the option to book a trip for $1,800 or you can continue to save money until your sinking fund reaches the amount needed for your dream vacation.

The whole point of having a sinking fund is to allow you to plan and save money so you go on a vacation, upgrade your refrigerator, buy nice Christmas gifts, get new clothes for work, and be prepared for any car repair costs.

You don’t have to worry about dipping into your emergency fund or going into debt to cover these expenses.

How to organize sinking funds in your monthly budget

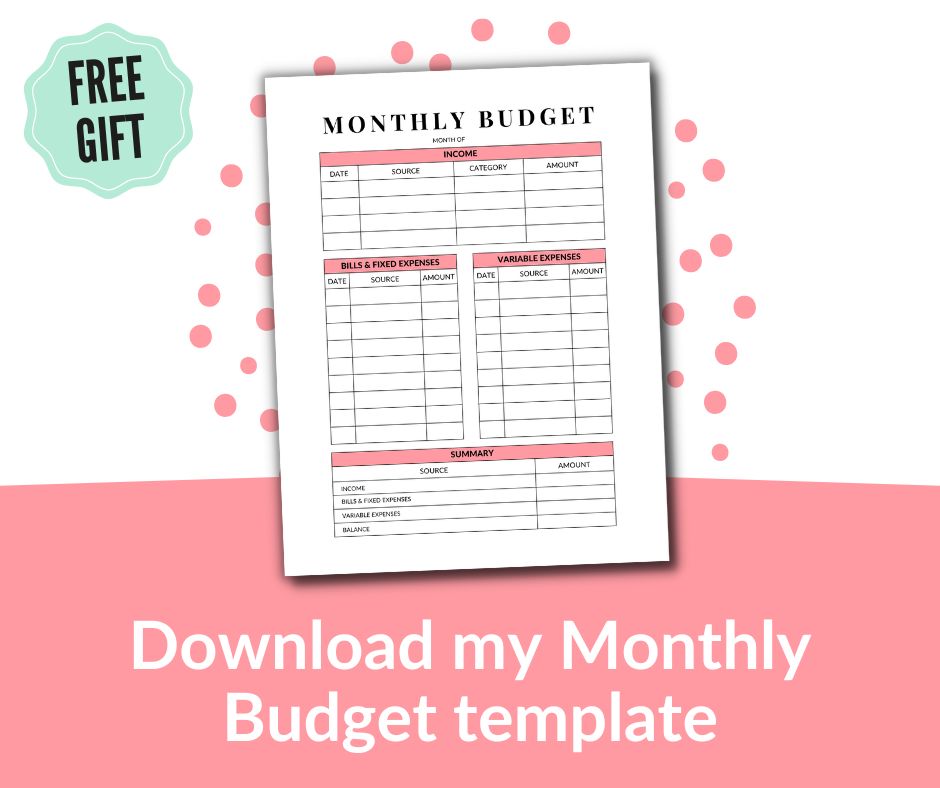

It’s a simple process to organize your sinking funds in your monthly budget.

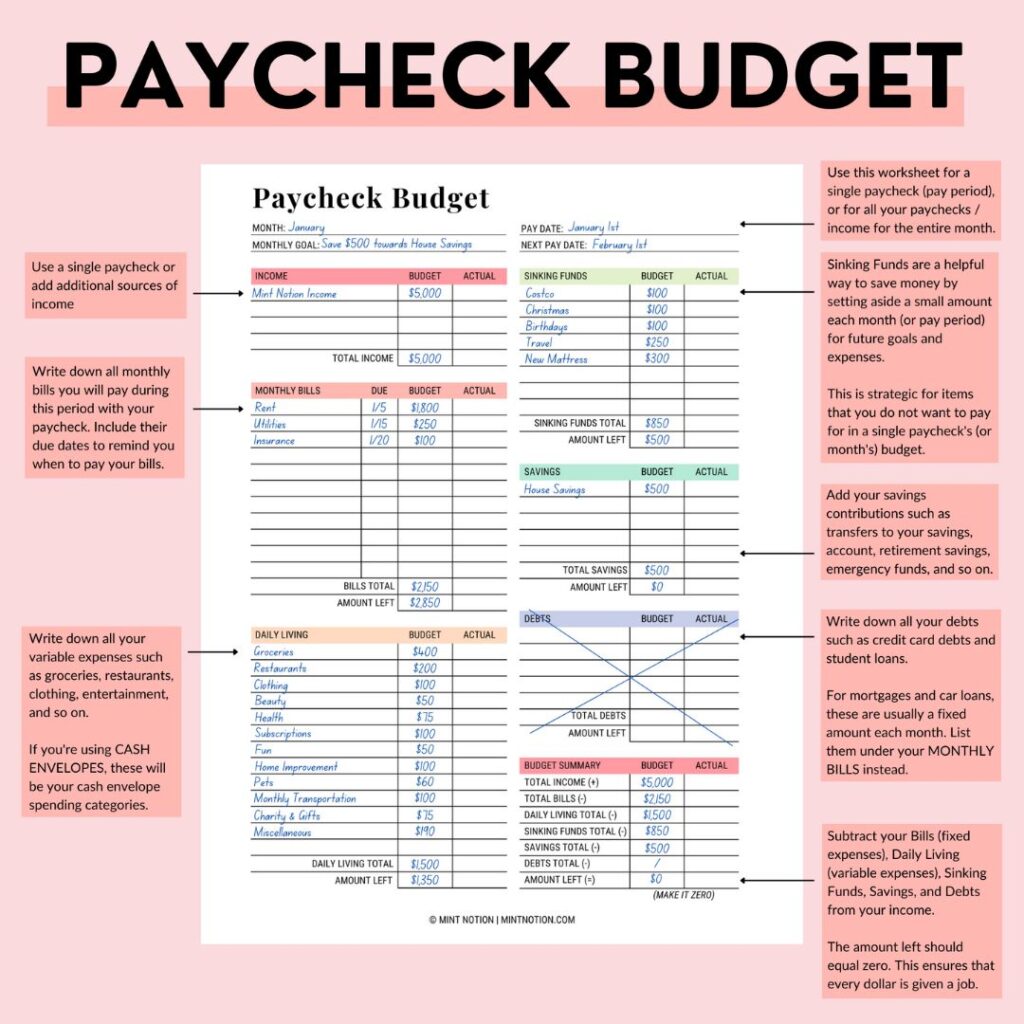

Start by creating a separate line in your monthly budget for each of your sinking fund categories, ideally under the “savings” section. Then, write down what you would like to call your sinking fund.

For example, if you’re creating a sinking fund to upgrade your kitchen, you may want to label it as “Kitchen Makeover”. Write down how much you would like to save in each sinking fund category every month.

Here’s how I like to track and include sinking funds in my monthly budget. This printable worksheet is included in my Budget Binder.

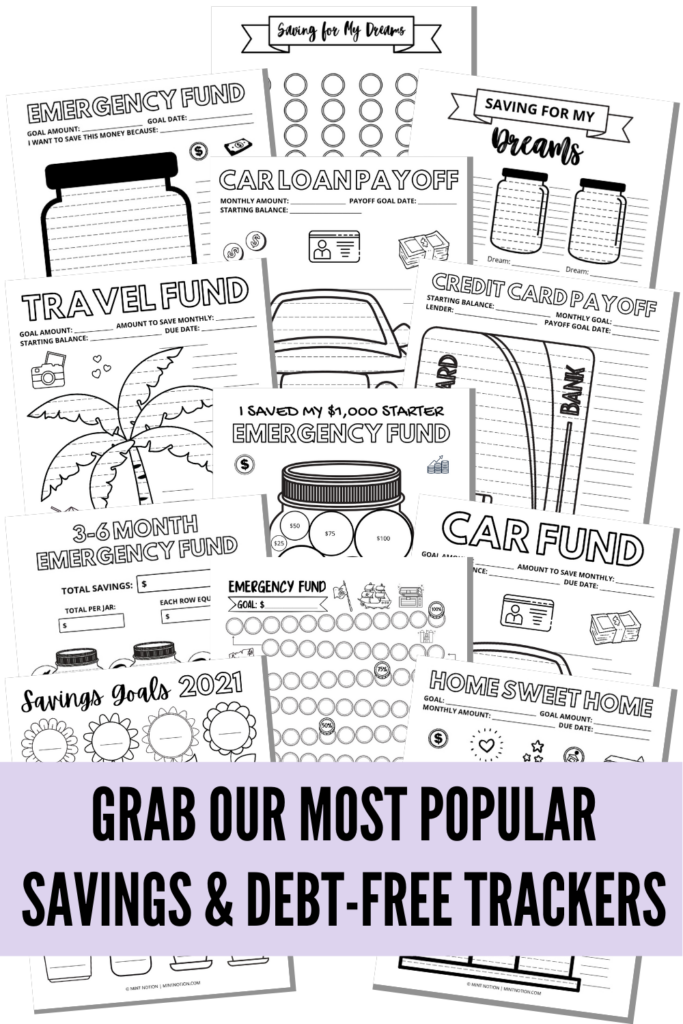

One way that I find helpful when working towards my savings goals is to have a visual template of my progress.

For example, I like using this printable sinking funds tracker below to keep track of my Christmas sinking fund.

I break down my savings goal into 12 steps (1 step per month) and write the amount on each level of the Christmas tree, with my final goal amount on the top.

I color in each level as I hit my savings goal, which is fun to do and helps me stay motivated to keep it up.

Final Note

Setting up your sinking funds doesn’t have to be hard. By creating your sinking funds now, this can help you reach your financial goals faster and reduce money stress. It’s that simple.

We all know that we need to start saving up for Christmas or birthdays. But it’s easy to let things sit on the back burner because it’s months down the road and we tell ourselves that “I’ll start saving for it later”.

Instead of letting these things sneak up on you and bust your budget, start by creating a sinking fund today so you can plan ahead and be prepared for these costs.