Budgeting by paycheck is a simple and effective way to manage your money. It can be an excellent method for those who get paid biweekly. If you’re new to budgeting or struggled to stick to a budget in the past, keep reading to learn how to create a biweekly budget.

If you get paid biweekly, you may find that creating a biweekly budget much easier to stick to than the traditional one-month budget.

A biweekly budget is just like a monthly budget, except you’ll be following a more detailed and intentional approach.

How to budget biweekly paychecks in 7 easy steps:

1. List all your bills

2. Fill out a monthly budget calendar

3. Set aside money for savings

4. Create your monthly spending categories

5. Write your first biweekly budget (Paycheck #1)

6. Write your second biweekly budget (Paycheck #2)

7. Track your spending

Related Posts:

- How to budget when you live paycheck to paycheck

- What is a zero-based budget?

- What is the 50/30/20 budget rule and how it works

Table of Contents

What does it mean to get paid biweekly?

When you get paid biweekly, this means you’ll receive 26 paychecks per year. Since there are 52 weeks in a year, this means most months you’ll receive two paychecks. There will be two months out of the year where you’ll receive three paychecks.

How to budget when you get paid twice a month

You may be wondering is biweekly pay is the same as getting paid twice a month. It’s actually different.

Those who get paid twice a month will only receive 24 paycheck per year. This means they won’t benefit from that third paycheck twice a year that biweekly pay experiences.

Whether you’re paid biweekly or twice a month, you can follow these simple steps to help you budget and manage your money.

How to make a budget for beginners (Step-by-Step Video)

If you need some more guidance, check out this video where you’ll learn how to make a budget for beginners.

1. List all your bills

The first step is to figure out what your monthly bills are and when they are due. To do this, simply grab a piece of paper and write down all your bills.

Not sure what your bills are? If this is your first time doing this, you’ll want to print out your monthly bank statements for the past 2-3 months.

Go through each transaction and highlight the bills that come out every month. Then add these bills to your list of recurring bills.

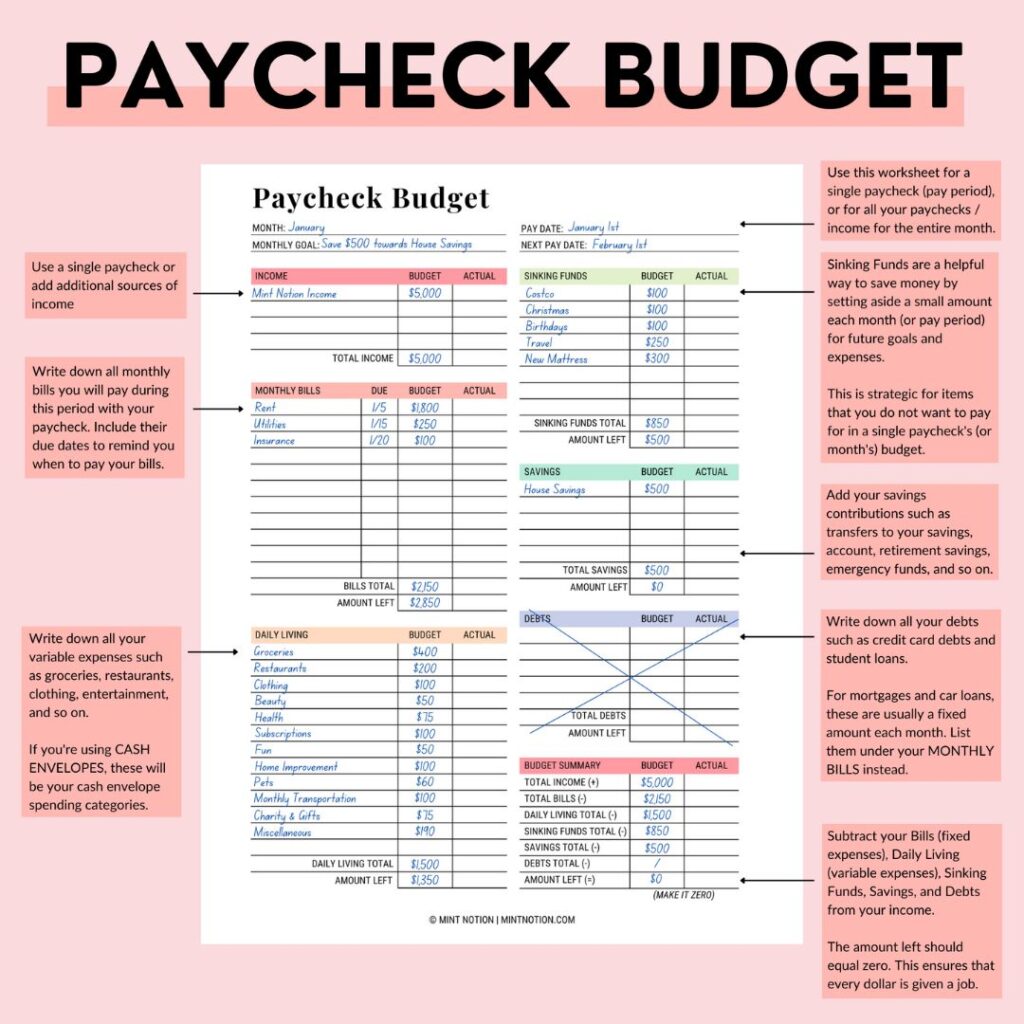

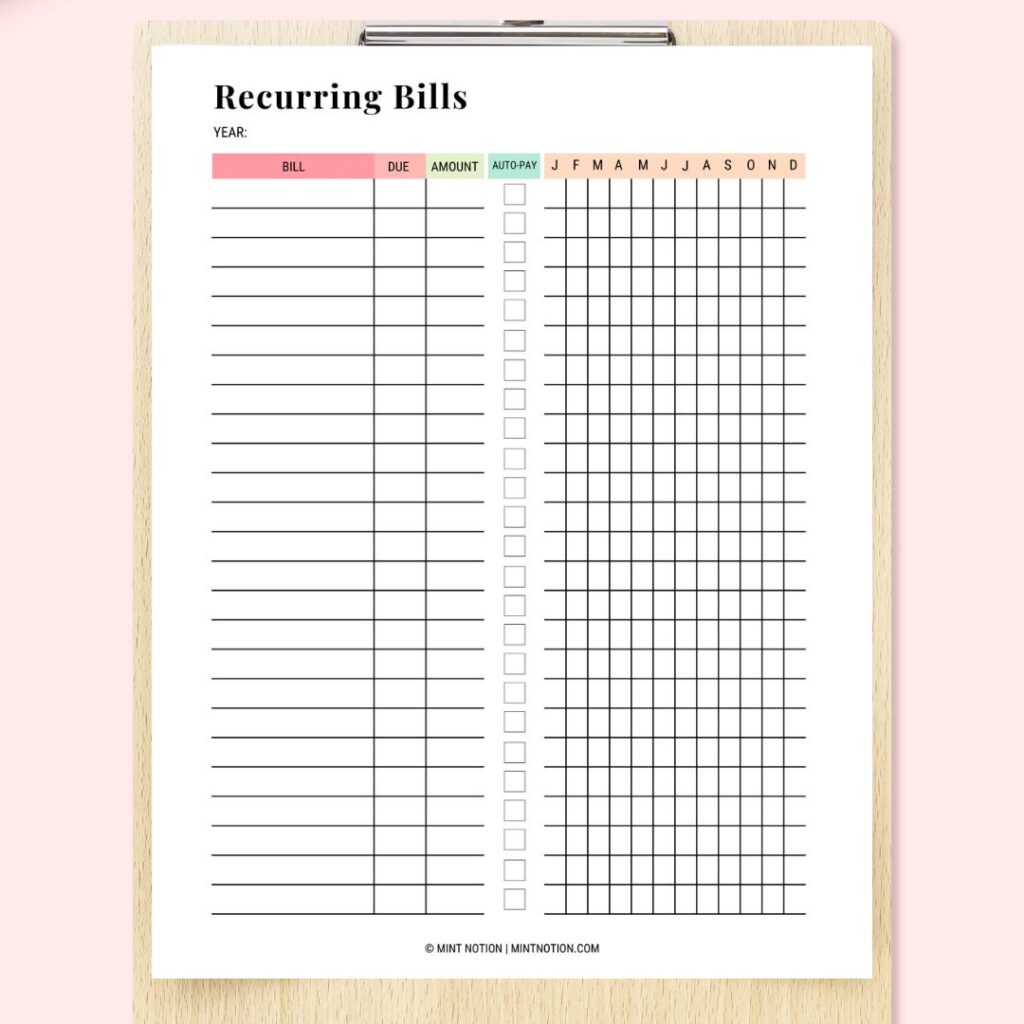

I like to use this Recurring Bill worksheet to help me organize and keep track of all my bills and fixed expenses (including annual, quarterly, and monthly bills).

This ensures that I don’t forget anything or miss an important bill payment. On the worksheet, you can:

- Write down your bill

- When it’s due

- Wow much it will cost

- If you have it on auto-pay

- Which months you’ll need to pay the bill.

For example, I pay my Spotify subscription each month, but my Beach Body fitness subscription is paid on an annual basis.

You can make your own or grab the one I use here in my Bi-Weekly Budget Planner.

Examples of monthly fixed expenses:

- Rent / mortgage

- Cell phone

- Internet

- Cable TV

- Utilities

- Insurance

- Child Care

- Subscription services

- Minimum payments on debts (car loan, student loan, credit cards)

PRO TIP:

Don’t forget about your irregular bills that are due annually or quarterly! Knowing exactly what expenses are due that month can help ensure that you’re prepared and make your budget work more effectively.

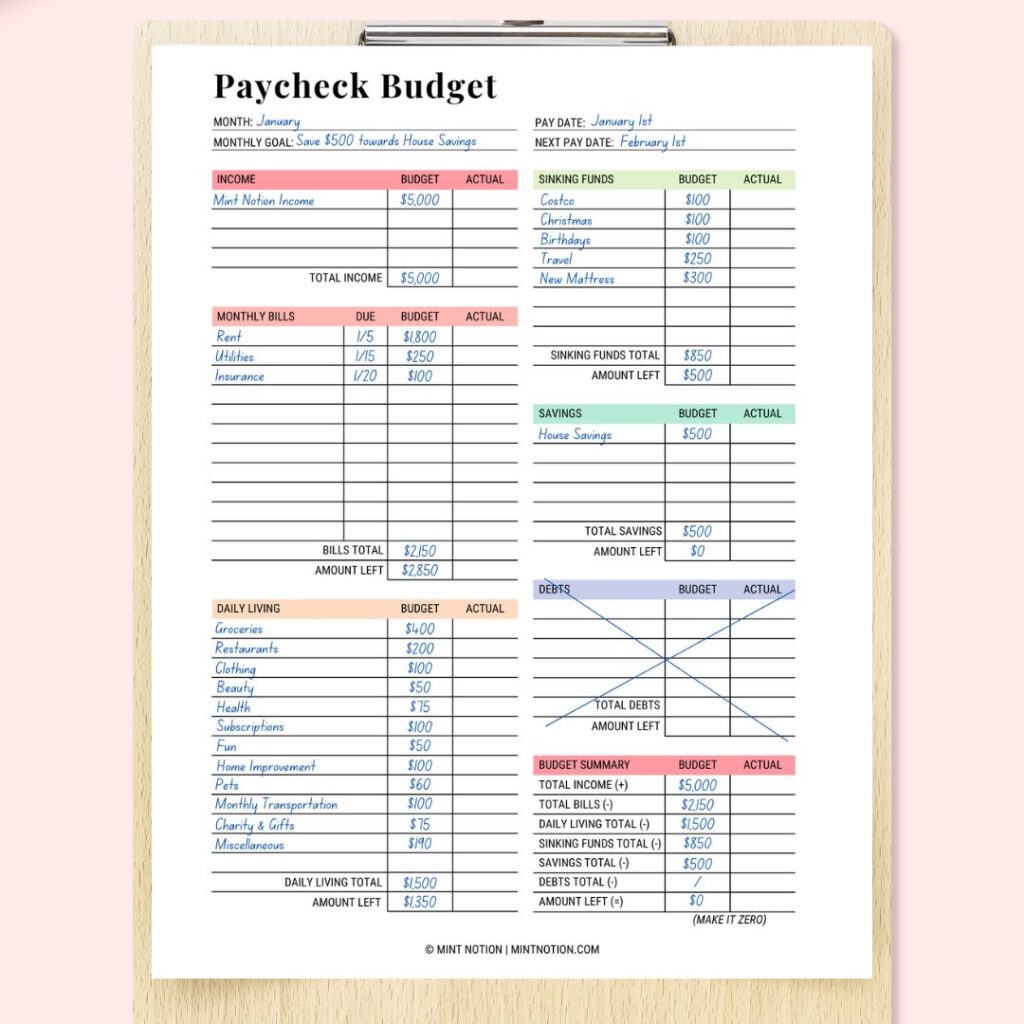

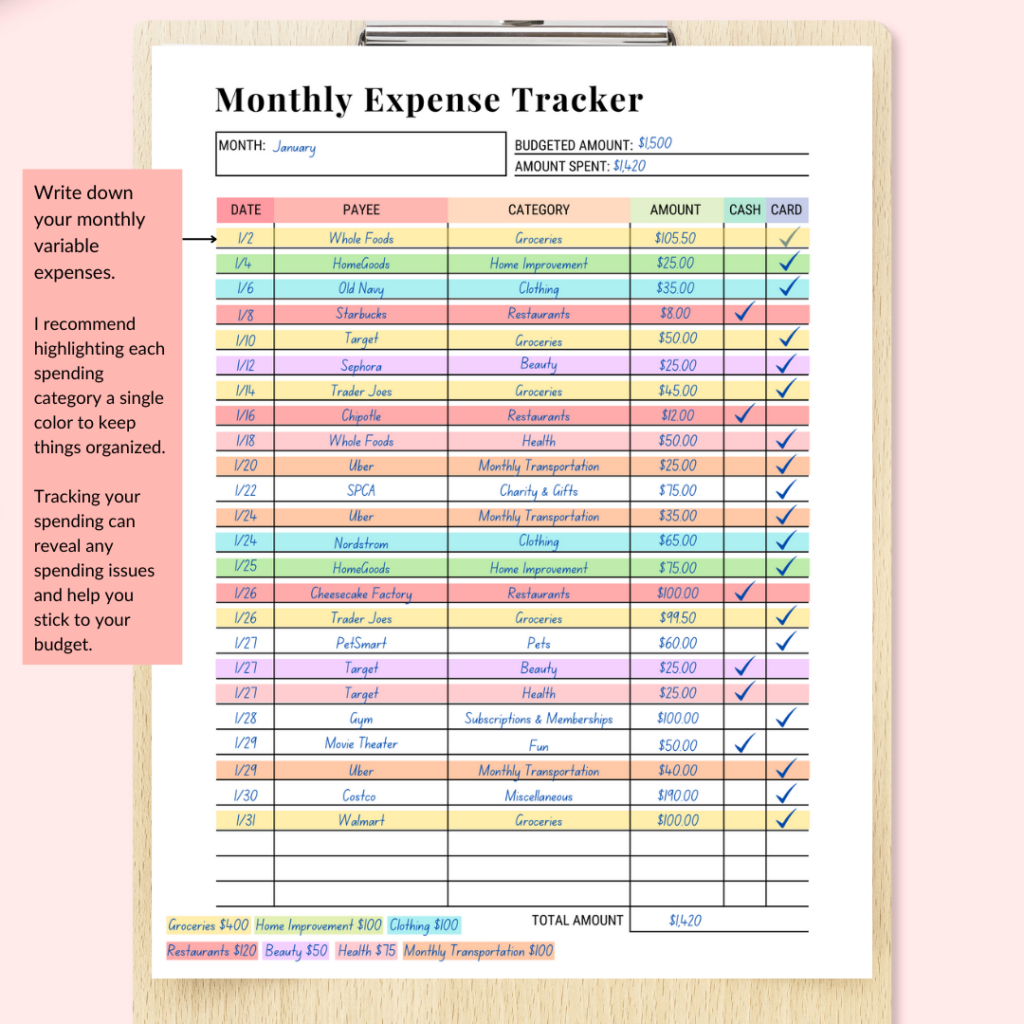

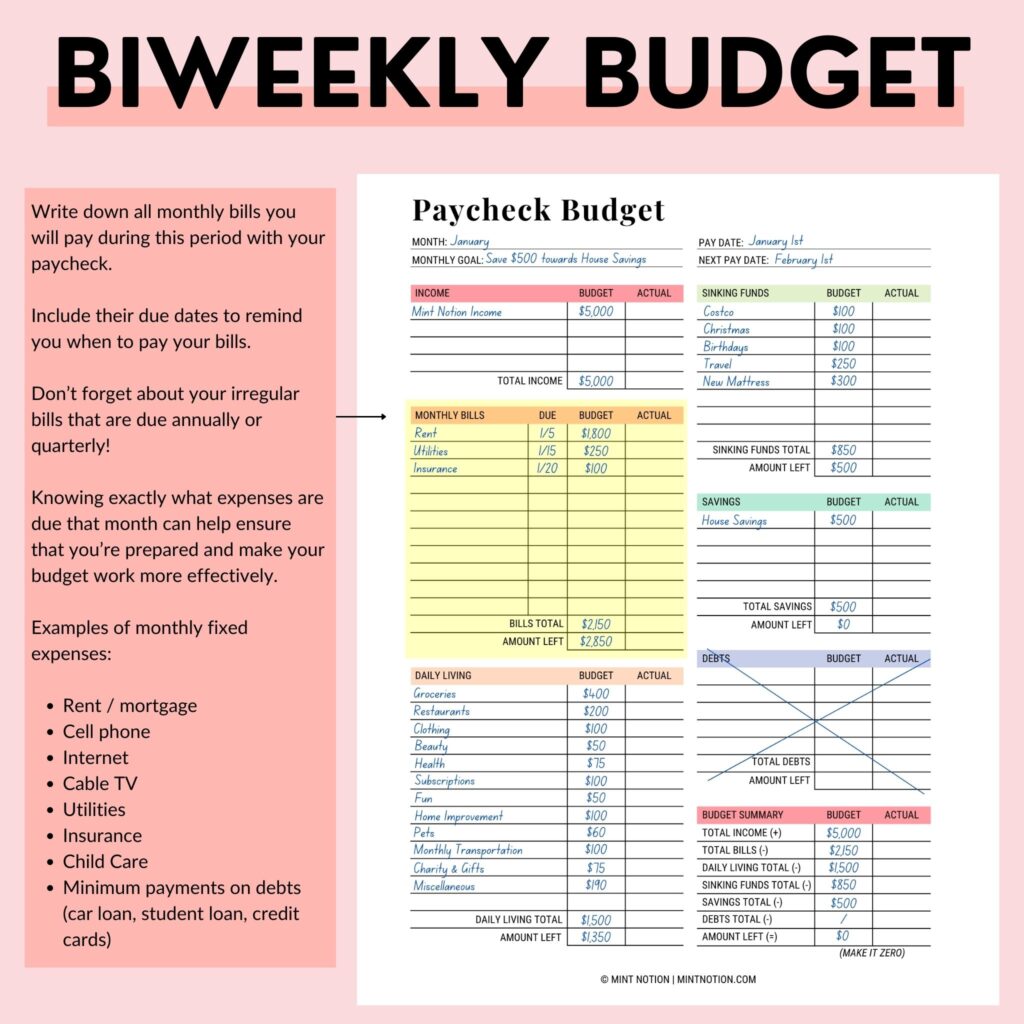

Below is an example of how you would write down your monthly bills on your biweekly budget template. This is the exact same template I use to create my biweekly spending plan.

Read Next: 50 creative ways to save money on a tight budget

2. Write down your paydays and bills on a monthly budget calendar

If you’re a visual person like me, then I highly recommend using a monthly budget calendar to help you stay on top of your bills.

What’s a budget calendar? A monthly budget calendar can be an excellent tool to help you see when you get paid, when your bills are due, your savings contributions, and upcoming special events or holidays. You can learn more about how to use a budget calendar here.

How to use a budget calendar when you get paid biweekly

1) Paydays and monthly bills – Write down when you get paid on your budget calendar. This is your biweekly income. Then write down all your bills to their appropriate due date on your budget calendar.

If you want to be super organized, highlight all the bills that will be paid from your first paycheck using ONE color (I used yellow in the example above). This will be the bills covered during this pay period.

Then highlight all the bills that will come out from your second paycheck with a different color (I used green in the example above).

If you have a big expense that requires money from multiple paychecks (such as your rent or mortgage), you can follow the half-payment method.

What’s the half-payment method?

2) Automatic payments and savings contributions – For payments that are automatically withdrawn from your bank account each month, you may want to consider putting an asterisk* next to these bills.

This is just a helpful way to remind yourself which bills are paid automatically, and which bills need to be paid manually.

3) Special events and holidays – This is also a great time to think about what special events or holidays are coming up this month.

Birthdays, school field trips, lunch dates with friends, doctor’s appointments, and vacations can all impact your budget. It’s important to plan ahead so you can budget accordingly for these things.

Once you’ve finished filling out your monthly budget calendar, make sure to put it somewhere that’s easy to see.

Hang it up on your family commend center, your office, your fridge, or put it inside your Budget Binder. You’ll want to reference your budget calendar throughout the month to help you stay on track and organized.

Read Next: How to budget with an irregular income

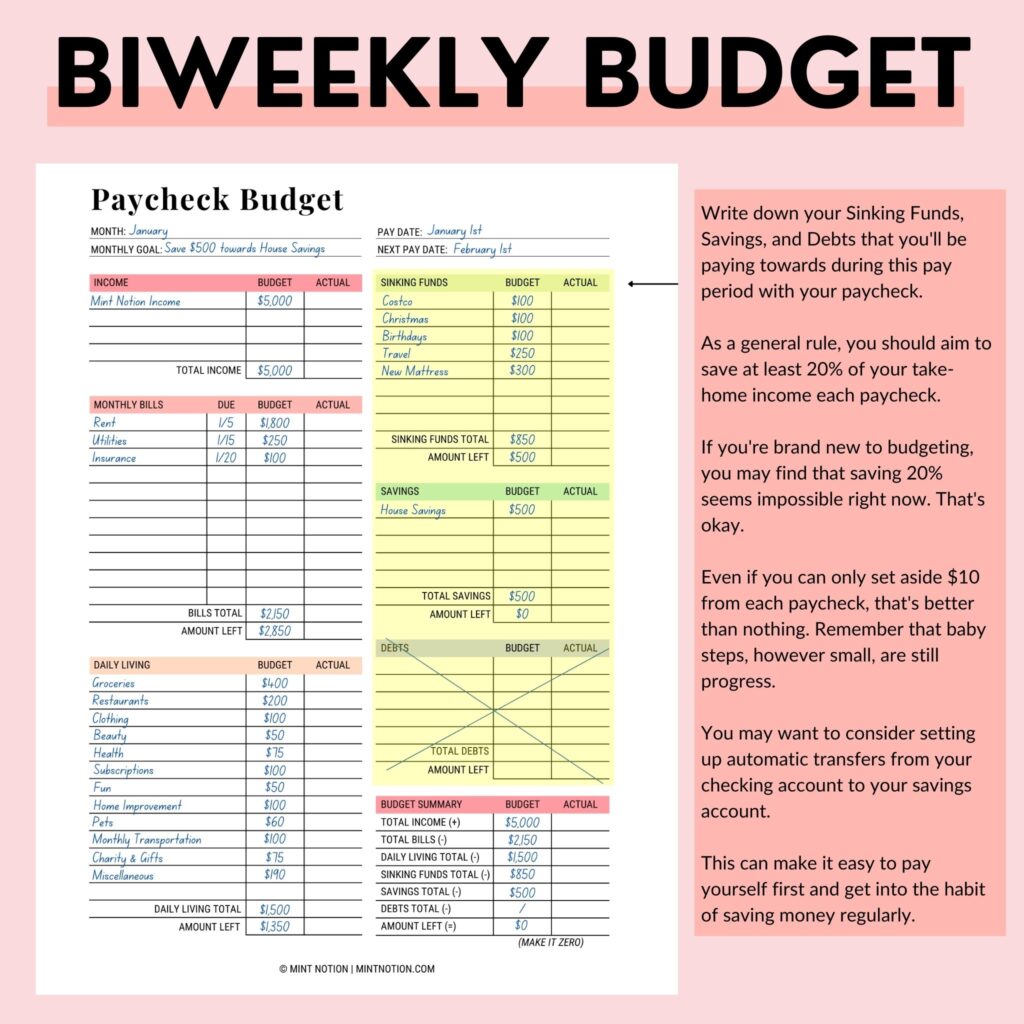

3. Set aside money for savings and investments (retirement)

One of the best money habits I’ve adopted is making sure to set aside money from each paycheck to put towards my savings. This means if you get paid biweekly, you’ll also want to save biweekly.

How do you save money when you get paid every 2 weeks?

You may want to consider setting up automatic transfers from your checking account to your savings account. This can make it easier to build an emergency fund without thinking about it.

Even if it’s just $10 from each paycheck. Every little bit helps.

$10 might seem like a small amount, but everyone has to start somewhere. It can help you get into the habit of saving money and paying yourself first. Then once your income starts to grow, you can put more money towards your financial goals.

How much of my biweekly paycheck should I save?

As a general rule, you should aim to save at least 20% of your take-home income each paycheck.

For example, if you’re following the 50/30/20 budget rule, this means you’ll want to set aside:

- 50% of your paycheck to put towards your needs (living essentials)

- 30% towards your wants

- 20% towards savings and debt payments

If you’re brand new to budgeting, you may find that saving 20% seems impossible right now. Don’t worry. Even if you can only set aside $10 from each paycheck, that’s better than nothing.

Remember that baby steps, however small, are still progress.

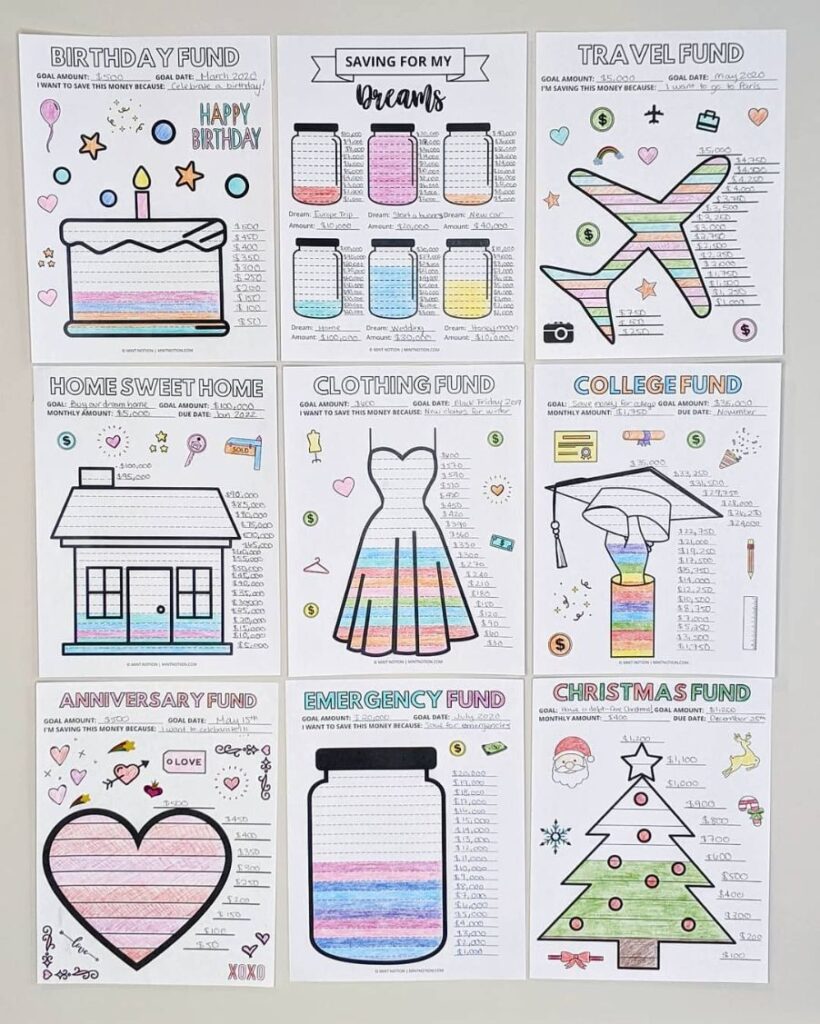

PRO TIP: One method that keeps me motivated to stick to my savings goals is to use a visual aid like these savings and debt payoff coloring sheets. I love to hang these savings trackers on the wall because it reminds me of my goal each day. It’s a great way to keep your eye on the prize!

Read Next: What is the 70-20-10 buget rule?

4. Create your monthly spending categories

Now that you have your monthly bills and fixed expenses listed, and set aside money for savings, it’s time to budget for your monthly variable expenses.

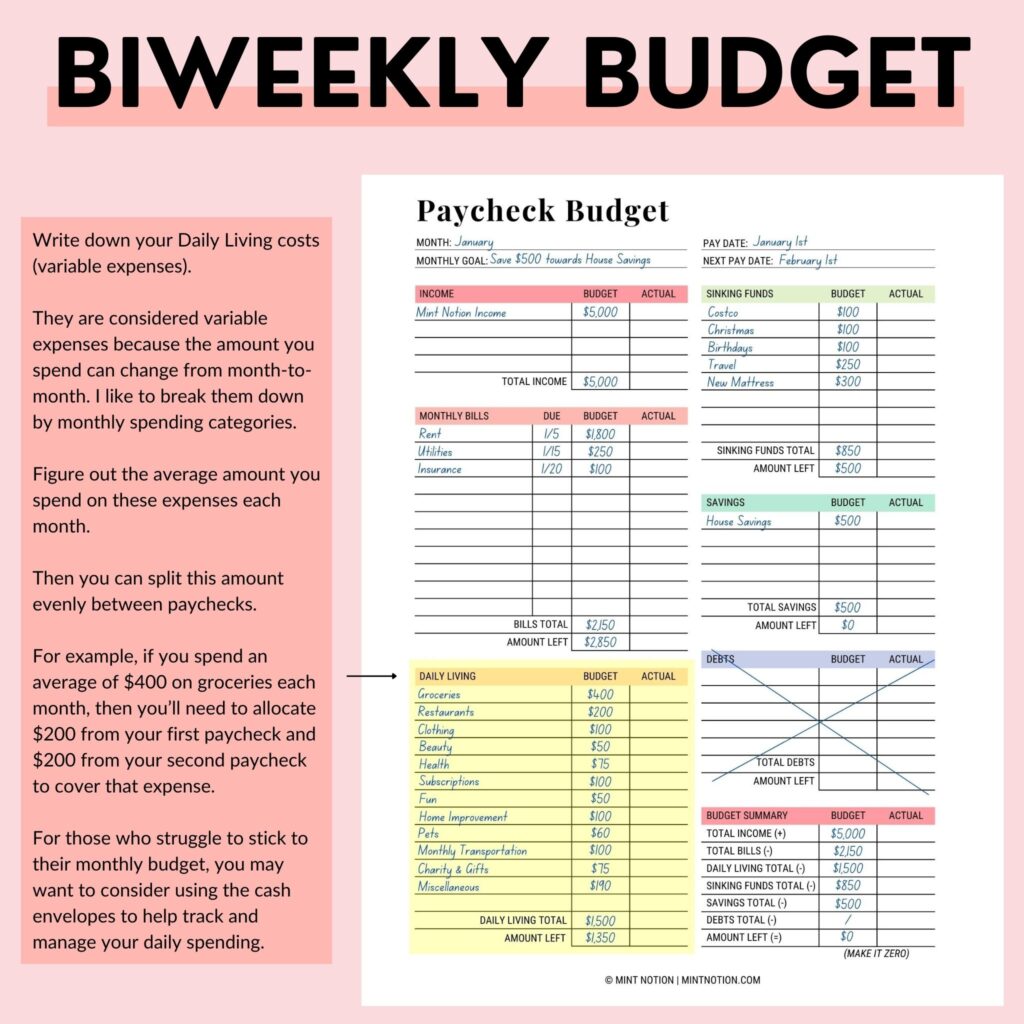

They are considered variable expenses because the amount you spend can change from month-to-month. I like to break them down by monthly spending categories.

Examples of monthly spending categories:

- Groceries

- Entertainment

- Restaurants

- Clothing

- Transportation

- Personal spending

- Household items

- Beauty & Haircare

- Giving

Figure out the average amount you spend on these expenses each month. Then you can split this amount evenly between paychecks.

For example, if you spend an average of $400 on groceries each month, then you’ll need to allocate $200 from your first paycheck and $200 from your second paycheck to cover that expense.

If you’re using my biweekly budget template, then you’ll write down your monthly spending categories under the “Daily Living” section, as shown in the example below.

Struggling to stick to your budget?

For those (like myself) who struggle to stick to their monthly budget, you may want to consider using the cash envelope system.

In the past, I was constantly overspending on clothes, dining out and groceries. I started using the cash envelope method to help track and manage my monthly variable expenses. It’s been a game-changer and a great tool that’s easy to use.

Use the cash envelope method for spending categories that tend to bust your budget the most.

For example, let’s say you budget $400 per month for groceries. This means when you receive your first paycheck, you’ll take $200 from your bank account and put the cash in your grocery envelope.

This $200 will last until you receive your second paycheck. Then you’ll take $200 from that paycheck and fill your envelope with cash again.

Then each time you spend money from your cash envelopes, use the spending log on the back to write down:

- Date of the transaction

- Store or description of the item(s) you purchased

- How much it cost (amount)

- How much money you have left in your cash envelope (balance)

Below is more information on how to start using the cash or cashless envelope method.

Read Next: How to use the cash envelope method without cash

5. Write your first biweekly budget

Now that you know your monthly bills and fixed expenses, your savings contributions, and monthly variable expenses, it’s time to put together your bi-weekly budget.

Yes, it may seem like a lot of prep work before you actually write your budget. But making sure you think through and include every expense can ensure that you’re setting yourself up for success.

The more prepared you are for your budget, the more likely it’ll work and you’ll stick to it! Isn’t that what we all want?

When creating your budget, you have two choices: Create a monthly budget or you can Budget-by-paycheck. (More information on how to choose the right method for you below)

How to budget when you get paid every two weeks – What’s the best option?

The best option is the one that works for you. Both methods are excellent and can be a highly effective way to budget your money.

If you prefer to see everything written down for the month, then follow the monthly zero-based budget method.

If you find it easier to just focus on budgeting one paycheck at a time, then follow the paycheck budgeting method.

If you’re living paycheck to paycheck or you’ve struggled to stick to a budget in the past, then you may want to consider starting out with the paycheck budgeting method. This can be easier to follow than the traditional one-month budget.

In this blog post, I will show you how to use the paycheck budgeting method to create your bi-weekly budget. If you want to grab this printable biweekly budget template, it’s avilable in my Bi-Weekly Budget Planner.

What to include in your first biweekly zero-based budget:

When putting together your first biweekly budget, ask yourself – What job does this money need to do before I am paid again?

Here’s what to do when you get paid – The first paycheck most likely won’t cover the whole month, so you’ll need to give each dollar a job that makes sense for your lifestyle and needs.

1) MONTHLY BILLS – Pay Bills & Fixed Expenses – Pay your immediate obligations first. This will be bills and fixed expenses that are due during the first pay period, such as rent or mortgage payment.

2) DAILY LIVING – Monthly Variable Expenses – Your monthly variable expenses, such as groceries aren’t a single bill. These are spending categories that you’ll spend from several times during the month.

Write down how much you need to budget for each spending category before your next paycheck. Then when you get your second paycheck, you can budget more for these categories.

3) SINKING FUNDS / SAVINGS – Savings Contributions – Write down your savings contributions. This includes money you’ll put towards your savings goals, sinking funds, retirement and so on. Below is some more information on how to save money with sinking funds.

Read Next: How to use sinking funds in your budget for beginners

4) DEBT – Make a plan for any leftover money – If you have any leftover money, you can send it to your savings or make extra debt payments.

If you’re following the debt avalanche method, throw that extra money towards the debt with the highest interest rate first.

If you’re following the debt snowball method, throw that extra money towards paying off the smallest debt first.

Read Next: What’s the best way to pay off debt?

Make sure that you give each dollar a job. Otherwise, it’s easy to spend that extra money on frivolous stuff. When following a zero-based budget, this means your income minus expenses (including fixed expenses, variable expenses, savings and debt payments) will equal $0.

6. Write your second biweekly budget

Now it’s time to budget your second paycheck. Chances are you’ve already paid your rent and other large bills for the month.

But the money you’ve budgeted for your variable expenses, such as groceries is close to running out. Again, ask yourself – What job does this money need to do before I am paid again?

What to include in your second biweekly budget:

1) Pay the rest of your bills and fixed expenses for the month.

2) Add more money to your monthly spending categories, such as groceries, gas, and so on. Add enough that you’ll need to last until you get your next paycheck.

3) Think about upcoming bills that are due at the beginning of the month. If your first paycheck of the month doesn’t cover your large bills, such as rent or mortgage, you can follow the half-payment method.

How to follow the half-payment method:

4) If there is any leftover money, send it to savings or make extra debt payments.

7. Track your spending

Congratulations on creating your biweekly budget. You’re already on your way to taking control of your money and doing amazing things! I am so proud of you!

Once you’ve written your biweekly budget, the next step is to track your spending. Making a budget is important, but tracking your spending is even more important.

This will help you see if you’ve made a realistic budget and whether or not you can stick to it.

Below is the Monthly Expense Tracker worksheet I use to track my expenses. Here you’ll write down:

- Date of the transaction

- Store or description of the transaction

- The appropriate spending category that fits the transaction

- The amount spent

- If you used cash or card to pay for the transaction

To keep things organized, I like to use a different highlight to highlight all the transactions for each spending category. This makes it easy to see how much I spent for the month on groceries, clothing, beauty, and so on.

If you find that you’ve blown your budget within the first week of payday, take a moment to breath. You are not a failure. This is just a bend in the road, not the end of the game.

When we make mistakes in our budget, we can use this as an opportunity to learn and grow. I know it’s easy to get frustrated, but remember that this is temporary.

Now it’s time to tweak your biweekly budget to make it more realistic. You’ve got this!

Read Next: 4 ways to track your expenses

Budgeting biweekly tips for success

Below are some helpful tips to help you stick to your biweekly budget and do more with your money.

How do I budget for 3 paychecks a month?

When you get paid biweekly, this means you’ll receive 26 paycheck per year. Biweekly pay cycles occur once every two weeks, which means some months will have three pay periods.

What’s the best way to budget these extra paychecks?

Many people think of this third paycheck as “bonus money” or a good excuse to go on a shopping spree. Spending your third paycheck with this mentality can lead to paying your next set of bills late.

Instead, here’s a better way to spend that third paycheck:

- Set aside money that you’ll need to cover your bills for the next two weeks. Then set aside money for the next two weeks to cover your everyday expenses, such as groceries, gas, and so on.

- If there is any leftover money, then throw it towards paying off debt or put it in your savings account.

If you have a big savings goal such as a vacation or home down payment, this can be a good opportunity to send more money towards this goal.

Organize your finances to simplify your life

No matter how you get paid, the key to success is to find an effective and fun way to organize your finances. Have you ever noticed when something is fun, you enjoy the process so much more?

There is no best way to organize your finances. Everyone has their own personal preference. That’s why personal finances is PERSONAL. Get it?

If you prefer to have everything on your phone, then using an app can be helpful. If you prefer to use spreadsheets, then that’s good too.

If you’re like me, who prefers to write everything down on paper, then using a Budget Binder might be perfect for you!

I find that writing everything down really helps me to feel connected to my finances. I can easily see and understand where my money is going, and I feel less stressed when everything is organized.

You can even combine organization methods. For example, use a Budget Binder to handle your biweekly budget and track your spending using cash envelopes or a spreadsheet. It’s up to you!

Don’t forget to include a buffer in your budget

To give you peace of mind, you may want to consider including a buffer in your biweekly budget. A buffer is simply extra cash left in your checking account. Some call it a cushion or mini-emergency fund.

A buffer is used to cover any small fluctuations in expenses, such as covering monthly bills that end up costing more than you planned. It can also be used to cover spending categories that you forgot to budget for, such as miscellaneous expenses.

Having a buffer can help you stick to your budget and prevent overspending. It allows for mistakes, because nobody is perfect.

How to include a buffer in your budget:

Set family budget meetings once per week

If you want to improve your finances, you need to make it a priority.

No one, absolutely no one likes to sit down and review their budget. It’s easy to think of a million other things that we want to do instead.

(Yep, I used to be guilty of this). But that’s why I never saw my money situation improve, because I was putting my budget on the back burner.

Once you start setting aside time each week to review or write your biweekly budget, it will become habit. Making your finances a priority can help you reach your money goals faster and give you peace of mind.

PRO TIP: Schedul a budget date with yourself (or with your family) once a week. Treat it as a self-care activity for you, your finances, and your goals.

I like to put this Budgeting for Success playlist on and let it inspire me as I check-in with my budget to see where I’m doing well and where I can make improvements.

This also gives me time to make adjustments to my budget throughout the month as needed. During these budget dates you can:

- Get up to date with tracking your expenses.

- Pay upcoming bills that are due soon.

- Write a new budget if payday is coming up.

- Find ways to cut back on your monthly expenses.

- Track how much you have saved towards your goals.

- Think about investment opportunities to grow your money.

- Set new savings goals that you want to reach.

- Think about side hustle opportunities or ways to increase your income.

Biweekly Budget FAQs

Is it better to budget weekly or monthly?

You might be wondering if you should budget by paycheck or monthly. Traditional budgets follow a monthly format, where all your income and expenses are planned out for one month.

This budgeting method can work really well for some people, but if you live paycheck to paycheck, you may find that the traditional monthly budget is the not the best option for you.

Instead, you may prefer the Budget-By-Paycheck method. This is where you create a new budget for each paycheck you receive. If you get paid biweekly, then this means you’ll create a biweekly buddget (as shown in this post).

This can help take some of the stress out of traditional monthly budgets. It can also help give you a better understanding of the money flowing in and out of your bank account so you can stay on top of your bills.

What’s the 50/30/20 budget rule?

The 50/30/20 budget rule is a way to manage your money by dividing your paycheck into the three categories:

- 50% for needs (essentials)

- 30% for wants (non-essentials)

- 20% for savings (investments and debt payments)

You can choose to follow this guidline when creating your biweekly budget. However, you may find that your essentials is more than 50% of your monthly income. If so, you can reduce your wants to help you stick to your budget.