How to save money fast on a low income? If you want to save money on a tight budget, keep reading. Today I’m sharing creative ways on how to budget and save money on a small income.

When you’re living on a tight budget, it’s not easy finding extra ways to save money. It can feel like every penny is going towards paying your bills, with nothing left at the end of the month.

After saying “enough is enough!” – I realized that making small changes in my monthly spending could make a huge impact. This gave me the motivation I needed to look for new and creative ways to save money.

Today I’m sharing clever ways to save money on a tight budget. You may be surprised how doing a few temporary tweaks to your monthly spending can add up to big savings! Follow these realistic ways to save money so you can reach your goals faster.

Related Posts:

- 10 ways to stop spending money you don’t have

- How to save money for a house down payment

- 10 fast ways to save money without even trying

Table of Contents

1. Create a budget

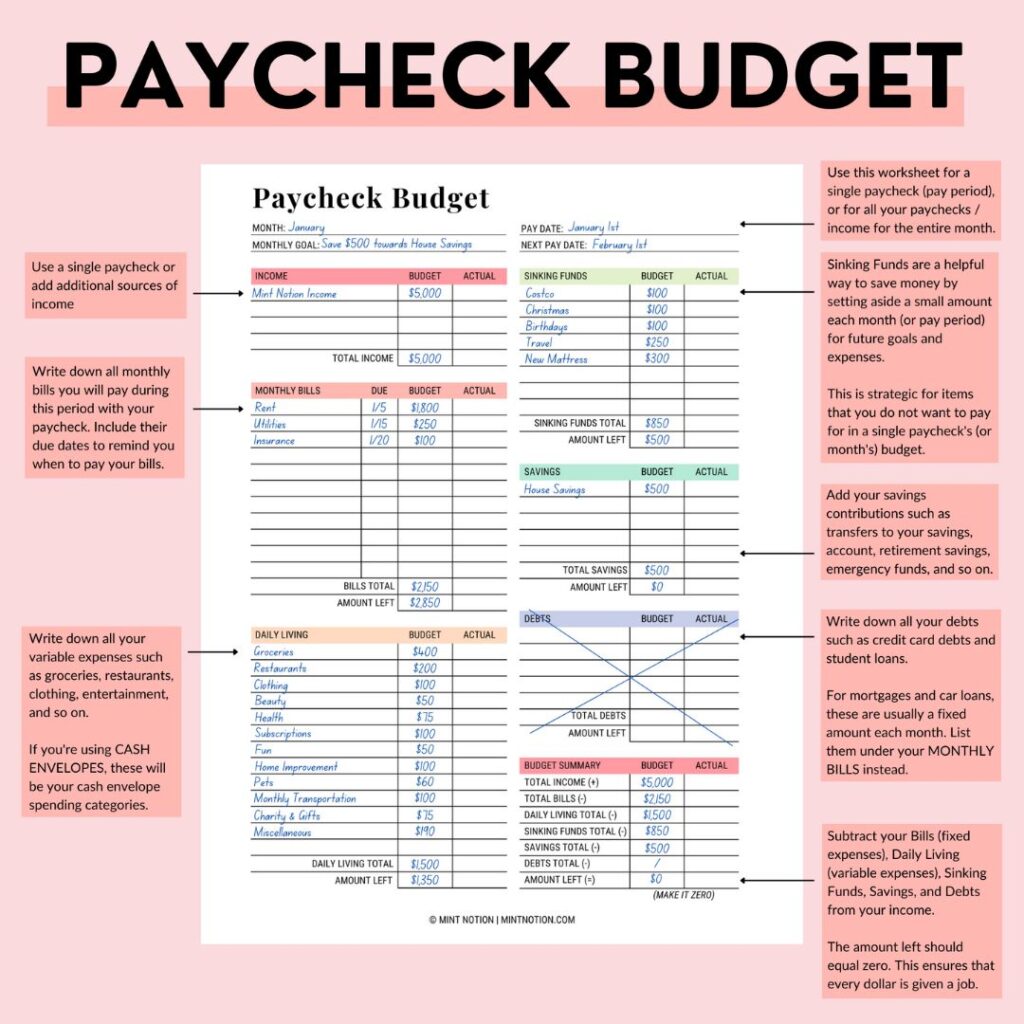

Whether you want to save money on a low income or a high income, you need a budget. For many people, the thought of budgeting can be overwhelming, especially if you’re not sure how to get started. Learning how to create a budget doesn’t have to be complicated.

A budget is simply the process of making a plan for how to spend and save your money. With the right tools, you can put together your monthly budget with ease. This can help you save money every month.

Ready to get your money under control? Making a plan for your money is the first step in taking responsibility for your finances. Below are the same budgeting worksheets I used to help me stop buying unnecessary things and save my first $100,000 in my mid twenties. If you’re interested, you can grab them here.

Budgeting resources you may find helpful:

- How to make a zero-based budget (Great for those who get paid once a month)

- How to budget when you get paid biweekly (Great for those who get paid twice a month)

- How to follow the 50/30/20 budget rule (Great for those who are new to budgeting)

- How to budget with an irregular income (Great for those with seasonal jobs, side gigs, self-employed, or fluctuating income)

2. Follow the cash envelope system

If you have trouble with overspending, consider switching to a cash diet. This means you’ll put away your debit card and credit cards, and pay for everything using cash. It’s one of the best ways to learn how to live on a budget and save money.

The cash envelope system can be a fun way to help budget for items which tend to bust your budget. Studies have also shown that we often spend less money when we pay for items with cash. This can help save money on a tight budget.

If you’re interested in learning more, here’s an in-depth post on how to get started using the cash envelope method.

3. Use a budget calendar to save money

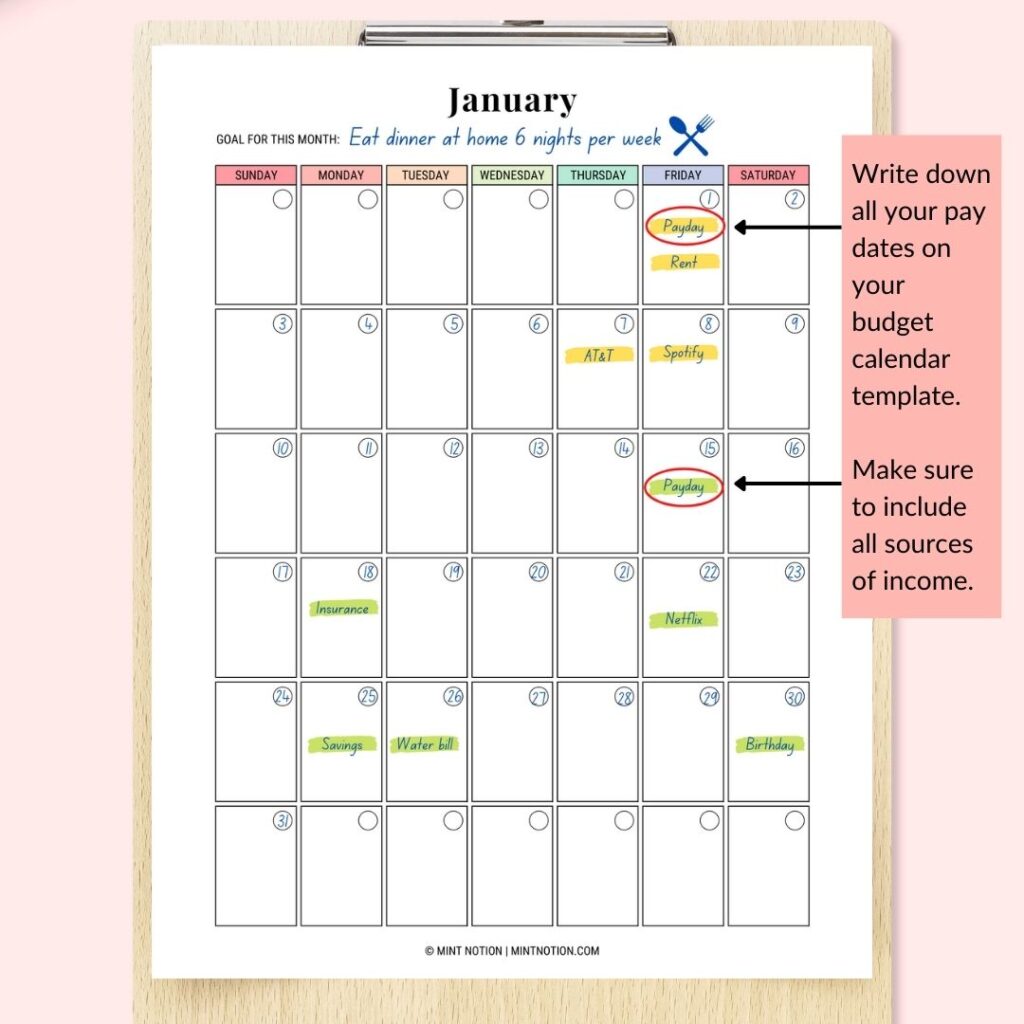

Many of us rely on calendars and day planners to keep track of everything in our lives, so why not use a calendar to keep track of your finances?

Using a budget calendar can help you stick to a budget and stop living paycheck to paycheck. I use the calendar in my Budget Planner and find it helps me save more money each month.

A budget calendar is a financial tool designed to help to help you remember when money is coming IN and when money is going OUT.

I’m not just talking about your bills. You also need to know when you need money for specific events.

Such as buying a birthday present for a family member, or expenses for your child’s school field trip, or meeting your parent’s for lunch, or when you need to buy a dress for your friend’s wedding.

It’s important to keep track of all these dates on your budget calendar. This can help you save money on a tight budget.

Read Next: What is a budget calendar and how to use it

4. Track your spending

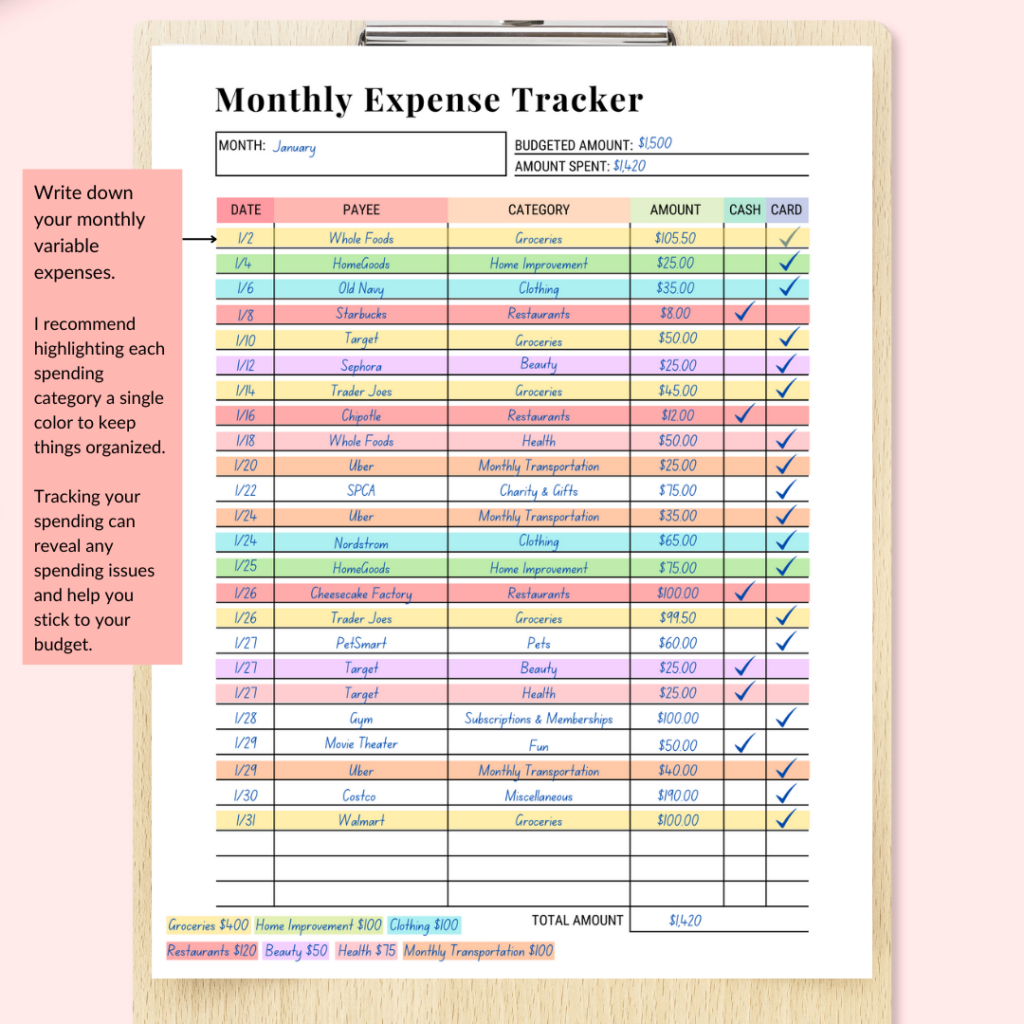

Do you know where your money is going? Tracking your spending is the first step in getting your finances under control. When I started tracking my spending, I was surprised to see just how quickly those small expenses added up!

You may not think those $5 purchases here and there will make a dent in your savings. But seeing how much these purchases add up to may change your mind.

Think of it like a spending journal. If you’re struggling to save money, then track your spend for the next 30 days. This can help you see exactly where your money is going.

I like using the Monthly Expense Tracker worksheet included in my Budget Planner to easily track my spending.

5. Get free gift cards with Swagbucks

Swagbucks is one of the best and most popular sites for earning free gift cards and money. You just need your smartphone, computer or tablet to get started.

Join Swagbucks for free and get a free $5 welcome bonus

After signing up, make sure to verify your email address so you can start making money right away. There are many ways to make money with Swagbucks from everyday things you already do online.

You’ll earn Swagbucks Points (SB), then redeem your points for Starbucks gift cards or money via PayPal.

There are many different ways you can earn points. Simply shop online, answer surveys, watch entertaining videos, search the web, play games or check out free offers from brands.

Read Next: 12 legit survey sites that pay cash online

6. Build an emergency fund

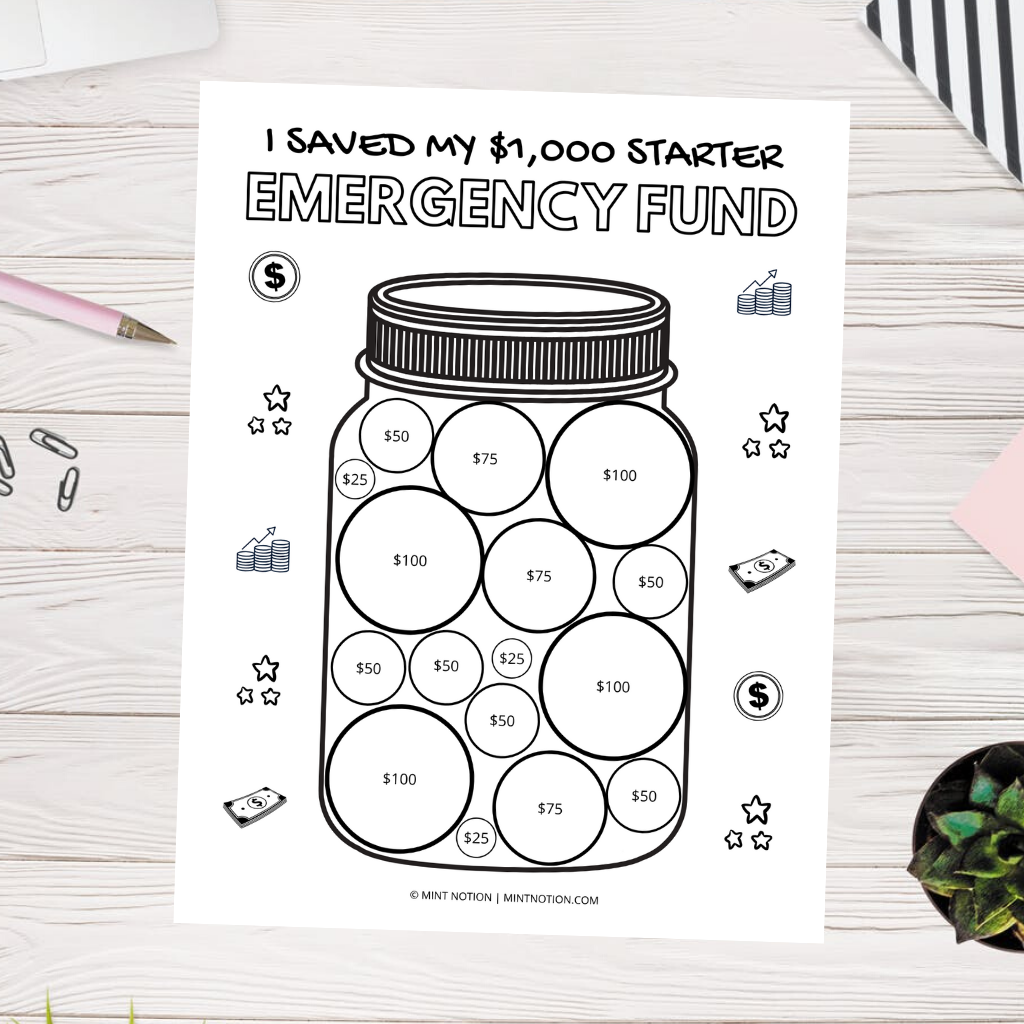

It’s easy to think that emergency situations won’t happen to us, such as a sudden job loss or a medical emergency. Having an emergency fund can protect your savings and ease financial stress when you encounter surprise expenses.

Most financial experts recommend having at least $1,000 in your emergency fund or at least three to six months’ worth of living expenses saved up.

However, the exact amount you need will depend on a few variables. To find the right amount for you, I recommend estimating the cost for your critical expenses, such as housing, food, transportation, utilities, healthcare, debt, and so on.

Here’s an in-depth post on how to build your emergency fund.

7. Save money with sinking funds

One of my favorite money saving tips is to create sinking funds. These are specific savings goals, such as saving money for a house down payment or saving for kids.

A sinking fund means you save up a small amount of money each month for a certain period of time. This is a strategic way to save for planned expenses, such as a new car, a vacation or Christmas.

For example, if you want to spend $1,000 on a vacation that’s three months away, then you’ll need to save around $330 every month until your trip’s departure date. This can help you save for a vacation on a tight budget.

Having a sinking fund can help you save money on a tight budget, so you’ll be prepared to cover expected expenses without having to dip into your emergency fund or go into debt.

You can check out this post to learn more about how to save money with sinking funds.

Read Next: Sinking Funds Tracker and Top Sinking Funds Categories

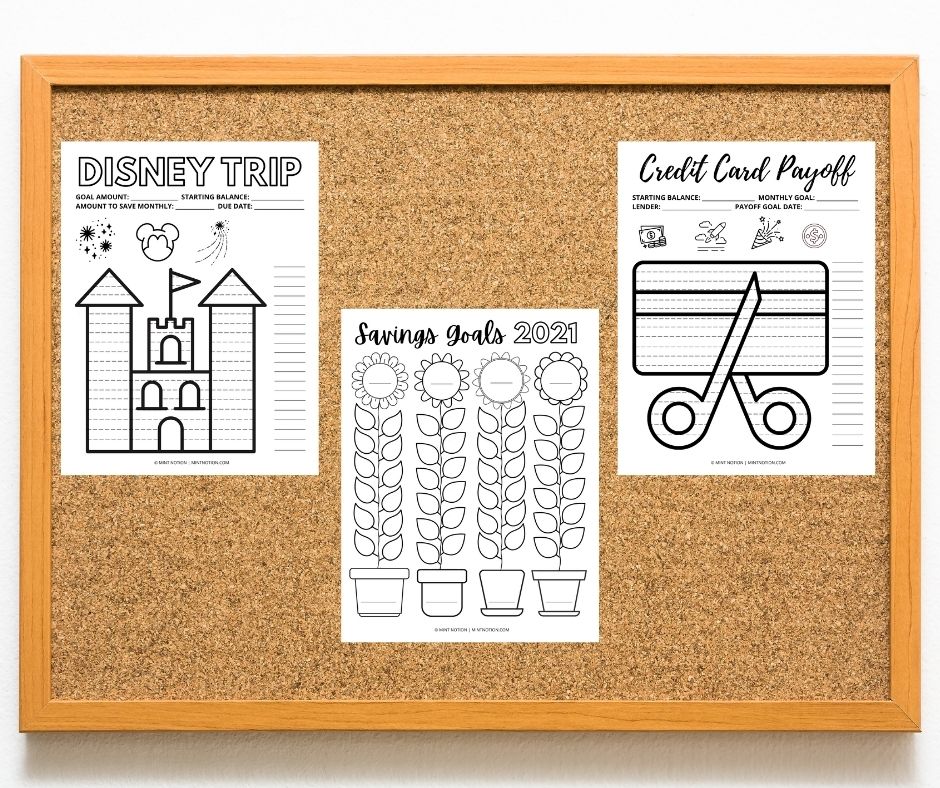

8. Stay motivated with savings tracker coloring sheets

When I was saving money to quit my 9-5 job and go back to school, I used a savings tracker visual aid so I could see my progress. In the beginning, it can be hard to get motivated to save up for a big goal, especially when it feels so far away.

But no matter how big or small your savings goal is, having a visual aid is essential for keeping you inspired and motivated to track your progress. This can help you save money each month.

Savings trackers and debt payoff charts are simple and fun to use. Your success will depend on you sticking to your goal and filling them out on a regular basis. If you want to save money fast, a visual tracker can help.

Read Next:

- 10 savings and debt payoff coloring pages

- 15 savings trackers to visualize your progress

- Sinking funds tracker + Top sinking fund categories

9. Follow the 30-day rule

What is the 30 day rule? Following the 30-day rule can be an effective way to control impulse shopping. I share this tip in my e-book, The Intentional Spender, to help women take back control of their spending.

Here’s how it works:

- Whenever you feel the urge to shop, especially for items you don’t really need, force yourself to stop. Put the item back, empty your shopping cart, and leave the store.

- Write the item down on a piece of paper with today’s date, the store where you found it, and the price. I like to call this my “Shopping Wish List”.

- After 30 days has passed, think about if you really need to buy the item. If you still feel the urge to buy it, then consider looking for the most cost-effective way to get it.

10. Unsubscribe from retailer emails and shopping apps

If you struggle with impulse spending, avoidance is one of the BEST strategies to use. Avoid and resist. I teach this strategy in my book, The Intentional Spender.

Shopping online to pass the time can be dangerous. You open a site, see a cute dress that catches your eye, and you’re suddenly tempted to buy it. Once you see the item, it’s going to be difficult to resist that temptation.

Sometimes we can’t rely on willpower alone. We must avoid and resist the temptation.

PRO TIP:

Read Next: How to overcome a shopping addiction

11. Shop your closet

If you want to cut back on shopping and buying clothes, a great place to start is by getting better mileage from what you already have.

To help you wear everything in your closet, I’ve created this free 30-Day Shop Your Closet Challenge. I share this same challenge in my e-book, The Intentional Spender, and many of my readers LOVE it!

Each day (for 30 days) you can follow the different prompts to help you put together new and exciting outfit combinations. The best part is – this challenge is completely free to do. You’ll be using items you already have!

12. Create a capsule or minimal wardrobe

Instead of buying trendy pieces that quickly go out of style, focus on creating a capsule wardrobe. A capsule wardrobe is free from clutter, it represents your lifestyle, saves you money, and can help simplify your life.

Here’s an in-depth guide on how to build a capsule wardrobe for beginners.

13. Save money on a tight budget with Rocket Money

With more people signing up for monthly subscriptions and streaming services today, it can be easy to lose track of everything we’re paying for.

Because most subscriptions are pretty cheap, many people end up paying for things that don’t actually need.

That’s why the Rocket Money App was born. They’ve been helping its users cancel old subscriptions and save more money.

Is your cell phone provider overcharging you? Rocket Money can automatically take care of it for you.

Rocket Money will also negotiate your monthly bills, such as your cable, cell phone, and internet bill. It works behind the scenes and automates ways to save you money.

Yep. I know you can you cancel unwanted subscriptions and negotiate your bills without an app. But Rocket Money makes it super easy and painless. There’s no stress or anxiety – just more of your hard-earned money back in your wallet.

All you have to do is sign up here and Rocket Money will do the heavy lifting for you.

14. Meal Plan

Americans spend an average of $3,459 on dining out each year (including take-out, fast food and restaurants), according to the U.S. Bureau of Labor.

You may not think you’re spending that much on dining out, but let’s take a quick look. If you eat out for lunch Monday through Friday, that’s around $10 per day. This adds up to $50 each week or $2,600 per year.

The #1 way we save money each month and to actually get excited about eating dinner at home is to meal plan. Meal planning is basically just a budget for your food. You get to decide upfront what you’ll be eating during the week.

If you’re short on time, consider investing in an Instant Pot. This can help you quickly get dinner on the table without much effort.

New to meal planning? Consider trying the $5 Meal Plan. Many of my readers have told me great things about how this service makes planning meals each week simple and easy.

Don’t have time to go grocery shopping or figure out what’s for dinner? You may want to consider trying Hello Fresh or Chef’s Plate. This meal kit delivery is perfect for those busy weeks.

To get started, all you have to do is pick your plan (quick meals, family meals, or vegetarian meals). You can also select the number of people in your household (2-4 people).

Then you’ll get fresh ingredients delivered straight to your door for the week. Your Hello Fresh box includes simple step-by-step recipes complete with nutritional information and fresh, pre-measured ingredients to help you put together a delicious meal in no time.

You can click here to try Hello Fresh and get $80 off your order

14. Earn cash back when shopping online

Did you know that you could earn up to 20% cash back when shopping online? Many people don’t realize they can save money and earn cash back just by shopping at their favorite stores, such as Starbucks, Target, Amazon, and Wal-Mart.

While there are many cash back sites available today, Rakuten is my favorite. Rakuten currently has a TrustScore of 4.3/5 on Trust Pilot, which makes it one of the highest rated cash back sites.

I’ve been using this site for years to save money. I think I’ve earned over $2,000 cash back just by shopping through Rakuten! That’s A LOT of money!

It’s free to join and you’ll even get a free $10 welcome bonus when you sign up!

How to claim your free $10:

- Start here to sign up for Rakuten. (It’s free to join)

- Find your store on Rakuten next time you need to buy something. It’s connected to over 2,000 stores, including Amazon, Target, and Walmart. You’ll need to spend at least $25 on your first purchase within 90 days.

- Your Rakuten account will be credited with reward points. Get this cash sent to a PayPal account or choose to receive a Big Fat Check from Rakuten. It’s up to you!

For Canadian shoppers, you can click here to sign up for Rakuten (free $5 welcome bonus).

16. Have a staycation

If you’re on a tight budget, that doesn’t mean you have to skip vacations. There are plenty of ways to relax and unwind by having a staycation. Check out these 27 budget-friendly staycation ideas.

17. Save money with Honey

Honey is a free browser extension that atomically finds and applies coupon codes at checkout when shopping online. If you’re looking for a quick and easy way to save money on a tight budget, this can be a great option.

How Honey works: The extension is free and easy to use. Once Honey is installed, you will see the Honey icon appear as an extension to the store pages of most online retailers.

Simply click on the Honey button to see coupons that are available for a store. Honey will automatically try all known coupon codes for that shopping site and apply the code that saves you the most money.

Pretty awesome right? I love Honey and have been using it for the past year to save money when shopping online.

How to get started with Honey:

- Join for Free: Click here to sign up for Honey. Then, you can install Honey.

- Shop Online: When shopping online, click the Honey button to see coupons available for a store.

- Save Money: Honey will atomically apply the code at checkout that saves you the most money.

18. Save money on your cell phone bill

According to a recent survey, the average American spend $99+ a month on their cell phone plan. This comes to about $1,188 a year!

Companies such as Mint Mobile, can be an excellent option for those looking to drastically reduce their cell phone bill without sacrificing their mobile needs. With plans starting at just $15 per month, this can be a great way to save money on a tight budget. You can check out Mint Mobile’s phone plans here.

I highly recommend checking you phone plan to see:

- How much it costs per month

- How much data you’re actually using

- What your data plan looks like

You may find that you can negotiate a better rate with your cell phone provider or switch to a plan with a data cap to save money.

To help cut my monthly expenses, I recently called my cell phone provider to negotiate a better rate.

I now pay $25 Canadian dollars per month for unlimited nationwide talk and text (through Rogers Wireless). I don’t have a data plan because I find that it’s easy to stay connected through free wifi. This saves me hundreds of dollars per year!

19. Save money on your utilities

A great way to save money on your utilities to sign up for OhmConnect. It’s free to join and you’ll get rewarded just by saving energy. OhmConnect community members can earn up to $300 per year. You can learn more about OhmConnect and sign up here.

22. Save money with discounted gift cards

There’s no reason to pay full price for gift cards again. Sites, such as Card Cash, sell gift cards at a discounted price so you can save money.

CardCash currently has a TrustScore of 4/5 on Trust Pilot, making it one of the highest rated gift card exchange sites. This can be a great way to turn unused gift cards into cash or buy discounted gift cards to save money.

Read Next: 12 ways to get FREE Starbucks gift cards

23. Exercise at home

If you’re like most people who sign up for a gym membership in January and slowly stop going after a few months, then you may want to re-evaluate your membership.

There are plenty of great ways to stay in shape and exercise at home. I recently purchased these resistance bands and love them! There are also many free online classes available that you can do from the comfort of your own home.

If you’re interested in doing yoga, consider checking out Yoga Download. They offer over 1,500 online yoga classes for all levels. They currently have a TrustScore of 4.7/5 on Trust Pilot, making them one of the highest rated online yoga programs.

24. Lower your credit card rate

This can usually be done by calling your provider to negotiate a lower credit card rate. Having a good payment history and credit score can help give you more leveraging power.

If you’re unable to lower your credit card rate, ask if you can transfer your exisiting balance to another card. This can help you save on interest for a set period of time and allows you to focus on paying off debt or saving that extra cash.

25. Save your cents and invest it with Acorns

Many people shy away from investing because they think you need a lot of money to be an investor. But that’s simply not true!

If you’re new to investing, a good place to start is with Acorns. This app is great for beginners who want to dip their toes into investing.

What is Acorns and how does it work?

Acorns is a microsavings app and cash back rewards program that makes investing easy. Every time you make a purchase, Acorns will automatically round it up to the nearest dollar and invest that change towards your future. Your spare change can quickly add up and every nickle and dime counts.

Acorns can be a great tool for people who struggle to save money or want a hands-off approach to investing. You can click here to learn more about how to make money with Acorns.

Read Next: How to invest in real estate without buying property

26. Save money with the Drop App

Another great way to save money when shopping is to use the Drop App. Each time you make a purchase at one of your favorite retailers, you can earn points through the Drop App.

This means you can earn points for going grocery shopping, taking an Uber, grabbing a snack, and more. The best part is – it’s free to download and use!

I love using the Drop App because it’s an effortless way to earn rewards. Simply link your debit and credit cards to the Drop App (this is completely safe).

Then you’ll earn Drop points for purchases you make using any of your linked cards, in addition to debit / credit card rewards points.

Every 1,000 points is worth $1. You can redeem your points for gift cards to your favorite retailers, such as Amazon, Starbucks, Walmart, and more.

How to get started with Drop:

- Download the App: After you download the app, link your debit and credit cards. You’ll automatically earn points whenever you spend with any of your linked cards.

- Shop at Your Favorite Places: Whether it’s grocery shopping or taking an Uber, you’ll easily earn points.

- Get Cash Rewards: Redeem your Drop points for gift cards to where ever you want. Simple.

Read Next: 10 best cash back apps to save money when shopping

27. Cut cable

When we moved into our apartment, we decided to go without cable TV. This helped us to cut down on how much TV we were watching and do more productive things instead, such as starting a side hustle to make extra money.

You can also switch a subscription service like Netflix, Amazon Prime, or Hulu. These are usually more affordable than paying for a monthly cable TV package. We usually cancel our subscription during the summer months we spend more time outdoors and sign up again in the winter.

Read Next:

28. Declutter

I can appreciate that people like to collect items that are very important to them, such as books, sports cards, designer handbags, and so on. However, many of these investments often take up space or become items that collect dust over the years.

Instead, consider selling these items. It can be a great way to declutter and make extra income. This can help you put aside money each month that can go towards your savings or paying down debt.

I made nearly $1,000 in one month just by selling my old stuff on Facebook Marketplace.

Read Next: 18 best items to flip for profit

29. Paint your nails at home

I used to get my nails done at the salon, but it was costing me $40 every two weeks (or around $80 per month). To save money, I invested in a gel UV LED nail lamp and gel polish. It took some practice, but now my nails look amazing when doing them at home.

30. Drink more water

Swap that can of pop or sugary juice for water. Drinking more water has a number of great health benefits and it can also help you save money (since water is free).

I stopped buying plastic water bottles and switched to this resuable one. Bottled water costs almost 2,000 times as much as tap water. This is a great way to save money and the environment.

If you still prefer a carbonated beverage, I recommend using a Soda Stream. This will allow you to make carbonated beverages in the comfort of your own home. It’s a great way to save money on a tight budget.

31. Become a bartender at home

Drinking at home is always cheaper than drinking out, plus you can control the strength of your drink if you’re making mixed drinks. The markup on wine and beer at a restaurant are 2-4x the regular retail price.

My boyfriend and I have been learning how to make cocktails at home. We bought this cocktail shaker which has made it fun to try different recipes.

Still want to go out for drinks? Find a place that is hosting a happy hour or drink specials that day to help you save money.

32. Shop your kitchen before going to the grocery store

A good way to save money on groceries is to shop your kitchen first. Take inventory of what you have in your fridge, pantry, and freezer to help you plan meals for the week. This can help you save time, money and reduce food waste.

33. Shop by the flyers / Compare prices

After shopping your kitchen, decide if you need to buy anything from the grocery store. Shopping by the flyers can help you save time and money.

I like to spend about 10 minutes each week going through the grocery store flyers and making a list of items I need to get for my weekly meal plan. About 99% of the time, I only buy items when they are on sale.

34. Make coffee and tea at home

While this tip won’t make you rich, every little bit of savings can help when you’re living on a tight budget.

Once I did the math and realized that my daily $5 latte from Starbucks added up to $1,200 per year, I changed my habits. That money could have went towards a vacation instead. Now I make coffee at home and only visit Starbucks occasionally.

My favorite way to make coffee at home is to use this pour over coffee maker or espresso machine. It’s affordable and makes an amazing cup of coffee!

35. Have a potluck with friends instead of going out

A fun evening with friends is usually associated with an evening out for dinner and drinks, followed by dancing. But this can add up quickly and put a dent in your wallet. Suggest having a potluck instead.

You can even have theme potlucks, such as Taste of Italy where everyone brings over their favorite Italian dish – be creative!

36. Visit your local library

Just like Arthur says – “Having fun isn’t hard when you have a library card!”

I love the public library. I use it all the time to borrow books, movies and magazines for free. Here in Toronto, library card holders can also get free passes to visit city museums and attractions. It’s a great way to save money on a tight budget.

37. Have a staycation

If you’re on a tight budget, that doesn’t mean you have to skip vacations. There are plenty of ways to relax and unwind by having a staycation. Check out these 27 budget-friendly staycation ideas.

38. Take care of items you already own

A good way to cut your monthly expenses is to take care of what you already own. This can help extend the lifespan of the items you have so you don’t have to buy new stuff unnecessarily. Here are some examples:

- Taking your car in for regular maintenance.

- Washing your clothes properly to make them last longer. I like using these mesh laundry bags.

- Filling saggy cushions with new foam to make your couch last longer.

- Vacuuming your carpet frequently to curb the amount of dirt that accumulates. I am obsessed with our Dyson vacuum cleaner. We saved up money to purchase one and it makes cleaning so easy now!

- Using appropriate cleaners on furniture to make it last longer.

Read Next: 20 ways to make your clothes last longer

39. Stop associating your happiness with spending money

Do you shop when you’re emotional? If I had a bad day at work, I used to go shopping and get some “retail therapy”. If I was happy, I would go shopping and “treat myself” to something nice. Emotional shopping is very common.

When you understand your spending triggers and which kind of shopper you are, this can help you avoid impulse buys because you’ll know how to better manage your triggers.

I have a very detailed chapter in my e-book, The Intentional Spender, which helps you learn how to identify, understand, and manage your shopping triggers.

Read Next: How to stop spending money on unnecessary things

40. Say “no” to impulse buys

Nearly 90% of Americans have succumbed to the temptation to impulse shopping, according to a recent survey. While it might seem like an impulse buy here and there is harmless, it can sabotage your goals such as paying off debt, building your emergency fund, or saving for a large purchase.

To help cut your monthly expenses, here’s an in-depth post on how to curb impulse spending.

41. Visit a hair dressing school

I’ve been cutting my own hair at home for the past 12 years. I know this option isn’t practical for everyone. That’s why I recommend going to a hair dressing school. Most schools offer a full salon: hair cutting, hair color, manicure, etc.

You can save yourself a lot of money by going to a school instead of a regular salon. This can help you manage money on a tight budget.

42. Make your own cleaning supplies

According to the Nest, American families spend around $40-$50 per month on cleaning supplies. This can add up to $600+ per year. Most of these cleaning supplies are not reusable.

Cleaning is essential to protecting our health in our homes, but many of the popular store-bought cleaners include harmful chemicals. I’ve been making my own homemade cleaners for the past year and love it.

Here is the recipe I use for my favorite DIY all-purpose cleaner:

- 2 tablespoons Castile soap

- 2 cup distilled water

- 10-15 drops of tea tree oil (You can use lemon oil or lavender oil instead)

Put all ingredients in a reusable spray bottle. Gently shake it up. And it’s ready to be used to clean your home.

43. Rent out your spare room or basement

If you have an extra room in your home, consider becoming an Airbnb host to make extra money. This can help you save money on a tight budget and reduce your monthly housing payments.

Don’t have any extra room? You can choose to become a host for your neighborhood or make money by hosting a unique experience (hiking, cooking classes, and more). You can learn more about Airbnb here.

44. Find cheap or free entertainment

Since the lockdown started, we’ve drastically but back on our entertainment expenses.

Whether it’s reading a book, learning how to bake in the kitchen, streaming a movie, or going for a nature walk – there’s plenty of ways to have fun without busting your budget.

Read Next: 75 fun things to do when you’re bored at home

45. Eat less meat

This suggestion is going to trigger many people, but hear me out. I used to eat a lot of meat, but noticed how expensive our grocery bill was getting. Then I read the book, How Not To Die, and it was a total game-changer.

That’s when I started eating a more plant-based diet. I felt healthier, I lost weight, my energy increased, and I saved a ton of money on groceries!

There are lots of affordable plant-based sources of protein, such as beans, legumes, lentils, tofu, and tempeh.

46. Avoid lifestyle inflation

I know it’s tempting to spend more money when you get a cash windfall or pay raise at work. This is called lifestyle inflation – increasing one’s spending when income goes up. If your income increased, so should your savings.

Put that extra money to good use, such as paying down debt, boosting your savings, or building your emergency fund.

Read Next: What is the fastest way to pay off debt?

47. Automate your savings

Set up an automate transfer so a portion of your paycheck is deposited into your savings account every time you get paid. Even if it’s just $20 from your paycheck, this can be an easy way to start saving more money.

48. Try the $5 challenge

What is the $5 trick? This means whenever you receive a $5 bill as change, you set aside that $5 bill in savings until the end of the year. This can be a creative way to save money in a jar.

Then at the end of the year, you can put those $5 bills towards your financial future, such as a savings goal. If you save $5 each day, in one year you’ll have $1,825 extra cash in your pocket!

49. Do a no-spend challenge

A no-spend challenge is where you decide to only spend money on essential items, such as your regular monthly bills, transportation, and groceries. A no-spend challenge can last a weekend, a week, a month, or longer.

Another idea is to focus on ONE category in your budget to save money. This is where you choose a category in your budget that you want to stop spending money on for a set period of time.

For example, choosing to stop buying any new clothes, shoes or accessories for 30 days or longer. If 30 days is too long for you, challenge yourself to do a No-Spend Weekend.

Read Next: 8 rules for a successful no-spend month

50. Set goals for your money

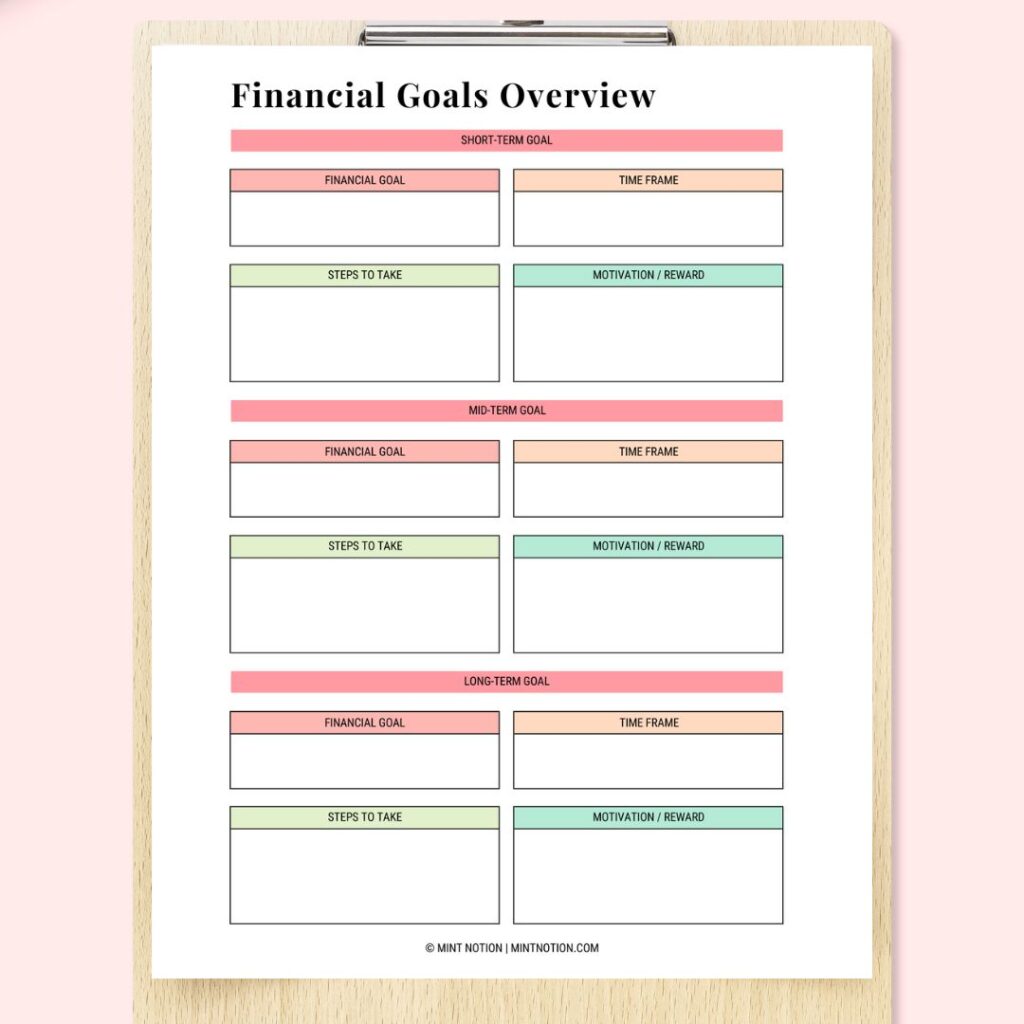

Without a concrete goal in mind, it can be tempting to spend any leftover income on unnecessary things.

Instead, get clear about why you want to save money. For example, “I want to save $1,000 a month for 10 months to go on my dream vacation”.

Once you label that savings, you’ll be less likely to spend it on other things except for its intended purpose. I like using this Financial Goal tracking sheet included in my Budget Planner. This helps me to clairfy my goals and create an action plan to achieve htme.

51. Consider the cost per wear

When considering a new purchase, such as clothing, kitchen tools, tech gadgets, or fitness equipment, ask yourself, “How often will I wear / use this?”

Consider your cost per wear / use. The most simple way to use this formula is to take the price of the item and divide it by the number of times you plan to wear / use the item.

CPW = Total cost of the item / Number of times you wear or use it

For example, if you want to purchase a new dress to wear to a friend’s wedding, consider how often you will wear it. If the dress costs $100 and you only plan to wear it once (to your friend’s wedding), the cost per wear is $100.

But if you estimate that you’ll wear the dress 5 times, then the cost per wear is $20 per use.

52. Learn how to sew

A good way to save money is to learn how to do simple sewing projects. Sewing kits are usually affordable and this can used to mend your clothing so it can stay in good shape. The next time something rips, you can repair it before buying a new replacement.

53. Freeze your credit card

If you find that you’ve been overspending on stuff you don’t need, try doing this funny personal finance tip: Freeze your credit card!

It sounds a bit extreme, but some people have found that freezing their credit card in a block of ice can help slow down their overspending habit. I also recommend deleting your saved payment information from online shopping sites and apps. This will make it more inconvenient to spend on impulse buys.

54. Bring your own snacks to the movies

Going to the movie theatre is fun, but the cost of tickets and snacks can quickly add up – especially for families with kids. Instead, look for times when movie tickets are cheaper (usually on Tuesdays) and bring your own snacks to save money.

Another creative way to save money is to create your own movie theatre experience at home. I like using this movie projector and making a batch of homemade popcorn.

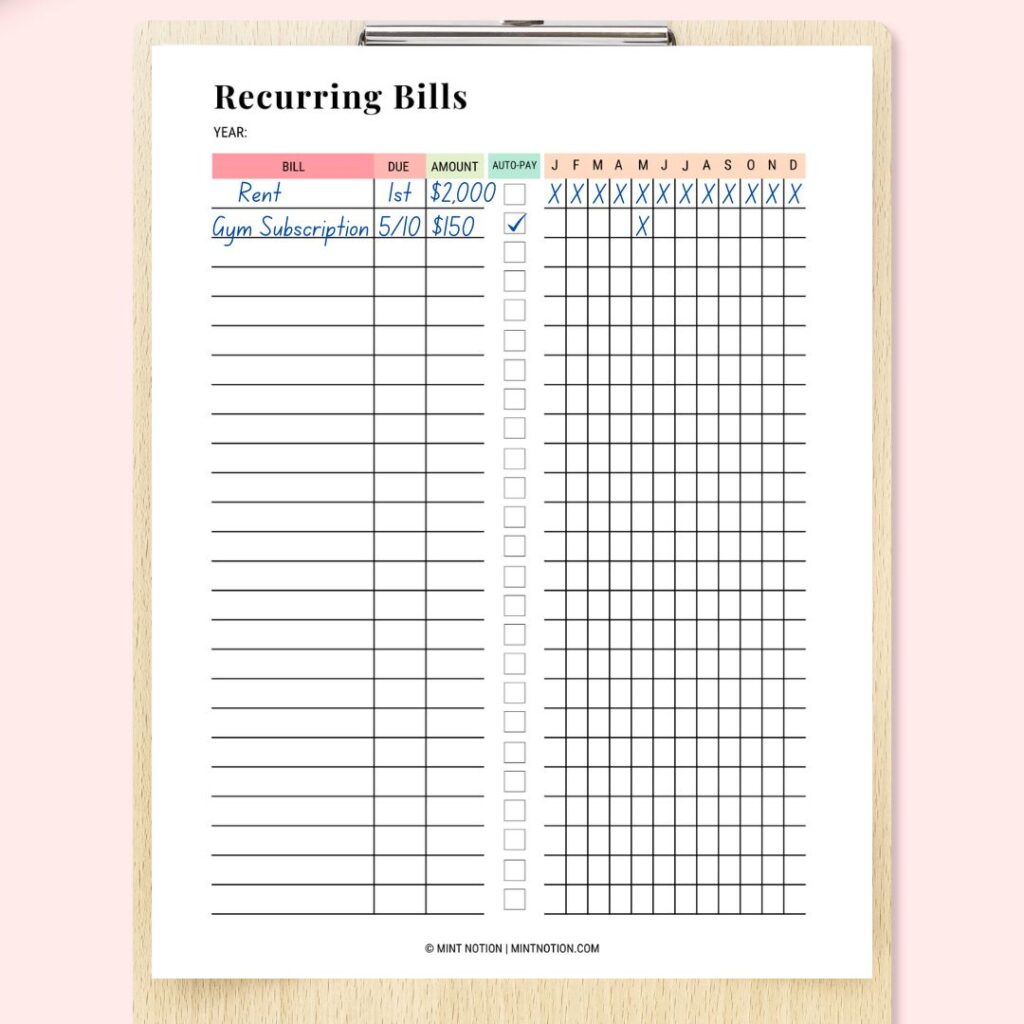

55. Organize your bills

If you’re stressed out trying to keep track of all your bills and their due dates, consider using a Recurring Bill tracker. This is the one I use which is included in my Budget Planner.

This is a handy way to stay on top of your regular and irregular bills so you never miss another payment.

You can also call your providers to ask to move their due dates so it can be easier to manage payments. For example, if all your monthly bills are due at the beginning of the month, it can make it difficult to have enough money leftover to cover daily essentials until your next pay day, such as groceries.

Read next: How to use the half payment method to save money

56. Pay more than the minimum on debt

If you want to accelerate your debt payoff, you’ll want to try paying more than the minimum towards your debt.

Consider following the Debt Snowball or Avalanche Method. The snowball method focuses on paying the smallest balance first, which can help you stay motivated to continue your debt free journey.

The Avalanche method focuses on paying off the debt with the highest interest rate (or balance). This will save you the most money and is the fastest way to get out of debt.

Read Next: Debt Snowball vs. Debt Avalanche Method – What’s the best way to pay off debt?

57. Find free things to do

It’s important to make room in your budget for “fun money”. This is your guilt-free spending money to spend on whatever you want.

If you want to stretch your “fun money” further, start looking for free or cheap ways to have fun. You can Google free things to do in your city or check out this post: 45 Things to Do Instead of Spending Money

58. Do Secret Santa

Instead of buying gifts for every family member and friends during the holiday season, I started doing Secret Santa.

Put everyone’s name in a bowl and each person will randomly draw a name. The Secret Santa is given a wish list of gift ideas to choose from to give to their chosen giftee.

This way, each person only has to buy ONE gift and you can set a budget limit for gifts ahead of time. When you exchange presents, the giftee has to guess which member of the group was their Secret Santa. It’s a fun Christmas tradition!

59. Swap clothes with your friends and family

If you want to spruce up your wardrobe, instead of going to the mall, host a clothing swap instead.

Each person brings a few items of clothing, shoes, or accessories, and trades with another person. Below are a few tips to make sure it’s a successful clothing swap:

- Limit the number of items. I recommend bringing 3-5 items. Remember to focus on high-quality items over quantity.

- Make the items looks nice. Hang them on a clothing rack, display them on a table, and make it easy for everyone to find a piece they love.

- Donate or sell the leftover items. If some items aren’t claimed, you can choose to donate, sell them, or store them for another clothing swap.

60. Celebrate your wins

Just because you’re working hard to save money on a tight budget, doesn’t mean you can’t have fun or reward yourself. Each time you hit a savings goal, such as building your emergency fund or paying off debt, celebrate your success!

Clever Ways to Save Money FAQs

Below are some common questions about how to save money fast on a tight budget.

What is the 30 day rule?

The 30 day rule is simple. When you see something that you want to buy, such as an expensive or an impulse purchase that you don’t really need, make note of the item.

Write it down on your Shopping Wish List and make yourself wait at least 30 days before buying the item. After 30 days, you can revisit your Shopping Wish List and ask yourself — “Do I still want to buy this?”

You might find that you no longer desire to purchase the item. If so, cross it off your list. If you still want to buy the item, then consider finding the most cost-effective way to get it.

The 30-day rule can be a great way to develop financial discipline with your money because you are delaying gratification.

How much of your income should you save?

According to the 50/30/20 budget rule, you should aim to save at least 20% of your monthly take-home income.

What are 10 ways to save money?

Below are the top 10 ways to save money fast:

- Create a budget – I like to make a zero-based budget each month.

- Track your spending – I like to use my Budget Planner to keep my finances organized.

- Separate wants from needs – It’s tempting to spend money on wants. I like to use my Shopping Wish List to help curb impulse spending.

- Pay yourself first – As soon as my paycheck hits my bank account, I like to tranfer money to my savings and sinking funds.

- Meal Plan – This helps me save money on groceries and dining out.

- Destroy debt – If you have debt, create a game plan to figure out the best way to pay off debt.

- Audit your expenses – Do you pay for a gym membership that you rarely use? Can you switch to a lower cell phone plan, such as with Mint Mobile? Audit your expenses to see where you can cut back or eliminate.

- Use cash envelopes – Cash envelopes can help prevent overspending in areas that tend to bust your budget such as groceries or entertainment.

- Set savings goals – Goals can help your budget a purpose. Stay motivated by using a visual savings tracker.

- Take a staycation – I love going on vacation, but airfare and hotels can get expensive. To relax and unwind, consider taking one of these budget-friendly staycations close to home.

How can I save $1,000 fast?

The best way to save $1,000 fast is to cut back or eliminate some of your daily spending. Here’s what you can do:

- Make a Budget – Use a budget to find areas where you can reduce your variable expenses, such as dining out, shopping, entertainment, and so on.

- Prioritize your savings – Set aside money in your savings account before your pay your bills or spend money on daily expenses.

- Sell your stuff – If you have items laying around your home that you don’t need anymore, consider selling them online. Check out how my friend Rob makes over $100,000 per year selling old stuff on eBay.

- Try a no-spend month – Check out the rules to have a successful no-spend month.

- Keep your eye on the prize – I like using these printable savings trackers to help me stay focused.

What’s the 50/30/20 budget rule?

The 50/30/20 rule is a simple way to budget your money. 50% of your monthly take-home income goes towards your needs, 30% goes towards your wants, and the remaining 20% goes towards your savings and debts.