If you’re tired of living paycheck to paycheck, you’re not alone. Nearly 80 percent of Americans say they struggle to stretch their money each month. Today I’m sharing tips to help you stop living paycheck to paycheck and save your first $1,000.

Table of Contents

What is considered living paycheck to paycheck?

Living paycheck to paycheck means that you are using most or all of your monthly income to cover your monthly expenses. This means you have no money leftover and no money in savings.

When you live paycheck to paycheck, it means you often worry about running out of money before the end of the month. The days just before payday are always the hardest. Without a safety net, you pray that no surprise expenses show up.

You work hard to provide for yourself and your family, but money quickly disappears. It feels like it’s nearly impossible to get ahead financially.

But, there is hope. You can choose to make a change and transform your financial situation.

There’s a light at the end of your tunnel. By following these tips, you can regain control of your money and get on track to reaching your financial goals. Here’s how to stop living paycheck to paycheck even if you have no savings.

Related Posts:

- 2020 Budget Binder Printables package

- 5 things to do before creating a budget

- 10 silly mistakes people make when budgeting

1. Budget by paycheck

If you want to stop living paycheck to paycheck, the most effective thing you can do right now is to create a budget and stick to it.

Back when I was in college, I had two part-time jobs making minimum wage. I didn’t have good spending habits at the time and was constantly buying things I didn’t need.

As a result, I was living paycheck to paycheck. I was constantly stressed about money and school. I realized the best thing for me to do was to create a budget. This helped me transform my financial situation.

But here’s the thing…you don’t want to create just any type of budget. You need to budget by paycheck. This type of budgeting method can help you get a better handle of your money and break the paycheck to paycheck cycle.

One of the best ways to stop living paycheck to paycheck is to do paycheck-to-paycheck budgeting. Instead of looking at your month as a whole, such as with traditional budgeting methods, paycheck-to-paycheck budgeting means you’ll be able to see which paycheck pays for which expenses.

How to budget by paycheck

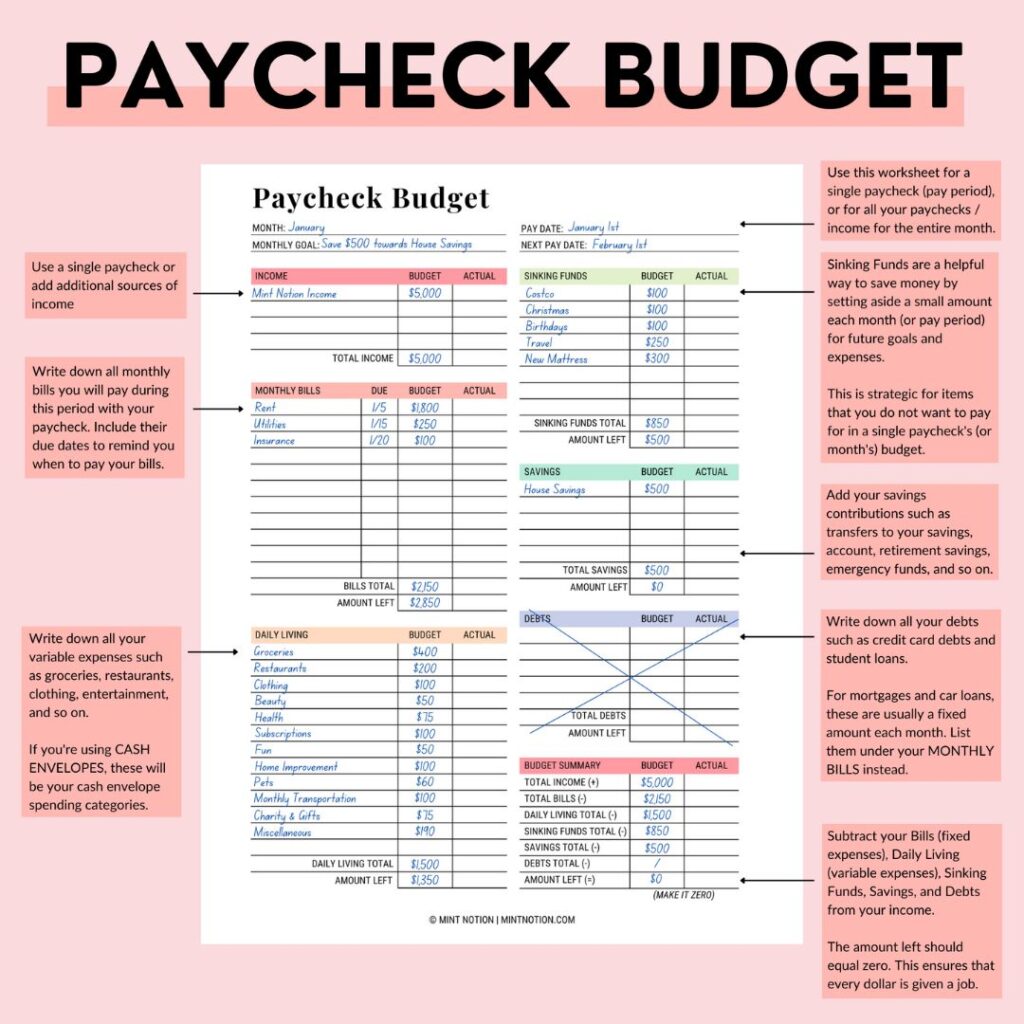

To get started, you can use my Paycheck Budgeting worksheet available in my Budget Binder Printables package. Or feel free to create your own worksheet. It’s up to you!

I also recommend using my Financial Calendar worksheet in conjunction with the Paycheck Budgeting worksheet. Everything is available in my Budget Binder Printables package.

When you live paycheck to paycheck, you MUST know when money is coming in and when money is going out. I’m not just talking about your bills. You ALSO need to know when you need money for specific events. Such as buying a birthday present for an upcoming party, or expenses for your child’s school field trip, or meeting your parent’s for lunch, or when you need to buy a dress for your friend’s wedding. It’s important to keep track of all these dates on your financial calendar.

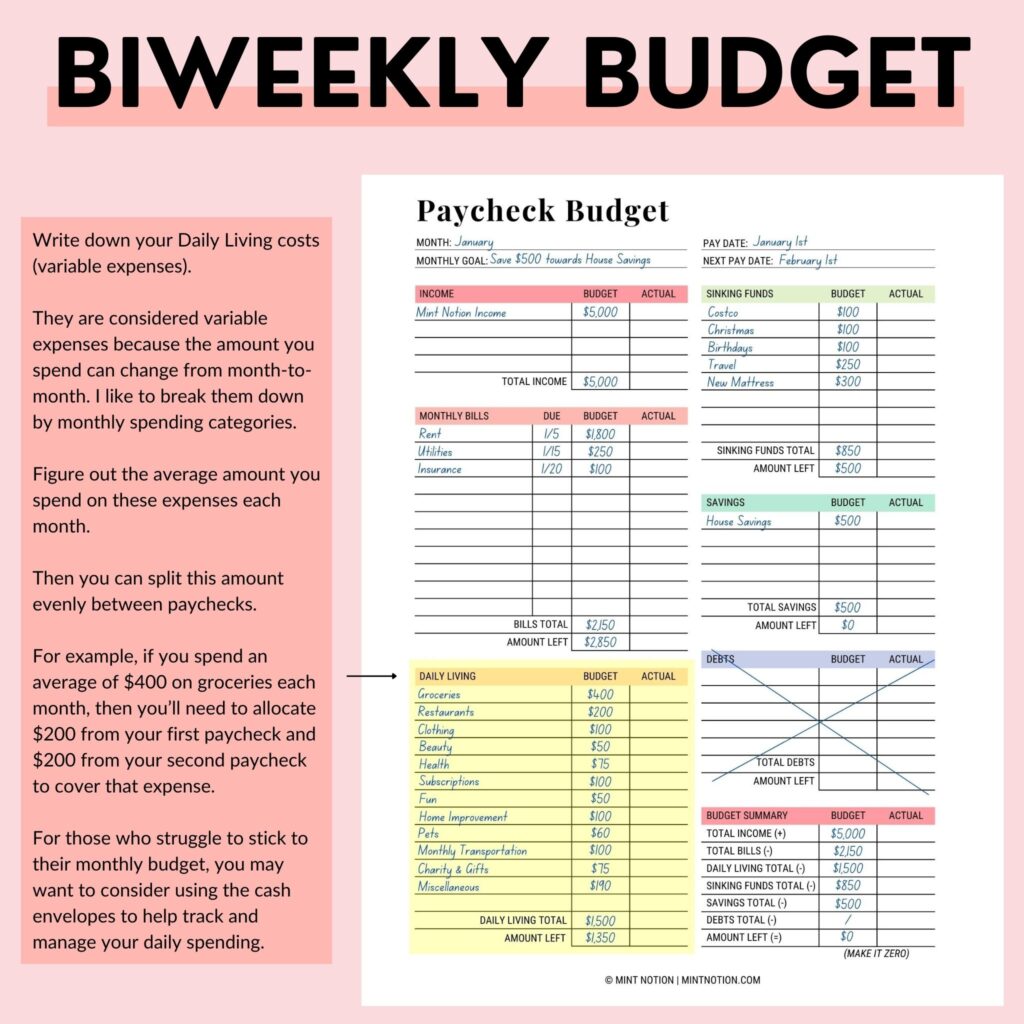

Paycheck Budgeting – Step 1

Write down the date you get paid, your paycheck amount, and your next expected pay date. This will let you know how many days (or weeks) you have to make this paycheck last.

Paycheck Budgeting – Step 2

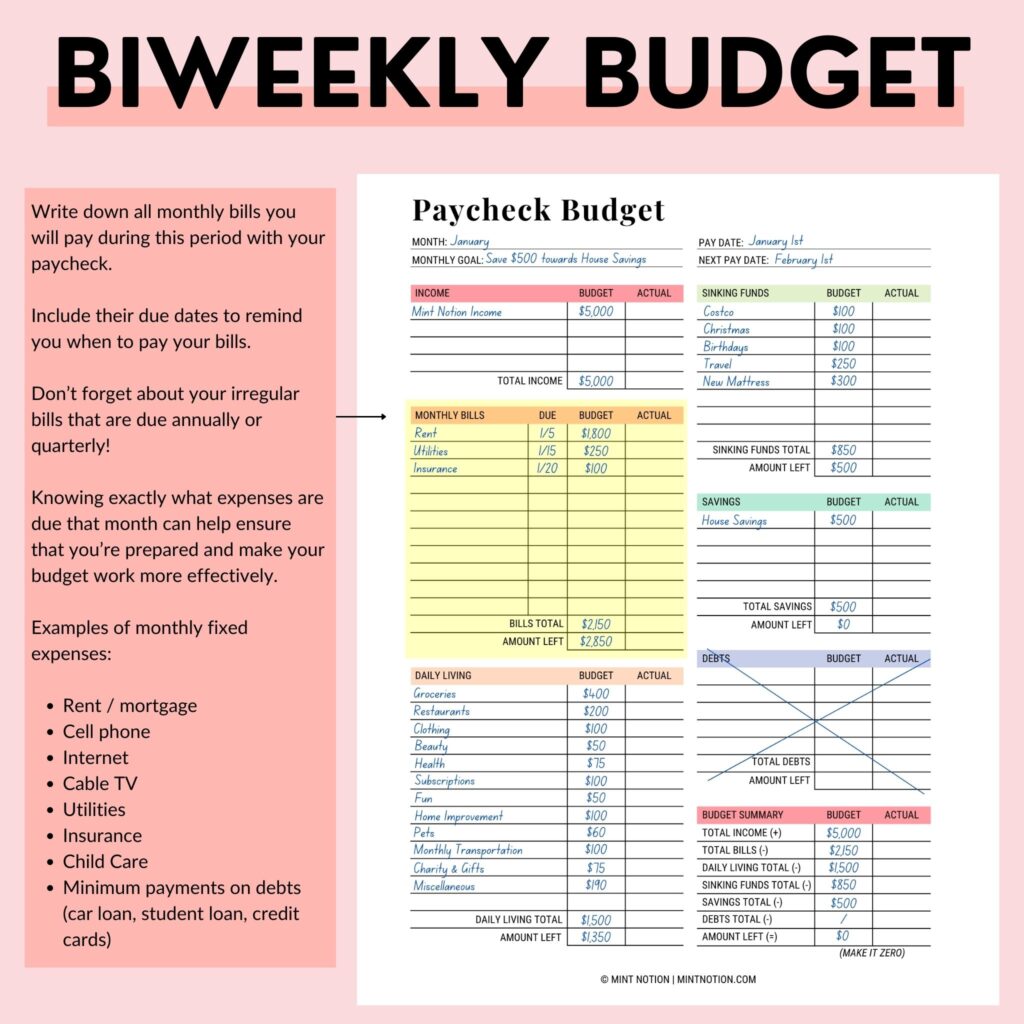

Next, list all the monthly bills you plan to pay using this specific paycheck. Record the bill total and any leftover amount from the paycheck. Leftover money will go towards your monthly variable expenses (your cash envelopes), your savings plan, and paying off any debt.

If you get paid twice per month, I recommend dividing your monthly bills into two groups. This means the first paycheck of the month will pay the first group of bills. The second paycheck of the month will pay the second group of bills.

PRO TIP: Pay your bills the day or the day after you get paid. This will ensure you don’t miss any bill payments. Otherwise, it’s really easy to fall into the trap of “I’ve spent all my money before paying the bills”.

Paycheck Budgeting – Step 3

It’s time to create your cash envelopes.

The cash envelope system can be a great way to help budget for items which tend to bust your budget. Studies have also shown that we often spend less money when we pay for items with cash.

Here you’ll use cash (or your debit card if you prefer not to use cash) to pay for different categories in your budget, such as clothing, groceries, restaurants, and so on.

For example, if your grocery budget for the month is $500 and you get paid bi-weekly, you’ll take out $250 cash from your first paycheck and put it into your “Grocery” envelope. Alternatively, if you prefer not to use cash, you can use your debit card to pay for these items.

Each time you withdraw money from your “Grocery” envelope, write down the store name and the amount you spent. This will help you keep track of all your grocery purchases so you can stay within your budget. You can use my Tracking Expenses sheet to track all your monthly purchases, available in my Budget Binder Printables package. Or you can create your own worksheet to track your monthly expenses.

What do you do with spare change? If you’re using cash to pay for your purchases, I recommend rounding up purchases to the nearest dollar. This will keep things simple. Put all loose change into a separate coin jar. The change in your coin jar can go towards your savings or “Fun Money”.

When you get your second paycheck, do the same thing again. Put $250 in your “Grocery” envelope and use this money to pay for all your groceries.

NOTE: The money in your “Grocery” envelope is ONLY used to pay for groceries. Once the money is gone, it’s gone. Don’t take money from your other cash envelopes to pay for groceries. Use only the money in your “Grocery” envelope to pay for grocery-related purchases. The cash envelope method is designed to help you improve your spending habits.

Create as many cash envelopes as you need to cover all your monthly variable expenses. Write down the total amount of money you’ve budgeted for the cash envelopes. Then write down the any leftover amount from your paycheck.

Any leftover amount of money can go towards your savings plan and paying off debt.

PRO TIP: I recommend having a “Fun Money” envelope. You can put as little or as much money as you’d like in here. I like to put $20 bi-weekly (or $40 per month). This money is my guilt-free spending money which I can spend any way I wish.

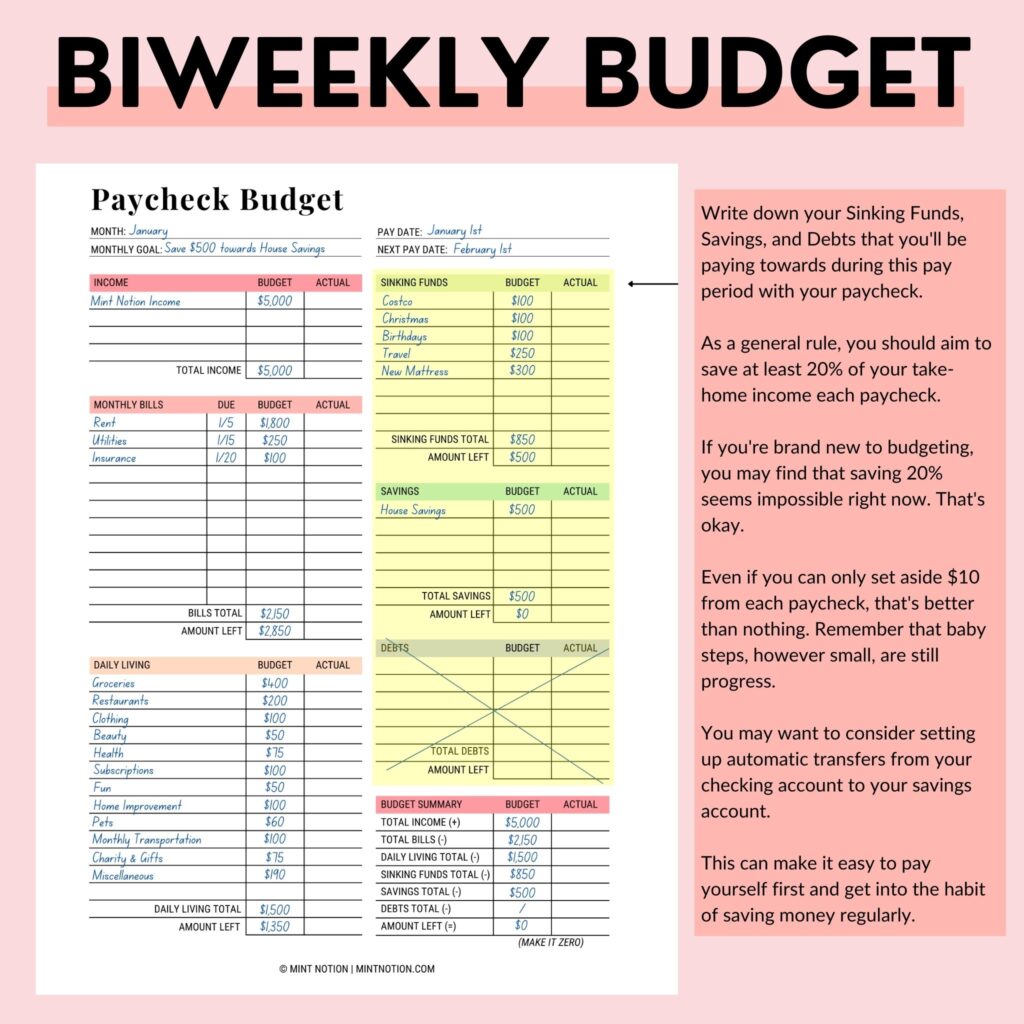

Paycheck Budgeting – Step 4

Determine how money much you’d like to put towards your savings plan. If you’re starting with little savings right now, I recommend building an emergency fund first. Having an emergency fund can help prepare you for those unexpected events in life you can’t plan for. Without an emergency fund, people often go into debt to pay for those surprise expenses, such as car troubles.

I also recommend setting aside money to put towards your sinking funds. These are savings goals that you’re working towards, such as saving up for Christmas or a vacation. You can learn more about what sinking funds are and how to use them in this post: How to save money with sinking funds

Paycheck Budgeting – Step 5

After you’ve created a budget for your monthly bills, variable expenses (cash envelopes), and savings plan, put any leftover money towards paying down debt.

2. Pretend you make less than you do

Now that you’ve established a realistic budget, you’ll want to pretend you make less than you do. I know this sounds easier said than done, but committing to spending less than you earn can help you break the cycle of living paycheck to paycheck.

When I started tracking my monthly spending, I realized I was spending A LOT of money on frivolously things, such as clothing. To help me save more money each money, I challenged myself to NOT give into immediate gratification. This meant I learned how to say “no” to impulse spending.

I saved money by finding new ways to mix and match clothes I already had. I borrowed clothes from family and friends when I felt the urge to buy new clothes for a special event. (In the past, I would buy new outfits for events).

It wasn’t easy to make these spending cuts in the beginning. But with more practice, I got better at controlling my impulse spending. Watching my savings account grow each month was also a HUGE motivator!

PRO TIP: Challenge yourself to reduce your spending in several of your cash envelope categories by $10. This means you’ll aim to spend $10 less each paycheck on groceries, clothing, entertainment, and so on. These savings can add up quickly and go towards your savings plan or paying off debt.

3. Build an emergency fund

One of the keys to breaking the cycle of living paycheck to paycheck is to have money in the bank. Surprise expenses can and do happen, and having an emergency fund can help you stop adding to your debt.

An emergency fund can also help manage these stressful and unplanned expenses, so you can stay on track to reaching your financial goals.

Read Next: How to build your emergency fund – Free savings tracker printable

If you haven’t started building your emergency fund yet, I recommend including this in your Paycheck Budgeting worksheet until it’s fully funded. Even if you can only add $10 or $20 from each paycheck to your emergency fund, it’s important to start somewhere.

How much should you have in your emergency fund? Everyone should have a minimum of $1,000 in their emergency fund. This amount can help you cover a minor unexpected expense without having to add to your debt, such as a car repair or veterinary emergency.

PRO TIP: I recommend putting your emergency fund in a bank account that’s separate from the one you use daily. This can help prevent you from being tempted to spend the money other things. I keep my emergency fund in a high-yield savings account. This lets me access my money quickly when I need it. Plus, my money earns interest.

4. Pay off debt

Each month, debt is eating up a portion of your paycheck. This can be holding you back from doing what you really want or reaching your financial goals. If you want to stop living paycheck to paycheck, it’s time to make a commitment to start paying off debt.

If you have credit card debt, it’s important to stop using your credit cards until you’re completely out of debt. Continuing to put money on your credit cards won’t help you get of out debt.

When I was living paycheck to paycheck, I was using my credit card to pay for everything because I wanted to collect rewards points. I spent money BEFORE it was in my account, which was a big mistake. I put my credit card in a drawer and locked it up so I wouldn’t be tempted to use it anymore.

Switching to a cash-only diet helped me get my spending under control and save more money.

Related Posts:

- 12 ways to pay off debt fast

- 10 habits of debt-free people

- 10 ways to stop spending money you don’t have

5. Increase your income

If you feel like you’ve already cut out all unnecessary spending, but you’re still living paycheck to paycheck, then you may want to consider finding ways to increase your income.

Making extra money can help you save more each month, pay off debt, and reach your financial goals faster.

PRO TIP: When you’re making more money, it’s important to avoid lifestyle inflation. When I got a full-time job after college, I fell victim to lifestyle inflation, which destroyed my budget. To prevent lifestyle inflation, you MUST make plans for that extra money. By planning ahead, you’ll be able to use this extra money to gain control of your financial future.

Need some ideas to help you increase your income? Here are some of my favorite ways to bring in more money.

Ask for a raise

If you have some concrete results to show for all the hard work you’ve been doing lately, now might be a good time to ask for a raise.

Find a second job

Many of us have only one source of income per person. However, with today’s lack of job security, having only one source of income can be a huge risk. Job loss can happen, and I’ve seen it first-hand in my family. It’s not easy.

Finding a second job can help you make more money and add an extra layer of financial security. Use the income from your second job to save money and pay off debt. Once you’re debt free, you can quit your second job.

Find a new job

We all have busy lives. If finding time for a second job isn’t feasible, then you may want to consider finding a new job. Switching companies can lead to an average of 10%-20% increase in salary, compared to a normal 2%-3% annual raise by staying at your current company.

Get a side hustle

Almost 37% of Americans engage in a regular side hustle. This can be an excellent way to make extra money. Blogging was my side hustle while I was in graduate school, and now it has become my full-time job!

If you need some inspiration for side gig ideas, you may want to check out these helpful posts:

- How to work from home as a proofreader

- How to become a freelance writer

- How to make money flipping items for profit

- How to work from home as a virtual assistant

- How to make money selling on Amazon FBA

The bottom line is, you have the power to take control of your financial future. I know it may not feel like it at times, especially when you’re trying to break the cycle of living paycheck to paycheck. But when you plan ahead, you can create a plan to tell your money exactly where to go. This can help you stop living paycheck to paycheck. You’ve got this!

Live the life you’ve always imagined with the right tool at your fingertips. The Budget Planner can help you get there.

These printables were hand-crafted to help you save time when organizing your finances, stop living paycheck to paycheck, save more money, pay off debt fast, and more! Use these functional sheets to create a realistic budget tailored to your specific needs and goals.