Saving money isn’t easy, especially when you feel that gravitational pull towards the sale section every time you enter a store. Today I’m sharing tips on how to stop spending money on unnecessary things.

It doesn’t matter how many times you’ve told yourself that you’re ONLY going to buy the items on your list – a few unplanned purchases always seem to make its way home with you.

While an impulse purchases here and there may seem harmless, they can sabotage your money situation and prevent you from reaching your goals (such as buying a home or paying off debt).

If you can relate, please don’t feel shame about it. I used to be 100% guilty of this. That’s why I put together this post on how to stop spending money you don’t have and start saving more of your hard-earned money instead.

So whether you want to learn how to stop spending money on clothes, food or games, use these tips to help you take back control of your finainces.

Table of Contents

Are you overspending? Here’s how to know:

You’re busting your budget every month

Each month, it seems like you need to find new and creative ways to stretch your paycheck to cover basic food and housing costs. This could be a sign that you’re spending more than you earn, which can lead to (or add) to debt.

You have FOMO (fear of missing out)

When scrolling on social media to see what your friends are up to, it’s easy to play the comparison game and feel like you need to keep up with everyone. You find yourself overspending on things you don’t actually need.

You don’t have room for your latest purchase

Maybe you love collecting coffee mugs, shoes, or tech gadgets. No matter what you love to buy, it’s becoming harder to find a place in your home to store things. This is a surefire way to build up clutter. You may want to reconsider how you’re choosing to spend your money.

Related Posts:

- 50 creative ways to save money on a tight budget

- 10 tricks to stop spending money on clothes

- 20 things to stop spending money on

1. Set money goals

When you don’t set clear goals for yourself, it’s easy to let your emotions run the show when spending money. Trying to sustain momentum is difficult if your direction lacks definition.

But when you set specific money goals, this can help prepare and motivate you to do the work so you can reach your goals. This can help you to stay on track and learn how to stop spending money on unnecessary things.

Sometimes setting a big financial goal, such as saving money for a house, can seem overwhelming in the beginning.

I recommend breaking down your big goal into bite-size pieces. This will make it easier to manage and help you create a realistic plan to achieve your goal.

For example, if you have a goal that will take a year to accomplish, break it down into something you can accomplish this month. Then break this month’s goal into something you can do this week.

Success rarely happens overnight. It involves continuous progress in the right direction.

When planning my own money goals, I like to write them down and figure out which actions I need to take in order to accomplish my big goals.

Examples of big goals might include:

- Retire at 55

- Pay off all debt

- Save money for a house

- Save money for a wedding

- Earn enough money for your partner to quit their job

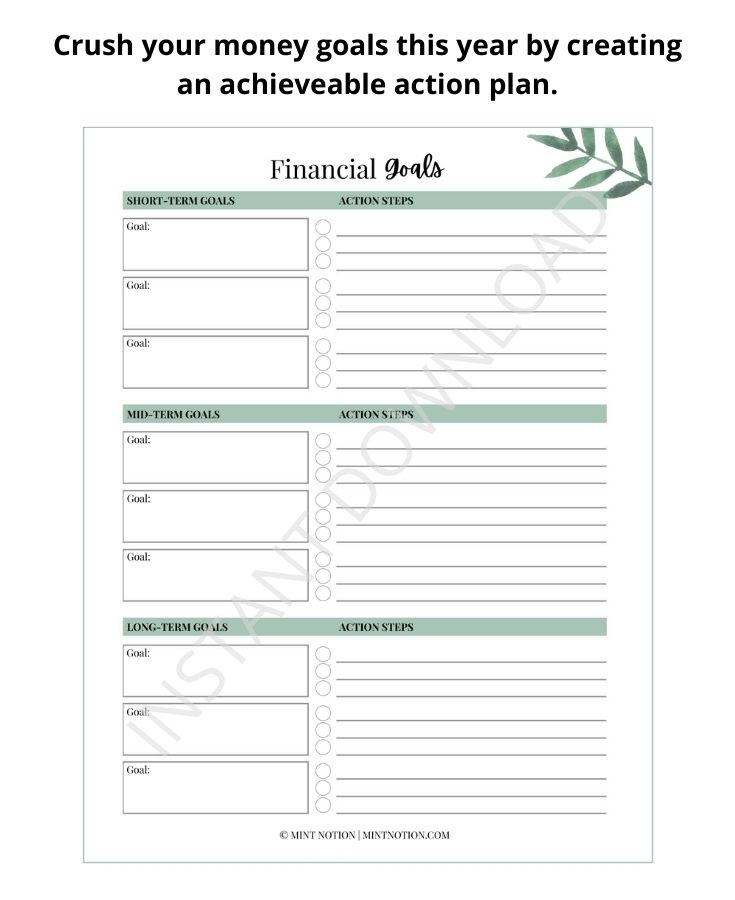

I use the Financial Goals worksheet included in my Budget Binder to list all my goals, how much I need to save for each goal, and when I need the money by. Then I can determine how much money I need to save on a weekly or monthly basis in order to accomplish my goals.

If you’re feeling overwhelmed, my advice is to start small. Think of a small money goal that you want to reach in the next week or month. Maybe it’s to pay all your bills on time this month. Or maybe it’s to save money for a fun date night.

Read Next: 5 things to do before creating a budget

2. Figure out your current money situation

If you don’t know where your money is going, you’re more likely to spend frivolously. Simply being aware of your current financial situation can help you develop better spending habits and stop spending money.

One of the best ways to gain control and better manage your money is to track your expenses. Knowing where your money is going can help you understand how much you’re actually spending. Then you can make adjustments, as needed, to help you reach your financial goals.

How to track your expenses

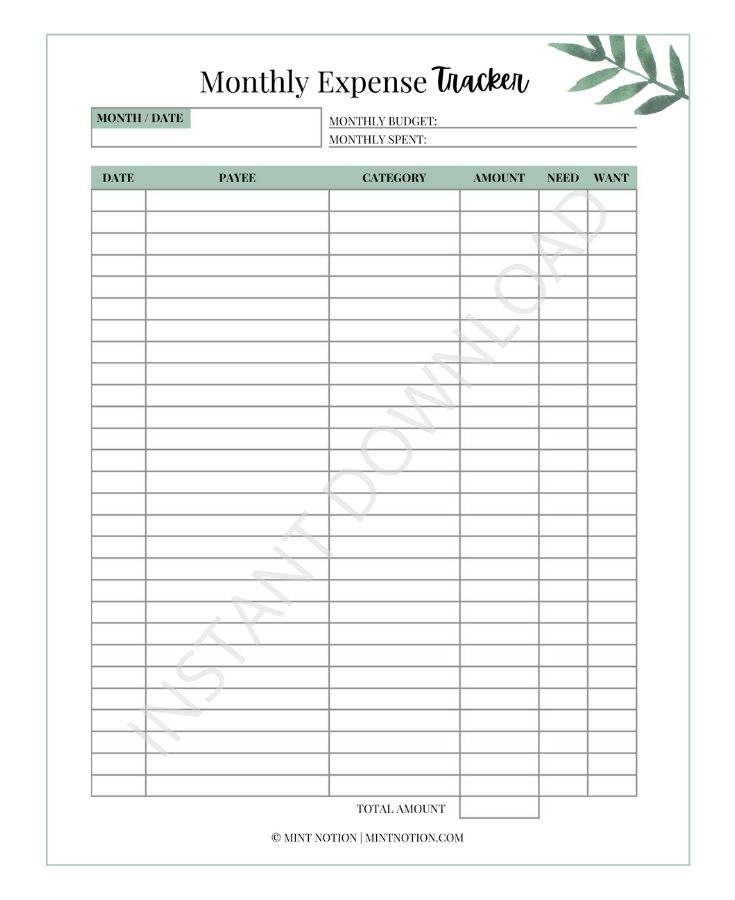

The easiest way to track your expenses is to record every time you make a purchase: Write down where the purchase was made and how much it cost. You can use an app to do this, however I personally like to use pen and paper. This is the printable worksheet I use.

After a couple of weeks of tracking your expenses, you’ll start to notice trends in your spending behavior. I recommend breaking down your purchases into different categories. This can help you understand how much money you’re spending in each expense category.

Here are some examples of popular expense categories:

- Clothing

- Entertainment

- Dining out

- Groceries

- Gifts

- Gas

- Beauty & Cosmetics

- Fun Money (I like to include fun money in my monthly budget. This is guilt-free money that you can spend any way you wish)

You can include all your monthly expenses on one sheet or use a separate sheet for each expense category. I personally like to use separate sheets because this helps me see everything clearly and stay organized.

You may also want to make a note next to each purchase if it was a “want” or a “need”. For example, did you really need to buy this item? Or did you just want it?

Read Next: How to make a zero-based budget

3. Create a budget that works for you

Now that you’ve set your goals and figured out your money situation, it’s time to create a budget. I know it sounds boring and like another tedious task on your never-ending to-do list. But after a few months, creating a budget will become habit and your wallet will thank you.

So what exactly is a budget? If you’ve been following Mint Notion for awhile now, you’ll know that budgeting is a plan for your money. It’s a plan for how YOU want to spend your money. It’s completely unique to your goals and lifestyle.

If you’re new to budgeting, I recommend using the budget-by-paycheck method. When I was living paycheck to paycheck, I found that this was the best and easiest way to manage my money.

Why this budgeting method works: Instead of looking at your month as a whole, such as with traditional budgeting methods, paycheck-to-paycheck budgeting means you’ll be able to see which paycheck pays for which expenses. This approach can help you get a better handle on your spending.

Read Next: How to budget when you live paycheck to paycheck

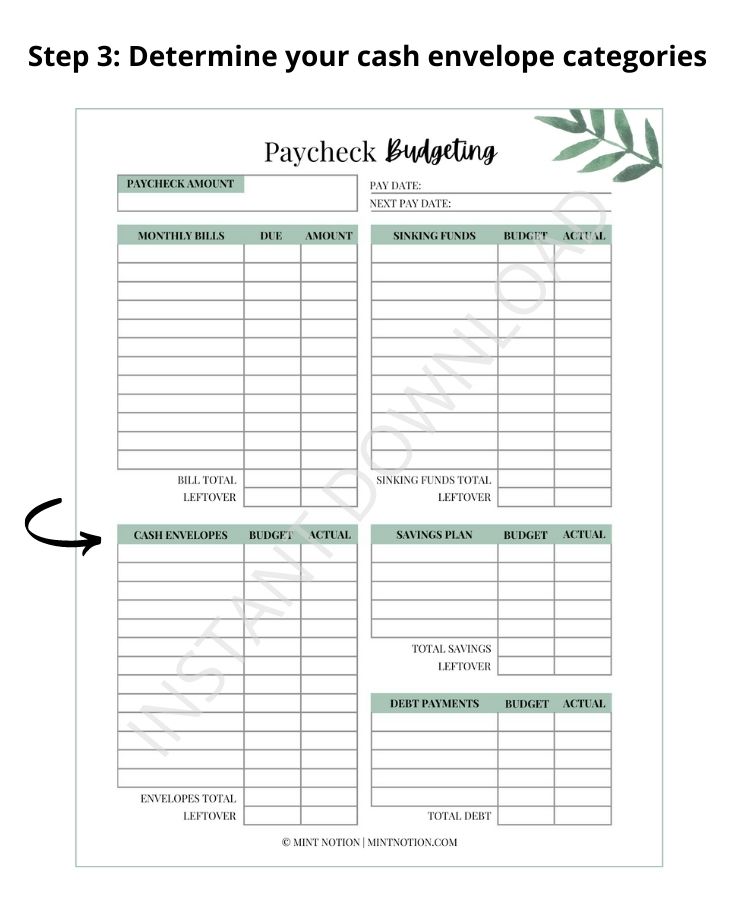

How to budget-by-paycheck

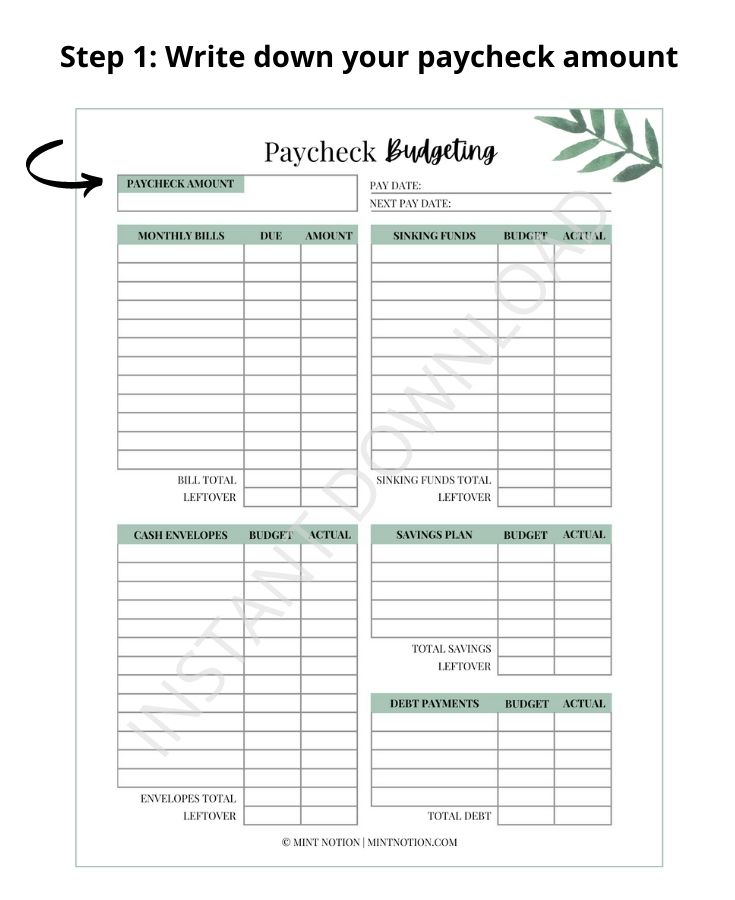

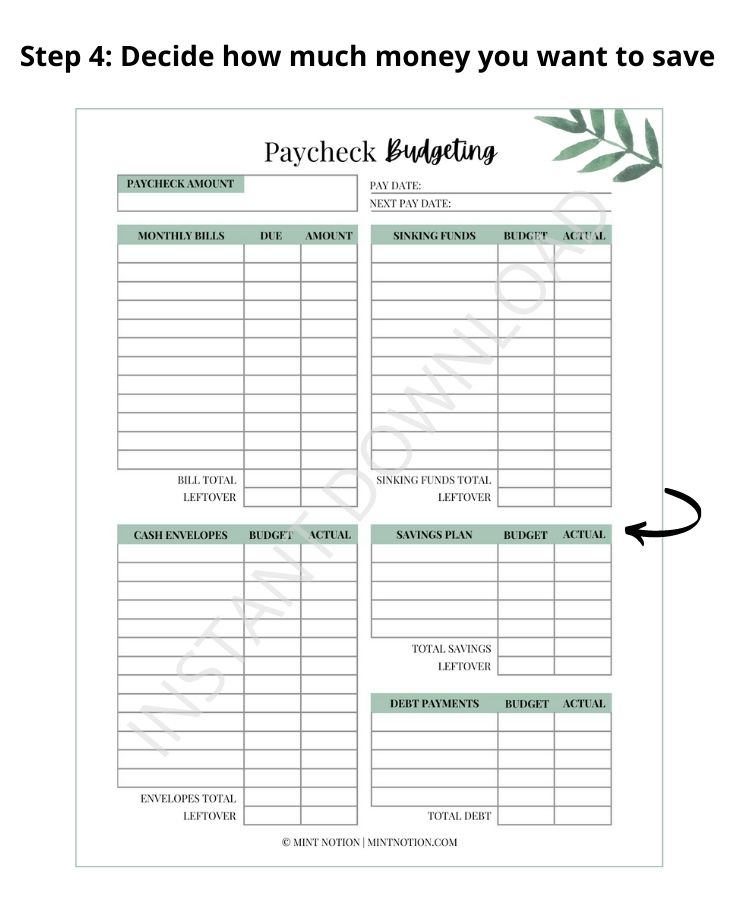

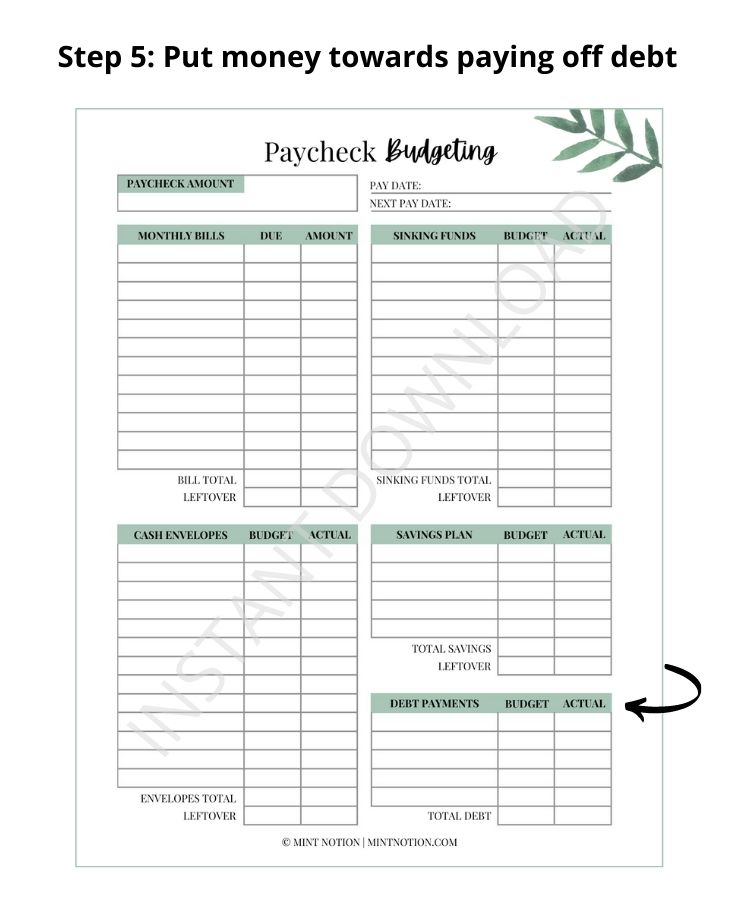

To get started, you can use my Paycheck Budgeting printable or feel free to create your own worksheet. It’s up to you!

Step 1: Write down the date you get paid, your paycheck amount, and your next expected pay date. This will let you know how many days (or weeks) you have to make this paycheck last.

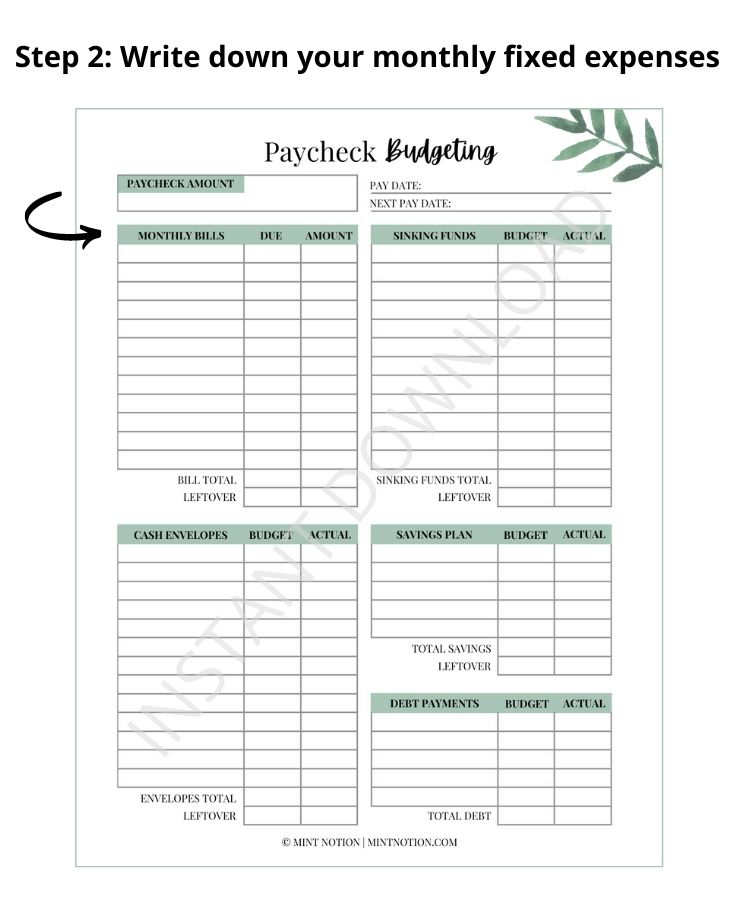

Step 2: List all the monthly bills you plan to pay using this specific paycheck. Record the bill total and any leftover amount from the paycheck. Leftover money will go towards your monthly variable expenses (your cash envelopes), your savings plan, and paying off any debt.

If you get paid twice per month, I recommend dividing your monthly bills into two groups. This means the first paycheck of the month will pay the first group of bills. The second paycheck of the month will pay the second group of bills.

Step 3: Here you’ll use cash (or your debit card if you prefer not to use cash) to pay for different categories in your budget, such as clothing, groceries, restaurants, and so on.

The cash envelope system can be a great way to help budget for items which tend to bust your budget. Studies have also shown that we often spend less money when we pay for items with cash.

For example, if your grocery budget for the month is $500 and you get paid bi-weekly, you’ll take out $250 cash from your first paycheck and put it into your “Grocery” envelope. Each time you withdraw money from your “Grocery” envelope, write down the store name and the amount you spent.

Read Next: How to use the cash envelope system without cash

Step 4: Determine how money much you’d like to put towards your savings plan. If you’re starting with little savings right now, I recommend building an emergency fund first. Having an emergency fund can help prepare you for those unexpected events in life you can’t plan for.

Step 5: After you’ve created a budget for your monthly bills, variable expenses (cash envelopes), and savings plan, put any leftover money towards paying down debt.

4. Plan your month using the calendar method

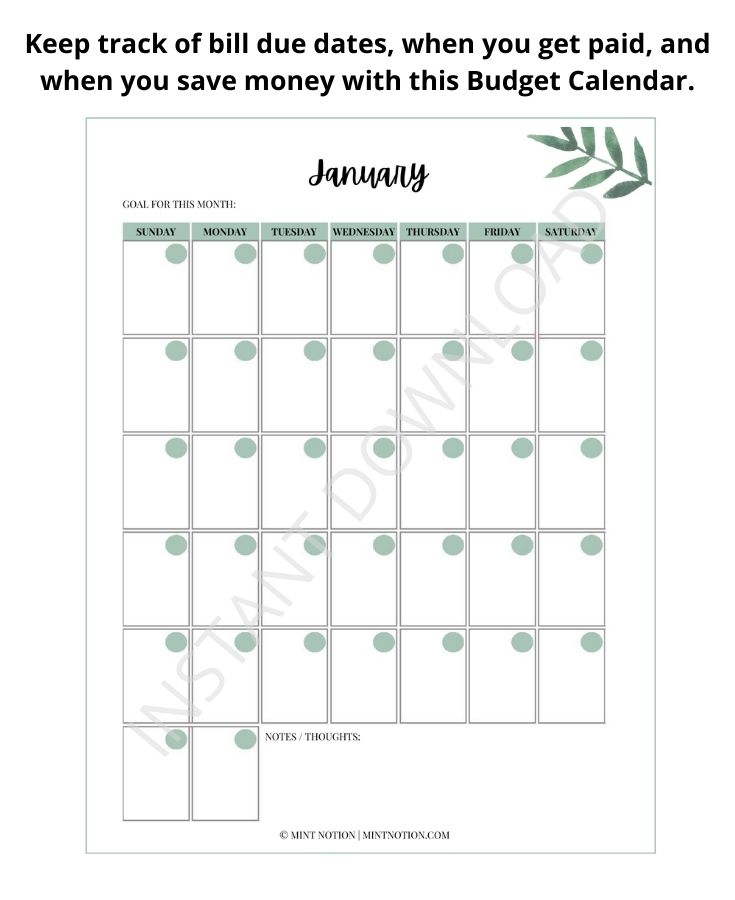

If you want to stop spending money you don’t have, you MUST know when money is coming in and when money is going out.

I’m not just talking about your bills. You ALSO need to know when you need money for specific events. Such as buying a birthday present for an upcoming party, or expenses for your child’s school field trip, or meeting your parent’s for lunch, or when you need to buy a dress for your friend’s wedding.

I recommend using a financial calendar to keep track of all these dates. This works well in conjunction when following the budget-by-paycheck method and can help you stop spending money. You can grab the printable financial calendar worksheets I use here, or you can create your own.

Read Next: What is a budget calendar and how to use it

Read Next: How to budget when you get paid biweekly

5. Pause before making a purchase

If you’re having trouble sticking to your new budget, force yourself to wait before making a purchase. I recommend waiting at least a week or longer, especially for those big-ticket items. This is one of the best ways to prevent impulse purchases and stop spending money.

Ask yourself: How many times will you actually wear those expensive shoes? Is that cute dry-clean only skirt worth the maintenance? Do you really need another eye shadow palette?

Chances are you’ll conclude that you don’t need the item and can put it back. If you still want the item, then wait. Make sure to include it in next month’s budget so you can purchase it without feeling guilty.

I know you can argue that if you don’t buy the item today, the price will increase or it won’t be available to buy anymore. I used to use this excuse to justify my impulse purchases ALL the time. But the truth is, if you let this fear of missing out influence you, there is always going to be an excuse to buy something – even for items you don’t need.

Read Next: 5 ways to stop overspending on impulse shopping

6. Stop using your credit cards and pay with cash

Research has shown that people are willing to spend more (up to 83%) when paying with credit card instead of cash. This is because credit card payments may not be as noticeable as paying with cash.

We don’t realize the pain of our payment until the bill comes in weeks later. If you’re having trouble sticking to your budget, leave the credit cards at home and switch to a cash diet instead. This can help you save more money.

7. Stop trying to impress people

A big reason why we spend money we don’t have is because we are trying to impress others. Whether it’s to keep up with our friends and family or to maintain an imagine, this can lead to unhealthy spending habits.

When we see others going on vacations, driving nice cars, wearing new outfits, moving into new homes, it makes us feel like we need to have those nice things too.

The truth is, people like to only share their highs in life. When you look on the outside only, you don’t have the complete story. And this can create the illusion that they are happier than you. They prefer not to tell you that they’ve gone into debt in order to buy their new car or they’re still working to pay off their tropical vacation.

Once you start focusing on your money goals instead of trying to keep up with others, your whole mindset will change.

This is because everyone is unique and a budget works best when its tailored to an individual’s lifestyle. This is when your goals have the highest chance of being achieved.

For example, if your friend is saving money to travel around the world, but saving money for a home is more important to you, you’ll want to budget accordingly. It’s easy to feel a little FOMO (fear of missing out), but it’s important to focus on what matters to you most.

Creating a budget which aligns with your goals will make you happier than trying to keep up with the Joneses. This can also help you to stop spending money unnecessarily.

Read Next: Saying “no” to friends when you’re trying to save money

8. Eat more meals at home

How to stop spending money on food — eat more meals at home. Most of us know that cooking food at home is healthier and more cost-effective than dining out, however a lot of people don’t do this.

To help save you money and eat more meals at home, here’s a simple solution: Spend 10-15 minutes on the weekend planning out your breakfasts, lunches, snacks, and dinners for the week. I like to do this on Sunday morning before I hit the grocery store.

This is called meal planning and it can be a helpful way to organize what you want to eat during the week. When you meal plan, this can prevent you from grabbing take away on the way home from work because you already know that you have dinner at home.

If you need help getting started, you can grab my weekly meal plan printable here. It’s included in my Meal Plan Binder, which I use to organize my grocery lists, fridge and pantry inventory, and my family’s favorite recipes.

PRO TIP: New to meal planning? You may want to check out $5 Meal Plan. For just $5 per month, you’ll get quick and easy meal plan ideas delivered to your inbox. Mint Notion readers love this option.

9. Avoid impulse buys

Raise your hand if you’ve ever gone to Target to get something small, such as shampoo, but you ended up leaving the store with a bunch of items that weren’t on your shopping list.

We all love getting deals and it’s hard to say “no” when stores are flashing their big sale signs. Whether or not you’d like to admit it, retailers are experts at getting us to spend money and make impulse purchases.

Impulse purchases are unplanned decisions to buy something right before the purchase is made. To help you avoid these shopping traps, it’s important to understand what exactly triggers you to shop and spend money.

For example, do you shop when you’re bored? When I’m bored, I used to scroll through my emails or open my favorite shopping apps to pass the time. Before I knew it, I would add items to my cart and click the “buy now” button. Oops!

Do you shop when you’re emotional? If I had a bad day at work, I used to go shopping and get some “retail therapy”. If I was happy, I would go shopping and “treat myself” to something nice. Emotional shopping is very common.

When you understand your spending triggers and which kind of shopper you are, this can help you avoid impulse buys because you’ll know how to better manage your triggers. I have a very detailed chapter in my e-book, The Intentional Spender, which helps you learn how to identify, understand, and manage your shopping triggers.

Read next: How to do a successful no-spend challenge

10. Clean and declutter

A lot of people believe that if you declutter, you’ll need to go shopping and buy new items to replace the ones you got rid of. This is NOT true.

When you clean and declutter, you’ll actually find all those items that you spent money on and thought you needed, but no longer use anymore.

All that clutter used to be time and money. Time used to shop and buy the item and money that could have been better spent elsewhere.

I recently just helped my boyfriend clean, declutter, and organize his wardrobe. It took nearly a full day since he hasn’t done it for a while. But now he has so much room in his closet. He can easily see everything he owns. Nothing is hidden underneath piles or clothes or tucked away back in the closet.

This has given him motivation to keep it clean instead of going out and buying a bunch of new things.