Have you ever asked yourself at the end of the month, “Where did all my money go”? Creating a budget might seem like an overwhelming and tedious task. But learning how to track your expenses is the best way to start winning with money.

It’s a simple way to gain control over your finances, and it could also reveal your spending patterns.

Here you’ll learn how to easily track your expenses in this step-by-step guide.

Related Posts:

- How to budget when you get paid biweekly

- How to follow the 50-30-20 budget rule

- How to use the half payment method to budget

Table of Contents

Step 1: Make a rough budget

If you’re brand new to budgeting, it’s important to track your spending first by creating a “rough budget”.

You need to figure out exactly what you spend your money on BEFORE you can create a realistic budget.

A rough budget is an outline of your income and expenses. This will help you understand where your money goes each month so you can spend and save wisely.

Think of your “rough budget” like the first draft of a paper. It’s your sloppy copy and the goal is just to get your expenses written down without trying to make it perfect. Nobody’s “rough budget” is meant to be perfect.

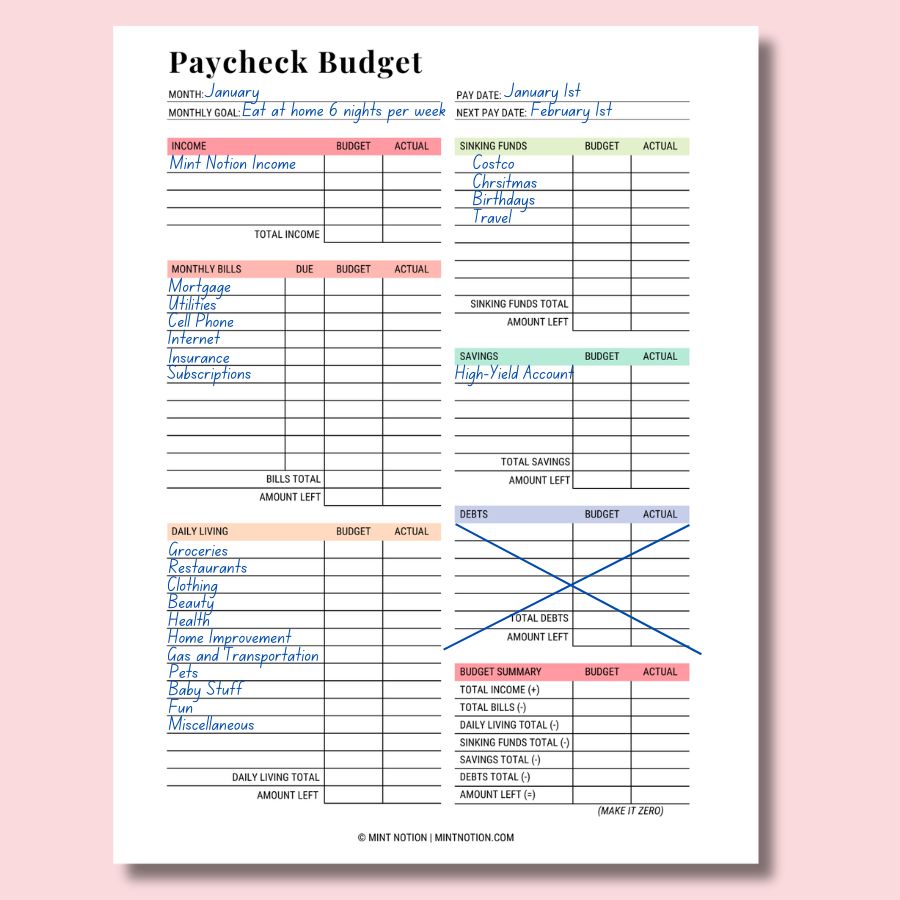

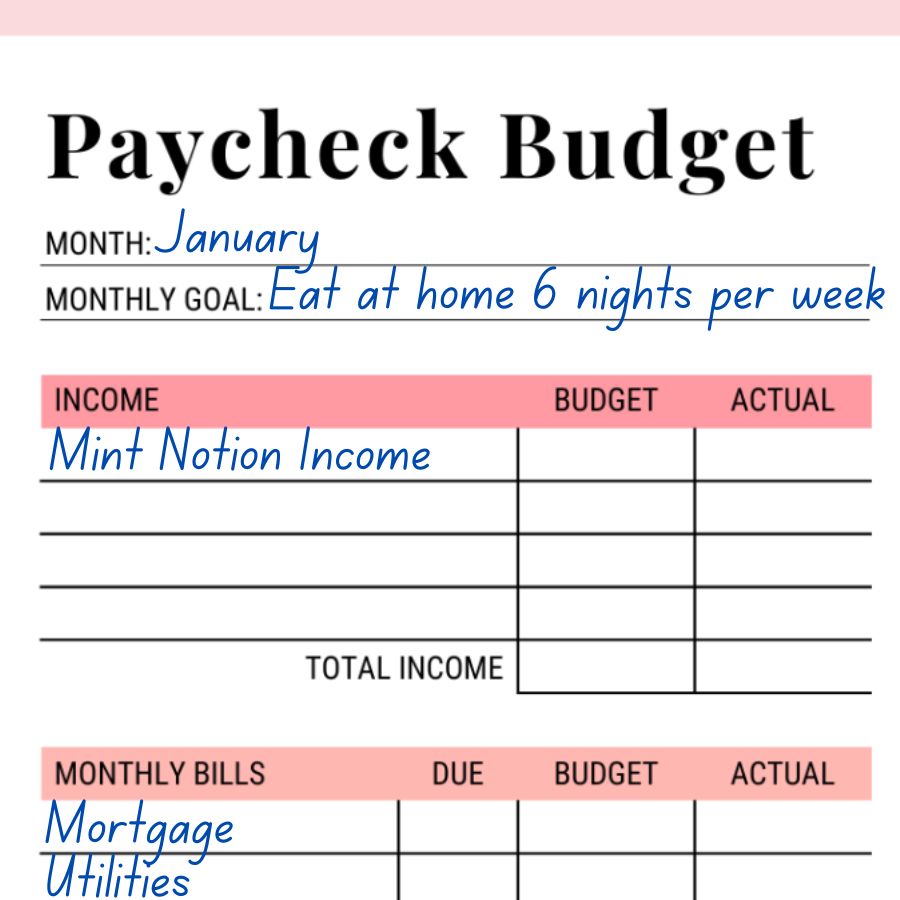

In fact, you can even call it your “sloppy budget” if you want to. Below is an example of my rought budget to give you an example.

What do you write under “Budget” and Actual”? Under the “Budget” column, this is where I normally write down how much money I plan to earn and spend for each budget category.

Unless you have a number in mind, leave the “Budget” column blank for now. Then at the end of the month, you can write down the amount you actually earned and spent under the “Actual” column.

Again, if you’re new to budgeting, just focus on tracking your expenses for this month. Then next month, you will have a better idea of how much you need to budget for each spending category.

1. List your income

The first step in making a rough budget is to list your income. This includes all the money you plan on making this month, such as your regular income, and any extras like side hustles.

If you earn irregular income, then look at what you’ve made for the past few months. Then take the lowest earning month and use that for this month’s planned income.

Below is an example of how I list my income in my budget.

I get paid once per month, so I would write down how much I plan to earn in the “Budget” column. Then once I receive my paycheck, I’ll write down the actual amount in the “Actual” column.

2. List your expenses

If you’re new to budgeting, then you may not know what all your regular and irregular expenses are for the month.

That’s okay. Right now, you’re just focusing on making a rough budget.

You can review your bank statements for the past few months to give you an idea of what your fixed, variable, and irregular expenses are.

Then write down everything that you plan on paying for this month. Make sure to include money that you want to set aside for savings and giving (tithes) too.

When making a budget, your income minus expenses should equal zero. This is called a zero-based budget, which means that every dollar you earn is given a job (whether it’s spent on expenses or tucked away into your savings).

But for this month, you don’t have to write down how much money you’re budgeting for each expense.

Remember, this is your “rough budget”, which means that you just want to get an idea of what expenses you’ll need to pay for.

Then once you get a better understanding of what you spend your money on, you can go back and make adjustments as needed.

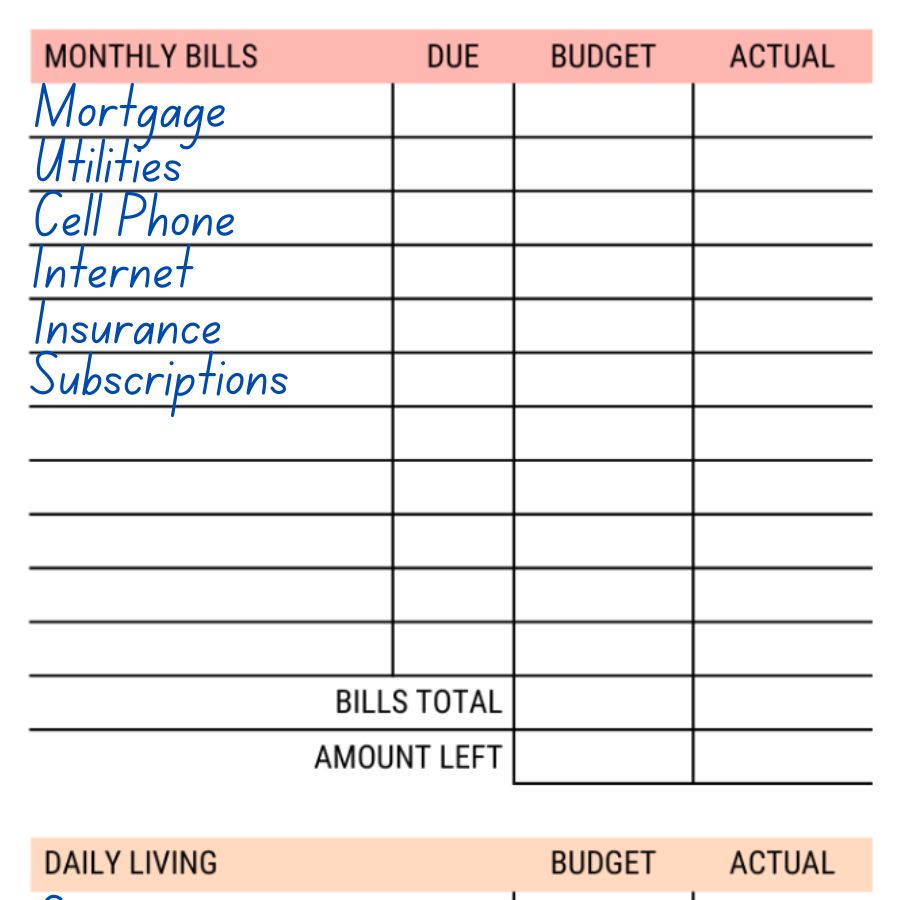

Fixed Expenses – These are the expenses that you can expect to stay the same over time. Below are some common fixed expenses that you might want to include in your budget.

- Rent / Mortgage

- Car Payments

- Other Loan Payments

- Property Taxes

- Phone and Utility Bills

- Insurance Premiums

- Child Care Costs

Below is an example of how I list my fixed expenses in my budget.

I list them down under the “Monthly Bills” section. There is also a space to write down when the payment is due so you can stay on top of your bills.

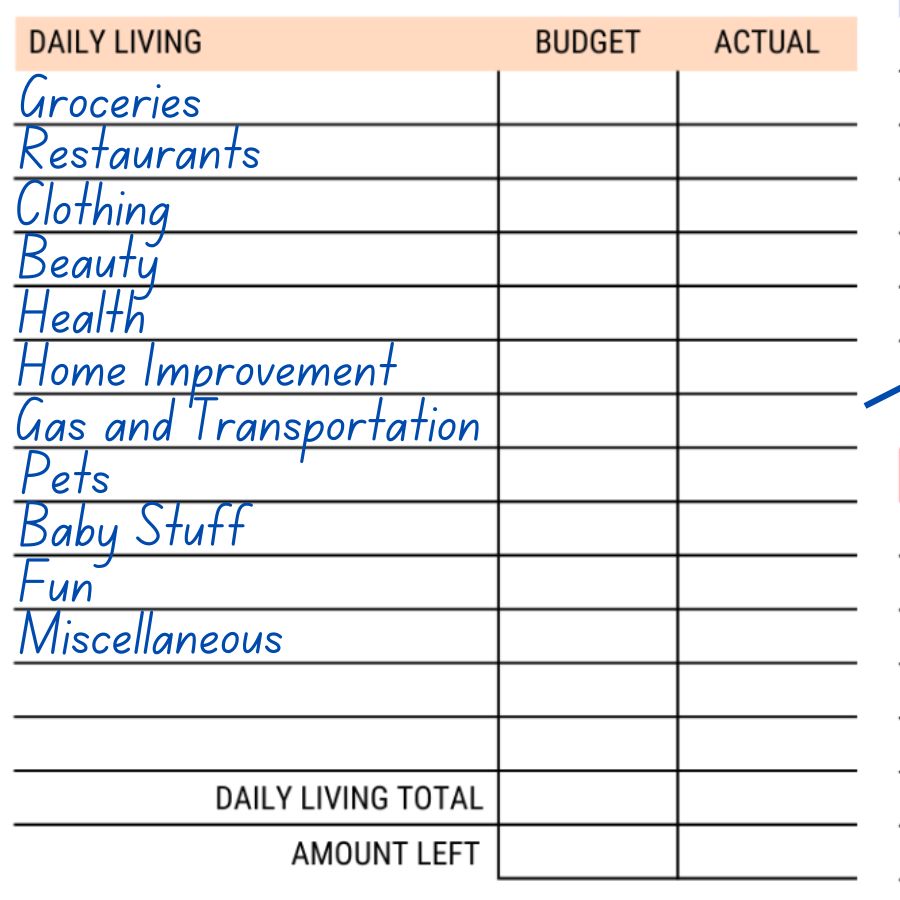

Variable Expenses – These are expenses that may recur, but the amount you pay each month might change. Below are some common variable expenses that you might want to include in your budget.

- Groceries

- Restaurants

- Clothing

- Beauty

- Pet Stuff

- Kid Stuff

- Gas and Transportation

- Entertainment

- Travel

- Fun Money (This can be used to spend on whatever you want)

Below is an example of how I list my variable expenses in my budget. I list them under the “Daily Living” section.

Irregular Expenses – These are expenses that happen on a quarterly or annual basis. They can also be seasonal, such as birthday or holiday related expenses. Below are some examples of irregular expenses:

- Birthdays

- Holidays (Valentine’s Day, St. Patrick’s Day, Easter, Fourth of July, Mother’s Day, Father’s Day, Labor Day, Halloween, Thanksgiving, and Christmas)

- Insurance Premiums

- Property Tax

- Charitable Contributions

- Retirement Contributions

- Income Tax Payment

- Car Maintenace and Repairs

- Home Maintenance and Repairs

- Education Expenses (Tuition bills, school supplies, field trips)

- Health Expenses (Yearly doctor check-up, Dental work, Glasses or contacts)

- Pet Expenses (Vaccinations, check-ups, grooming, prescriptions, pet boarding)

- Leisure Expenses (Travel, Season tickets or passes, concerts, electronics, sports activities, membership fees, kids’ activity fees)

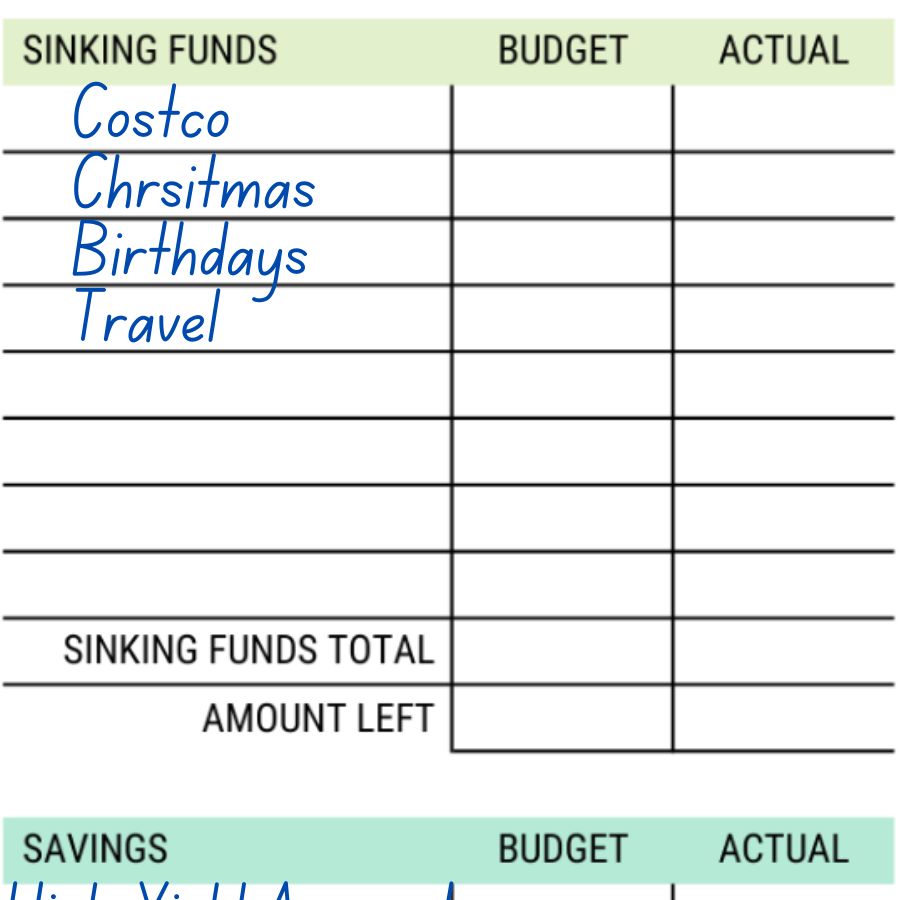

Sinking Funds – These are the things that you’d like to save up for. They are specific savings goals or expenses, such as an upcoming trip, Christmas, birthdays, or even property taxes.

For example, I like to save $1,000 per year for Christmas. This money will cover gifts, parties, baking ingredients, and any other Christmas related expenses.

Instead of waiting until December to pay for Christmas with a single month’s budget, it’s much easier to set aside a little bit of money each month.

Saving up small amounts over time is more manageable than having to come up with a big chunk of money all at once. Below are some examples of sinking funds:

- Christmas

- Birthdays

- Vet Bills

- Wedding Expenses

- Travel

- Concert Tickets

- Special Occasion Clothing

- School Books and Supplies

- Home Renovations and Landscaping

- House Downpayment

- Car Repairs

- Insurance

- New Bed Mattress

Below is an example of how I list my sinking funds in my budget. I list them under the “Sinking Funds” section.

Savings – This is money that you want to set aside, such as in your high-yield savings account, emergency fund, retirement contributions, and so on.

Below is an example of how I list my savings in my budget. I write them down under the “Savings” section.

Debts – If you’re paying off debt, write down how much money you would like to put towards debt payments this month.

*I am debt free, so I just cross out this section of my budget*

Now that you’ve written down all the expenses you plan on paying for this month, the next step is to track your income.

Step 2: Track your income

Whenever you receive money (from your regular paycheck or side hustle), enter that amount under the “Income” section of your budget.

This is extremely important if your income fluctuates. But even with regular income, it’s important to make sure that everything looks good with your paycheck.

Step 3: Track your spending

Every single time you spend money, write it down.

When you visit the grocery store to pick up some items for dinner, write it down. When you go to the gas station to fill up your tank, write it down. When you grab coffee with a friend, write it down. When you pay the rent, write it down. When you pay for a monthly streaming service (like Netflix), write it down.

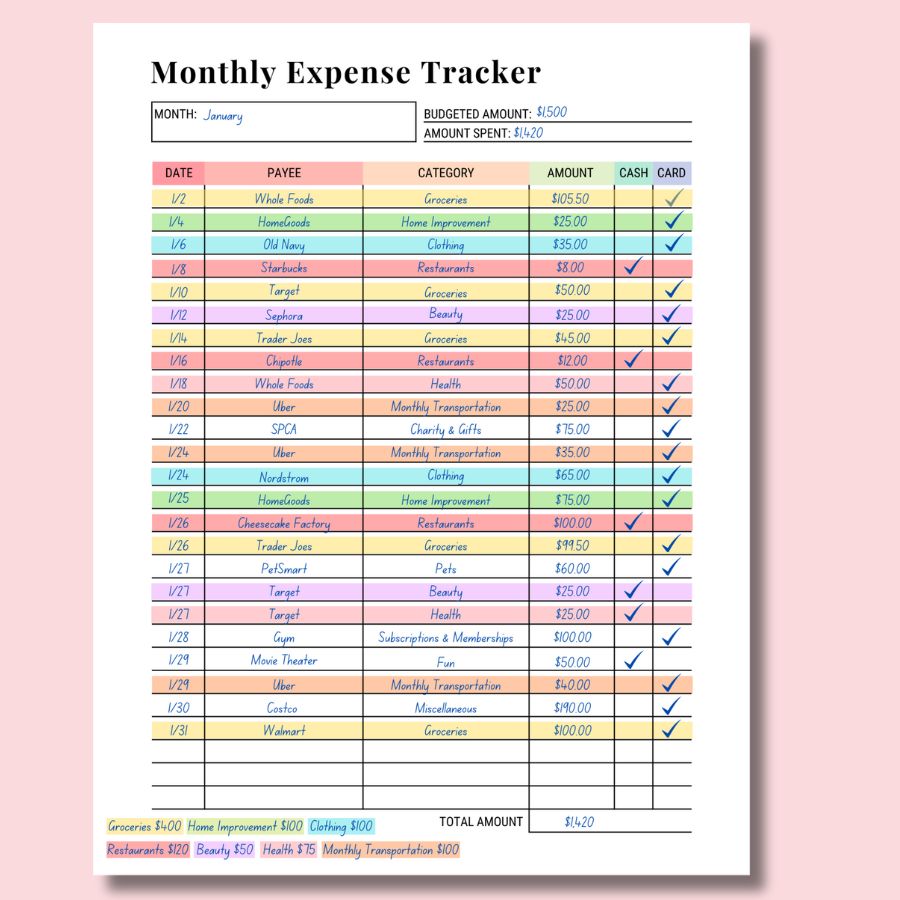

I like using this Monthly Expense Tracker to stay organized.

I highlight each spending category with a different color so it’s easy to see everything at a glance.

- Date – Record the date of the transaction.

- Payee – Record the one who is receiving the payment, such as the store name or business.

- Category – Record the budget category that best describes the expense, such as “Groceries”, “Rent or Mortgage”, “Phone Bill”, “Restaurants”, and so on.

- Amount – Record the payment amount.

- Cash / Card – Make a note if the payment was made using cash or a credit card. If the payment was made by check, this would fall under the “Cash” column.

*If you have a lot of expenses during the month, you can print out as many copies of the Monthly Expense Tracker as you need*

Try to get into the habit of tracking your expenses on a daily basis. It might seem tedious in the beginning, but it will get you thinking carefully about your spending habits.

Plus, it prevents you from having to deal with a backlog of expenses to record at the end of the week (or month).

I like to keep all my paper receipts in a folder or envelope, which I tuck into my Budget Planner. For digital receipts, I keep them in a file on my computer or print them out to store in my Budget Planner.

4 Ways To Track Your Expenses

Now that you know how to track your expenses, below are four different ways you can do it. There is no “best way” to track your expenses. The best way is the method that you’ll actually stick to.

1. Pen and paper

My favorite way to track expenses is to write everything down on a paper budget.

Studies have shown that people who write down their goals are more likely to achieve them. That’s because we are better at remembering things when we write them down ourselves than if we merely read them.

A similar phenomenon happens when we track our expenses with a pen and paper. The act of writing things down by hand allows you to retain more financial information and keeps your money goals at the top of your mind.

When you write down the numbers, you see it in real time, which helps you resonate with it better and stick to your budget.

For many people, our relationship with money is emotional. But most of us don’t look at our spreadsheets or budgeting apps on a daily basis, which makes it easy to disconnect from our spending.

When you track your expenses with a pen and paper, you’re more likely to take note of your budget before heading to the grocery store and make a note of your spending when you check out.

The act of writing it down can help you think twice before making a purchase out of convenience or impulse that normally derails your budget.

It also helps you to have an emotional connection to it, which could prevent impulse shopping. For example, you might say things like…

“I’m getting close to my budget number, do I really need to be buying the brand name when the store brand is half the cost?”

Or “Do I really need to be getting takeout again when I have food to make at home?”

Pros:

- You don’t need access to technology.

- Writing everything down on paper helps you stick to your budget.

- It’s affordable and easy to do.

Cons:

- It takes time to write everything down and do the math.

- It requires you to be diligent about keeping receipts and recording your spending.

- Lacks the automation that comes with digital budgeting tools.

2. Spreadsheet

Spreadsheets are a digital way to budget and track your expenses. Like using a pen and paper budget, you’ll manually enter the numbers into your spreadsheet. Once you set it up though, the math is done for you.

Pros:

- It’s easy to add or remove budget categories and make adjustments.

- Spreadsheets provide automatic calculations.

- Spreadsheets also populate charts to help you get a bird’s eye view of your spending.

Cons:

- It’s not convenient since you’ll need to go on your computer or tablet to enter the numbers.

- There’s a learning curve. If creating the spreadsheet yourself, you’ll need to be knowledgeable about spreadsheet formulas. Otherwise, you can purchase a budget spreadsheet that handles more complicated formulas.

- Spreadsheets are reliant on technology, which could make them susceptible to crashes or glitches.

3. Cash Envelope Method

The cash envelope method uses cash to pay for as many things as you can in your budget. For bills, retirement contributions, investments and savings, you’ll send checks or make a debit card payment online.

But for expenses that you pay in person, you’ll stick to cash. This includes groceries, restaurants, clothing, entertainment, pet and kid stuff, beauty, gas, and other variable spending categories.

At the start of the month when you make your budget, you’ll label cash envelopes with the spending categories you want to pay for in cash.

Decide on how much you need for each of these spending categories, then fill each envelope with the amount of cash you budgeted for that particular category.

For example, if you budget $400 a month for groceries, you’ll label an envelope as “Groceries” and stuff it with $400 in cash. Then you’ll use this cash to pay for any grocery related purchases during the month.

Once the money is gone, it’s gone. If there is any money leftover in your budget at the end of the month, you can put that towards your savings.

Since you’ll be paying cash for these purchases, you’ll easily be able to see how much money you have left in your budget.

Studies have also shown that we tend to pay less when paying with cash due to the psychological pain of payment. When you hand over a $20 bill, you’re literally watching the money disappear before your eyes.

If you have trouble sticking to your budget, using the cash envelope method can help prevent overspending and impulse shopping.

Pros:

- You’ll know exactly how much money you have left in your budget and when you need to cut back on spending.

- You don’t need to worry about overspending because once the envelope is empty, you’re done spending for that budget category.

- It’ll help you stay disciplined and strengthen your willpower.

Cons:

- Sometimes paying cash is inconvenient or not an option.

- You don’t have the protection and miss out on rewards that credit cards offer.

- It might be hard to get the whole family on board because not everyone likes using cash.

4. Budgeting Apps

Budgeting apps have grown in popularity because you can easily track your expenses from your phone.

It’s the easiest and most convenient way to track your spending because it automatically pulls and categorizes from your bank accounts.

But when you automate your budget, you’ll feel less accountable, and it creates emotional distance from you and your money. In the long run, this can lead to overspending and make it difficult to get ahead with your money.

Pros:

- It’s easy and convenient.

- Budgeting apps usually come with lots of different features to help you create a budget.

- You can use your phone to track your expenses anywhere because it automatically updates in the app.

Cons:

- It relies on technology which could crash.

- The company who made the app could shut down overnight and you’ll lose access to your budgeting history. (This happened with the Mint app).

- Automating your budget could lead to overspending since it creates emotional distance between you and your money.