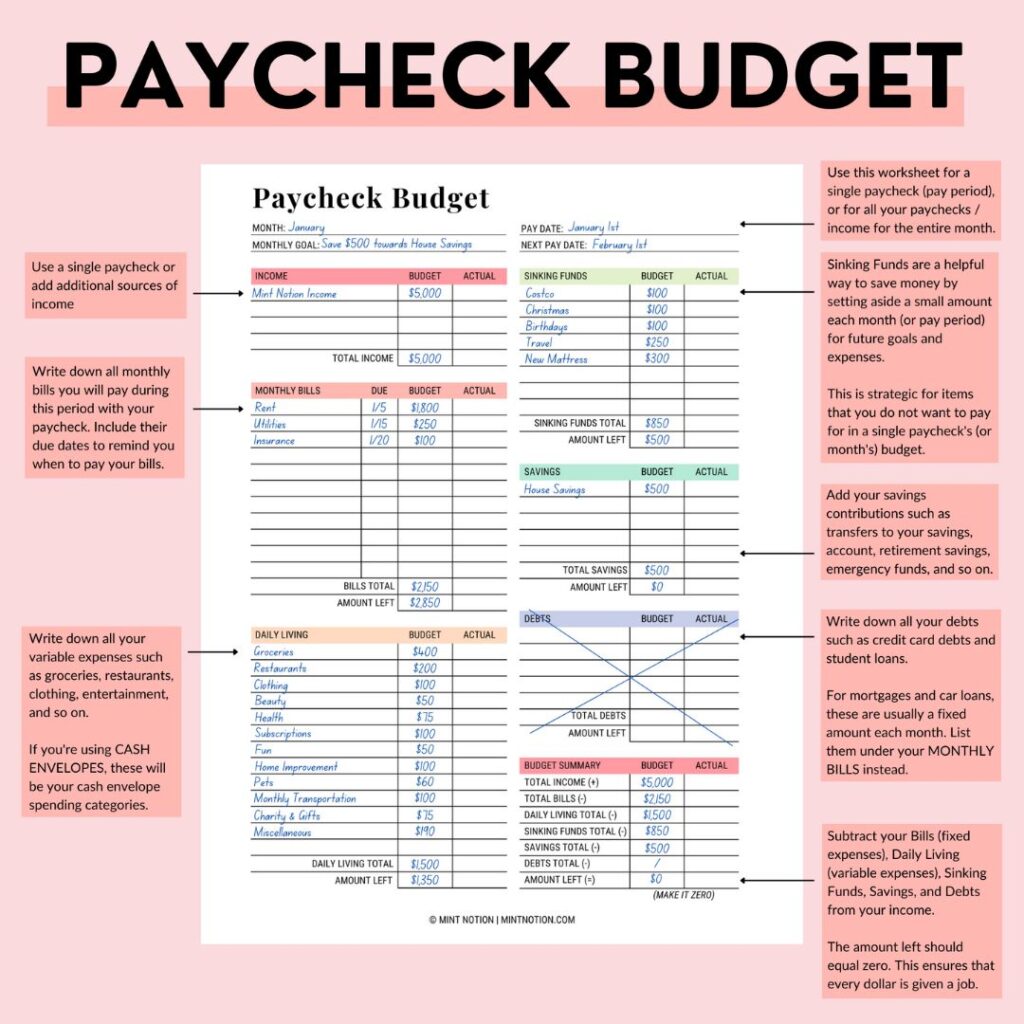

What is a zero-based budget? This budgeting method means your income minus expenses will equal zero. With a zero-based budget, every dollar you have is assigned a job. Some of your dollars will be assigned to paying expenses, some of them will go towards your savings, investments, or paying off debt.

Zero-based budgeting means every dollar has a job and you should have zero dollars left in your budget.

For example, if you earn $3,000 per month, you want to make sure every expense, savings, or debt payment will add up to $3,000. This budgeting method can help prevent overspending.

Zero-based budgeting doesn’t mean you have zero dollars left in your bank account. You’ll want to keep a buffer or financial cushion in your checking account. Choose an amount that feels comfortable and safe for you.

It’s your budget that should hit zero every month, because you’re giving every dollar you make a job. You can repeat budget categories and amounts every month or mix it up, depending on the season or your goals.

Related Posts:

- How to use the cash envelope system without cash

- How to budget when you get paid biweekly

- What is the 50/30/20 budget rule?

Table of Contents

Why is a zero-based budget important?

A zero-based budget is a simple and flexible way of budgeting where your income minus expenses equals zero. It’s an effective way to get your money under control, pay down debt, and reach your savings goals.

A zero-based budget forces you to pay attention to every dollar that comes in and out of your budget. And the best part is – you don’t have guess anymore about how much you’re saving or spending on food. You get the power to create a plan for your money.

Creating a zero-based budget is important because you don’t have to guess where your money is going. Instead you’ll assign every dollar you make a specific spot in your budget.

A zero-based budget also gives you a sense of control over what’s happening with your money, especially during this economy where peace of mind about your finances is essential.

How to Start a Zero-Based Budget

There are a few things you’ll need to do before you start a zero-based budget. This will help ensure that you create a budget that you can actually stick to and accomplish your money goals.

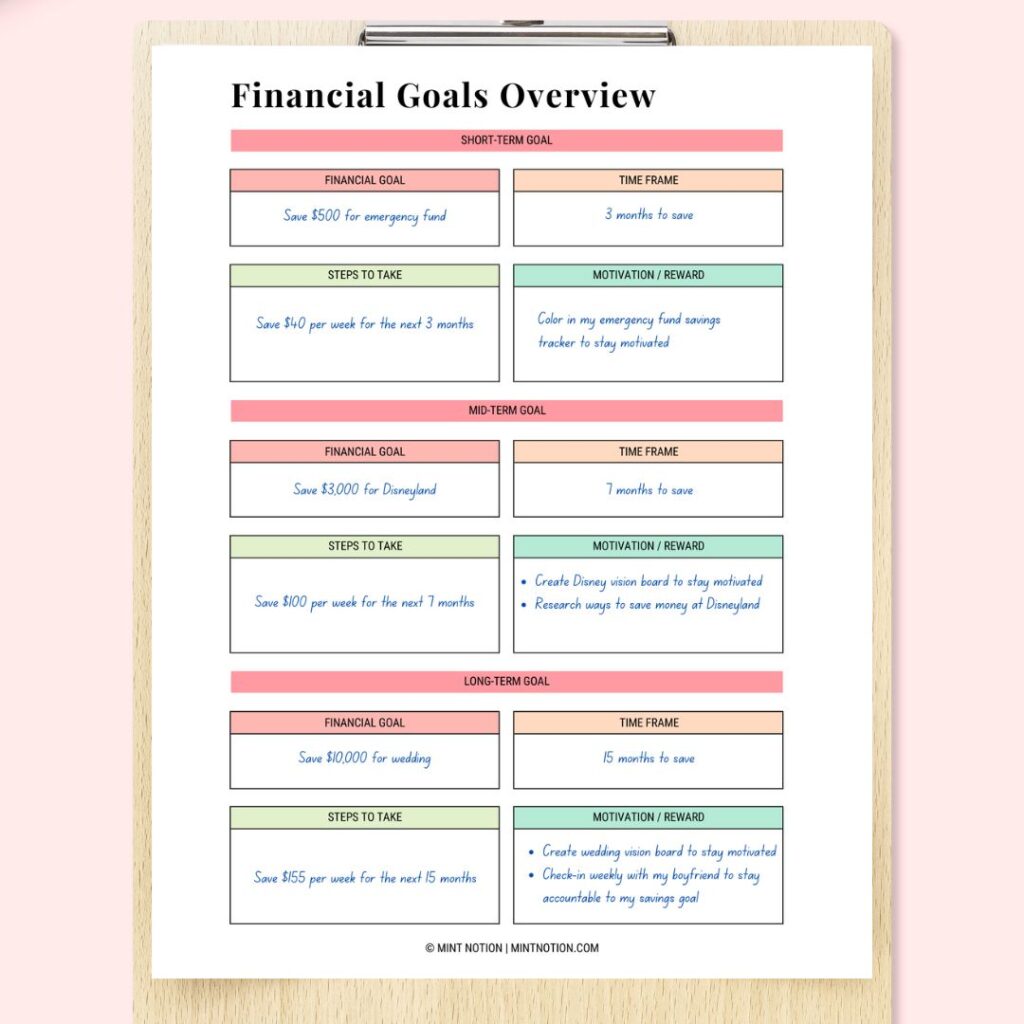

Set your money goals

How and what you budget will be dependent on your goals. Your goals can be anything you want. Maybe you want to pay off credit card debt, or save money to purchase a car, or build an emergency fund.

The more specific you can get, the easier it will be to break down your goals into manageable steps. I like to use this Financial Goals worksheet to help me organize my money goals.

Track your spending for at least one month

Before you get started, you’ll need to know where your money is going. If you use your credit or debit card for most of your spending, you can refer to your previous bank statements to see where your money is going.

If you use cash to pay for everything, start today by tracking all your spending going forward. Save the receipts and write down each transaction in a notebook or by using my Monthly Expense Tracker.

Read Next: 4 ways to track your monthly expenses

Write down your recurring monthly expenses

These are expenses that don’t change from period to period. For example, your mortgage / rent payments, utility bills, insurance payments, streaming services, and so on.

Figure out your common spending categories

Most of our daily spending falls into a few different budget categories. These categories will be different for everyone.

Some common budget categories may include groceries, entertainment, transportation, clothing, restaurants, haircare / beauty, and personal spending.

Assign your spending to the appropriate budget category

Once you’ve created a list of your top spending categories, go through your bank statements (or monthly spending tracker) and assign each expense to its appropriate budget category.

Once you’ve finished, calculate the total amount to see how much you’re spending in each budget category.

Identify areas for improvement

If this is your first time tracking your spending, it may shock you to see where your money is actually going. I remember when I started tracking my spending, I couldn’t believe how much money I was spending at restaurants.

It’s easy to get upset over your spending habits, but it’s important to remember that you’re taking action now to get your money under control. These are the uncomfortable steps that we must take to reach our goals.

Decide how much you’d like to budget for each spending category

Remember that zero-based budgeting isn’t telling you not to spend money. It’s giving you the power to spend your money the right way.

To help you achieve your money goals, decide how much you’d like to budget for each spending category.

For example, if you’ve been overspending on groceries each month, set a realistic budget for the following month.

Read Next: 50 creative ways to save money on a tight budget

How to Create a Zero-Based Budget

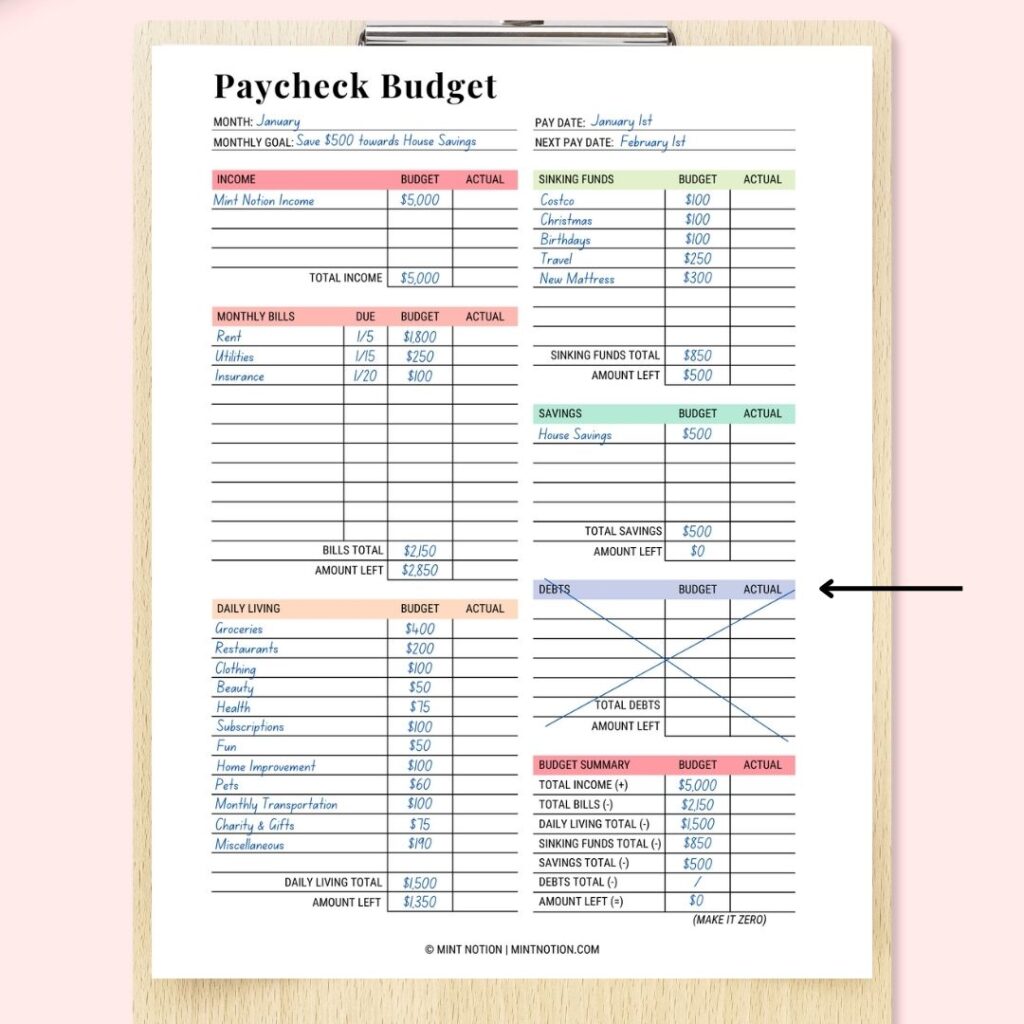

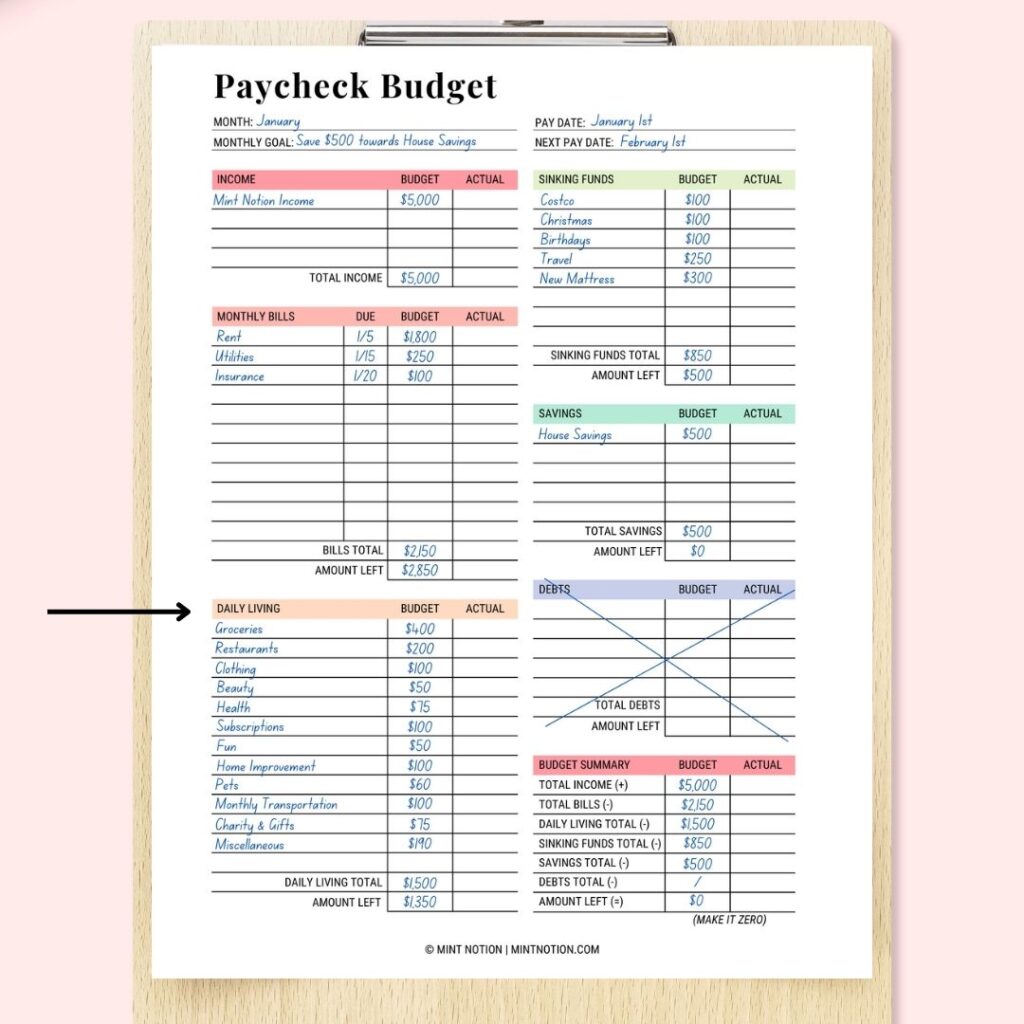

1.Write down your income

It’s can be helpful to see the big picture written out on paper. Income includes your paychecks, side hustles, rental income, child support, and any other cash you bring in.

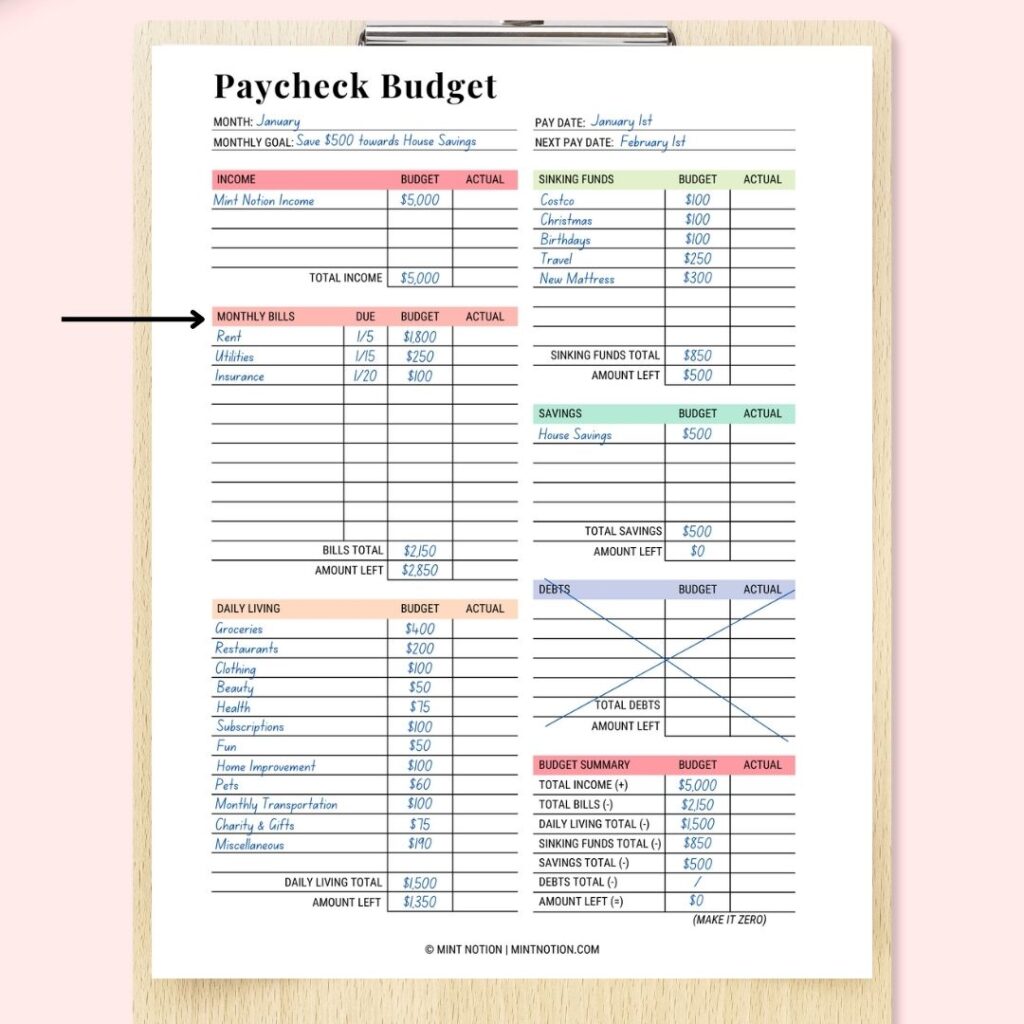

2. Write down your monthly bills and expenses

Before the month begins, write down all your monthly bills and fixed expenses. These are expenses that don’t change from period to period.

For example, your mortgage / rent payments, utility bills, insurance payments, streaming services, and so on.

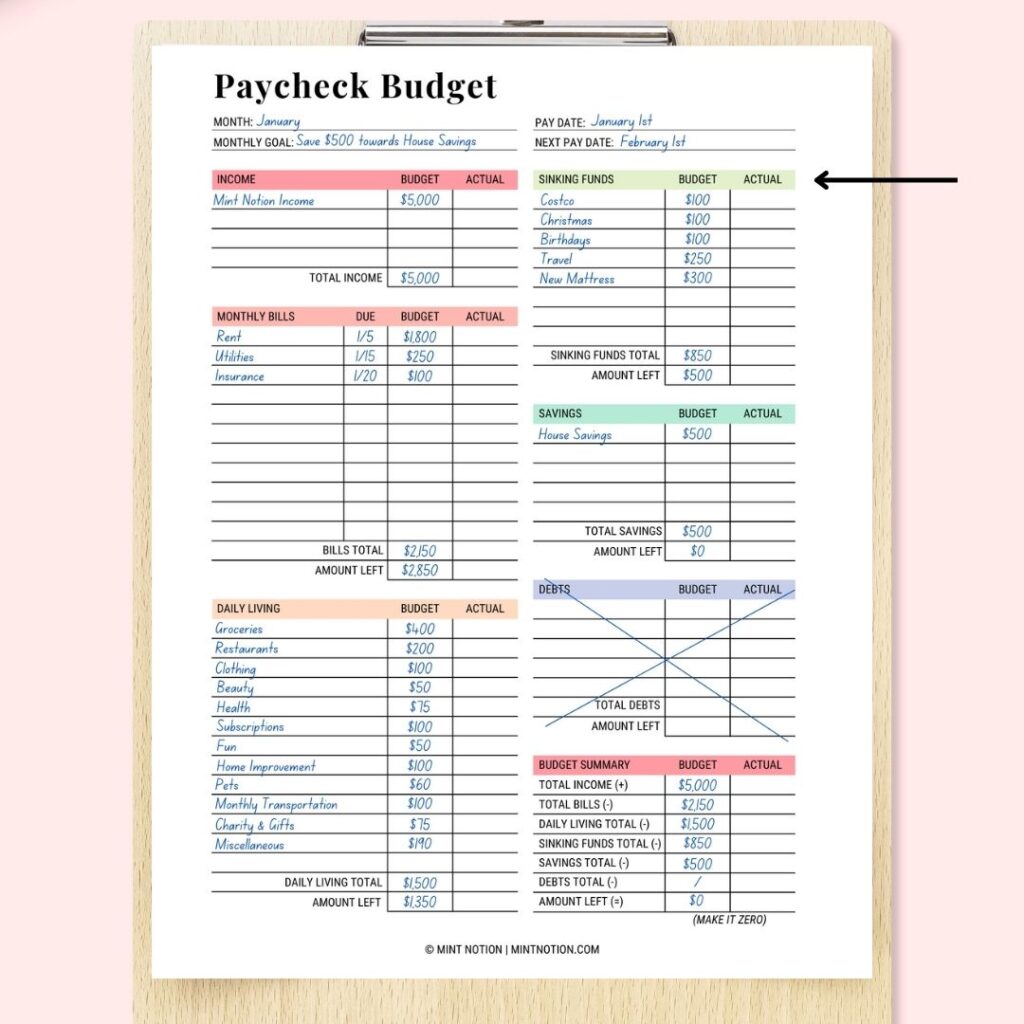

3. Write down your sinking funds

Here you can list all your sinking funds that you’d like to save for. Sinking funds are specific savings goals. You can set aside money each month to save up for these goals, such as Christmas, travel, birthdays, property taxes and so on.

If you’re interested in learning more, here’s an in-depth guide about how to start using sinking funds in your budget.

If you’re brand new to budgeting, you can leave this section blank for now. When I first started my budget, my only sinking fund was for vacations. I would set aside money each month in my budget to save up for a trip.

If you celebrate Christmas, you may want to set aside money each month so you’ll be prepared when Christmas arrives in December.

For example, if you want to save $800 for Christmas, then divide that by how many months are left to determine how much money you should save each month.

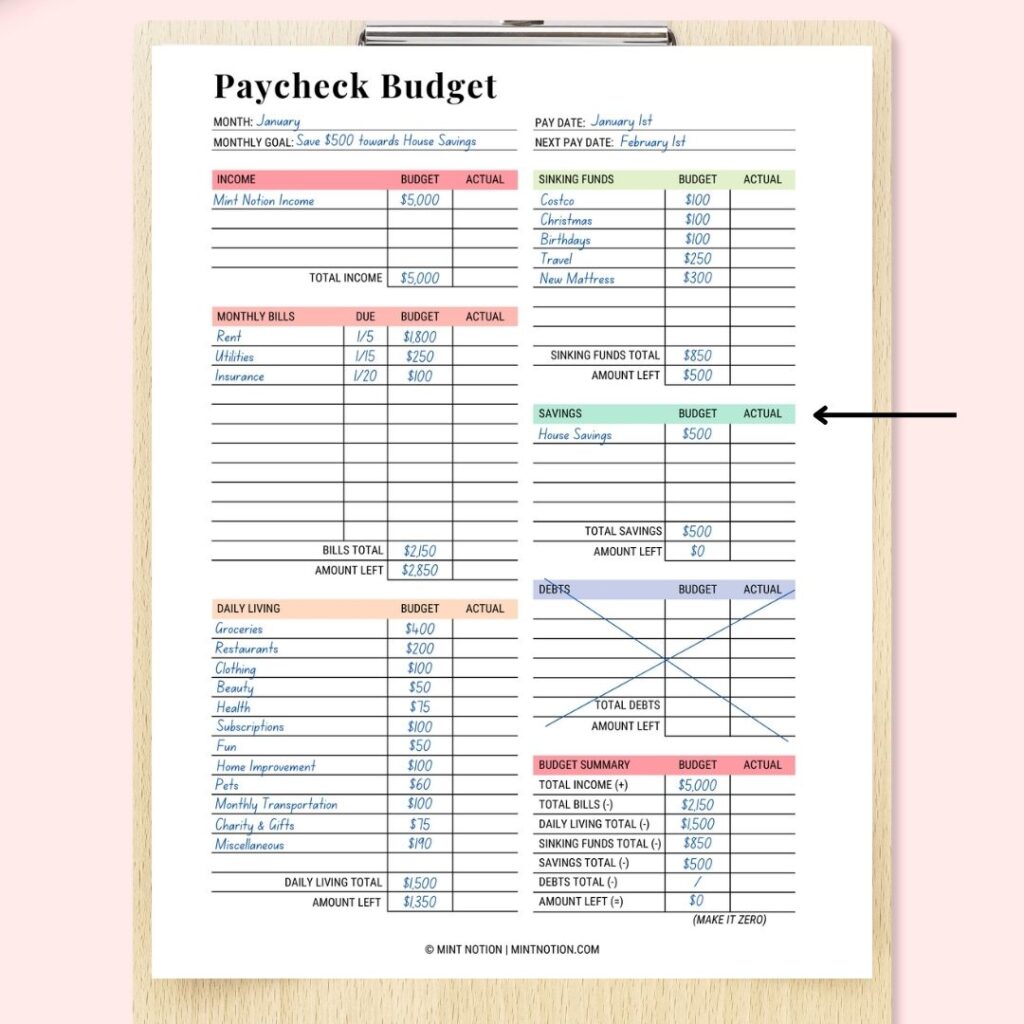

4. Write down your savings plan

Write down how much money you would like to add to your savings plan this month, such as your savings account.

This can also be money that you want to put towards building an emergency fund or your retirement fund.

5. Write down your debt payments

If you’re paying off debt, write down how much money you would like to put towards debt payments this month. If you don’t have debt, then you can leave this section blank.

6. Write down your daily living expenses

Here you’ll write down your variable expenses for the month. Variable expenses represent your daily living spending, such as buying groceries, eating at restaurants, drinking Starbucks, buying clothes, or going to a bar with friends.

They are considered variable expenses because the amount you spend can change from month-to-month.

List your top spending categories for the month and how much you’d like to budget for each category. Your needs will most likely change from month-to-month. This is why it’s important to create a new zero-based budget for every month.

How to budget for unexpected costs

I understand that life happens. That’s why I recommend adding a miscellaneous category in your budget.

Use this money for unexpected costs or spending that doesn’t quite fit into your other budget categories. For example, that one time I accidently broke my coffee carafe and had to order a new one. Oops!

Just because you have miscellaneous money available in your budget doesn’t mean you should spend it on things you don’t need.

If you have money leftover at the end of the month, put it towards your goals, such as paying off debt or your sinking funds.

Read Next: What is the 70-20-10 buget rule?

How to make a budget for beginners (Step-by-Step Video)

If you need more guidance, check out this video where you’ll learn how to make a budget for beginners.

How to use cashless envelopes to prevent overspending

Zero-based budgeting doesn’t have to be complicated. But if you’re having trouble sticking to your budget each month, you may want to consider using cash envelopes (or cashless envelopes) to help you stay on track.

The cash envelope system is a budgeting method where you use cash and envelopes to help track and manage your monthly variable spending (daily living costs).

You can create a separate envelope for every single budget category or just use envelopes for the categories that tend to bust your budget. This could be things like groceries, restaurants, entertainment, clothing, and so on.

For example, let’s say you budget $400 for groceries. This means you’ll take out $400 in cash from your bank and put the cash in your grocery envelope.

If you’re going cashless, which means you’ll use your debit or credit card to pay for everything, you’ll put the receipts inside the appropriate envelope and record the transaction.

You can grab my free cashless envelopes here to get started. Then check out this in-depth tutorial on how to use the cash envelope method without cash.

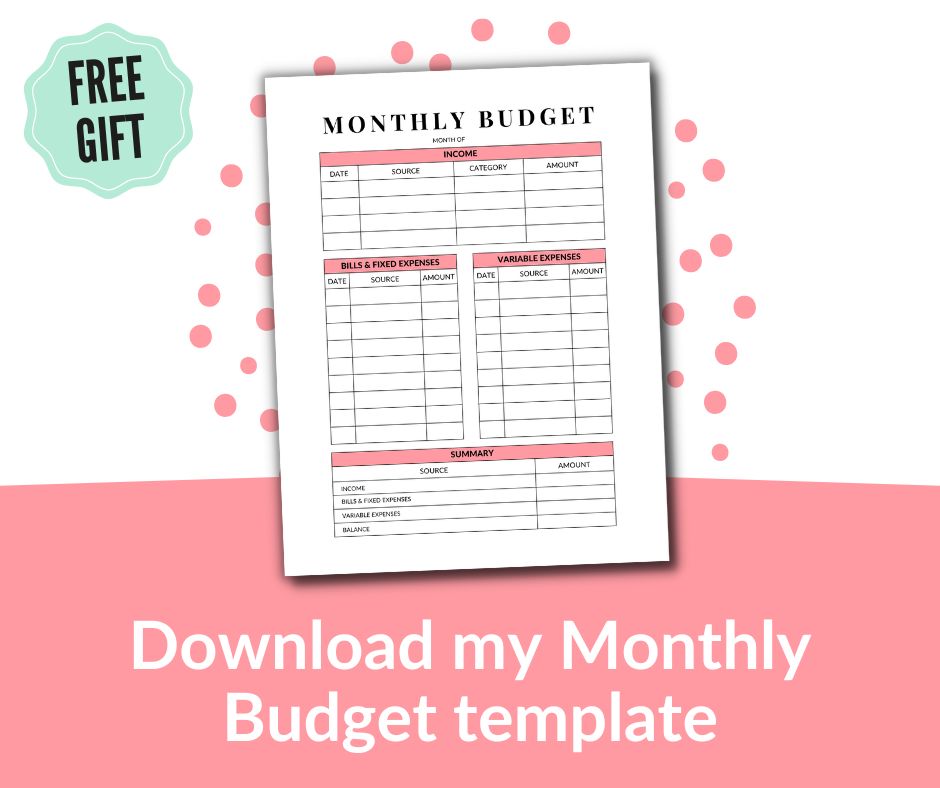

Zero-Based Budget Template

To get started, you can grab my monthly budget template here.

If you’re ready to seriously get your money under control, consider grabbing my Budget Planner, which includes the zero-based budgeting template shown in this post.

Can You Make a Zero-Based Budget with Irregular Income?

Yes! Zero-based budgeting can work even if you have irregular income. This means you get paid different amounts and / or at different times on a regular basis.

I run my own online business and earn irregular income too. It’s just as easy to create a zero-based budget with irregular income as it is with regular income. It just looks a little different.

You’ll base your budget on your lowest earning month for the past year. Next, all you have to do is make sure that you’ve got your monthly bills and living essentials covered (rent / mortgage, utilities, transportation, and food).

Then you can set aside money for your savings, debt payments and other daily spending that’s important to you.

A zero-based budget can provide the flexibility you need in this economy, especially if your income isn’t consistent or your expenses change from month to month. This is because you start your budget fresh before the beginning of each month.

You can add or remove budget categories as needed or increase or decrease how much money you assign to each spending category, based on your income and goals.

Read Next: How to budget with an irregular income

Why is it important to write a zero-based budget every month?

Budgeting is one of the key tools to your financial success. Writing and following a zero-based budget can help prevent impulse purchases and overspending.

It’s important to write a new zero-based budget each month because it forces you to pay attention to where your money is going and make adjustments as needed.

Tips for Zero-Based Budgeting

If you’re new to zero-based budgeting, it may take a month or two to get the hang of it. This is normal. In the meantime, you’ll learn a lot about your monthly spending. To get the most from your zero-based budget, here are a few tips you’ll want to follow.

Track your spending

Making a monthly budget and keeping receipts from purchases is great. But it won’t actually help you change your spending habits unless you keep track of every dollar you spend. This can help make sure that you’re sticking to your budget plan and shape your budget categories for next month.

Overestimate your daily living costs

Your daily spending can be tough to estimate at times. When it comes to estimating how much you will spend, aim to budget on the higher end of the spectrum.

If you have any “leftover money” at the end of the month, you can transfer it savings, debt payments, or use it to cover other budget categories where you need it.

Don’t forget to budget for seasonal or irregular expenses

You may have expenses that you need to pay once a twice per year, such as insurance. To make sure that you have the cash on hand to cover these costs, here’s an easy way to include them in your budget.

Divide the amount you need to pay for the expense by 12, then assign that amount its own category in your budget each month.

For example, you can create a sinking fund for your annual insurance bill. Each month, you’ll set aside a specified amount of money towards this cost.

Then when your insurance bill is due, you’ll have the cash to pay for it without having to dip into your emergency fund.

Be prepared to make adjustments

Once you’ve created your zero-based budget, it may go ahead as planned, which is awesome.

But if you live in the real world, you’ll probably need to tweak or readjust your spending for your budget categories as the month progresses.

For example, you might set a grocery budget of $200 for the month, but realize that it’s not realistic.

If this happens, you can readjust your budget so you can set a more practical grocery budget for next month. A zero-based budget should act as a tool to help you track your spending so you can do more with your money.

PRO TIP: Schedul a budget date with yourself once a week. Treat it as a self-care activity for you, your finances, and your goals.

I like to put this Budgeting for Success playlist on and let it inspire me as I check-in with my budget to see where I’m doing well and where I can make improvements.

This also gives me time to make adjustments to my budget throughout the month as needed.