If you have fluctuating income, creating a budget can be difficult. However, with some careful planning, a zero-sum budget can be an effective way to budget with an irregular income.

If you’ve struggled to stick to a budget in the past and you want to get a better handle on your money, follow this easy step-by-step guide on how to create a personal budget plan.

How to budget with an irregular income in 6 easy steps:

- List your income

- List your expenses

- Use a budget calendar

- Subtract your expenses from your income

- Track your expenses throughout the month

- Make adjustments as needed

Related Posts:

- How to budget biweekly paycheck: Step-by-step guide

- What’s the 50-30-20 budget rule?

- How to use the half payment method to budget

Table of Contents

What is an example of irregular income?

Irregular income is when the income you receive fluctuates from month to month or comes in uneven increments. This means your income doesn’t come on a predictable or regular basis.

Some months, your income might be low, and for others, it might be high.

Since each month has regular fixed and variable expenses, it’s important to have money set aside to help cover these costs during lean months.

Examples of irregular income jobs may include seasonal work, part-time employment, self-employment, temporary work, fixed-term work, on-call work, or agency work.

Will budgeting work if you have irregular income?

Yes, you can definitely budget with an irregular income. You may have heard from someone that budgets don’t work with variable income. That’s simply NOT true.

Many people work hourly, have commission-based jobs, earn bonuses that vary each year, receive dividend payments, earn interest on savings, or have side gigs that boost their income each month.

Everyone needs a budget, but when you have irregular income, a budget is essential to help you save money and plan for your future.

It can help smooth out the highs and lows and put yourself in a better position to make your money work for you.

Having a budget for your variable income can give you the confidence to make better financial decisions.

Below is a vidoe I made sharing, step-by-step, how to make a budget.

How do you budget when you have irregular income?

Below is how to budget irregular income in 6 easy steps:

1. List your income

The first step is to figure out how much money you actually take home each month (after tax income).

If you earn irregular income, your best option is to plan low. This means that you’ll want to create a budget based on your lowest monthly income estimate.

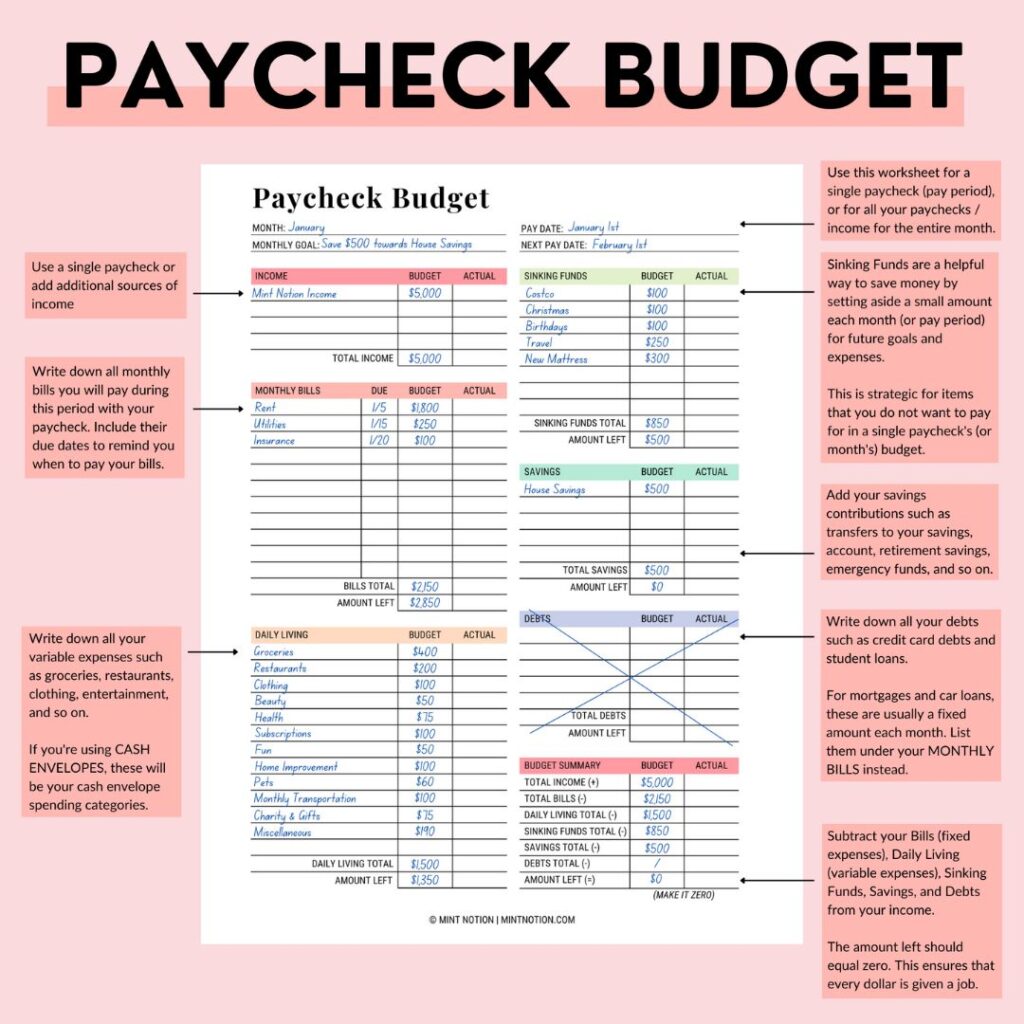

Below is the exact budget worksheet I use to budget with irregular income. You can learn more about it here.

Can you budget based on your average income? Yes, but you don’t want to do this.

When you budget low, it’s much easier to make adjustments as needed.

When you set your budget higher, and your monthly income is less than you anticipated… you’ll be creating a lot of unnecessary stress for yourself.

I’m self-employed and have been making an irregular income for the past 5 years. Learning how to create a realistic budget with an irregular income has been vital to helping me build over six-figures in savings and live debt free (except for our mortgage).

Yes, it involves a little more work than creating a monthly budget for regular paychecks. But with practice, you’ll quickly get the hang of it and become a master of your money.

How do you find your lowest earning month?

Look at your gross income each month for the past few months. Then take the lowest month and go with that.

Ideally, you’ll want to look at your income for the past 12 months and go with the lowest month. This can help you get familiar with earning trends and how your income may vary throughout the year.

For example, a rideshare driver’s income might be higher in the spring and summer months when travel is popular, and lower in the winter when more people are staying indoors.

If you’re new to side gigs, working on commission, or living on irregular income, don’t worry! Try your best to estimate what your lowest earning month will look like and use that as your income.

2. List your expenses

While your income might fluctuate each month, there are some items that you must pay on a regular basis.

To plan a successful budget on an irregular income, you need to have a clear view of what your monthly fixed costs and variable costs are.

Before you start listing out your bills and other expenses, the first step should be to set aside money for savings. Aim to save at least 20% of your income each paycheck.

If 20% is too high right now, then start with 10% of your income. Every little bit counts.

The second step is to list your essential living costs. These are things that you MUST pay each month in order to survive and make money, such as:

- Food

- Shelter

- Utilities

- Transportation

Food and transportation costs might vary from month to month. If so, tally their total cost for the year and divide by 12 to get an average.

After you’ve figured out your essential living costs, then you can budget for your other monthly expenses. Focus on important items such as insurance, debt payments, loan payments, childcare, and medical bills.

The third step is to list your non-essential living costs. These are extra costs that are NOT necessary for living or working.

Examples of non-essential living costs include TV streaming services, subscription boxes, restaurants, other streaming services, sports and entertainment, travel, shopping and personal spending.

This will look different for each person, depending on your lifestyle and what you’re willing to sacrifice. If you earn irregular income, you may have to cut back your spending in certain categories in order to align your budget with your goals.

And if you have a high-income month, such as receiving a large commission check, it’s important to make a plan for that extra money. For example, you may want to put those extra funds towards your emergency fund or investments for your future.

It may not sound as much fun as going out for a fancy dinner or a nice vacation, but you want to cover your “needs” before your “wants”.

Once you get a good handle on your budget, or your income starts to grow each month, then you can allocate more money to spend on those extras. You can do this!

Read Next: What is the 70-20-10 budget rule?

3. Use a budget calendar

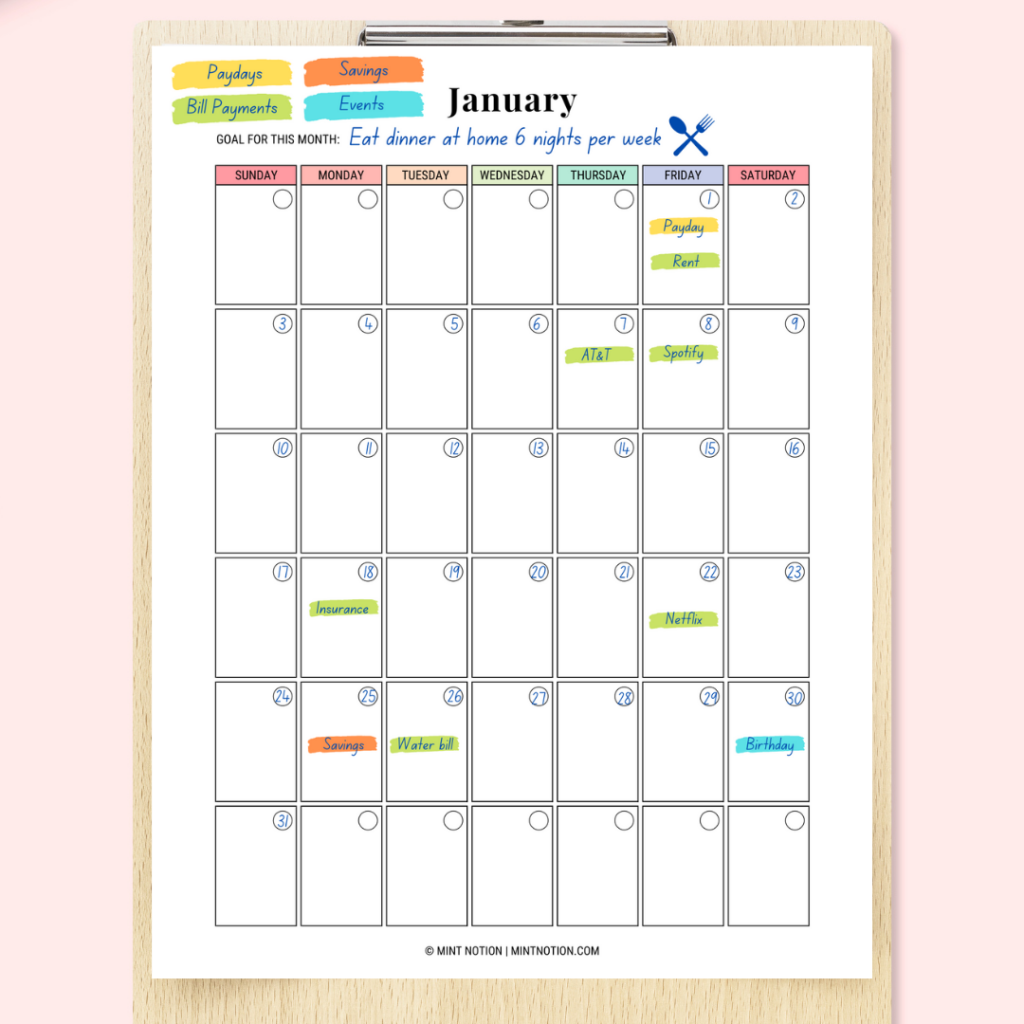

A simple budget hack that changed my life was using a budget calendar. This is a game-changer for visual people.

What is a budget calendar? A budget calendar is a tool you can use to get an overview of when money is coming IN and going OUT in a given month.

How to use a budget calendar when you have irregular income

1) List your paydays and monthly bills – Write down when you get paid on your budget calendar. If you’re not sure when you’ll get paid, then try to estimate your paydays.

For example, I get paid multiple times throughout the month. Instead of writing down each individual payday on my budget calendar (which can get very confusing), I just write down ONE payday at the beginning of the month.

This payday represents my estimated income for the month. I use the lowest earning month in the past year to base my budget around.

Then list all your bills to their appropriate due date on your budget calendar.

2) Automatic payments and savings contributions – For bill payments that are automatically withdrawn from your bank account each month, you may want to consider putting an asterisk* next to these bills.

This is just a helpful way to remind yourself which bills are paid automatically, and which bills need to be paid manually.

3) Special events and holidays – Think about which special events or holidays are coming up this month. Write them down so you can plan ahead and budget for these occasions.

This may include dinner dates, birthdays, school field trips, weekend brunch dates, holiday parties, concerts, sports events, and so on.

After filling out your budget calendar, make sure to put it somewhere that’s easy to see, such as your family command center, office, or inside your Budget Binder. This makes it simple to reference it throughout the month and stay on top of your bills.

Read Next: How to use a Budget Calendar

4. Subtract your expenses from your income

If you’ve given every dollar a job, then this number should equal zero. This is called zero-based budgeting, which is the budgeting method I use and highly recommend.

What makes a budget a zero-based budget? This budgeting method is when you allocate all your income to expenses, savings, and debt payments.

As a former shopaholic, I know how easy it is to make impulse buys when you don’t have a plan for your money.

Since using a zero-based budget, I’ve become a more intentional spender. This has helped me reach my financial goals faster!

When you subtract your expenses from your income and you get a positive number, this means you’re spending LESS money than you earn. You can put this leftover money towards your extra savings or paying off debt.

Or you can add some of those extra non-essential expenses back in your budget. You want to make sure every dollar has a job, and your budget aligns with your goals.

If you get a negative number, this means you’re spending MORE money than you earn.

The quickest way to adjust your budget and make sure it equals zero is to reduce your non-essential costs – at least for now until your income minus expenses equals zero.

For example, when I first started earning irregular income and money was tight, I cancelled several TV streaming services to save money. I also switched to a cheaper cell phone plan that made sense for my budget.

If you’ve already reduced your non-essential spending, you may want to find ways to temporarily cut back on your fixed expenses.

For example, when my boyfriend (now my husband) and I were first dating, he was sharing a 1-bedroom condo with a roommate.

Eventually his roommate moved out, and my boyfriend decided to move back home to live with his parents temporarily to save money.

Moving to a more affordable home allowed him to save enough money to eventually buy his own condo, where we both live today.

Sure it wasn’t ideal, because his family lived an hour away from me. But we made our long-distance relationship work, and this temporary sacrifice was the best decision for our future.

5. Track your expenses throughout the month

Now that you have a plan for your spending, the best way to stick to your budget is to track your expenses.

This means, whenever you spend money on something, you’ll subtract that amount from its budget line.

For example, if you’ve budgeted $400 a month for groceries and you spent $100 the first week of the month, this means you have $300 left in your budget for groceries.

Tracking your expenses can help you know exactly how much money you have left to spend. This can also help prevent you from overspending.

What’s the best way to track your expenses?

While there are many budgeting apps for irregular income, I personally found that using a pen and paper was the best way for me to stay on top of my spending.

When I automated my budget in the past, I felt disconnected from my spending. But when I write everything down, it helps me to slow down and focus on where my money is actually going.

You can follow any method you wish to help you track your expenses. Below is how I like to track my monthly spending.

Cash Envelope Method

For my monthly variable expenses, I use cash envelopes to manage and track my spending.

Each cash envelope will be used for ONE spending category. I usually use 6 cash envelopes each month for the following spending categories:

- Groceries

- Clothing

- Household

- Restaurants

- Beauty

- Miscellaneous

If you’re just starting with cash envelopes, I recommend just choosing ONE spending category to focus on right now. Pick the category that tends to bust your budget the most. For most people this is usually groceries, restaurants, or clothing.

Then as you get a better handle on your spending, you can incorporate using cash envelopes for other spending categories. It’s up to you!

Using cash for your envelopes – If you’re using cash for your envelopes, this means you’ll take out enough cash for the week (or the month) and put the cash inside each envelope.

For example, if your budget is $400 for the month for groceries, this means you’ll take $400 in cash and stuff it inside your grocery cash envelope.

If you’re budgeting for the week, you’ll stuff $100 in cash inside of your grocery cash envelope. Then each time you spend money at the grocery store, you’ll use the cash inside of your envelope for payment.

Once the money is gone from your envelope – it’s gone! You’ll have to wait until next week (or month) to refill your cash envelope. This will help prevent you from overspending and stick to your budget.

Going cashless – If you prefer not to carry cash, then you can follow the cashless envelope method. This is what I do.

Instead of using cash, I use my debit or credit card to pay for everything. After each transaction, I use the spending log on the back of the envelope to write down the amount spent.

Then I calculate the remaining balance to see how much money I have left in my budget.

I put the receipts from each transaction inside the appropriate envelope to stay organized. If I’m using my credit card for payment, I make sure to pay off the entire balance in full each month, so I don’t carry a balance and avoid interest fees.

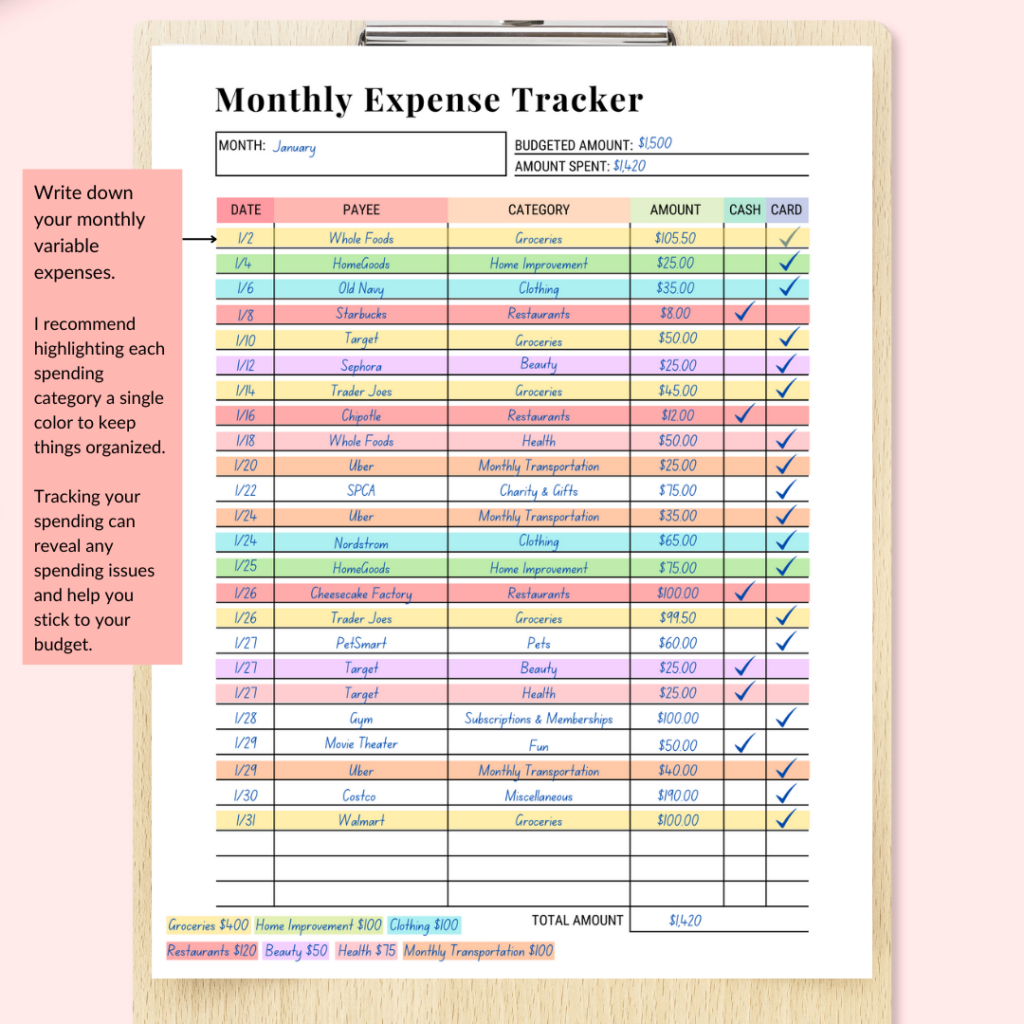

Monthly Expense Tracker

I also use the worksheet above to track and manage all my monthly expenses.

This helps me keep a running balance of how much money I spent during the month to make sure I’m staying within my budget. It also lets me note which purchases are paid with cash or card.

I use a different highlighter to highlight each spending category to keep everything organized. Then at the end of the month I can see exactly where my money went. This worksheet is included in my Budget Planner.

Read Next: 4 ways to track your monthly expenses

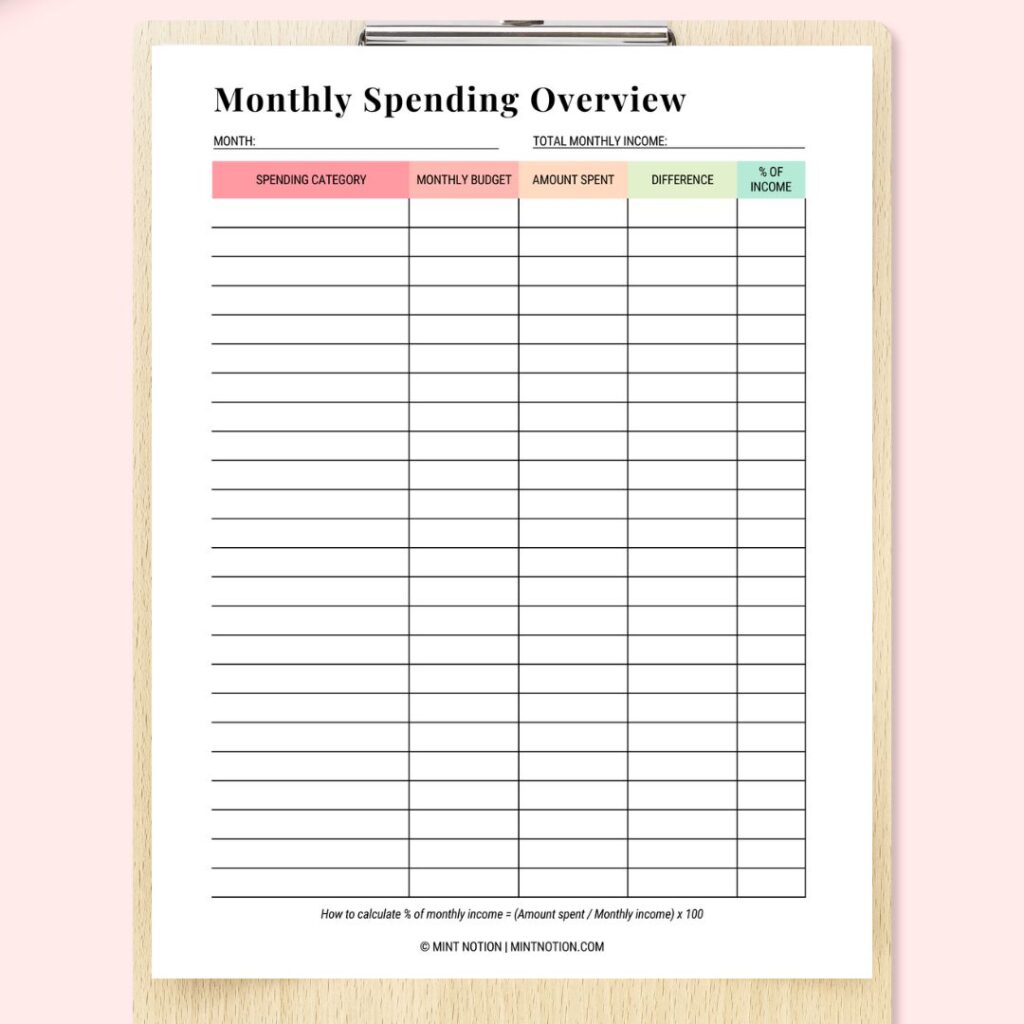

Monthly Spending Overview

For those who want to get a better understanding of their monthly spending, this worksheet will give you a nice overview.

I use this worksheet to write down each spending category for the month, such as clothing, groceries, household, clothing, pets, gifts, personal spending, beauty, and so on.

Then I write down my monthly budget, the amount spent, the difference between these two numbers, and the percentage spent of my monthly income.

You don’t need to be as thorough as me when it comes to tracking your expenses. This is just the method that works for me and helps me to stay on top of my budget. You can follow this method or find something that works well for you.

6. Make adjustments as needed

The key to being successful with your budget is to give yourself grace. No one is perfect (myself included), and it may take a few months to get the hang of budgeting with an irregular income.

It may be uncomfortable in the beginning, especially when you discover spending leaks in your budget.

For example, I used to have a shopping problem. I was too scared to look at my bank account or admit that I had a problem, so I would continue to buy clothes and other random stuff.

Buying stuff made me feel better in the moment, but it wasn’t helping me get ahead with my finances.

It wasn’t until I started budgeting, that I realized how much money I was mindlessly throwing away each month on unnecessary things.

Once I became a more intentional spender, my savings grew, and I felt confident about my financial future.

One way you can adjust your budget is to pay attention to when you get paid. For example, if your income is higher than you anticipated, you’ll want to add that extra income to your budget.

If you set your monthly income to $3,000 but you actually made $4,000, make sure to add that extra $1,000 in as incme.

Then give that extra money a job. You can add it to one of your savings goals, or you can throw that extra money towards debt payments, or it can go towards something fun.

Personal finance IS personal, so do what makes sense for you and your goals.

PRO TIP: Schedul a budget date with yourself once a week. Treat it as a self-care activity for you, your finances, and your goals.

I like to put this Budgeting for Success playlist on and let it inspire me as I check-in with my budget to see where I’m doing well and where I can make improvements.

This also gives me time to make adjustments to my budget throughout the month as needed.