What is the half payment method? The half payment method is a budgeting technique where you take your regular monthly bills and divide them in half. This means each time you get paid, you’ll set aside half of the bill’s payment so you’ll be prepared when the full payment is due.

If you’re struggling to make ends meet each paycheck, then you may want to consider using the half payment method.

Use this budgeting hack if you’re paid biweekly. It can be a helpful way to get ahead on bills, manage your money, and provide financial peace.

For many people, the first half of the month is usually bill heavy. After paying all your bills at the beginning of the month, it seems like there’s nothing left to cover daily living costs.

As a result, you feel broke and might have to rely on using credit cards as a bridge until you get your next paycheck. This can be a huge source of financial stress.

The second half of the month usually has less bills, but unexpected expenses always seem to crop up.

This means instead of paying off your credit cards that you used to cover groceries in the first half of the month, you might spend this money on other things.

If you want to break the cycle of living paycheck to paycheck and save money, there’s a simple budget strategy you can follow to pay the same amount for your fixed bills with each paycheck.

It’s called the half payment method. Here you’ll find tips to help you get started in using the half payment method to improve your finances!

Related Posts:

- What is a budget calendar and how to use it

- How to budget when you live paycheck to paycheck

- How to budget when you get paid biweekly

Table of Contents

How do you split bills between paychecks?

One paycheck will cover half of your expenses and the next paycheck will cover the other half. This is a simple way to split your bills.

The half payment method is great for those who get paid weekly, biweekly or twice a month. This method can be a helpful way to spread out your expenses and manage your money with minimal stress.

No matter what your income level is, the half payment method can help you live within your means, save more money, and pay off debt.

For example, if most of your expensive bills are due at the beginning of the month, such as rent or mortgage, it can be easy to spend most of your paycheck to cover these bills.

This can leave less money to cover living essentials such as groceries, which you may have to put on your credit card. You can avoid this by planning ahead and setting aside the half payment in advance.

How to pay your bills twice a month

If you get paid biweekly, you’ll set aside half the cost of your bills during the pay period prior to when these bills are due.

Then when it’s time to pay your bills, you’ll have the money ready and won’t have to struggle to come up with the entire amount from one paycheck.

You will only need half because you’ve already set aside the other half from your previous paycheck. This is a simple and effective way to pay bills twice a month.

For example, if your rent is $1,000 per month, this means:

- You’ll set aside $500 from one paycheck, during the pay period prior to when your rent is due.

- Then next time you get paid, you’ll set aside $500 to cover your full rent payment.

This is how you’ll handle the half mortgage payment twice a month. For more tips, check out the in-depth guide below on how to budget when you get paid twice a month.

Read Next: How to budget when you get paid twice a month

Where do I set aside half the bill payment?

When following the half payment method, you may be wondering where to set aside the money to cover half your bills.

Perhaps you’re worried that you’ll be tempted to spend this money on other things instead of saving it to pay your bills. As a spender at heart, I can appreciate this concern.

The best place to save the advance half payments is in a separate checking or savings account that is strictly for bills.

This way, you won’t be tempted to spend the money on other things. Or you can take cash out and put it in an envelope. This is particularly helpful for those following the cash envelope system.

Some companies or landlords accept partial payments. You can ask if it’s possible to pay half your bill directly to the company during the prior pay period. Then pay the remaining half when the bill is due.

How the half payment method works

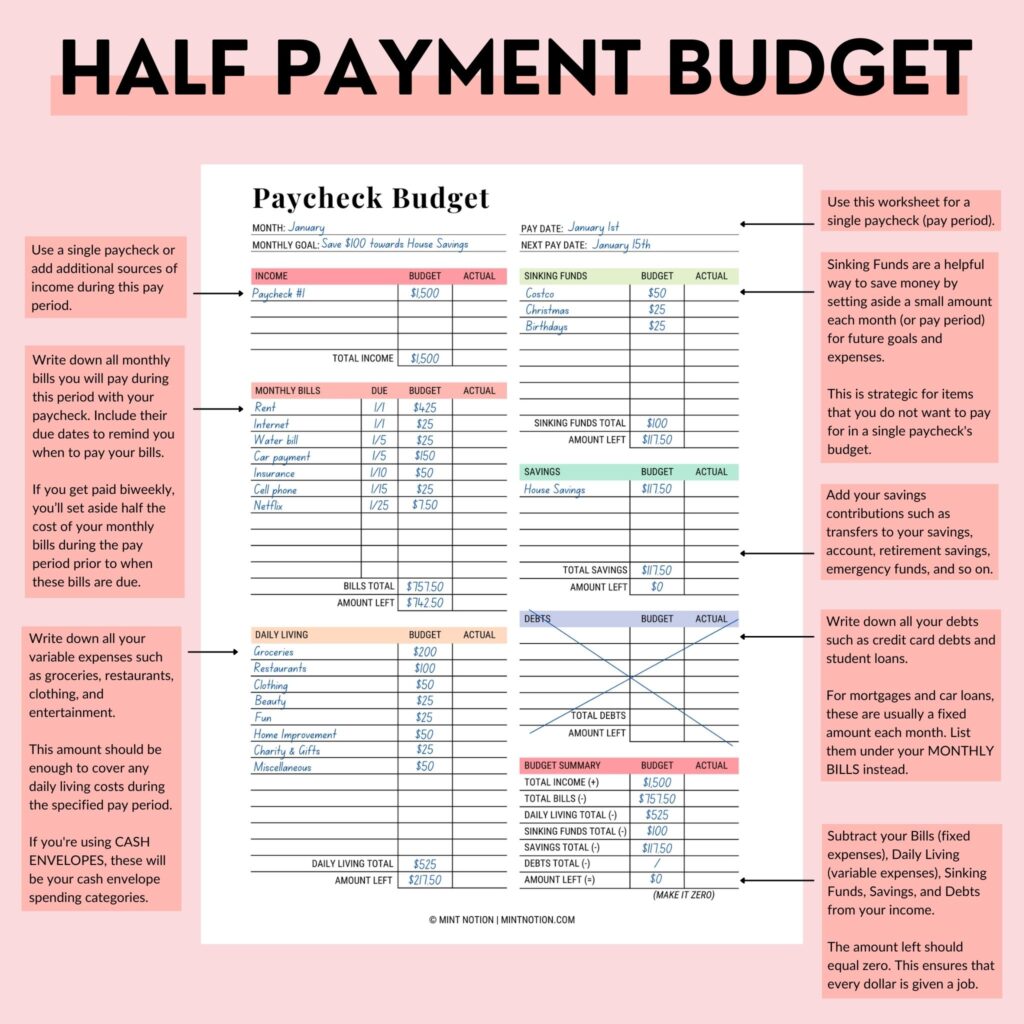

If you are a visual person like me, I learn best when seeing a breakdown of how a budgeting method works. Here’s an example of how to use the half payment method:

When following this half payment budget template, let’s say your monthly take-home pay is $3,000 per month.

You get paid twice per month, on the 1st and on the 15th. Your monthly fixed expenses (regular bills) look like this:

- Rent: $950 (due on the 1st)

- Cell Phone: $50 (due on the 15th)

- Internet: $50 (due on the 1st)

- Water Bill: $50 (due on the 5th)

- Car Payment: $300 (due on the 5th)

- Netflix: $15 (due on the 25th)

- Insurance: $100 (due on the 10th)

Traditional Monthly Budget Method

Below is what a traditional monthly budget would look like:

Paycheck #1: $1,500

- Rent: $950 (due on the 1st)

- Internet: $50 (due on the 1st)

- Water Bill: $50 (due on the 5th)

- Car Payment: $300 (due on the 5th)

- Insurance: $100 due on the 10th)

Total payment due: $1,450

Amount leftover: $50

As you can see, having just $50 leftover from this paycheck is not enough to cover other living essentials such as groceries, transportation, or emergency expenses.

This can lead people to get into debt by having to rely on credit cards each month to cover their variable expenses.

Paycheck #2: $1,500

- Cell Phone: $50 (due on the 15th)

- Netflix: $15 (due on the 25th)

Total payment due: $65

Amount leftover: $1,435

Having more money leftover in the second half of the month is great, but it can lead to careless spending if there’s no budget plan in place.

Instead of using the money to pay off credit cards, people might be tempted to spend this money on other things.

Read Next: What is the 70-20-10 buget rule?

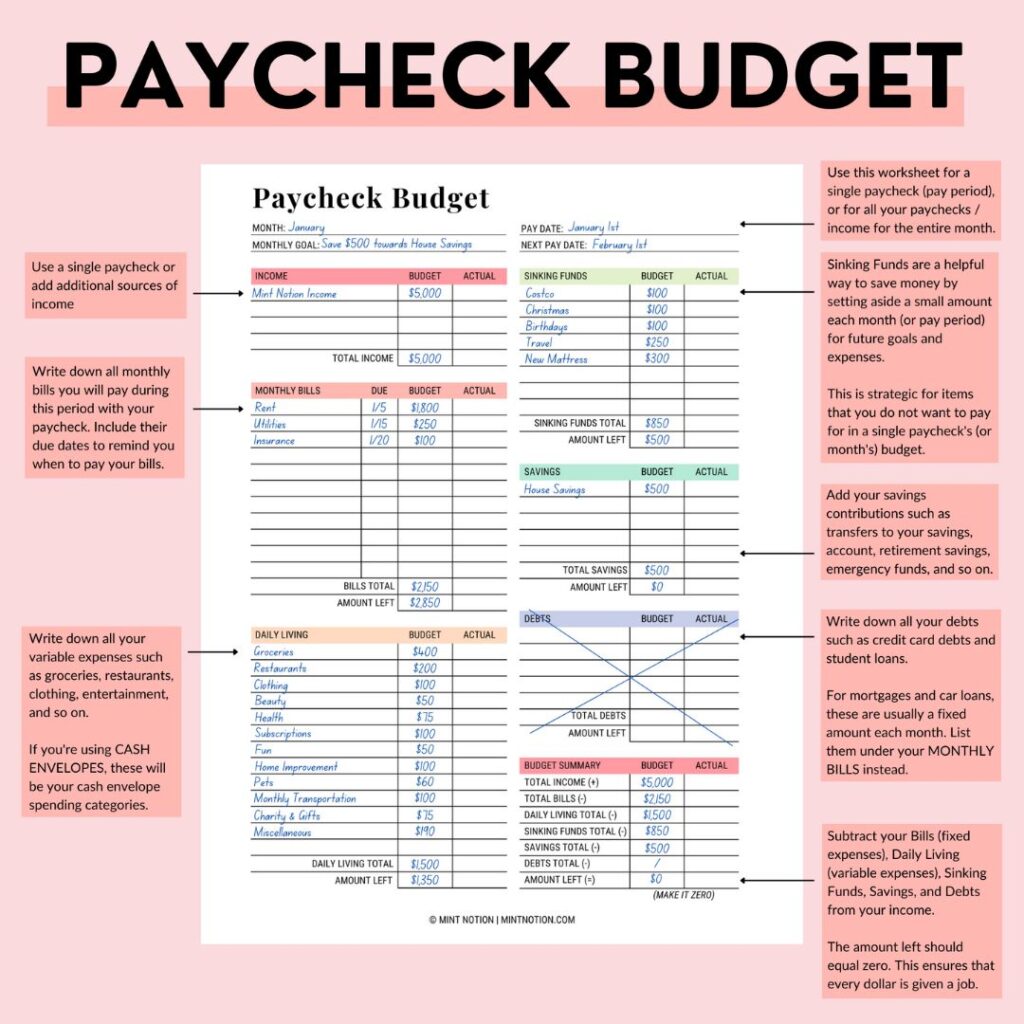

Half Payment Budget Method

Below is what a half payment budget would look like:

Paycheck #1: $1,500

- Rent: $475

- Internet: $25

- Water Bill: $25

- Car Payment: $150

- Insurance: $50

- Cell Phone: $25

- Netflix: $7.50

Total payment amount: $757.50

Amount leftover: $742.50

Below is an example of how this would look when using my Paycheck Budget worksheet.

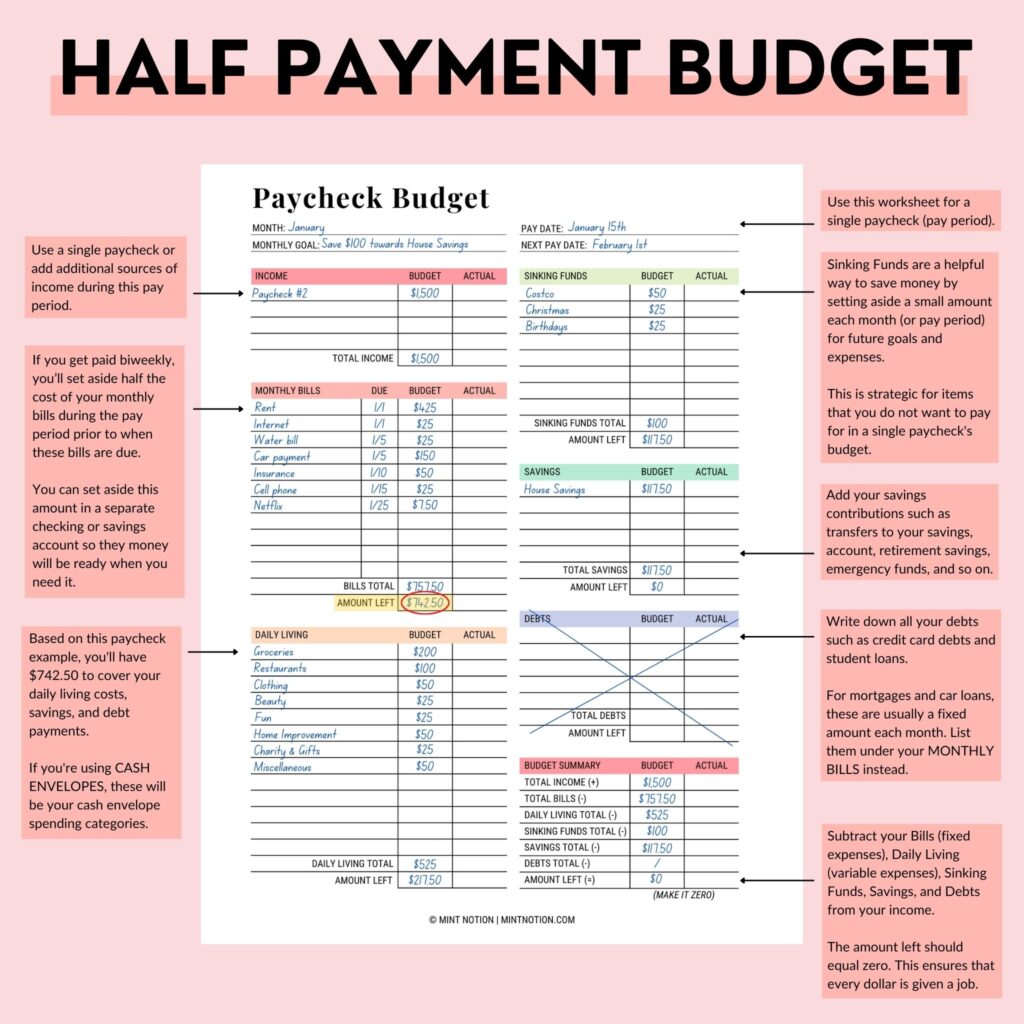

Paycheck #2: $1,500

- Rent: $475

- Internet: $25

- Water Bill: $25

- Car Payment: $150

- Insurance: $50

- Cell Phone: $25

- Netflix: $7.50

Total payment amount: $757.50

Amount leftover: $742.50

Below is an example of how this would look using my Paycheck Budget worksheet.

As you can see, you’ll have $742.50 leftover to at the end of each pay period.

The half payment method takes some practice and careful planning to set up in the beginning, but it can be a better way to spread out your expenses and manage your money.

Your leftover money at the end of each pay period is evenly distributed to cover your variable expenses such as groceries, transportation, dining out, entertainment, and so on.

You may even have enough money leftover to put towards your savings, building an emergency fund or paying off debt.

Do you get paid weekly?

If you get paid weekly, you can still use the half payment method to help you budget and save money.

To do so, adjust this method to make it the quarter payment method. This means you’ll set aside one-fourth of your fixed expenses each paycheck.

Pros of the half payment method:

- It’s a simple way to manage your finances each month, compared to traditional budgeting methods.

- You won’t feel like you’re living paycheck to paycheck anymore or struggle to stretch your money until next payday.

- You’ll know exactly where your money is going.

- You’ll prevent impulse spending by moving your half payments to a separate checking or savings account that’s used only for bills.

- You won’t have to rely on credit cards to help you make ends meet until next payday.

- You’ll gain more confidence and feel more in control with your budget.

Cons of the half payment method:

Like with any budgeting method, there can be some disadvantages as well. Here are some reasons why you may not find the half payment method helpful:

- It takes time to set up. To get the full benefits from using this budgeting method, you should be at least half a month ahead.

- It can be tempting to spend the money you set aside for your bills. This is why I like to put the money in a separate checking or savings account so I won’t spend it on other things.

- You have to pay close attention to due dates. This is why you might find using a Budget Calendar particularly helpful.

Will the half payment method work for you?

As I mentioned above, the half payment method can work well for those who get paid weekly, biweekly or twice a month.

No matter which budgeting method you choose, it’s important to remember that it takes time to set up and make adjustments to make it realistic for you.

Planning ahead for your bills can be less stressful than scrambling to make sure your fixed expenses are paid.

The half payment method can be a highly effective solution to help you pay your bills in full and on time.

This can give you the financial peace you’ve been looking for when it comes to managing your finances.

Read Next: 50 creative ways to save money on a tight budget

How to start using the half payment method

Before you start following the half payment method, you can decide if you want to use this method for ALL your fixed expenses or just focus on ONE bill payment in the beginning, such as your rent or mortgage.

If you prefer to choose a smaller bill to make it easier, then that’s fine too.

Once you’ve gotten a handle on using the half payment method to help budget for this bill, then you can slowly add more bills in the subsequent pay periods.

It can take a few months of following the half payment method before you feel like you’ve gained control of your finances.

Below are five simple steps to help you start using the half payment method:

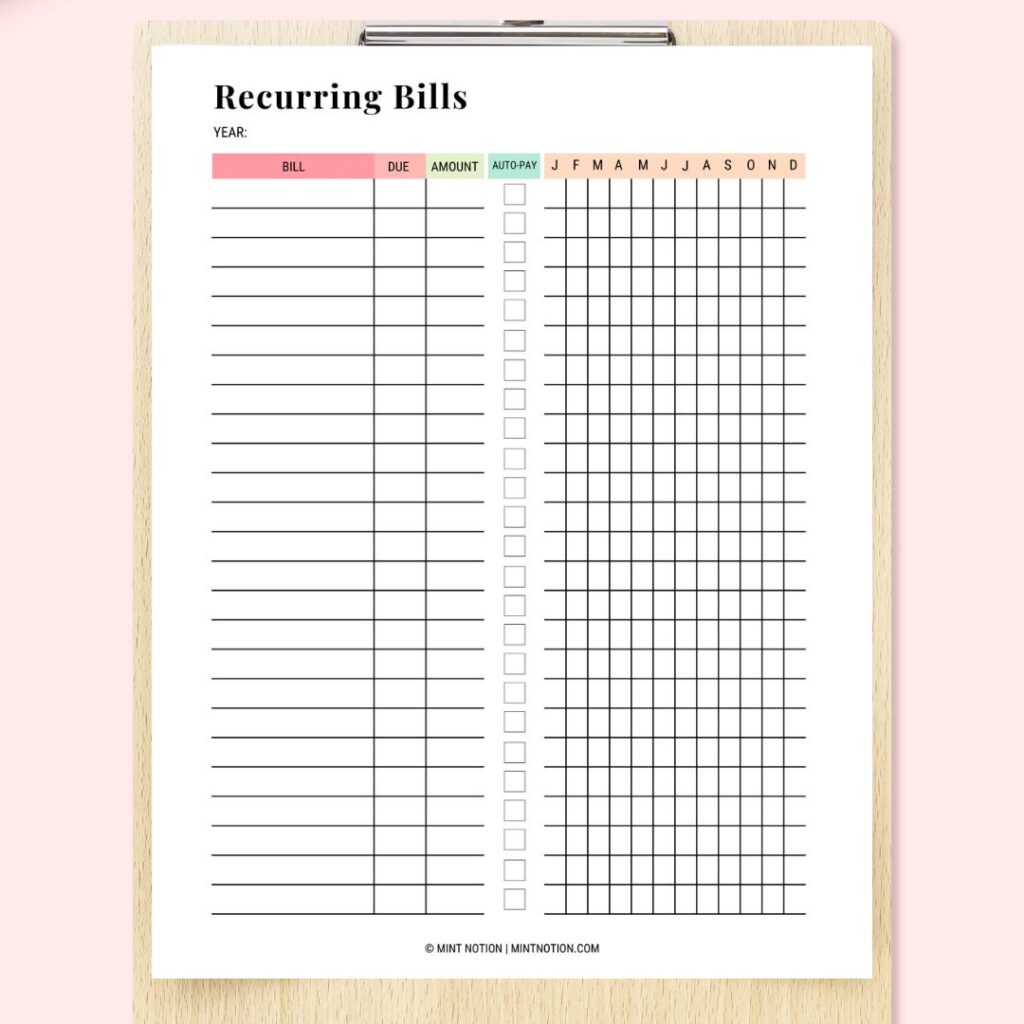

Step 1: Write down all your regular bills

The first thing you need to do is write down all your regular bills and find their due dates. These are your fixed expenses that are usually around the same amount each month.

I like to use a Recurring Bill worksheet to help me keep track of all my bills and their due dates.

This is a master list of all your regular, annual, and quarterly bills. If you’re interested, you can grab the one I use here in my Budget Planner.

Read Next: 4 ways to track your expenses

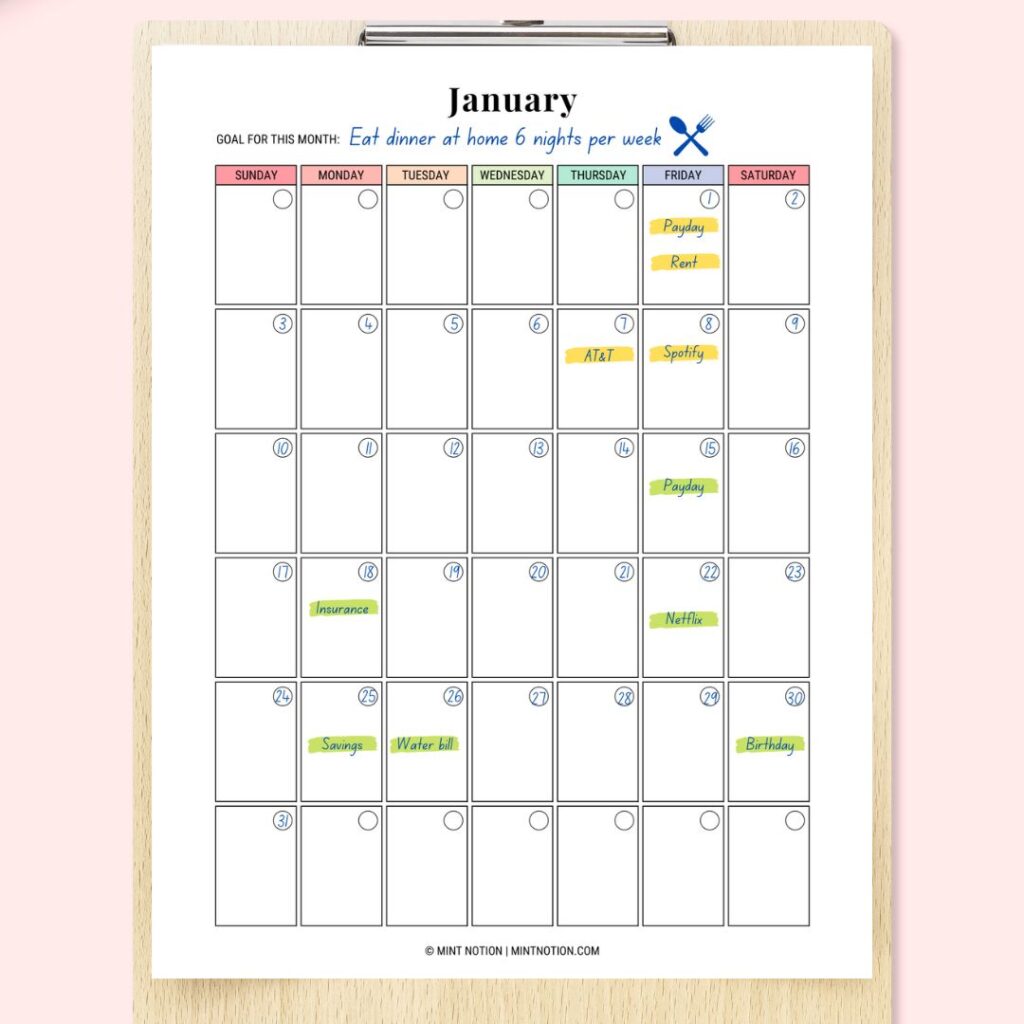

Step 2: List your bills on a Budget Calendar

For visual learners like myself, I like to use a Budget Calendar to help me see when all my bills are due that month.

You can also use a Budget Calendar to write down your paydays, when you make savings contributions, and any special events or occasions happening that month (birthdays, vacations, and so on).

You can use any type of calendar to do this or grab the one I use here in my Budget Planner.

Step 3: Take each bill and divide it in half

Once you have all your regular bills written down and their due dates, it’s time to divide your bills in half.

For example, if your rent is $950 per month, you would need to set aside $475 from each paycheck (assuming you get paid biweekly).

This means during the pay period prior to when your rent is due, you’ll set aside $475 from your first paycheck.

Then when your second paycheck hits your account, you’ll only need to half ($475), which you’ll add to the money you’ve previously set aside from your first paycheck.

Suddenly, $950 seems less overwhelming when you only need to save $475 per paycheck.

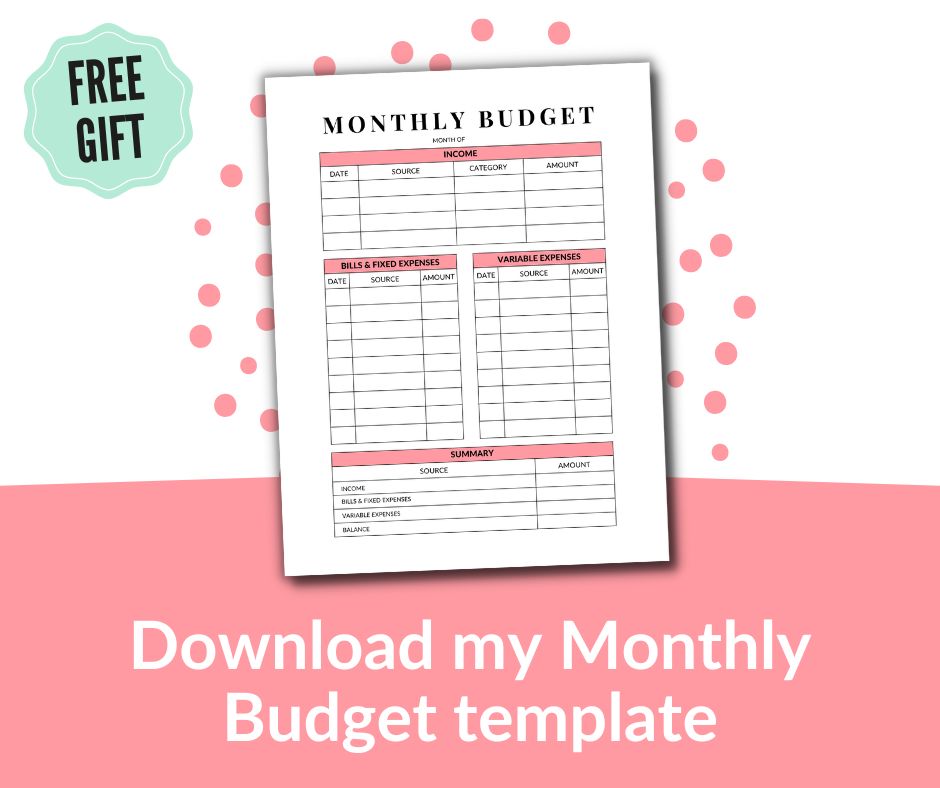

The best way to keep track of your bill payments in your budget is to follow the budget-by-paycheck method.

This means each time you get paid, you’ll create a spending plan for that paycheck.

You may find this easier than following the traditional one-month budget. If you’re interested, you can grab this worksheet in my Budget Planner.

Step 4: Each payday, transfer the money you need to set aside

Each time you get paid, you can transfer the amount of money you need for your half payment to a separate checking or savings account.

This can help keep the money safe and prevent overspending since this account will only be used to pay bills.

Make sure to choose a bank that allows you to open multiple checking or savings accounts for free and have a low minimum balance requirement.

You can also withdraw cash and put it inside an envelope to store until your bill is due. Choose the method that works best for you.

If you are 100% confident that you won’t spend the money on other things, then you can leave the half payment amount in your main checking account.

But if you really want this budgeting strategy to work, it’s better to transfer the money to where you’ll be least tempted to spend it carelessly.

Step 5: When a bill is due, transfer the money back to your main checking account

Before the bill is due, transfer the money back into your main checking account and pay the bill in full.

Yes, it may seem a bit tedious to follow these steps in the beginning. Once you get the hang of it, it’ll become easy to stay on top of your finances.

Read Next: How to budget with an irregular income

How to be successful with the half payment method

If you want to be successful with the half payment method, it will involve some careful planning as outlined in the steps above.

Ultimately, the half payment method can help you manage your monthly cashflow and break the cycle of living paycheck to paycheck.

When you get a bonus or receive any extra income, put it towards your half payments in advance.

If you get paid biweekly and receive a third paycheck in one month, set aside that third check for half payments. This can help prevent spending that extra money on other things.

If you’re spending more money than you earn each month, unfortunately the half payment method won’t be much help.

In this case, the first step is to figure out how to cut back on your monthly spending so you can live within your means.

Half Payment Method FAQs

How do I split my weekly paycheck?

A simple way to split your weekly paycheck is to follow the 50/30/20 budget rule. This rule of thumb recommends dividing your paycheck into 3 sections: 50% of your take-home income towards your needs, 30% towards your wants, and the remaining 20% towards your savings and debts.

How do I change my bill due date?

Changing due dates on your monthly bills can make it easier manage and pay your bills on time. First, you need to decide which pay dates you would like to modify. Then you can contact your creditors to ask for a change. This is usually done with a phone call or online.

How to budget bills biweekly?

To budget your bills biweekly, you’ll need to create a biweekly budget. To do this, write down all your paydays and expenses on a Budget Calendar. Then determine your variables spending and savings goals. Create a new budget for each paycheck (or pay period).