What is the cashless envelope system? The cashless envelope method works that same way as the cash envelope system. Except instead of carrying around envelopes stuffed with cash, you’ll bring trackers with you. Use the trackers to record your spending to make sure you don’t spend more money than you allocated for a certain budget category.

Have you been thinking about using the cash envelope system, but don’t like the idea of having to carry cash all the time?

I totally get it! Carrying cash around stresses me out.

That’s why I’m sharing how you can enjoy all the benefits of using cash envelopes, but with the cashless envelope method.

But first let’s quickly cover – what exactly is the cash envelope system?

Related Posts:

- How to budget when living paycheck to paycheck

- How to use the half-payment method to budget

- How to budget when you get paid biweekly

Table of Contents

What is a cash envelope system?

The cash envelope system was made popular by Dave Ramsey. It’s a budgeting method where you use cash and envelopes to help track and manage your monthly variable (or discretionary) spending.

Many people use the money envelope system to pay off debt. Below are some tips on how to set up a cash envelope system.

Read Next: What is the best way to pay off debt?

How do you start a cash envelope system?

Below is a step-by-step guide on how to start using the cash envelope method.

Step 1: Create your monthly budget

Here you’ll use your expected income and monthly fixed expenses.

Monthly fixed expenses are expenses that don’t change from period to period. For example, your mortgage / rent payments, utility bills, insurance payments, and so on.

While your fixed expenses are not set in stone, they usually take more time and effort to change these monthly amounts. For example, spending several hours researching and making phone calls to change your insurance plan.

If you’re new to budgeting, it’s important to find a budget method that works best for you. I like following a zero-based budget. This works best for those who get paid once a month or want to use a monthly budget.

If you get paid bi-weekly (or twice a month), check out: How to budget when you get paid bi-weekly. This is great for those who want to budget by paycheck.

If you prefer to budget by percentages, check out the 50/30/20 budget rule. This works well for those who don’t like traditional budgets.

Read Next: How to budget with an irregular income

Step 2: Subtract your monthly fixed expenses from your income

This leftover money will be used to cover your variable expenses and money you put towards your savings and debt payments (if you are paying off debt).

For example, if you earn $3,000 (take-home pay) and your total monthly fixed expenses are $1,500, this means you have $1,500 leftover to budget for your monthly variable expenses, savings and debt payments.

Variable expenses represent your daily living spending, such as buying groceries, eating at restaurants, drinking Starbucks, buying clothes, or going to a bar with friends.

They are considered variable expenses because the amount you spend can change from month-to-month.

For tips on how to reduce your variable expenses, check out: 50 creative ways to save money

Step 3: Determine your top budget categories for your monthly variable spending

You can create a separate envelope for every single budget category or just use envelopes for the categories that tend to bust your budget.

This could be things like groceries, restaurants, entertainment, clothing, and so on.

Read Next: 4 ways to track your monthly expenses

Step 4: Figure out how much you want to budget and fill your envelopes with cash

How much should I put in a cash envelope? Decide how much money you’d like to budget this month for your cash envelopes.

For example, let’s say you budget $400 for groceries. This means you’ll take out $400 in cash from your bank and put the cash in your grocery envelope.

NOTE: Some people prefer to budget by paycheck. If you get paid twice per month, this means when you receive your first paycheck, you’ll take $200 from your bank account and put the cash in your grocery envelope. This $200 will last until you receive your second paycheck. Then you’ll take $200 from that paycheck and fill your envelope with cash again.

You’ll do the same for each cash envelope you plan to use. When shopping, you’ll take your cash envelopes with you and use the cash in those envelopes for their intended purchases.

Each time you spend money from your cash envelopes, you’ll record the transaction and subtract the amount from your allotted budget.

For example, if you spend $100 at the grocery store at the beginning of the month, this means you have $300 left to spend on groceries for the rest of the month.

When the money is gone – it’s gone! Don’t be tempted to take money from different envelopes to pay for food at the grocery store. The cash envelope system can work well for many people because studies have shown that we spend less when paying with cash.

What are the downsides of using a cash envelope budget?

If you need the extra discipline, using cash envelopes can certainly help you stick to your budget and prevent overspending.

However, the cash envelope system does have a few downsides. Here are some reasons why you may not like the idea of using cash:

You are at risk of loss or theft because you’re carrying a large amount of cash on your person or in your home.

Going to the bank regularly to take out cash might be inconvenient for you.

You don’t have the added protection that credit cards can offer.

You miss out on cashback rewards that credit cards offer.

You won’t accumulate interest on your savings because your money is in an envelope and not in a savings account.

Due to the pandemic, some stores have stopped accepting cash as a form of payment.

It can be confusing. You’re going to come across situations where using cash from envelopes can get confusing.

For example, if you go to Costco and buy $25 worth of clothing, $50 worth of groceries, and $25 worth of home decor, where do you get the cash from? You’ll need to take cash from three different envelopes, which might be inconvenient for you.

It’s hard to get the whole family on board. Some people just don’t like using cash and prefer the ease and simplicity of using their debit or credit card. In order for the cash envelope system to work, the whole family needs to be on board.

Because of these disadvantages, I don’t use cash. Don’t get me wrong though, using cash can be an excellent way to get your spending under control.

However, I’ve been able to tweak my own budget so I could enjoy the benefits of the cash envelope system without using cash.

Reasons to use the cashless envelope system

Below are some reasons why you may want to consider using the cash envelope system without cash.

The cashless envelope system works

The cashless envelope system provides the same benefit as using cash – it’s designed to stop you from overspending. This can be a great alternative to the traditional envelope system.

Less wasteful spending

You don’t have to guess how much money you have left in your grocery budget. When using envelopes, you can see exactly how much money is left in your budget. You’re more likely to think through every purchase.

It’ll help you stay disciplined and strengthen your willpower

This can help improve your spending habits so you can reach your financial goals faster.

Read Next: 10 budgeting hacks you’ll wish you knew sooner

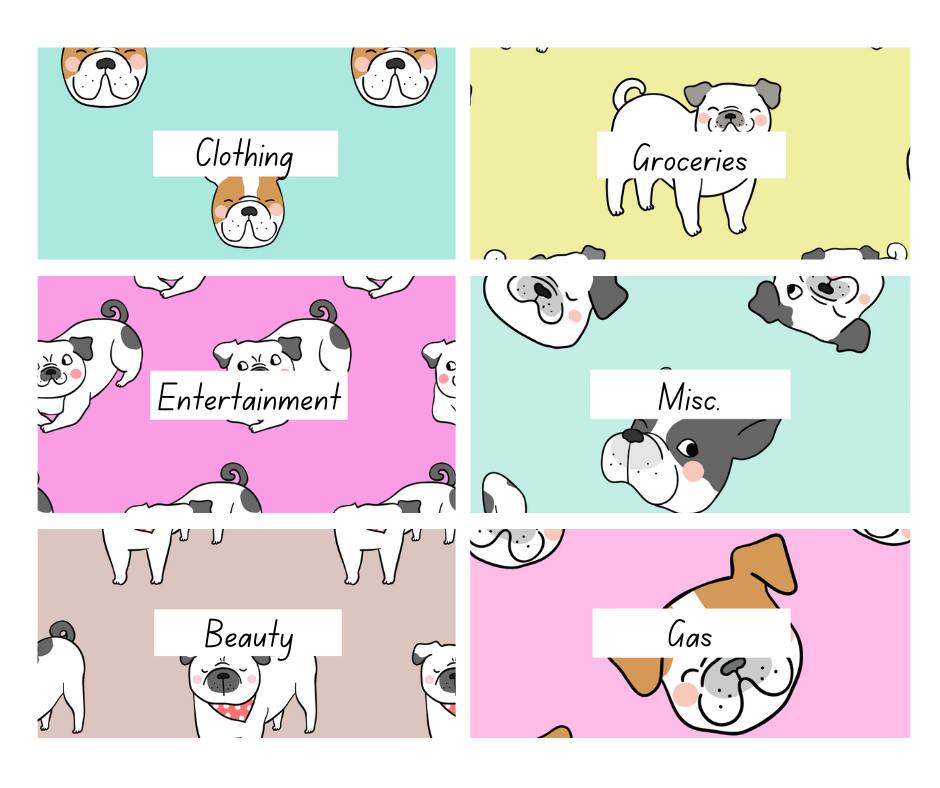

What are the categories of the cash envelope system?

Below are some of the common budget categories you should consider using with the cash envelope system:

- Groceries

- Clothing

- Restaurants

- Entertainment

- Fun money

- Gas

- Car repairs and maintenance

- Personal spending

- Gifts

- Haircare / Beauty

- Pets

- Household supplies

- Miscellaneous

You can click here to check out the cash envelopes I use for budgeting. Each envelope has a ledger on the back to help you keep track of your purchases and prevent overspending.

Read Next: What is the 70-20-10 buget rule?

How to use the cash envelope method without cash

I can appreciate that using cash is not for everyone, especially since many of use are shopping more online. Below is a step-by-step guide on how to use the envelope without cash.

The cashless envelope method works pretty much the same way as the cash envelope system. You will need to:

1. Create your budget

Just like when using regular cash envelopes, you’ll need to make a budget for the month. This is a plan for your money and how you want to spend it.

This is the hardest step of the process. But budgeting doesn’t have to be complicated. It can take a few months of budgeting and tweaking your budget to figure what works best for you.

If you’re new to budgeting, below are some easy step-by-step guides on how to create a budget for beginners:

- How to make a zero-based budget

- How to budget when you live paycheck to paycheck

- What is the 50/30/20 budget rule?

- How to budget when you get paid bi-weekly

2. Determine your monthly variable expenses.

After paying your fixed expenses, you’ll divide the leftover money between your variable expenses, savings and debt payments (if you are paying off debt).

Read Next: Debt avalanche vs. Debt Snowball – What’s the best way to pay off debt?

3. Figure out how much you want to spend in each of your top budget categories.

Decide how much money you want to budget for groceries, entertainment, clothing, gas, and so on.

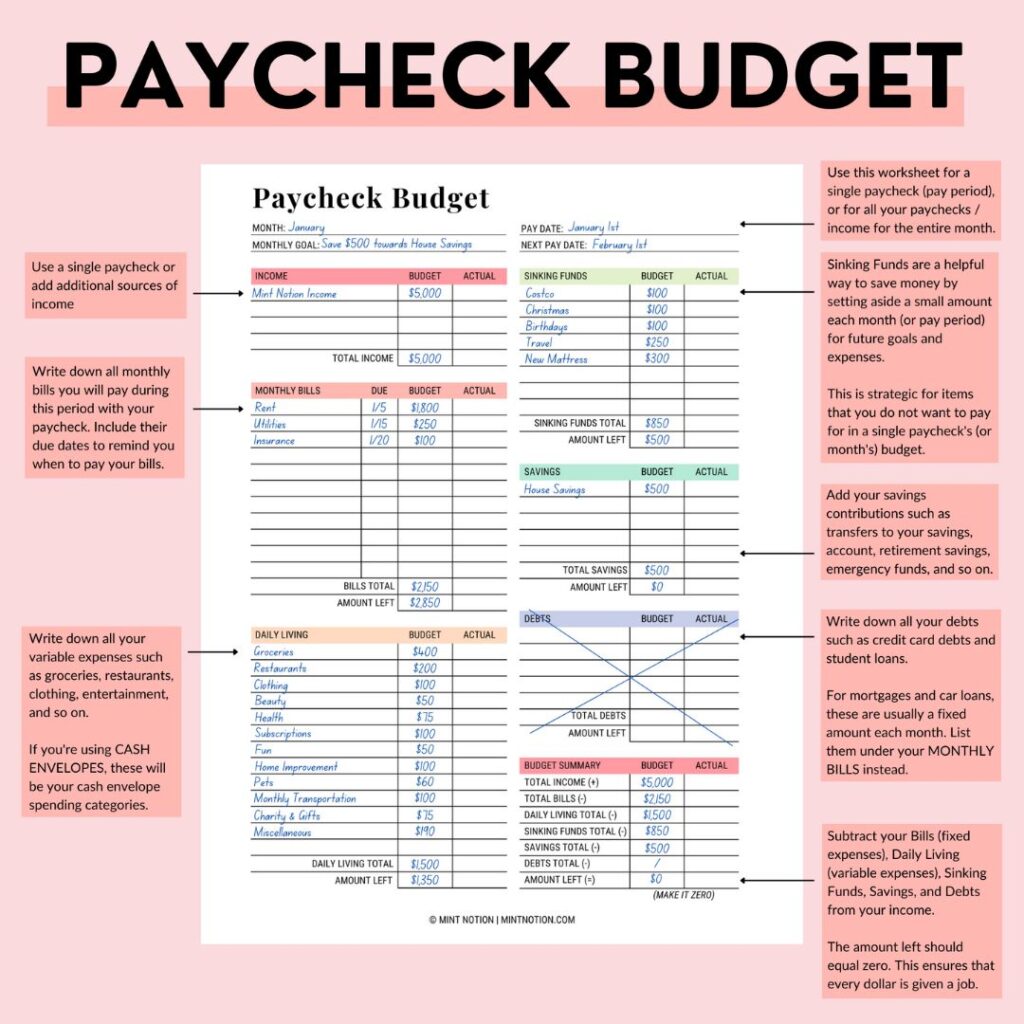

If you’re using my Paycheck Budgeting worksheet, you’ll write down these budget categories under the “Daily Living” section.

This worksheet is included in my printable Budget Planner.

4. Create an envelope for each budget category

Instead of stuffing each envelope with cash, your cash envelope with serve two functions for you:

- You’ll put the receipts from each purchase inside the envelope.

- You’ll keep track of your spending within the envelope using the spending log located on the back of your envelope (if you’re using my cash envelopes). Or you can use an index card to track your spending.

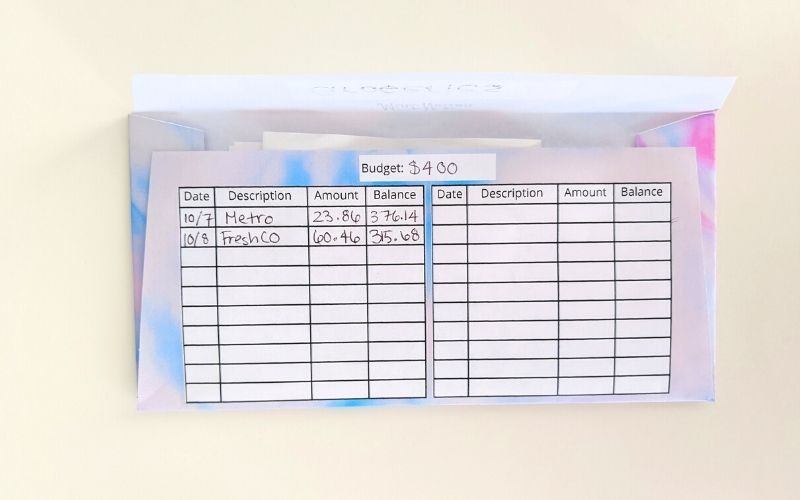

When you use my cash envelopes, each one includes a cashless envelope tracker template for your convenience. This can help you record and track each transaction so you can see how much money you have left in your budget.

What forms of payment to use for the cashless envelope system

Instead of using cash, there are a few different ways you can pay for items and track your spending. It’s important to find the form of payment that works best for you. I recommend choosing one form of payment that you like and sticking to it.

Credit Card

I pay for everything using my credit card. For stores that don’t accept credit cards, I use my debit card.

If you don’t have a credit card or prefer to stay completely away from credit cards, that’s fine. There are other forms of payment you can choose to use.

I NEVER recommend using a credit card if you feel that you cannot use it responsibly.

NOTE: Each week, I pay off the full balance on my credit card. I never pay interest on my credit card or exceed my credit limit because the balance is always paid off in full each month. Paying off my credit card each week lets me do a weekly check-in with myself to make sure that I’m accurately tracking my spending and sticking to my budget.

Use the envelope system with debit cards

A debit card is a convenient way to pay for items when using the cashless envelope system.

Because debit cards draw from money you already have in a bank account, you’ll want to make sure that you have enough money to pay for your purchases.

For example, if you have $1,500 a month to budget for your variable expenses, you’ll want to make sure that you have this money available in a bank account when using your debit card.

Gift Cards

Instead of stuffing your envelopes with cash, you can choose to use gift cards. At the beginning of the month, purchase gift cards that correspond with you budget spending categories.

For example, you might get one gift card for groceries, one gift card for gas, one gift card for entertainment, and so on.

If your grocery budget for the month is $400, you can buy a gift card to use at your primary grocery store.

Before purchasing any gift cards, make sure to read the fine print so you’ll know if there are any fees or expiration dates.

Reloadable Prepaid Credit Card

A prepaid card can help you maintain discipline and control your spending. It’s similar to a gift card where the card starts with a zero-dollar balance and must be loaded with cash until you can use it for purchases.

Then when the balance drops down to zero, you can’t use it until more funds are loaded onto the card.

Before choosing this as your preferred form of payment, make sure to research any fees associated with the card, such as a card purchase fee or monthly maintenance fee.

How to make cash envelopes for budgeting

You can make your own cash envelopes at home using blank white envelopes and index cards. Or you can grab one of my cash envelope bundles here.

My cash envelope system printables include a handy spending log on the back of the envelope to make it easy to track and monitor your daily spending.

I recommend printing your cash envelopes on card stock paper like this. This is more durable than regular paper.

You’ll use a separate envelope for each of the top spending categories in your variable expenses. For example, one envelope for groceries, one envelope for gas, one envelope for entertainment, and so on.

If you’re using my cash envelopes, download and print out the envelopes at home. Then cut out the envelope and fold it together as shown in the video below. You can use tape or a glue stick to put your envelope together.

@mintnotionHow to create cash envelopes for budgeting ##cashenvelopes ##cashenvelopesystem ##daveramsey ##budgeting ##printable♬ original sound – Eden Ashley

On the front of the envelope, write down the budget category. For example, “Groceries”.

On the back of the envelope, write down the total amount budgeted for that spending category for the month.

For example, if you are budgeting $400 for groceries, you’ll write $400 as your monthly budget. This will be your starting point that you’ll subtract your purchases from.

Each of my envelopes have a cashless envelope tracker template on the back. This makes it easy to track and mange your daily spending.

You will keep these envelopes with you whenever you spend money. This will let you track your spending and know exactly how much money you have left in your budget for the month.

Each time you make a purchase with your card, write down the transaction on your spending log (located on the back of the envelope).

Then subtract the total from your budgeted amount. For example, if you spend $100 on groceries today, you’ll have $300 left in your budget for the month. ($400-$100 = $300)

After recording your transaction, put the receipt inside the envelope.

While you may not feel the psychological pain of using cash, you’ll still become aware of your spending. The cashless envelope method is just as EFFECTIVE as using cash as long as you actually use it.

Remember, once the money is gone – it’s gone! Don’t borrow from other spending categories (cash envelopes). This is how you’ll change your spending behavior so you can stick to your budget and reach your financial goals, such as paying off debt.

If you find yourself running out of money in one of your variable spending categories, such as groceries, then you may need to adjust your budget.

For example, if you budget $400 a month for groceries, but you regularly spend $500 a month, then make adjustments to your budget to reflect this.

At the end of the month, plug in the numbers of your total spending into your monthly budget. Take a moment to compare your actual spending with the amount you had budgeted.

This can help you see which areas in your budget you did well and which areas you can make improvements.

To stay organized, I recommend using a cash envelope system wallet like this one.

How many cash envelopes should I have?

Deciding how many cash envelopes you need is up to you. I recommend 4-7 cash envelopes.

Using more than 7 cash envelopes can become difficult to organize. Using less than 4 cash envelopes may not be addressing all of your “problem” budget categories or expenses.

Pay attention to which areas of your budget where you tend to overspend. For example, I used to overspend a lot on clothing, groceries, eating out, and beauty. These were my high-risk expense categories that would often bust my budget.

Instead of telling myself “I’ll try better next month”, these categories became part of my cash envelope system.

Take a closer look at your spending and choose 4-7 budget categories or expenses where you run the risk of overspending.

What do you do with leftover money in cash envelopes?

If you have money leftover in one of your variable spending categories at the end of the month, put it towards paying your highest-interest debt.

If you don’t have debt, you can invest the money, put the money in your savings account, or carry it over to the next month.

If the thought of using the cash envelope system stresses you out, then give the cashless envelope method a try! It’s simple, easy to use, and can be a highly-effective way to prevent overspending.

If you’re new to budgeting, start with my paycheck budget template. This is the complete budgeting resource I use to organize my finances.

It’s the same tool I used to help me save my first $100,000 in my twenties.