Is there really such a thing as a being a shopaholic or having a shopping addiction? What are the symptoms of a shopaholic? I mean, everyone needs to buy stuff, from groceries to clothes. Right?

Giving into the occasional impulse buy, such as a dress that will look so cute for summer, probably won’t impact your budget. However, when your occasional impulse buy becomes a compulsive habit, this is one of the first signs you might be dealing with something more serious, like a shopping addiction.

Just a few years ago, I considered shopping as a hobby. I loved the thrill of finding a good deal and the excitement that came when buying something new. It was an instant “high” which I quickly became addicted to.

I used to think my shopping hobby was harmless. It’s become socially acceptable for a woman to enjoy shopping and showing off her shopping haul to family and friends.

I mean, there’s a reason why fashion hauls are so popular on social media – it’s an effective bonding behavior between the viewer and the social media creator.

People love showing what they’ve purchased because it feels like it’s part of their identity in some way. And we love watching because we’re curious and it seems like an innocent way to get inspired. Right?

Well no.

Sometimes our “shop till you drop” behavior can lead to compulsive buying and financial distress. Sometimes we feel like we’re out of control, despite the serious negative consequences.

If you think you’re a shopaholic or addicted to shopping, you may feel like you’re on an emotional roller coaster. I have a free audio training which can help teach you how to overcome a shopping problem.

Related Posts:

- 10 tricks to kick your shopping habit

- What I learned from giving up clothes for a year

- How to stop living paycheck to paycheck

Table of Contents

What is a shopaholic?

A shopaholic is a term that is sometimes used to describe someone with a shopping addiction. This frequent shopper is often unable to control his or her spending, which can lead to serious problems in their life.

Here are some of the common phases every shopaholic goes through.

The Anticipation Phase

This is the stage where thoughts and urges start. Whether you saw an email in your inbox advertising a sale or a commercial on TV, you’re starting to think about shopping and making a purchase.

Maybe you saw a friend wearing a new dress and you’re fantasizing about how nice it would be to go shopping. You’re excited about the possibility of buying something new.

The Preparation Phase

This is the stage where the individual makes plans to go shopping. They are looking into sales and may spend hours researching items to buy online. This is the process of getting ready to hit the mall or visit a store to buy something.

The Shopping Phase

This is the stage where the shopping happens. You feel excited and experience a shopper’s “high” that comes when you’re ready to buy something.

The Spending Phase

This is the stage where the item(s) is purchased. You feel like your shopping mission has been fulfilled and you get a sense of euphoria.

The Guilt Phase

This is the stage where the individual may feel remorse, guilt, shame, depression, anxiety, frustration or other negative thoughts and feelings after the purchase has been made.

This may cause the individual to return the item(s) back to the store for a refund. They may try to hide the purchase from their loved ones because they feel guilty about how much they’ve spent afterwards.

Is shopping a real addiction?

A shopping addiction, also known as oniomania or Compulsive Buying Disorder (CBD) is a behavioral disorder. This is characterized by an obsession or uncontrollable urge to buy things which can lead to adverse consquences.

The compulsion to shop is usually a learnt strategy that is used by the individual to cope with negative emotions, such as anxiety, loneliness or depression.

What are the symptoms of a shopaholic?

If you’re wondering if you or a loved one might be a shopaholic, here are 10 signs of a potential problem and how to overcome a shopping addiction.

1. You have unopened or tagged items in your closet

This is not referring to items you received as a gift. These are items that you picked out and bought on your own. Chances are, you’ve forgotten about some of these items.

Read Next: How to wear everything in your wardrobe

2. You experience a rush of excitement when you buy something

This is not necessarily about owning the item. Simply the act of purchasing something can give you a shopper’s “high”.

3. You feel the urge to shop after having an argument

Many shopaholics turn to shopping in attempts to fill an emotional void, such as low-self esteem or lack of self-confidence.

4. You buy things for the sake of getting a good deal

If you find yourself buying items you don’t need just because they’re a good deal, you may be a shopaholic.

5. You try to hide your shopping habits

Do you hide shopping bags in the back of your closet or try to pass new clothes off as old standbys? Hiding your shopping habits from your loved ones can lead to rocky relationships.

6. Your shopping habits have hurt your relationships, work, school, or financial situation

If your shopping habits have negatively impacted your daily obligations, such as work or school, you may be a shopaholic.

7. You feel remorse or guilt after making a purchase

Many shopaholics feel a rush of excitement when shopping and buying something. However, their shopper’s “high” quickly disappears and they are left with feelings of remorse, guilt or frustration that they can’t control their shopping habit.

Despite experiencing feelings of remorse, shopaholics are quick to defend and rationalize their purchases if challenged.

8. If you can’t buy something you really want, you feel deprived, upset or angry

Let’s say you see a beautiful dress that you just have to have. But you can’t afford to buy the dress and the shop owner doesn’t allow you to pay for it in small increments.

You beg the shop owner to let you pay it off this way because the thought of not buying this dress is painful.

But once you eventually buy the dress, it won’t be long before you find something new that you want to buy. It’s an ongoing cycle.

9. You often buy things you don’t need or didn’t plan to purchase

It’s difficult to resist the temptation to grab that cute dress you saw in the store, especially when it’s on sale.

You didn’t plan to purchase it, but you can easily justify how nice it would look on you for the summer. No matter what your shopping bag contains, you find it hard to avoid impulse spending.

10. You’re shopping and spending more than you can afford

Perhaps your shopping behavior has led to debt. Maybe your shopping behavior is preventing you from breaking the cycle of living paycheck to paycheck.

Or maybe your shopping behavior is preventing you from being able to save money or reach your financial goals.

Can you relate to any of the signs above? If so, figuring out what’s driving you to shop can be a huge step in helping you get on track to kicking a shopping habit and saving more money.

How do I stop a shopping addiction?

Feeling out of control or depressed about your spending habits isn’t fun. Fortunately, it’s not too late to take back control of your shopping habits.

The following tips are based on my own experience and conversations I’ve had with others. Here are some helpful strategies to help you go from being a shopaholic to taking back control of your spending.

Try the no new clothing challenge

Yes, I know this sounds pretty extreme. But doing the no new clothing challenge was the best decision I ever made.

Why? Because during the challenge, it forced me to find new and healthy ways to manage my negative thoughts and feels that didn’t involve shopping (or spending money).

I recommend trying the challenge for at least one month (or longer) if you can. You can read about my experience doing the no new clothing challenge here.

If you think you might be a shopaholic, chances are you probably have a large wardrobe. Finding ways to shop your wardrobe and put together different outfit combinations can help you successfully complete the challenge. You never know what magic might be hiding in your closet.

To help you get better mileage from your closet, I’ve created this free 30-Day Shop Your Closet Challenge.

Each day (for 30 days) you can follow the different prompts to help you put together new and exciting outfit combinations. The best part is, this challenge is completely free to do. You’ll be using items you already have!

Switch to a cash diet

Research has shown that people are willing to spend more (up to 83%) when paying with credit card instead of cash. This is because credit card payments may not be as noticeable as paying with cash.

We don’t realize the pain of our payment until the bill comes in weeks later. If you’re having trouble sticking to your budget, leave the credit cards at home and switch to a cash diet instead.

Read Next: How to prevent overspending with cash envelopes

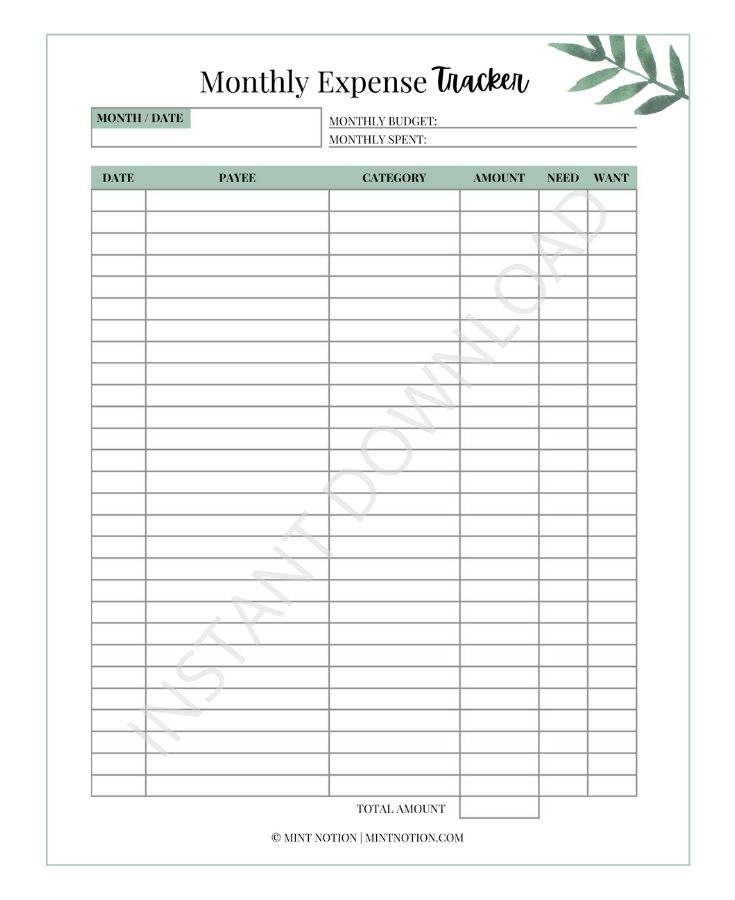

Track your spending

One of the best ways to stop impulse spending is to track your spending. This is the first step in understanding how you currently manage your money, which can help you take back control of your finances.

Before you make a purchase, pause and ask yourself: Do I really need this or is this something I just want to have?

By asking this question, it can interrupt the buy-buy-buy cycle and prevent impulse spending. Tracking your expenses will force you to acknowledge mindless spending.

To get started, you can grab my printable budget binder here or create your own.

Avoid going to the mall / browsing shopping apps

If you know you have trouble controlling your spending, avoid going to places that encourage you to shop. Browsing the mall or online retail websites will only tempt you to make purchases that you may later regret.

I also recommend unsubscribing from store emails. Retail emails tend to pop up every day in our inbox and seeing these emails on a daily basis can encourage us to click and browse the store’s website — especially if there is a sale happening.

Understand your spending triggers

Our emotions and environment can impact our behavior. This is why it’s important to understand and manage your triggers which drive you to shop.

I recommend keeping a journal and documenting when you feel the urge to shop. Is it due to boredom, sadness, or anger? Do you feel the urge to shop after you’ve watched a particular television show? Do you want to shop after hanging out with a certain friend or family member?

Recognizing which triggers drive you to shop can help you learn how to better manage these triggers.

Read Next: How to stop buying clothes that you never wear

Figure out what you truly value in life

You’d be surprised to learn that most of us don’t know our values, or understand what’s important to us. Instead, we usually focus on what our society and media values. Sounds pretty silly, right?

It’s important to identify your values, because when our actions and values are aligned, that’s when we feel most content.

Not sure what your personal values are? Here’s an exercise you can try:

Look back on your life and determine which times you felt really happy and proud of yourself. Choose examples from both your personal life and career.

Then, ask yourself why each experience was memorable?

Make a list of values from these peak moments and define what these values mean to you. When your spending habits align with your priorities in life, you’ll begin to feel more satisfied and live with intention.

Final Note

Recognizing the common signs of a shopaholic and admitting you may have a problem is the first step. Like with any addiction, denial is a large part of the process and many people will have to reach a low point before they can accept that their spending behavior is negatively impacting their life.

As a former shopaholic, it’s easy to justify shopping as something you want to do, even if your friends or family have noticed your spending behavior is more than others.

Fortunately, it’s not too late to make a positive change. Be honest with yourself. You deserve to live an amazing, wonderful life.

Life is meant to be lived, not spent. And through my journey of healing, I’ve discovered that a wonderful life isn’t found in buying more stuff or spending more time shopping.

Introducing: The Intentional Spender

In The Intentional Spender, you’ll learn insider secrets on how to conquer your impulse spending for good. As a former shopaholic, I know all too well how emotions can easily influence your spending.

Studies show that is takes 21 days to form a habit. That’s why I’ve put together this 21-day program to help you form and implement healthy spending habits. This includes shopping with intention, living within your means while still having fun, and feeling comfortable and confident with your personal style.

I don’t believe in depriving yourself or living on a bare bones budget! I believe that you are 100% capable of transforming your mindset by discovering the root cause behind your spending habit and developing a game-plan that actually works.