Are you tired of wondering where all your money went at the end of the month? Try cash stuffing envelopes!

The cash envelope system has been around for decades, but this budgeting method has recently gotten popular on TikTok and Instagram.

Here you’ll learn exactly how cash stuffing envelopes works, and how you can get started using this money saving strategy today.

It’s one of the best financial hacks that can help you stick to your budget and stop overspending.

Table of Contents

What is cash stuffing?

Cash stuffing – also known as the cash envelope system – is a budgeting method where you’ll use cash to pay for things and give your credit card a rest.

You’ll set aside cash in envelopes for different spending categories at the beginning of the month. The goal is to only spend the amount of cash you’ve set aside for each category.

Before stuffing your envelopes with cash, you’ll set a budget for each expense that month. Then you’ll use the cash in the envelopes to pay for things as needed.

Once the money in your envelope is gone – it’s gone. This will force you to stop overspending so you can reach your financial goals faster!

It works best for categories that tend to bust your budget, such as dining out, getting gas, buying groceries, and other variable expenses that you can pay in cash. It’s a great tool to help you stick to your budget.

How cash stuffing envelopes works

When we pay for things with our credit or debit card, it’s easy to lose track of how much we’re actually spending.

However, using cash to pay for things can help us put boundaries on our spending. Once the money runs out, this makes it pretty hard to overspend.

Here’s how you can easily start the cash stuffing budget method:

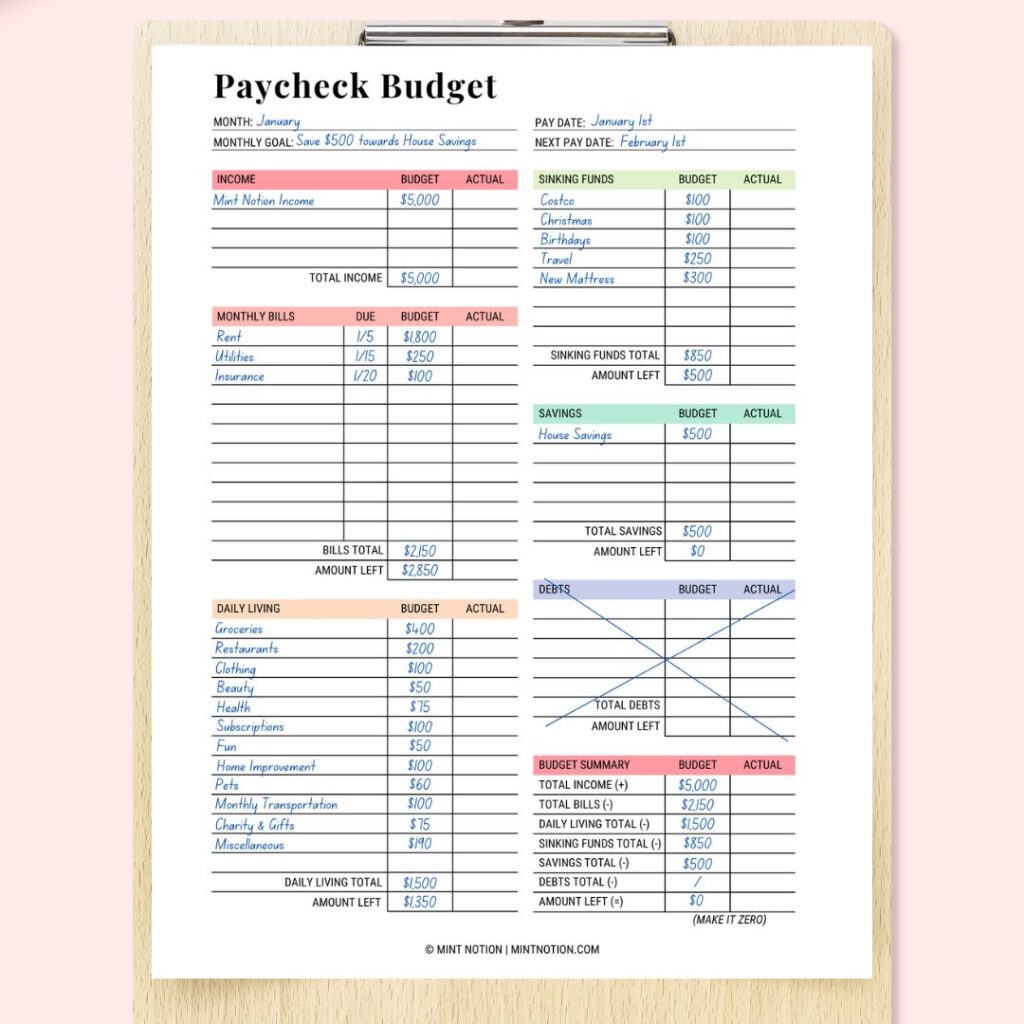

1. Create a budget

Before you can start stuffing envelopes with cash, you’ll need to set a budget for all the spending categories in your life.

If you’re new to budgeting, then you may not know how much you should spend when it comes to your wants, needs, and how much to save.

To start, write down how much money you plan to make this month (this includes all sources of income coming in).

Then, you’ll list out all your expenses for the month. This includes your monthly bills, day-to-day spending (groceries, gas, shopping), how much you plan to set aside for savings, and debt payments.

You may need to look at your past bank statements to get an idea of everything you spend money on.

I like to follow a zero-based budget, which means that your income minus expenses will equal zero. Every dollar coming in is given a job, whether it’s to be spent or saved.

If you’re brand new to budgeting, it can seem a little overwhelming to get started. Remember that your budget is simply a tool that can help you get good with money.

It’s okay if you mess up in the beginning. Just make a rough estimate for now, then you can make adjustments to it over the next few months.

If you need a refresher on setting up your budget, check out how to create a budget here.

2. Decide which categories in your budget need a cash envelope

As you’re making your budget, think about the categories where you tend to overspend each month, such as groceries, restaurants, or shopping.

Here are some spending categories that most people find helpful for the cash stuffing method:

- Groceries

- Entertainment

- Pets

- Gas

- Clothing

- Household items (toiletries, paper products, cleaning, etc.)

- Restaurants

- Beauty (hair care, makeup, skin care, etc.)

- Kid stuff

- Gifts

- Travel

- Home décor

- Car maintenance

You get to decide how broad or how specific you want to be for your envelope labels. Here are some more specific cash envelope ideas:

- Date nights

- Coffee

- Alcohol / Drinks

- Movies

- Sports

- Food at work

- Going out with friends or family

- Books

- Shoes

- Craft supplies

- Nail salon

- Massages

- Organizing supplies

- Gardening items

How many cash envelopes should you have?

I recommend using 5-7 envelopes in the beginning.

Cash stuffing envelopes can help you better manage your money, so you’ll want to focus on the areas where you tend to bust your budget the most each month.

If you use less than 5 envelopes, then you may not be including all of your “problem” categories in the cash envelope system.

If you have more than 7, then you might get overwhelmed trying to keep everything organized when you’re just starting out.

Remember to give yourself some grace during this new budgeting venture.

It may take a few months of tweaking and adjusting your budget to figure out how many cash envelopes you need. That’s why I recommend starting out with 5-7 envelopes in the beginning.

3. Label and stuff your cash envelopes

Once you’ve created your budget and decided which spending categories to stuff with cash, it’s time to prep your envelopes!

For your envelopes, you have a few ideas that you can use:

- Plain white envelopes

- Colorful cash envelopes that you print at home

- Reusable money pouches

- Cash envelope wallet

- Digital envelopes (such as the Rocket Money app)

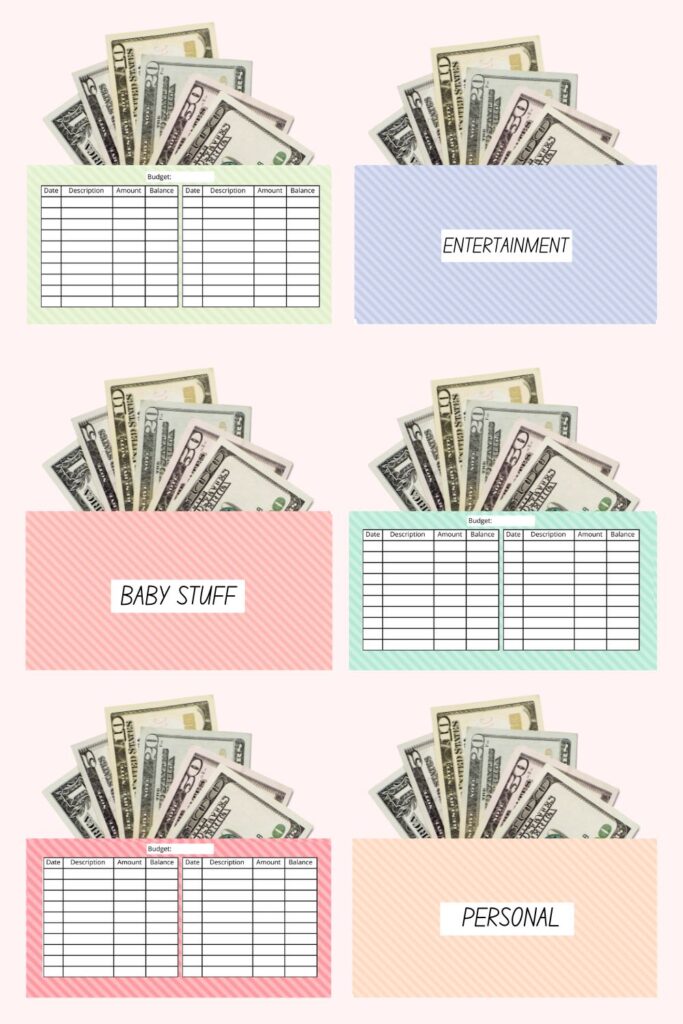

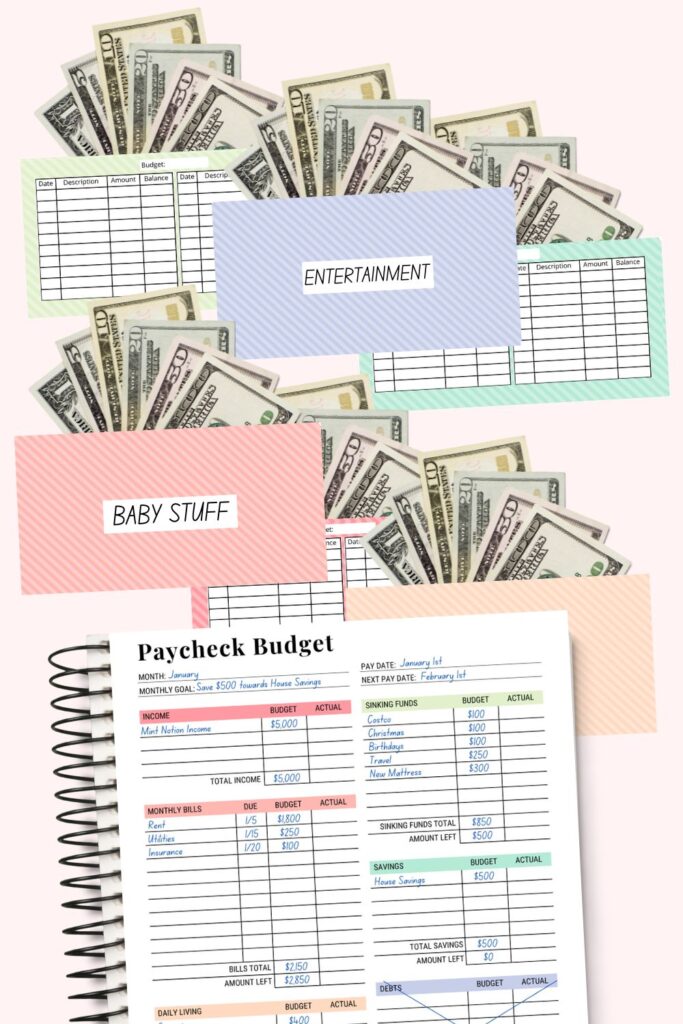

I like to use this Budget Planner which comes with six printable cash envelopes to help me manage my money.

Once you have your chosen envelopes, label each one with your spending categories. I usually create 6 envelopes and label them as the following:

- Groceries

- Baby stuff

- Restaurants

- Household items

- Personal care

- Entertainment

Decide which denomination of bills you’ll need for each envelope ($1, $5, $10, $20, $50, or $100).

Then when you receive your paycheck, withdraw enough cash from the bank that you’ll need to stuff your envelopes with.

Count the cash, sort it into separate piles based on each spending category, then stuff it inside the corresponding envelope.

For example, if you’ve budgeted $500 a month for “Groceries”, this means you’ll put $500 cash inside your “Grocery” envelope.

If you get paid twice a month, then you’ll withdraw $250 from the bank using your first paycheck and stuff it inside the envelope.

Then when you get your second paycheck, you’ll withdraw another $250 and put it inside the envelope. This is your $500 grocery budget for the month.

4. Use the cash in your envelopes for spending

To help you stick to your budget, only spend the cash that’s in your envelopes. This means when you pay for something, you’ll limit yourself to using the money from its corresponding envelope.

For example, when you go to the grocery store, take your “Grocery” envelope with you to pay for your groceries. If you forgot to bring your cash envelope with you, then turn around and go back home to grab it.

If you’ve already spent most of your grocery money at the beginning of the month, you’ll have to find ways to cut back until you can refill your envelope when you get your second paycheck.

Ideas include meal planning, using up what you already have in your fridge / freezer / pantry, shopping the sales, using coupons, shopping at a cheaper grocery store, eating less meat, and so on.

If you don’t have enough cash in your envelope to pay for the all the groceries, then put an item back on the shelf. I know it’s not fun and sounds like a pain in the butt, but you’re trying this new budgeting method to stop overspending.

- DO use the cash from your grocery envelope to pay for your groceries

- DON’T be tempted to take money out from your other envelopes to pay for your groceries

- DON’T use your grocery money to pay for anything except food at the grocery store

- DON’T use your credit card or debit card to pay for your groceries (unless you’re following the cashless envelope system)

If you find yourself constantly running out of money in your grocery envelope before the end of the month, then you may need to adjust your budget for next month.

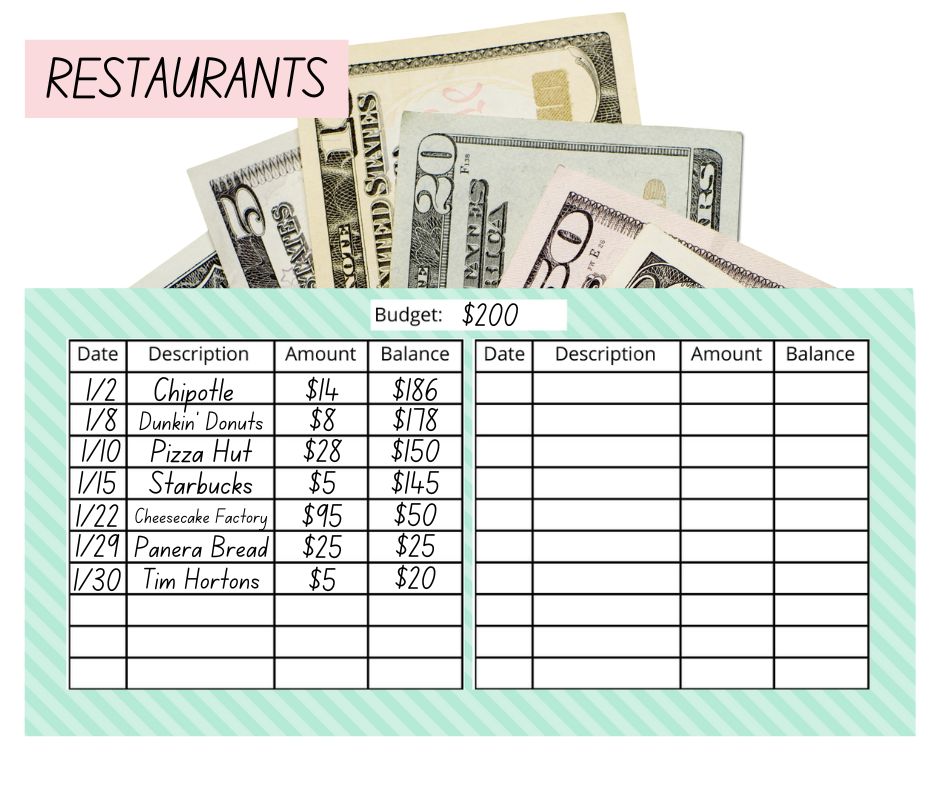

5. Record each transaction and stick to it

Cash stuffing is a highly effective way to track and manage your spending. But here’s the thing – it only works if you actually stick to it!

When you keep all of your spending money in your envelopes, it’s easy to see how much cash you have left for the month.

If there’s only a little bit of money left in your “Restaurant” envelope, then this is your sign to take it easy on takeout and cook more meals at home.

Each time you spend money from one of your cash envelopes, record the transaction down and subtract the amount from your budget. This will help you keep track of your spending and tell you how much money you have left for the month.

The cash envelopes I use have a handy spending log located on the back of each envelope. This makes it easy to record the date, the payee, and the amount I spent.

Once the month is done, take a moment to reflect on how it went. Think about what went well, and how you can make improvements for next month.

- Did you stick to your budget?

- Do you have any money left over in your envelopes?

- Did you become more mindful of your spending?

- Was the amount you budgeted for each category realistic, or will you need to adjust the amount?

If there is any money left over in your envelopes, that’s awesome! Consider using that extra money to pay off debt or put it in your high-interest savings account.

If you ran out of money quickly in one of your envelopes, consider ways to cut back your spending in that category. Or you might need to increase your budget in that category going forward.

Advantages of cash stuffing envelopes

- It can help you stick to your budget

- It can help you keep track of your spending

- It can help prevent more debt.

- It can help ease financial stress

- It can help keep you disciplined and save more money

Disadvantages of cash stuffing envelopes

- It’s time consuming to physically take cash out of your bank account and manually stuff envelopes

- There is little protection when you’re carrying a lot of cash, which could put you at risk of loss or theft

- You could be missing out on earning potential interest if you keep your money in an envelope instead of in a high-interest savings account

- You could miss out on credit card rewards

- It could make you spend more because some people find that having cash on hand makes them more tempted to spend it

Who is the cash stuffing budget best for?

If you’ve tried creating a budget with an app or spreadsheet in the past, but had trouble sticking to it, then cash stuffing could be a game changer for managing your money.

You’ll gain awareness and become more mindful and honest with your finances.

It’s easy to feel disconnected from digital budgets because it’s not hands-on. But when you’re physically paying for day-to-day spending with cash, you’ll always be aware of where your money is going.

This can help you stop impulse buying, pay off debt quicker, and take back control of your money.

But like any budgeting method, it only works if you actually stick to it. For some, the time required to go to the bank to withdraw cash, label, and stuff envelopes may be inconvenient. For others, it may be the answer to curbing overspending.

Challenge yourself to give cash stuffing a try for one month and see how it improves your spending and saving habits.

What if I run out of money in an envelope?

If you notice that you’re quickly running out of money in an envelope, it can be tempting to pull money from another envelope to pay for items.

Try your best to avoid transferring money from one envelope to another. The whole point of cash stuffing is to curb overspending and help you stick to your budget.

Let’s say if you’re constantly borrowing money from your “Grocery” envelope to pay for takeaway meals. This is your cue to meal prep so you can eat at home and avoid busting your budget at restaurants.

Alternatively, you may want to increase the amount of money you allocate for your “Restaurant” envelope and reduce the amount you stuff inside your other envelopes.

Cash stuffing isn’t meant to make you feel deprived of the things you love. It’s meant to help you better manage your money so you can afford to have fun on a budget you can afford.

If eating at restaurants is what you enjoy doing, then find a way to work that into your budget. This might mean you’ll have to decrease the amount of money you set aside for other categories, such as “Beauty”, “Home décor”, “Entertainment”, or “Clothing”.

Once you get a good handle on cash stuffing, challenge yourself to avoid spending all the money in your envelopes. Just because the money is there, this doesn’t mean that you need to spend it.

Pay attention to how much you have left in your envelopes and be intentional about how you choose to spend your cash. This will help you save more money so you can reach your financial goals faster, such as paying off debt.

Why if some of my expenses are paid online?

The cash envelope system works best when you have to use physical cash to pay for an item in person, such as shopping at the grocery store, eating at a restaurant, getting your nails done at the salon, getting a coffee from the local café, or filling up at the gas station.

This is because we tend to spend less money when paying with cash than when we swipe our debit card or card card.

When we pay with cash, we literally see the money disappear right in front of our eyes. But when we pay by card, it doesn’t feel as “painful”, and we feel fewer negative emotions when making a purchase.

You can still follow the cash envelope system for online purchases, it will just involve an extra step.

Below are a few options you can choose to follow:

Option 1 – Set a budget for online purchases

- Set budget for online purchases. Write down this budgeted amount on your envelope. Try not to spend more than this number.

- Use a spending log to keep track of each online purchase.

When making an online purchase, write down the date, the payee, and the amount of money you spent on the back of your envelope.

Then subtract what you spent from the budgeted amount for this cash envelope category.

For example, sometimes I like to order my groceries online for pickup, which involves using my debit card or credit card to make the purchase.

This is a great way to save money (and time) because I only purchase items on my grocery list and don’t get tempted to impulse spend by physically shopping in the store.

If I spend $100 on grocery pickup, I’ll record the transaction on the spending log on the back of my “Grocery” envelope.

*I like to use these cash envelopes because there is a spending log conveniently located on the back of each envelope.*

Then I’ll subtract $100 from the amount I budgeted for groceries. This tells me exactly how much money I have left for the month.

If you make an online purchase (which is more than what you budgeted for), take the difference from your envelope and deposit that cash back into the bank.

For example, if I set a budget for $100 to spend for online grocery pickup, but I actually spent $150 – I’ll take $50 cash from my “Grocery” envelope and deposit that money back into my bank account.

Option 2 – Withdraw all of your budget money in cash

- Withdraw all of your budget money

- Stuff that cash into the corresponding envelope categories

- If you want to make a purchase online, take the amount of cash that you want to spend from the envelope category, and deposit that money back into your bank account

If you tend to overspend when shopping online, this is a great option to help you get a better handle on your spending.

By having to go back to the bank to deposit the cash when making an online purchase, this increases the friction and makes you less likely to impulse buy.

You can even take this a step further by doing this – Whenever you want to make an online purchase, force yourself to wait a day or two before your can buy it. Then deposit the cash back into the bank before your order it.

Option 3 – Follow the cashless envelope system

- Label the envelopes based on the spending category

- Write down how much you plan to spend for each category on the back of envelopes

- Use your debit card, credit card, gift card, or pre-paid visa card to pay for your purchases

- Put the receipt from each purchase inside the envelopes

- Every time you spend money, record the transaction on the back of the envelope

- Subtract each transaction from the budgeted amount for the category to see how much money you have left for the month

If withdrawing cash from the bank every month doesn’t work for you, then you can follow the cash envelope system without using cash.

I used cash stuffing when I first started my financial journey, but now I follow the cashless envelope system.

This method can still be a highly-effective way to improve your budget, spending, and saving habits.

What happens if there’s an emergency?

If something comes up during the month where you have no choice but to borrow money from another cash envelope category, take a moment to breath and give yourself some grace. It’s going to be okay.

Unfortunately, emergencies can happen – especially when we least expect it. If that’s the case, figure out how to adjust your budget.

This may involve finding ways to cut back on your spending for the rest of the month, or having to dip into your emergency fund to cover the expense.

Having an emergency fund can help you stick to your budget when a surprise expense happens. If you don’t already have one, focus on setting aside at least $1,000 for emergencies. This should be your top priority!

What if I have money leftover in my envelope at the end of the month?

If you have any money left over in your envelopes at the end of the month, that’s awesome! Give yourself a big pat on the back and do a little victory dance!

You can choose to keep this extra money in its envelope to use next month, or you can deposit that money into your savings account.

Depending on your spending habits, you may not use up all the money in your “household” or “clothing” envelope during the month.

It’s perfectly okay to let that money carry over and build up in one of your categories if you don’t spend it all that month.

But if you consistently have money left over in one of your categories, such as “clothing”, then you may want to consider allocating less money for that category going forward.

Then you can put that extra money towards another category or your savings.

If you end up with leftover money in your food envelope, consider using it to treat yourself to a nice dinner out or fancy groceries.

What is an alternative to cash stuffing?

Cash stuffing can be a great method to get better at managing your money, but many establishments are going cashless.

Here are a few different budgeting methods that you can use to improve your spending and savings.