The best way to pay off debt is to follow the debt avalanche method. This can help you tackle high-interest credit card debt. With this debt payoff strategy, you’ll pay off debt with the highest interest rate first, while continuing to make minimum payments on your other debt. This is the smartest way to pay off debt.

Are you tired of feeling stressed and anxious by debt? You’re not alone. Today I’m sharing tips on the best way to pay off debt.

A recent study showed that 80% of Americans have some form of debt, such as car loans, unpaid credit card balances, student loans, medical bills, mortgages, or a combination of those.

Fortunately, you can decide to change your life today by learning how to handle your money. Yes, it will take some serious dedication. But if you’re ready to break free from debt, it is definitely possible!

Below I’ll share two popular methods for paying off your debt so you can create a plan that works best for you.

Read Next:

- 50 creative ways to pay off debt

- 12 ways to pay off debt fast

- 35 ways to make extra money to pay off debt

Table of Contents

Why you need a debt payoff plan

It’s important to figure out a debt payoff plan for yourself. When you work towards paying off debt, this can improve your finances, such as:

- You’ll save money by reducing the amount of interest paid over time. This is especially beneficial if you have high-interest credit card debt.

- Once you get out of debt, you can direct your full focus on saving money and other financial goals.

- Paying off debt quickly can help improve your credit score.

- Getting out of debt can help reduce financial stress.

When you choose the right debt payoff plan, this can help put you on the path for financial success. To organize my finances, I use my Zero-Based Budget Planner, which helps me save money every month and prevent overspending.

If you’re ready to get out of debt quickly, you’ll need to determine which plan of action you wish to take. It’s essential to create an outline of your debt payoff plan that makes sense for your goals and lifestyle.

There are two popular debt payoff methods that you can choose from:

- The Debt Avalanche Method

- The Debt Snowball Method

Which is better – debt avalanche or debt snowball? No matter which option you choose, the key is to pay at least the minimum monthly payment on all your debts.

Then you can throw as much extra money as possible towards tackling one debt at a time – either the account with the highest interest rate or the one with the smallest balance first.

Here’s how each debt payoff strategy works.

Debt Avalanche Method

How does a debt avalanche start? The debt avalanche method attacks debts with the highest interest first. This is the most effective way to pay off debt.

If you choose to follow the avalanche method, this means you’ll pay the minimum monthly payments on all your debts, but funnel any extra money each month to the highest interest rate debt first.

You’ll pay off your debts in order from highest interest rate to the lowest, regardless of balance.

This method could save you the most money in interest fees and has the potential to get you out of debt faster.

The Debt Avalanche Method works best for:

- Those who are patient and logical spenders. It may take time to feel like you’re making progress towards paying off debt when you focus on tackling the highest interest debt first, especially if it’s the largest.

- Those who want to save the most money.

- Those who want to get out of debt as quickly as possible.

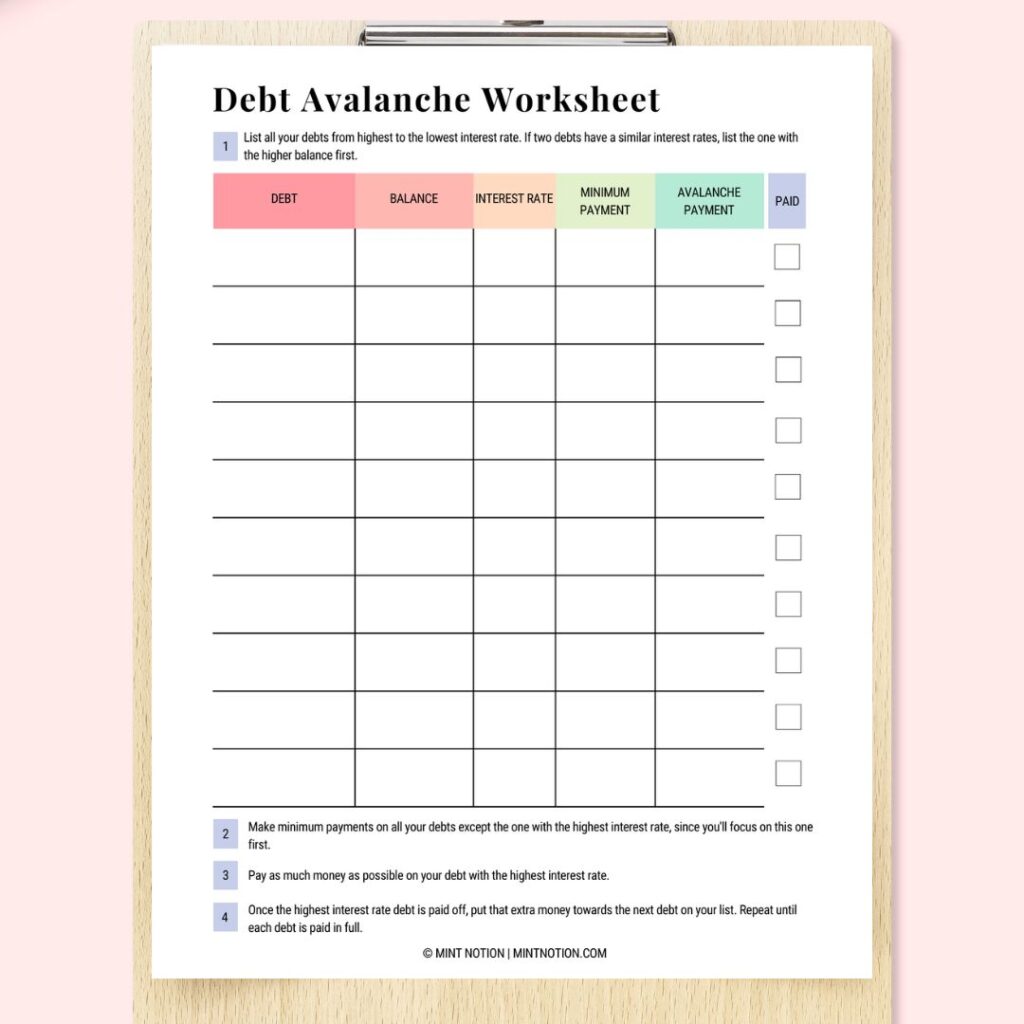

How does the Debt Avalanche Method work?

Step 1: List all your debts by their interest rate, from largest to smallest. If two debts have a similar interest rate, list the one with the higher balance first.

Step 2: Make minimum payments on all your debts except the one with the highest interest rate.

Step 3: Pay as much money as possible on your debt with the highest interest rate.

Step 4: Once the highest interest rate debt is paid off, start putting that extra money towards the next debt on your list. Repeat until each debt is paid in full.

Debt Snowball Method

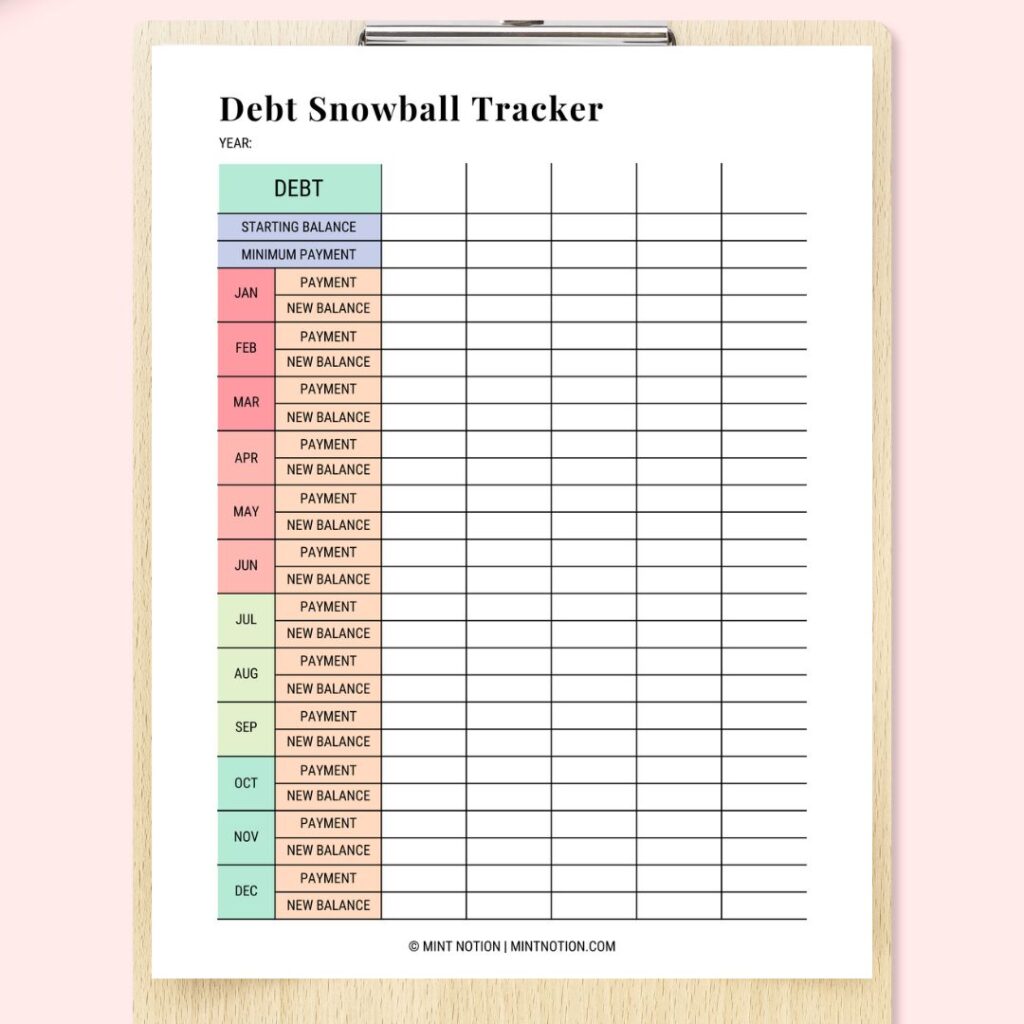

How do you start a snowball method? The debt snowball method targets debts with the smallest balance first. This is the best ways to pay off debt fast with a low income.

If you choose to follow this debt reduction strategy, this means you’ll pay the minimum monthly payments on all your debts, but funnel any extra money each month to the smallest balance first.

You’ll pay off your debts in order from smallest to largest, regardless of interest rate. When the smallest debt has been paid off in full, then you’ll put any extra money towards paying off the next smallest balance.

What makes the snowball method appealing, is that it can help you stay motivated by focusing on quick wins.

Personal finance is all about mindset, and when you see your progress faster, you’re more likely to stick to your game plan in the long-term.

The Debt Snowball Method works best for:

- Those who are motivated by quick wins. When you see your debts disappearing, it can provide that psychological boost and increase your motivation to continue paying off debt.

- Those who want to increase their confidence. Even if you’ve only paid off the smallest balance, this can give you the confidence you need to stick to your plan.

- Those who want to reduce stress. When you focus on only paying off one debt at a time, this method can help reduce stress from figuring out how to tackle all your debt at once.

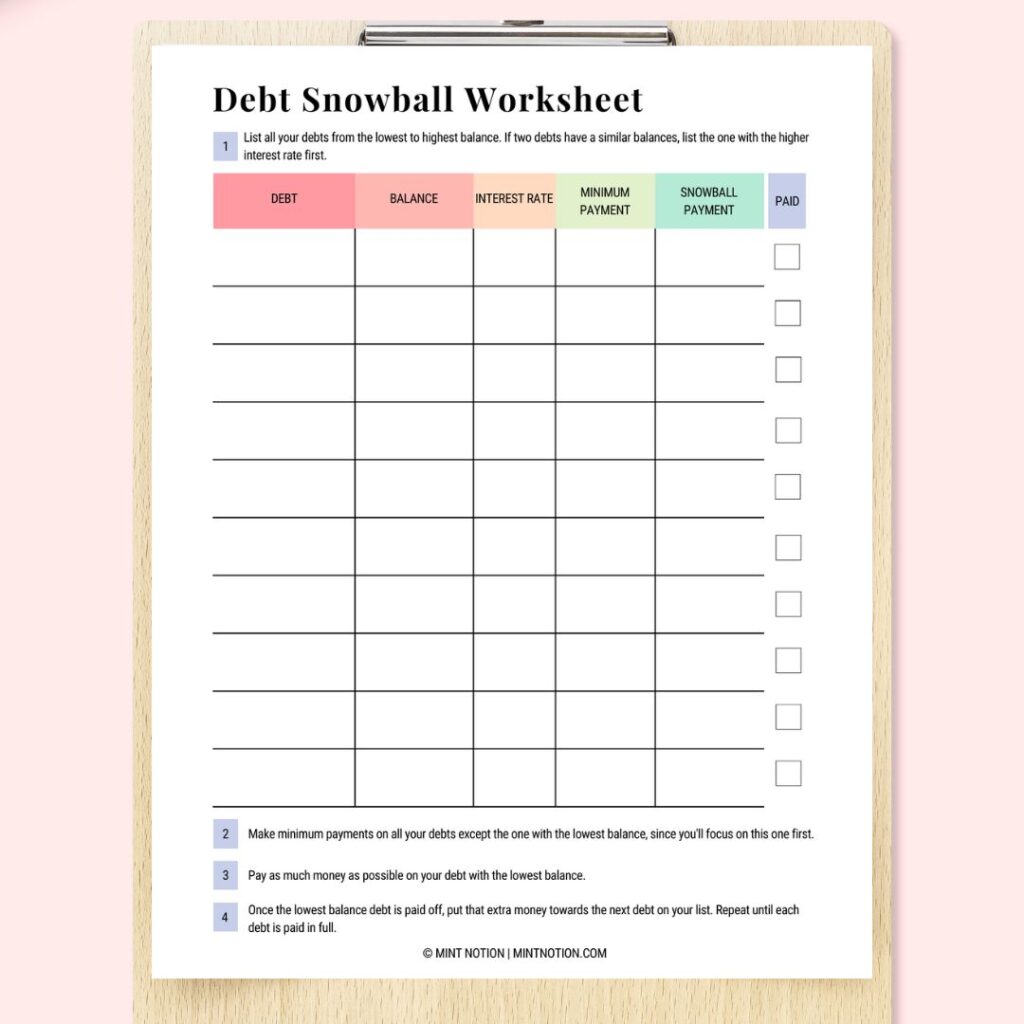

How does the Debt Snowball Method work?

Step 1: List all your debts from smallest to largest. If two debts have similar balances, list the one with the higher interest rate first.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Pay as much money as possible on your smallest debt.

Step 4: Once the smallest debt is paid off, start putting that extra money towards the next smallest balance. Repeat until each debt is paid in full.

Is debt snowball or avalanche better?

If you want to save the most money, then follow the debt avalanche method. Since you’re focusing on paying off debt with the highest interest rate (most expensive one) first, this means you’ll pay less overall.

But remember, the debt payoff plan you decide to choose is a personal choice. Both the debt snowball method and the debt avalanche method are similar, in that you’ll pay the minimum payments on all your debts except for one debt you focus on.

The only difference between these two methods is the order you’ll pay off your debts. At the end of the day, staying motivated through the snowball method is more important than saving a few dollars in interest from using the avalanche method.

If you love the personal satisfaction of knocking debts off the list one by one, then you may find the snowball method might be right for you.

On the other hand, if you want to save the most money and pay the least amount of interest, then the avalanche method might be a better choice.

Read Next: What is the 70-20-10 buget rule?

Which debt should you pay off first?

If you have any high-interest debt (any debt with interest rates in the double-digits), that should be paid off first. Typically, high interest debt may include credit cards, payday loans, or any bills in collections.

If you choose to follow the snowball method, you’ll start working towards paying off the smallest balance first on any high-interest debt you have. This will be your focus debt while you continue to pay the minimum monthly payments on all your other debts.

If you choose to follow the avalanche method, you’ll work towards paying off the highest-interest debt first, while continuing to pay the minimum monthly payments on all your other debts.

In some cases, it might make sense to pay off your car loan early. This is because your vehicle is depreciating all the time. If it’s the right financial decision for you, paying off your car loan early will save you money since you’ll pay less interest.

No matter which method you decide to choose, the most important thing is that you actually start paying off your debt.

The quicker you make a budget that allows you to funnel extra money towards paying off your focus debt each month, the faster you can free yourself from interest charges and set your future up for financial success.

Below are some helpful guides on how to create a budget:

- How to make a zero-based budget

- How to budget when you live paycheck to paycheck

- How to budget when you get paid bi-weekly

- What is the 50/30/20 budget rule?

- How to budget with an irregular income

- How to use the half-payment method to budget

What is the most reliable way to pay off debt?

The most effective way to pay off debt is to choose a repayment plan that plays to your strengths and motivations.

Your debt elimination plan may look different than someone else’s, but that’s okay. Personal finance IS personal. If you’ve found a way to stay consistent in your debt payoff plan, then that’s great.

Below are some tips that can help you pay off debt fast:

1. Figure out the amount of debt you owe

Writing down all your debt may make you want to run and hide, but it’s the essential first step in creating a solid action plan to pay off debt fast.

The best way to find out how much you owe is to contact the original creditor (for example, the credit card company, gym, or doctor’s office) and ask them for the amount. Another way to find out this information is to review your credit reports.

Remember – from this day forward, that number is only going to go down. If you can do this first step, there’s no stopping you from tackling your debt once and for all.

I like to use the debt avalanche worksheet and debt snowball worksheet in my Budget Planner to stay organized.

2. Make a budget

How to budget and pay off debt? When you know your income and expenses, this can help you figure out if you have any extra money to put towards paying down your debt.

Creating a budget can help you align your spending with your goals, such as paying off debt or building an emergency fund. While there are many ways to do this, one of the most effective budgeting methods is Paycheck Budgeting.

3. Stop using your credit cards

If you want to aggressively pay off credit card debt, you’ll want to stop using your cards. This can help prevent adding new debt to your balance, which can make it easier to manage.

Instead, I recommend using cash (or debit card) as your primary method of payment. To help you stick to your budget, a popular method to avoid overspending is to use cash envelopes.

You can choose to use cash envelopes for spending categories that tend to bust your budget each month, such as groceries, eating out, clothing, entertainment, and so on.

Below is more information how to follow the cash envelope method:

Read Next: How to use the cash envelope system without cash

4. Reduce your spending

Now that you’ve created a plan to get out of debt, it’s important to find ways to keep your spending in check.

Take a look at your current expenses and determine if there is anything you can reduce or eliminate. This can help you save money to pay down debt.

Below are some helpful posts to cut your monthly expenses:

- 15 fast ways to reduce your monthly expenses

- 16 ways to cut your monthly grocery budget in half

- 50 creative ways to save money on a tight budget

5. Celebrate your small wins

Just because you’re working hard to pay off debt faster doesn’t mean that you can’t reward yourself along the way.

Each time you hit a milestone in your debt free journey (such as you’ve paid off a balance or you’ve paid off a certain percentage of all your debts), you should celebrate every win.

It’s important to reward yourself when paying off debt because your milestones do matter and it’s acknowledging that you’re getting closer and closer to financial freedom.

How you choose to reward yourself is up to you. The possibilities are endless – just make sure that it fits within your budget and aligns with your goal.

Best way to pay off debt FAQS

Is it better to pay off a credit card or pay down several?

If you have multiple credit cards, it’s better to focus on paying off one at a time rather than trying to tackle all of them. You’ll make quick progress when you pay a larger amount to one credit card each month, while continuing to pay the minmium payment on your other debts.

Why is avalanche better than snowball?

Avalanche wants you to focus on paying off debts based on their interest rate, starting with the most expensive ones first. This means you’ll end up paying less interest and saving more money.

What are the 3 biggest strategies for paying down debt?

The 3 biggest strategies for paying down debt are: The snowball method (paying the smallest debt as quickly as possible), Debt avalanche (paying the debt with the highest interest rate or the largest one as quickly as possible), and Debt consolidation (combining all your debts into a single account).

When would you use the debt avalanche method?

This works best for those who are more disciplined, want to pay off their debts as fast as possible, and want to save the most money.

How to pay off debt with no money?

Getting out of debt is not easy, especially when you don’t have much money to spare. Fortunately, it is possible to pay off even when you’re broke. Below are some tips that can help:

- Create a budget – This can help you determine how much money you can afford to put towards paying off your debt each month. A budget is also a great way to create a plan for your spending and look for ways to free up money so you can pay off debt faster.

- Stop adding to your debt – Avoid using credit cards and switch to paying with cash. This can help you avoid creating new debt. I can appreciate how tough it can be to live without credit cards, but it’s essential to find a way to live within your means.

- Look for ways to cut back on expenses – Check your monthly bank statements to see where your money is going. For each expense, ask yourself if you can cut back or eliminiate it. You may find that you can live without a purchase and put that extra money toways paying off your debt. Once you’re debt-free, you can also decide if those purchases are worth adding back.

- Increase your income – Finding ways to make more money can help you stop relying on credit cards to cover your monthly spending and use that extra income to put towards tackling your debt. Consider looking for a higher-paying job or starting a side hustle to make money.

Best way to pay off credit card debt?

The best way to pay off credit card debt is to follow the debt avalanche method. List your debts from highest interest rate to lowest. Here you’ll focus on paying the highest-interest debt off first, while continuing to make minimum payments on your other debt.

As you are working towards paying off credit card debt, it’s also a good idea to switch to cash. This means to stop using your credit cards to prevent you from accumulating more debt.

How can I make paying off debt fun?

- Track your progress with debt-free coloring pages – If you’re a visual person like me, then you’ll love using debt-free charts to track your progress so you can reach your goal faster.

- Create a vision board – Make paying off debt fun by creating a vision board of your goals. Each day you look at your vision board, it will motivate you to keep going.

- Set small rewards for yourself – Sometimes becoming debt-free can seem like an impossible goal. To help you stay on track with your progress, set a small reward for yourself as you reach each milestone along your debt-free journey. Make sure to include this reward in your budget.