My husband (Sam) and I bought our dream home in 2023. But let’s start at the beginning to show you exactly how we made it happen.

We moved into our condo together in 2018. Even though we started dating in 2008, this was our first time living together. Prior to this, we were living at home with our parents.

Now before you decide to click away, hear me out – We know how fortunate we are to have family who live in the city and to be able to stay at home during our twenties.

Living at home with our parents allowed us to build up our savings so we could finally move out together.

I know that not everyone is able to live with family to save money, but we made the most of the resources we had at the time. This also meant maintaining a relationship for 10 years where we only saw each other on the weekends (we lived an hour away from each other).

We talked about living together when Sam purchased the condo back in 2011. He bought the condo for just over $400,000 (pre-construction).

He was able to save up enough money while living at home with his parents to afford the down payment and closing fees.

However, I was only making $38,0000 per year at the time. I was also planning to go back to school to get my MBA. Sam was also working full-time and wanted to get his MBA too.

Our combined income and expenses at the time were not enough to comfortably afford moving into the condo together. So once the condo was completed, we decided to rent it out instead, with the hope that we could afford to live there together someday.

It took us nearly 7 years to able to afford to move into the condo, and then another 5 years to save up for a down payment on our current house (4 bedroom / 4 bath home).

I’m going to show exactly what I did to save up $350,000 to put towards the down payment on our house.

*Together, Sam and I were able to save just over $500,000 for our house down payment. But today I’m just sharing the money saving strategies that I used to make it happen.*

We also managed to save this money without selling Sam’s condo. We currently rent it out which helps us cover the mortgage payment for the condo, and some of our current home’s mortgage.

Table of Contents

1. We lived on one income

I quit my 9-5 job in 2014 to finish my MBA program. I was living with my parents at the time, so I didn’t have any housing expenses.

Instead, I was responsible for my cell phone bill, subscriptions and streaming services, specialty groceries, and all other variable expenses (entertainment, shopping, beauty, travel, and so on).

While I was in school, I started this blog as a hobby. It took me 2.5 years before I made my first dollar from blogging.

I was motivated to turn my blog into a full-time business because in 2016, I had less than $1,000 in my bank account.

Before I left my previous job, I saved up just enough money to pay for school and do some traveling, which was running out now.

Remember that everyone starts somewhere. While I wasn’t starting right at $0, I had very little money left in my savings.

It wasn’t until the end of 2017 that I had enough money saved up to afford to move out with Sam into his condo.

We decided to live on one income when we moved in together – Sam’s income.

It was challenging in the beginning, but we knew that we wanted to eventually buy a house someday, and this was the best way for us to save money.

Even though I was making more money from blogging, I basically lived like I was still making $38,000 (or less). We wanted to avoid lifestyle inflation.

When I say that we lived on one income, I mean that Sam used his income to cover all housing related expenses, home internet, restaurants, travel, and entertainment.

*Sam’s cell phone and all car related expenses are covered by his work*

My income was used to pay for groceries, my cell phone, personal spending on health and beauty, pet care (we have two cats), and the rest went towards our savings goal of a house down payment.

I was saving over 80% of my income.

Sam was also saving a little money each time he got paid, but just not as much since he was paying for most of our expenses.

Living on one income allowed us to live below our means and aggressively save up for a house.

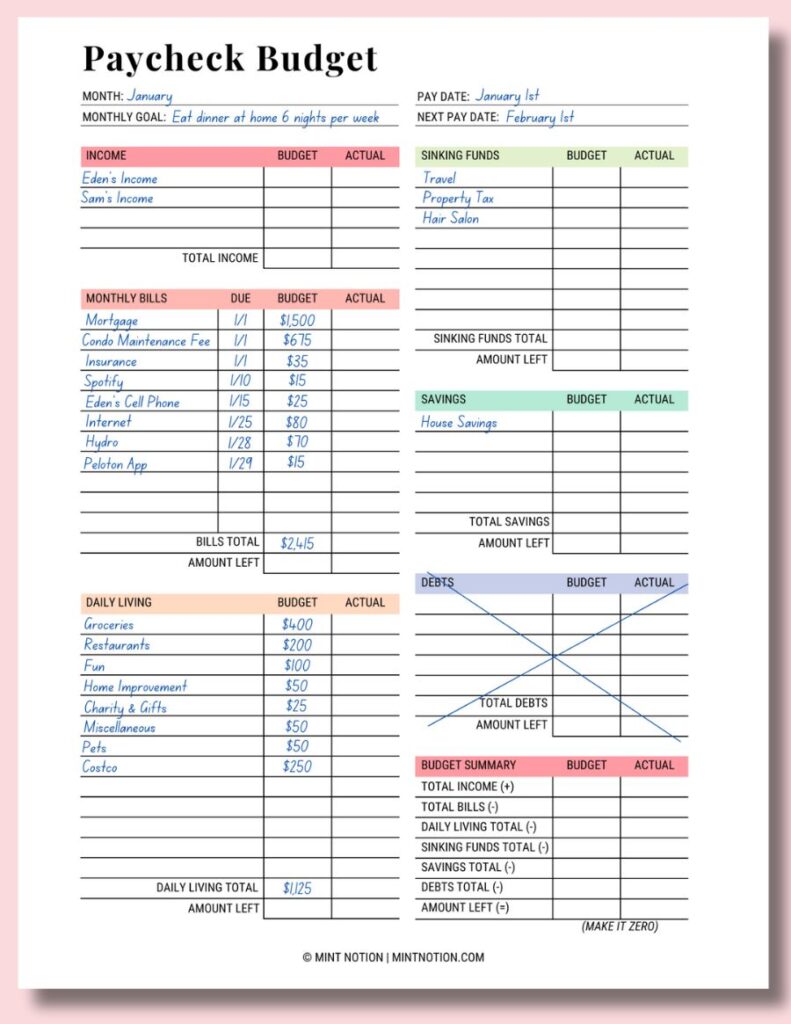

Below is a rough idea of what our monthly budget looked like while living at the condo and saving up to buy a house.

This is what our monthly fixed and variable expenses looked like in our budget. I prefer to keep our income private.

*Under the “Budget” column, I would write down what we planned to spend. Then at the end of the month, I would write down what we actualy spent under the “Actual” column.*

Monthly Bills – The mortgage for Sam’s condo is on a variable rate. When we first moved into the condo, it was around $1,000 per month for the mortgage. But after interest rates rose, the mortgage is now $1,500 per month.

Daily Living Expenses – I rarely bought clothes or spent money on beauty related items. The skincare I use goes on sale a couple of times per year, so that’s when I would buy enough to last me for six months.

The majority of our daily living expenses went towards food and household items (groceries, restaurants, and Costco).

Sinking Funds – I go to the hair salon a few times per year to get highlights. Each visit costs around $350. I set aside a little bit of money each month to save up for this.

We also like to travel a few times per year and like to put money into our travel sinking fund.

Debt – Sam and I are both debt free (except for our mortgage), so we just leave this section blank.

2. I cut back on frivolous spending

Moving downtown together for the first time was exciting, but we realized how tempting it was to increase our lifestyle spending without careful planning.

Sam has always been a minimal spender, but I struggled a lot with shopping and frivolous spending in the past.

I use this Budget Planner to help me cut back on unnecessary spending so that we could continue to live on one income and put the majority of my money towards our savings.

My Budget Planner follows the zero-based budgeting rule, which means that every dollar you earn is given a job.

Each month I would reflect on our spending to see exactly where our money went. Then, I would find ways we could make improvements going forward. Below are some ways we cut back on unnecessary spending:

Cancel subscriptions or streaming services we didn’t use or need anymore – The only subscriptions we pay for right now are Spotify, Paramount+, BODi, Peloton App, and Amazon Prime.

You can use a service like Rocket Money that finds and cancels subscriptions you don’t use anymore.

Eat more meals at home – Sam and I love eating at restaurants, but eating at home is significantly cheaper and healthier. We try to limit eating out to only a couple of times per week.

Meal planning helped us to get excited about eating at home. I would follow food accounts on social media and borrow cookbooks from the library to get recipe ideas.

My favorite cookbooks for quick and easy meals are Plant You, HealthyGirl Kitchen, and Joyful.

Shop at cheaper grocery stores – The closest grocery store to our condo was expensive for fresh produce. Instead, we drove to a cheaper grocery store on Sunday mornings (when it was quiet) to buy our groceries for the week.

This saved us about $50 every single week, which was huge!

Stop going to Starbucks – I only go to Starbucks if it’s free. I do surveys in my spare time to earn free gift cards to Starbucks. My favorite survey sites are Survey Junkie and Swagbucks.

Otherwise, I started making coffee and tea at home to save money. I’ve been drinking my own lattes for years now that whenever I go to Starbucks, I ALWAYS prefer my homemade drinks instead.

Workout for free at home – The condo we lived in had a gym and pool that was included in our monthly condo fees. Sam used to pay for a gym membership but canceled it once we moved to the condo.

2020 is when I got more serious about my fitness and health journey. That’s when I subscribed to BODi (formerly Beach Body) and used that to stream workouts at home. The cost was $119 per year at the time.

Unsubscribe from retailer emails and shopping apps – If you struggle with impulse spending (like I used to do), then avoidance is one of the best ways to stop mindless shopping.

You see an email from one of your favorite retailers. You open it and discover they are having a sale. You browse the website, and something catches your eye. Now you’re suddenly tempted to buy it.

Once you see the item, it’s going to be difficult to resist that temptation. So instead of relying on my willpower to not buy unnecessary stuff, I unsubscribed from all retailer emails and deleted shopping apps off my phone.

Keep my cell phone bill low – I pay $25 per month for my cell phone. Sam pays nothing since it’s covered by his work.

I keep my cell phone bill low because I only pay for unlimited talk and text. I don’t have a data plan. Instead, I use Wi-Fi at home or find free Wi-Fi to connect to when I’m out.

I live in Toronto and work from home, so I rarely need to use data. Most restaurants, gyms, hair salons, malls, and grocery stores offer free Wi-Fi.

I also don’t have the latest iPhone. I have an android that I bought two years ago and will continue to use it until it stops working.

Avoid bank fees – You want to avoid paying fees that aren’t necessary.

I always keep enough money in my checking account to maintain the minimum balance. This helps me avoid paying those pesky bank fees. You can also find bank accounts that are free to use and don’t require a minimum balance.

The checking account I use also waives my annual credit card fee. I use my credit card to pay for almost everything so I can earn reward points.

I never carry a balance on my credit card – it’s always paid off in full each month to avoid interest charges.

A basic rule I follow is this – If I can’t afford to pay for it in cash today, then don’t buy it. This helps keep my credit score in good standing, which is important if you want to qualify for a mortgage.

*To help put more money back into my pocket, I use Rakuten whenever I need to buy something online. It’s free to use, and you can earn up to 15% cash back at stores like Walmart, Old Navy, PetSmart, Best Buy, and more.*

Follow a minimalist beauty routine – My makeup routine is simple and affordable because I use drugstore products.

The only time I splurge is on good quality skincare products. My skin is super sensitive, so I must use products that agree with me. I also believe that when you follow a good skincare routine, you don’t need to wear much makeup.

I paint my nails at home. I wax at home. I don’t wear false eyelashes. I don’t get Botox or fillers. The only beauty treatments that I pay for are to get my hair highlighted (a few times per year) and my eyebrows filled (I have powdered brows).

I make my own cleaning supplies – Studies have also shown that the chemical ingredients found in store-bought cleaning products can increase the risk of long-term health problems.

Instead, I use vinegar, baking soda, Castile soap, and essential oils to clean. I’ve been doing this for years to save money.

Use what you already have – The key to saving money and owning less is to love the things you already have.

I try my best to follow a minimalist lifestyle. It’s helped me to be more intentional about what I bring into my home and mindful about my spending.

Many of us buy things hoping to find happiness or to find ourselves, only to realize that the joy of buying more quickly fades. That new iPhone is exciting today, but tomorrow you’ll be excited about the next iPhone model.

Find free or cheap entertainment – Sam and I like going out for dinner or getting a drink at a local brewery near us for fun. But during the pandemic, restaurants were closed for nearly a year.

We started going for walks after dinner by the lake, which saved us a lot of money. Sometimes we would bring food to have a picnic or wine in a tumbler. This was especially nice during the summer months.

Another way we found free or cheap entertainment was to use the reward points we earned from our credit cards. This would cover movie tickets, restaurant meals, travel, and shopping.

We also went to free events in our city, such as festivals, free museum nights, free concerts, and more.

3. I used a Budget Calendar to organize my finances

Many of us rely on calendars and day planners to keep track of everything in our lives, so why not use one to keep track of your finances?

I used my Budget Calendar to help me remember when money was coming IN and OUT during the month.

For example, I would write down my pay days, when bills were due, upcoming events or special occasions (such as birthdays and holidays), and when money would be transferred to my savings account.

This helped me to avoid paying late fees on bills and plan ahead in my budget for birthdays. If you’re living paycheck to paycheck, then using a budget calendar is vital to getting a better handle on your finances.

Simply being able to look ahead at the month’s expenses and special occasions can allow you to be more mindful with your spending so you can save money.

For example, if I had a big bill that was due this month, I would cut back on my spending to make sure that I had money set aside to cover the bill payment.

4. I always paid myself first

The easiest way to start saving money is to make it a habit to put money into your savings account first – as soon as you get paid and before you spend it on other financial obligations.

In the beginning, it was just a small amount that I could afford to put towards my savings – $25 from one paycheck, $50 from another.

I did what I could because the action of setting money aside helped build the foundation for good money habits going forward. And as my income grew, I was able to make bigger and bigger savings contributions.

I put my money in a high-interest savings account (high-yield savings account) so I could earn a return on my savings.

*If you are comfortable taking on more risk, you can put your house down payment savings into an investment account at a major brokerage.*

If you want to save money to buy a home, you need to build your budget around making that dream come true.

Choose a percentage of your paycheck that you can afford to save each month. Maybe it’s 5% or 25% – this will help you carefully consider your spending choices to make sure they align with your home ownership goal.

For example, when spending money during the month, you might say things like…

“Do I really need to be catching an Uber when I can easily take public transportation?”

Or “Do I really need to be getting takeout again when I have food to make at home?”

5. I took inspiration from Kakeibo

Kakeibo is a Japanese saving method, which can be translated to “household ledger”. Using a pen and paper, you’ll keep a journal and log your income and expenses.

The act of writing things down by hand allows you to retain more financial information and keeps your money goals at the top of your mind.

When you write down the numbers, you see it in real time, which helps you resonate with it better and stick to your budget.

Before starting your first ledger, there are four important questions that you need to ask yourself:

1. How much money do you have to spend?

You’ll write down how much money you plan to earn that month.

2. How much money would you like to save?

You’ll write down how much money you want to save that month. Your savings goals will be added as a fixed expense, so you don’t forget to set aside that money.

3. How much money are you spending?

You’ll write down your expenses for the month. Start with the basic things you need to survive, such as housing, food, utilities, and transportation.

Each time you spend money during the month, you’ll record the transaction on your ledger and label it as one of the following four categories:

- Needs (Housing, utilities, transportation, groceries, healthcare)

- Wants (Restaurants, clothing, travel, spa days)

- Culture (Museum visits, books, concert tickets, memberships)

- Unexpected (Car repairs, birthdays, holidays, medical bills)

4. How can you improve next month?

At the end of the month, you’ll look back at your spending to see where you can make adjustments and improvements for next month.

Kakeibo is a great place to start if you’re new to budgeting. I took inspiration from this method to help me create my zero-based budget planner.

While I’ve tried using budgeting apps and spreadsheets in the past, I’ve been able to save the most money by using a pen and paper.

For many of us, our relationship with money is emotional. But most of us don’t look at our spreadsheets or budgeting apps on a daily basis, which makes it easy to disconnect from our spending.

When you track your expenses with a pen and paper, you’re more likely to take note of your budget before heading to the grocery store and make a note of your spending when you check out.

This can allow you to create an emotional connection to it, which could prevent impulse shopping.

6. I used cash envelopes to track my discretionary spending

Cash stuffing is a budgeting method where you divide cash into various envelopes to manage your discretionary spending.

This means you’ll be paying cash for your variable expenses, such as groceries, restaurants, clothing, beauty, kid stuff, gas, and other items that tend to bust your budget.

At the start of the month when you make your budget, you’ll label envelopes with the different spending categories that you want to pay for in cash.

Decide on how much you need for each of these spending categories, then fill each envelope with the amount of cash you budgeted for that particular category.

For example, if you budget $500 a month for groceries, you’ll label an envelope as “Groceries” and stuff it with $500 in cash. Then you’ll use this cash to pay for any grocery related purchases during the month.

Once the money is gone, it’s gone. If there is any money leftover in your budget at the end of the month, you can put that towards your savings.

Studies have also shown that we tend to pay less when paying with cash due to the psychological pain of payment. When you hand over a $20 bill, you’re literally watching the money disappear before your eyes.

This is why the cash envelope method can be a great way to prevent overspending and save money.

I followed this method for a few months to help me develop better financial habits, but now I use the envelopes without cash.

This means instead of stuffing each envelope with cash, I use my credit card to pay for my discretionary spending. Then I put the receipt inside the appropriate envelope and record the transaction on my spending log.

Each time I spend money, I subtract the amount from my budget to see exactly how much money I have left for the month.

This gives me the same benefit as using cash, except I earn reward points when I use my credit card.

*I pay off my credit card balance in full each month. I never carry a balance on my credit card and I never pay interest.*

7. I sold stuff I didn’t need anymore

It wasn’t until the fall of 2020 that we started to get more aggressive with our house savings goal. The pandemic hit Toronto hard. For over a year, most places were closed (except for grocery stores).

It was tough during the winter months when we spent most of our time indoors. Sam and I were both working from home now and felt cramped due to the limited space in our condo.

While we were incredibly grateful to have a safe space to live and work, the pandemic closures really pushed our desire to continue saving up money for a house down payment.

Since we were spending more time at home, we wanted to free up space for us to live and work. We realized that we had a ton of items that we no longer needed anymore. So, we decided to sell stuff them on Facebook Marketplace.

We sold golf clubs, bookcases, our dining table and chairs, accent chairs, couch, coffee table, desk, my collection of books, clothing, shoes, musical instruments, lamps, mirrors, carpet, mattress, bed frame, small kitchen appliances, Christmas decorations, wall shelves, electronics, fitness accessories, throw pillows, storage containers, and more.

We made several thousand dollars by selling our old stuff on Facebook!

We put some of the money towards our house down payment and some of the money towards our wedding.

*We were supposed to get married in June 2020, but it was postponed due to the ban on public gatherings in Ontario.

Instead, we got married in October 2021. At the time, there were only 10 people allowed at public gatherings, but we didn’t want to keep postponing our wedding. So only our immediate family attended our wedding.*

And after we got married, I sold my wedding dress on Facebook Marketplace. I absolutely loved my wedding dress, but I wanted someone else to enjoy wearing it for their special day, rather than have it stay in my closet.

Every little bit helped us get closer and closer to buying our dream house!

8. We found ways to increase our income and reduce expenses

I know some people say that it doesn’t matter how much money you make, it matters what you keep.

While this is true, try telling that to someone who is making only $38,000 a year (like I used to earn).

If I continued to earn only $38,000 a year, it would have taken me A LOT longer to save up $350,000 for a house down payment.

The truth is, once you’ve developed good spending habits, the next step is to focus on increasing your income so you can build your savings faster.

This might mean negotiating for a pay raise at your current job, working extra hours, or finding a higher-paying job.

It could also mean picking up a side hustle or starting your own business.

Sam negotiated a pay raise at his current job, which helped him to save more money.

I was able to find new streams of income to add to my blogging business. This helped me to double my earnings.

*If you’re interested in starting your own money-making blog, you can check out my step-by-step guide here.*

I also looked for ways to reduce our expenses without giving up all the fun stuff, like travel.

One of the biggest ways we were able to save money is by not having car payments. Sam is fortunate to work for a company that offers him a car allowance. His vehicle, gas, and car maintenance are all covered by his job.

Since we lived downtown, we only needed one car because I could walk everywhere or take public transportation. I also work from home, so that saved me money on commuting costs.

We also love traveling but wanted to look for ways to travel on a budget (or for free).

Through my blog, I was able to earn Airbnb credits (before the affiliate program closed). This allowed us to travel several times a year for free. I earned enough credits to cover our Airbnb bookings.

Through my credit card spending, I was able to earn enough reward points to cover the cost of flights and hotels when traveling. Depending on how many points I had, sometimes travel was fully or partially covered.

9. I did low-buy and no-spend challenges

For the past 10 years, I’ve challenged myself to do a no-spend month each January. This has been an excellent way to reset my finances and start the year off with good spending habits.

How to do a no spend month?

This means you’ll only pay for your essentials during that month (housing, utilities, groceries, and transportation) and other necessities, but you’re saying no to all the extras.

You’ll make a commitment to use what you already have and eliminate all spending for the entire month.

How to do a low-buy month?

A low-buy month is a more flexible and less restrictive version of the no-buy month. Here, you’ll cut back on any unnecessary spending from your budget.

This means you’ll be making more mindful decisions whenever you choose to buy anything. Think of it like conscious consumerism.

The key is to be consistent and intentional with your spending. Here are 5 questions that I ask myself before spending money on non-essentials:

- Do I need this right now? Or is it something that I want?

- What is the real cost? If I spend money now, what am I giving up in the future? Will it keep me from paying a bill or setting money aside for savings? Can I actually afford it?

- What do I gain from buying this? Will it improve the quality of my life? Am I looking for status and the approval of others (external validation)? Will I still want or use this a year from now? Will it provide me with long-term enjoyment?

- Would the best version of me buy this? Is there something else that can bring me joy?

- What else can I do with this money? Can I put it towards my house savings goal instead?

Of course, you get to set the rules for your no-buy or low-buy challenge, which means you can be as strict or as flexible as you want with your spending.

After completing my no-spend January, I would challenge myself to other no-spend and low-buy challenges throughout the year.

Below are some money saving challenges I did. Hopefully it will inspire you to try them too!

No-spend weekend – Try to get into the habit of making one weekend per month a “no spend weekend”. This means you don’t spend money on anything (except essentials) for that weekend.

Use ingredients that you already have at home to make a meal. Find free things to do at home or in the city. If you choose to drive somewhere, make sure there’s enough gas in your tank so you don’t have to fill up that weekend.

Usually during my no-spend weekends, I would use it as an opportunity to catch up on work, declutter or deep clean the condo, or spend time outdoors (if the weather was nice).

No-new clothing challenge – I bought no new clothes for a year when I first quit my job. This was because I didn’t have an income at the time, and I needed to use the money to pay for school.

As a former shopaholic, it was tough to go a whole year without buying clothes, but I learned so much about my personal style and spending triggers by doing the challenge.

Challenge yourself to go one month (or longer) without buying new clothes. Instead, shop your closet and wear what you already have. If you need something new, consider borrowing it from a friend or family member before shopping.

No eating out challenge – When you eat at home, you’re more likely to make healthy food choices, eat less calories, and save money.

To make eating at home more exciting, I would get cookbooks from the library or try to recreate some of my favorite restaurant recipes.

Pantry challenge – If it was a busy week and I couldn’t get to a grocery store, it would be easy to just grab take-out from a local restaurant for dinner.

But one night, I decided to challenge myself to throw together a quick meal using items that I already had in my pantry.

I ended up making vegetarian chili and cornbread. Was it the most exciting meal? Probably not.

But it showed me that when you’re focused on reaching your goal (which was saving up for a house), there are plenty of creative ways to save money.

I try to do the pantry challenge once a month. Especially now that I’m taking care of my baby daughter, I don’t always have time to go to the grocery store each week. It helps to cut down on my grocery bill and reduce food waste.

10. I made saving money for a house my main priority

When you want to make one of the biggest purchases of your life – like a house – it’s all about priorities.

A big reason why I was able to save up enough money for a down payment on a home is that I created an emotional connection to my goal. This connection can help motivate you to pursue your financial goals, even on tough days.

For Sam and me, we wanted to get married and have a baby. We could raise our baby in the condo, but my dream was to be in a house. That was my emotional connection to my goal.

Shortly after we got married, we started looking at homes in different neighborhoods to get an idea of what was available in our budget, and which area we wanted to live.

I made a list of everything that I wanted in my dream home.

I wanted it to be close to the lake, to be a detached home, to be close to my parents (this is the best parenting hack), to have high ceilings, to be a new build or fully renovated (a turnkey property), to have a basement that’s big enough to build a home gym, to have at least 4 bedrooms and 4 bathrooms, to have an easy-to-maintain backyard, and to have a big kitchen that’s good for entertaining.

I knew all the items on my wish list would come at a certain price point due to the current housing market in Toronto. But this motivated me to continue finding ways to increase my income and save more money.

Each day I asked myself, “What am I doing today that will help me get closer to reaching my goal?”

I realized that there was always something that I could be doing to propel me towards my goal.

Whether this was tracking my expenses so I could be more mindful about where I was spending my money, or trying a new savings challenge, or planning out my budget for the following month so I could look for ways to make improvements.

I truly believe that if it’s meant for you, it will find you when the time is right.

At the beginning of January 2023, I found out that I was pregnant.

We went to look at a townhome that same week which we wanted to put an offer on. But we didn’t get the townhome because someone else made a higher offer.

I took this as a sign that buying a townhome was not meant to be, and to keep looking for my detached dream house.

Then during March break, when most families were away or too busy to think about putting offers on a house, we found our dream home.

We went to the open house on a whim, thinking that it was out of our budget. But as soon as we stepped into the house, I could feel it in my gut that we had found the ONE!

The next day, we put an offer on the house. After some back and forth between our realtor and the seller, our offer was accepted! We bought our dream house!

Remember that everyone’s journey will look different. Don’t let your current financial situation limit your dreams. You are capable of accomplishing anything your set your mind to.