Do you need to drastically cut your expenses? Today I’m sharing easy ways to cut your budget and monthly expenses. This can help you save money, pay off debt, and allow you to spend more quality time doing the things you love.

When my boyfriend and I moved into our apartment together, we asked ourselves – what can we cut from our budget to save money?

We wanted to find ways to cut our monthly expenses drastically so we could build our emergency fund and save more money. Even though we are dual income with no kids, we choose to live on on just income. This allows us to drastically cut our household expenses and save 50% of our income.

We put this extra money towards our savings and investments. It’s not always easy, but it has helped us learn how to live with less and be grateful for what we have. This has also taught us how to cut our spending habits.

If you want to know how to reduce expenses and save money so you can pay off debt, I’m sharing some helpful tips to help you cut everyday expenses. This is by no means a complete list. But it’s a good place to start if you’re looking to quickly reduce your household costs.

If you’ve recently experienced a sudden drop in your income or a job loss, then I recommend reading this post first. It shares tips for cutting expenses to the bone. How to budget after an unexpected pay cut or job loss

Before we dive into the best ways to cut expenses, you’ll want to do the following three steps to help set you up for success.

Read Next:

- How to budget when you get paid biweekly

- What is the 50/30/20 budget rule?

- How to follow the budget-by-paycheck method

Table of Contents

Write down all your monthly expenses

The best way to cut your monthly expenses is to figure out exactly what your current monthly expenses are.

Many people don’t realize how much they’re spending. That’s because it’s easy to spend $1 here or $5 there and not think anything of it. We may not think we’re buying anything lavish, but at the end of the month we’re left wondering – where did all of my money go?

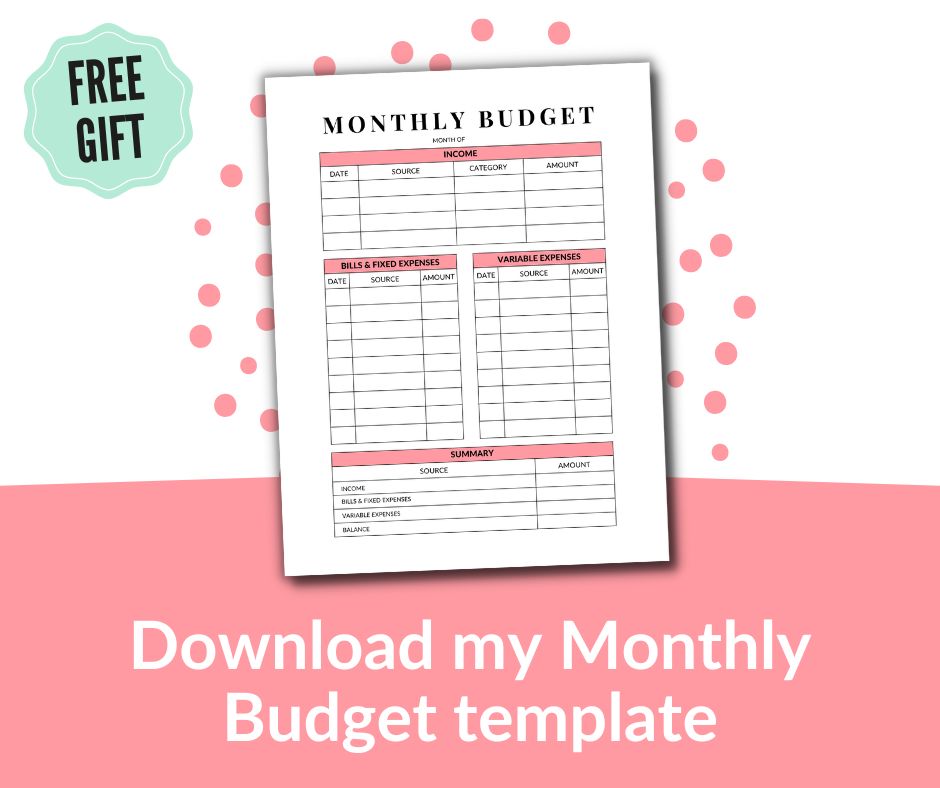

If you want to learn how to drastically cut expenses, the first step is to write down ALL your fixed and variable (discretionary) spending. An easy way to figure this out is to look at your previous bank statements to see what you spent. Or you can simply track your spending for the next month.

You can download my monthly budget template to help you do this.

Fixed expenses – These are expenses that you MUST pay each month, such as rent / mortgage, electricity, gas, water, savings plans, debt payments (credit card, car payments, student loan, personal loan) and so on.

Variable spending – These are non-essential expenses, such as dining out, vacations, entertainment, lunch with friends, gifts, clothes, manicures and pedicures, and so on.

If you’re currently having trouble paying your monthly bills, you’ll want to figure out the absolute minimum amount of money you need to cover your essential living costs. This includes:

- Food

- Utilities

- Shelter

- Transportation

If you are currently working towards paying off debt, then you’ll want to include debt payments in your essential living costs too.

I know it’s not easy to cut your monthly expenses and it can be tempting to stop debt repayments. But try to make at least the minimum payments on your debt. Continuing to pay down debt can help reduce your monthly debt payments.

Once you’ve determined your monthly fixed and variable expenses, compare this with your household’s income. If you’re currently living without a source of income, see how much cash you have set aside in your savings account or emergency fund.

Determine your financial goals

Most people want to reduce their monthly expenses because they want to save and accomplish more with their money. Knowing your goals can help you align your budget around achieving them.

The best part is your goals can be anything you want. Perhaps you want to pay off credit card debt, save money to purchase a car, or build an emergency fund. The more specific you can get, the easier it will be to break down your goals into manageable steps.

Ask yourself – what do I want my finances to look like a year from now? But starting today, you’ll begin planting the seeds for a successful financial future.

Create a realistic monthly budget

Now that you’ve determined your essential living costs and figured out ways to reduce your non-essential spending, it’s time to create a new monthly budget.

For those who currently don’t have an income, you’ll need to see how much cash you have set aside to make sure it’s enough to cover your essential living costs.

For those new to budgeting, you can follow my step-by-step guide on how to create a budget.

If you need a system to help keep all your finances organized, many Mint Notion readers love using my printable Budget Planner. It’s the same budgeting resource that I use to manage my money.

Creating a plan for your money is the first step in taking responsibility for your finances. Below are the same budgeting worksheets I used to help me break the cycle of living paycheck to paycheck, stop buying unnecessary things, and save my first $100,000 in my mid twenties. If you’re interested, you can grab them here.

Related Posts:

- How to create a zero-based budget

- 47 creative ways to save money on a tight budget

- How to save money on groceries and stick to your food budget

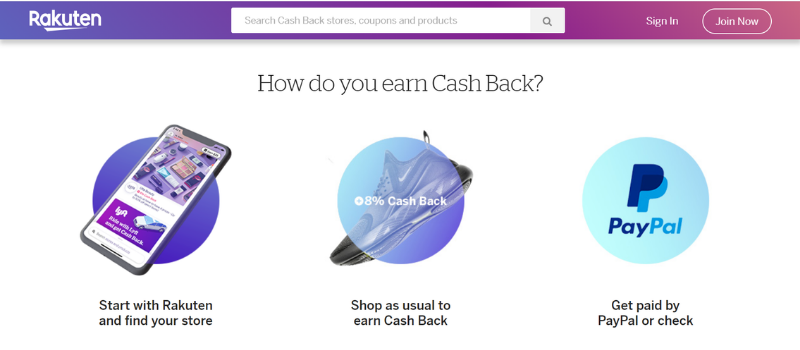

1. Earn cash back when shopping online

If you need to purchase something online, always remember to earn cash back. Many people forget to earn back cash on their purchases, which is essentially leaving your hard-earning money on the table.

My favorite cash back site to use is Rakuten. With Rakuten, you can earn up to 20% cash back when shopping online. I’ve been using this site for years to save money. I think I’ve earned over $2,000 cash back just by shopping through Rakuten! That’s A LOT of money!

It’s free to join and you’ll even get a free $10 welcome bonus when you sign up!

How to claim your free $10:

- Start here to sign up for Rakuten. (It’s free to join)

- Find your store on Rakuten next time you need to buy something. It’s connected to over 2,000 stores, including Amazon, Target, and Walmart. You’ll need to spend at least $25 on your first purchase within 90 days.

- Your Rakuten account will be credited with reward points. Get this cash sent to a PayPal account or choose to receive a Big Fat Check from Rakuten. It’s up to you!

For Canadian shoppers, you can click here to sign up for Rakuten (free $5 welcome bonus).

Please note: Just because you can earn cash back on your purchases should NOT be used as an excuse to spend unnecessarily. Only shop online when you actually need to buy something.

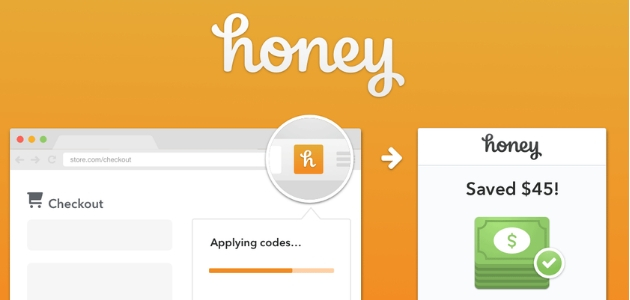

2. Take advantage of coupons to save money

Honey is a free browser extension that atomically finds and applies coupon codes at checkout when shopping online. If you’re looking for a quick and easy way to save money, this can be a great option.

How Honey Works: The extension is straightforward and easy to use. Once Honey is installed, you will see the Honey icon appear as an extension to the store pages of most online retailers.

Simply click on the Honey button to see coupons that are available for a store. When you’re on the checkout page, Honey will pop up. Click “Apply Coupons” and Honey will automatically try all known coupon codes for that shopping site. Honey will apply the code that saves you the most money.

How to get started with Honey:

- Join for Free: Click here to sign up for Honey. Then, you can install Honey.

- Shop Online: When shopping online, click the Honey button to see coupons available for a store.

- Save Money: Honey will atomically apply the code at checkout that saves you the most money.

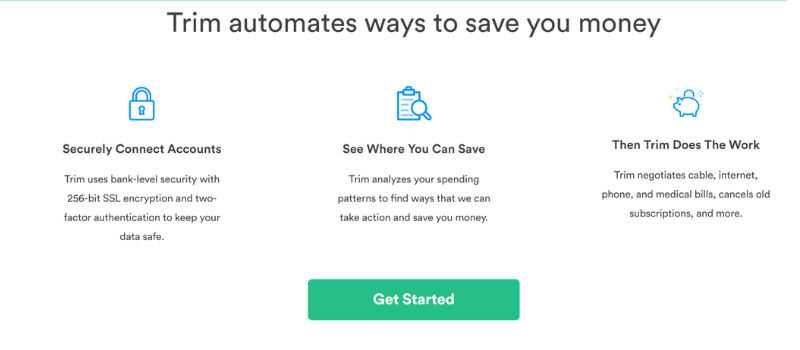

3. Stop paying for subscriptions you don’t use

No matter how closely you pay attention to your monthly bills, I’m sure if you take another look, you’d find at least one subscription that you’re not using. You may even discover a late fee you’ve forgotten about. Oops!

I recently went through all my monthly subscriptions and memberships and noticed there was a few I didn’t need anymore. Now the only monthly subscription I pay for is Spotify. Sam (my boyfriend) pays for Amazon Prime.

If you want to pay less on your monthly bills, consider using this free tool by Trim. This is a digital personal assistant that makes it easy to save money on your monthly bills. All you have to do is sign up here and Trim will do the heavy lifting for you.

Trim will also negotiate your monthly bills, such as your cable, cell phone, and internet bill. Trim works behind the scenes and automates ways to save you money.

Now you can cut your monthly expenses to help grow your savings and pay off debt faster. Simple enough, right?

4. Negotiate your monthly bills

Negotiating your monthly bills, such as your cell phone bill, can be a great way to cut your monthly expenses. I know many of us are attached to our phones today, but chances are we don’t need to be paying for an expensive cell phone plan.

Unfortunately Canadians pay some of the highest prices in the industrialized world for cell phone plans, which is why I talked to my provider to negotiate a better rate.

Because I work from home and live in a big city that has good WiFi connections at most places, I decided not to get a data plan. This saves me A LOT of money each month and I don’t feel like I’m missing out by not having a data plan.

Instead, I pay $25 per month for unlimited nation-wide talk and text (through Rogers). I can appreciate that this phone plan is not for everyone, but it works for me. Switching to a cheaper phone plan can radically reduce your expenses.

I recommend calling your phone provider to negotiate a better rate. You may find that you’re not using all the extras you’re paying for and can switch to a cheaper plan.

5. Meal plan to cut your monthly expenses

Americans spend an average of $3,459 on dining out each year (including take-out, fast food and restaurants), according to the U.S. Bureau of Labor.

You may not think you’re spending that much on dining out, but let’s take a quick look.

If you eat out for lunch Monday though Friday, that’s around $10 per day. This adds up to $50 each week or $2,600 per year.

Don’t eat out for lunch? That’s great! Instead let’s say you eat out for dinner a few times per week. That could add up to $75 per week (including taxes, tip, and delivery fees). This could add up to $3,900 per year.

As you can see, the cost of dining out can quickly add up. And if you don’t mind spending the money (and can afford to do so), that’s fine. But if you’re trying to cut expenses on food, cooking more meals at home is a good place to start.

The #1 way we save money each month and to actually get excited about eating dinner at home is to meal plan. Meal planning is basically just a budget for your food. You get to decide upfront what you’ll be eating during the week.

I like to spend about 10 minutes each week (usually on Sundays) to plan out all my breakfasts, lunches, and dinners for the week. Meal planning helps us save time, money, and reduces food waste.

I like using my Meal Plan Binder to help my keep track and organize healthy meals for my family. You can download your copy of my free weekly meal plan printable below!

New to meal planning? Consider trying the $5 Meal Plan. Many of my readers have told me great things about how this service makes planning meals each week simple and easy.

6. Sell gift cards you won’t use

I’m sure you’ve received a gift card before to a store or food retailer that you’ll never go to. CardCash is an online marketplace that will turn your unused gift cards into cash.

You can sign up for free, sell your unwanted gift card or trade it in for something else. Now you can put that extra cash towards your savings or paying off debt.

7. Save money on your utility bills

When you need to drastically cut expenses, every bit counts. Here are a few ways you can reduce your utility bill and cut housing expenses:

- Adjust your thermostat.

- Use dryer balls to help cut down dryer time.

- Unplug items not being used. This can help reduce your electric bill.

- Invest in blackout curtains. This can help keep warm or cool air from escaping.

- Change filters to keep your vents clean.

- Use energy-saving light bulbs.

Save money and get rewards with OhmConnect – Another great way to save money on utilities is to sign up for OhmConnect. It’s free to join and you’ll get rewarded just by saving energy. OhmConnect community members can earn up to $300 per year.

You can learn more about OhmConnect and sign up here.

8. Cancel your gym membership if you rarely use it

If you have a gym membership that you use on a regular basis, then that’s great. However, if you’re like most people who sign up for a gym membership in January and slowly stop going after a few months, then you may want to re-evaluate your membership.

Lately, I’ve been finding fun ways to stay healthy and exercise at home. I recently purchased these resistance bands and love them! There are many free online classes available that you can do from the comfort of your own home.

9. Take care of what you already own

A good way to cut your monthly expenses is to take care of what you already own. This can help extend the lifespan of the items you have so you don’t have to buy new stuff unnecessarily. Here are some examples:

- Taking your car in for regular maintenance.

- Washing your clothes properly to make them last longer. I like using these mesh laundry bags.

- Filling saggy cushions with new foam to make your couch last longer.

- Vacuuming your carpet frequently to curb the amount of dirt that accumulates. I am obsessed with our Dyson vacuum cleaner. We saved up money to purchase one and it makes cleaning so easy now!

- Using appropriate cleaners on furniture to make it last longer.

10. Shop your closet for new outfits

If you want to cut back on shopping and buying clothes, a great place to start is by getting better mileage from what you already have.

Many of us have items hiding in the back of our closet that we’ve forgotten about or still have the price tag attached. Now is your chance to wear these items. You never know if your least worn clothing will become your new staple items.

To help you wear everything in your closet, I’ve created this free 30-Day Shop Your Closet Challenge. I share this same challenge in my e-book, The Intentional Spender, and many of my readers LOVE it!

Each day (for 30 days) you can follow the different prompts to help you put together new and exciting outfit combinations. The best part is, this challenge is completely free to do. You’ll be using items you already have!

You can download this worksheet below!

11. Resist impulse purchases

Have you ever walked into Target to get something small, such as shampoo and you ended up leaving with a bunch of items that weren’t on your shopping list?

Don’t feel bad if you said yes. It’s called impulse spending and marketers are really good at encouraging consumers to make impulse purchases. This is an unplanned decision to buy a product (or service) right before the purchase is made.

Nearly 90% of Americans have succumbed to the temptation to impulse shopping, according to a recent survey. While it might seem like an impulse buy here and there is harmless, it can sabotage your goals such as paying off debt, building your emergency fund, or saving for a large purchase.

To help cut your monthly expenses, here’s an in-depth post on how to curb impulse spending.

12. Return items you don’t want

If you made an impulse purchase, don’t be afraid to return something you don’t need. Most stores have a 30-day return policy. Check with the store to see what their return policy is.

Please note: You don’t want to return items and come home with more purchases. The key is to return items you don’t need or want so you can put that money back in your pocket.

If it’s too late to return the item, consider selling it for cash. Take a look through your closet and storage to see if there’s any items you no longer use that might have value. You can sell them on Poshmark, Mercari, Facebook, eBay, or Craiglist. Then use the money to put towards paying off debt or your savings plan.

Flip items for profit – If you have old furniture that you no longer want, check out this free workshop and learn how to flip these items for cash. This can be a great side hustle opportunity!

Getting a side hustle can be an excellent way to increase your income and boost your savings. Here’s some helpful posts that are worth checking out:

- 15 fun hobbies that make money

- How to make $100 a day: 42 legit ways

- 15 ways to make an extra $500 a month

13. Stop paying for things you can get for free

There are many surprising ways to cut household costs by getting things for free. Here are some of my favorite things you can get for free:

Books, music and magazines – I used to buy books in the past, but now I borrow them from the library for free. You can also borrow music, stream movies, read magazines, and more.

Free gift cards – If you’re looking for an easy way to earn free gift cards while sitting at home in your pjs, signing up for online surveys can be a great option. My favorite survey sites include Survey Junkie, Swagbucks, and Branded Surveys.

Read Next: 12 ways to get free Starbucks drinks and gift cards

Bottled water – I stopped buying bottled water years ago. Instead I use my Brita Filter to get delicious tasting water at home.

Clothes – Before buying new clothes, I try to see if I can borrow or swap clothes for free with family and friends. Hosting a clothing swap is a great way to get rid of things you no longer wear and get some new clothes for free!

Entertainment – Many cities host free events, which can be a great way to have fun while saving money. Your local library can also be a good place to find live, in-person entertainment.

Vacations – If you’re on a tight budget, that doesn’t mean you have to skip vacations. There are plenty of ways to relax and unwind by having a staycation. Check out these 27 budget-friendly staycation ideas.

14. Stop paying late fees

Late fees can be a quick way to wreck both your budget and credit. The best way to avoid late fees is to use a budget calendar. This is a financial tool designed to help you remember when money is coming IN and when money is going OUT.

When everything is laid out nicely on your calendar, you’ll be less likely to miss a bill payment. This can help you avoid those pesky late fees and cut your monthly expenses.

15. Stop paying bank fees

If you’re paying a monthly fee for your bank account, then I recommend switching to a free bank account. There’s really no reason to pay for the bank to store your money.

As you can see, there are many ways you can cut your monthly expenses. For more helpful ways on how to cut expenses on the family budget, consider checking out these posts: