No matter your income level or financial goals, you need to make a monthly budget. For many people, the thought of budgeting can be overwhelming, especially if you’re not sure how to get started. Learning how to create a budget doesn’t have to be complicated.

It’s simply the process of making a plan for how to spend and save your money. With the right tools, you can learn how to make a monthly budget with ease.

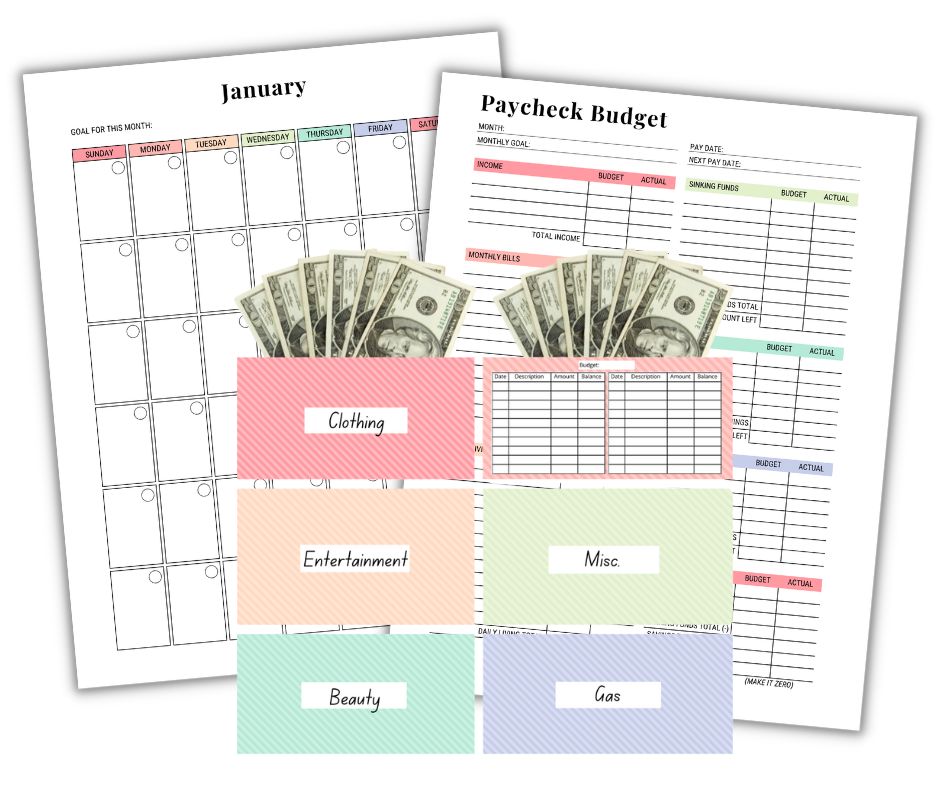

Before starting your budget, download the Mint Notion budget template. You can use these budgeting worksheets to help you easily create a successful budget.

Creating a plan for your money is the first step in taking responsibility for your finances.

These are the same budgeting worksheets I used to help me break the cycle of living paycheck to paycheck, stop buying unnecessary things, and save my first $100,000 in my mid twenties. If you’re interested, you can grab them here.

UPDATE: This step-by-step guide will show you how to create a basic budget for beginners. If you’re looking for a guide on how to make a budget that’s tailored to your unique goals and lifestyle, consider checking out the following posts.

- How to make a zero-based budget (Great for those who get paid once per month)

- How to budget when you get paid bi-weekly (Great for those who get paid bi-weekly or twice a month)

- How to budget when you live paycheck to paycheck (Great for those who want to stop living paycheck to paycheck)

- What is the 50/30/20 budget rule? (Great for those who are brand new to budgeting)

- How to start using the half-payment method to budget (Great for those who struggle to make ends meet each paycheck)

Table of Contents

1. Set realistic goals

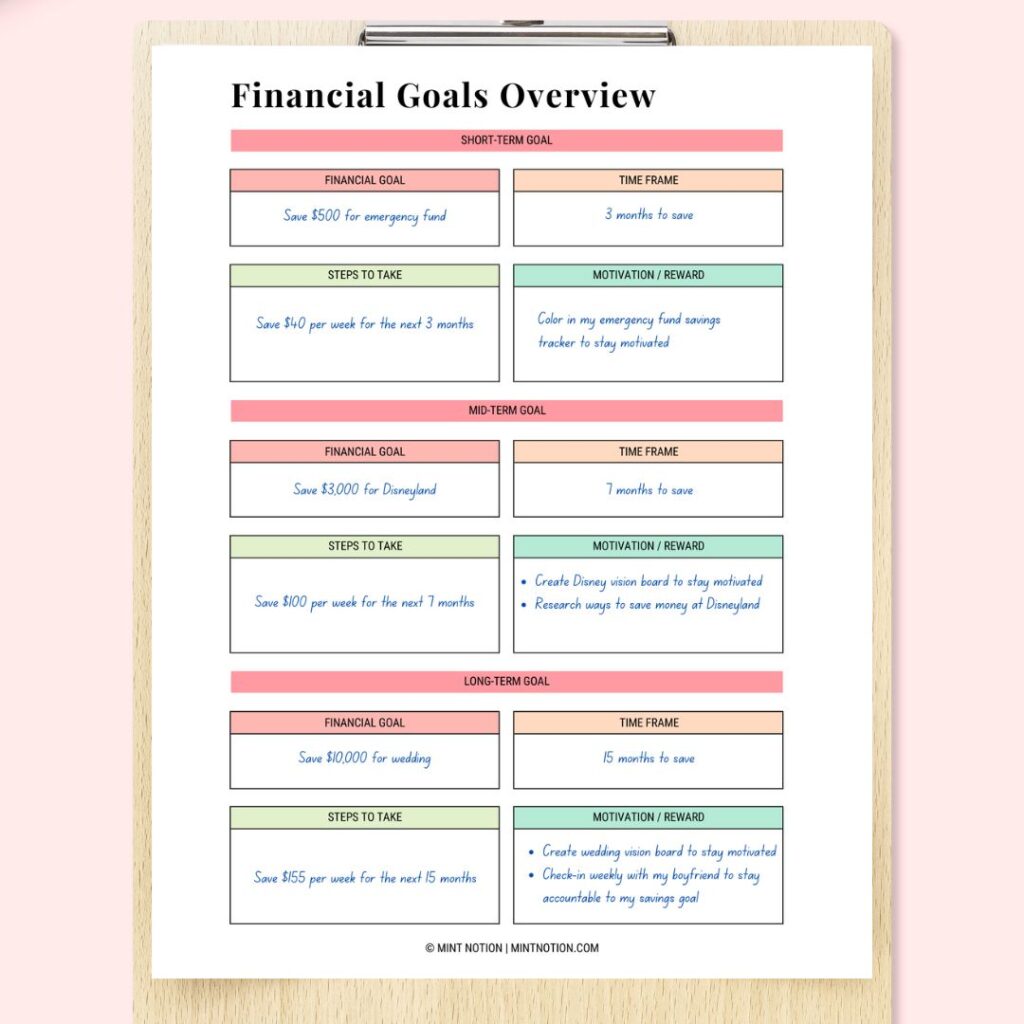

The first step in creating your budget is to set realistic goals for your money. Setting goals can help you make smart spending choices going forward. Plus, it creates a plan for your money, so you can prioritize what’s most important to you.

Ask yourself: What do I want my finances to look like in one year?

If you’re not sure which goals you’d like to set, here are some common financial goals to help you brainstorm ideas:

- Build an emergency fund

- Pay off debt

- Stop living paycheck to paycheck

- Plan for early retirement

- Save money for a house

- Spend less than you earn

If you still need help in determining your financial goals, I recommend checking out this post here: 5 Things To Do Before Creating A Budget

PRO TIP: The best way to achieve your goals is to make sure your monthly budget aligns with your financial goals. This means you’ll want to include your goals WITHIN your budget.

2. Identify your monthly income

The next step in creating your budget is to calculate your monthly income.

You can create your own budget sheet, or use my Income Tracker worksheet to list all your income. Make sure to include ALL sources of income such as wages from your job, rental income, side job income, child support, business income, and so on.

Do you earn irregular income? If your income varies from month to month (like mine does), you’ll want to pay yourself a “monthly salary”.

To do this, use the lowest income month from the past 12 months as your “base salary”. This will be the amount you’ll use to base your budget around. When extra money comes in, save it or put it towards your monthly debt repayment plan.

I don’t recommend using your average monthly income as your “base salary”. Using your lowest income month from the past 12 months will provide a bigger cushion and reduce the risk of overspending.

3. Make a list of all your fixed monthly expenses

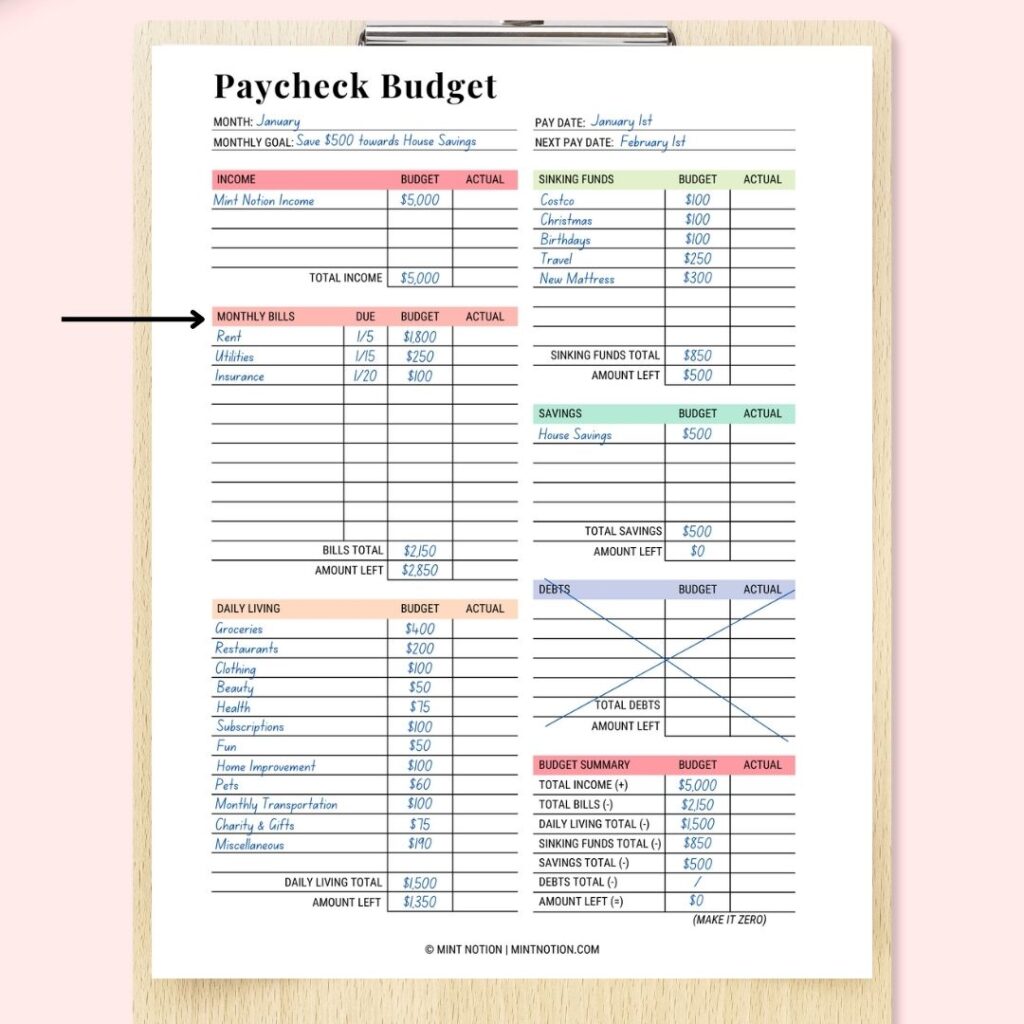

Once you have figured out your monthly income, it’s time to write down all your fixed monthly expenses. If you’re using my worksheet, write them down under the “Monthly Bills” section.

These are expenses that you MUST pay each month, such as rent / mortgage, electricity, gas, water, savings plan, debt payments (credit card, car payments, student loans, personal loans), and so on.

Think of your monthly expenses as costs that you can NOT go without paying.

NOTE: Your groceries can be considered a fixed monthly expense, since you need to buy groceries to eat. However, I like to include them in my “Variable Expenses”. You can choose to include them in your fixed or variable expenses, it’s up to you.

If you’re new to budgeting, I recommend going through your bank statements for the past few months (you can usually find these online), to determine all monthly fixed expenses.

If these expenses vary from month to month, then I recommend calculating the average amount for each expense category.

You can create your own budget sheet, or use my Zero-based budget worksheet to list all your Fixed Monthly Expenses.

This will cover the following expense categories: Housing, Utilities, Debts, Transportation, Medical, and Savings. This sheet provides a breakdown of each budget category to help you keep things organized.

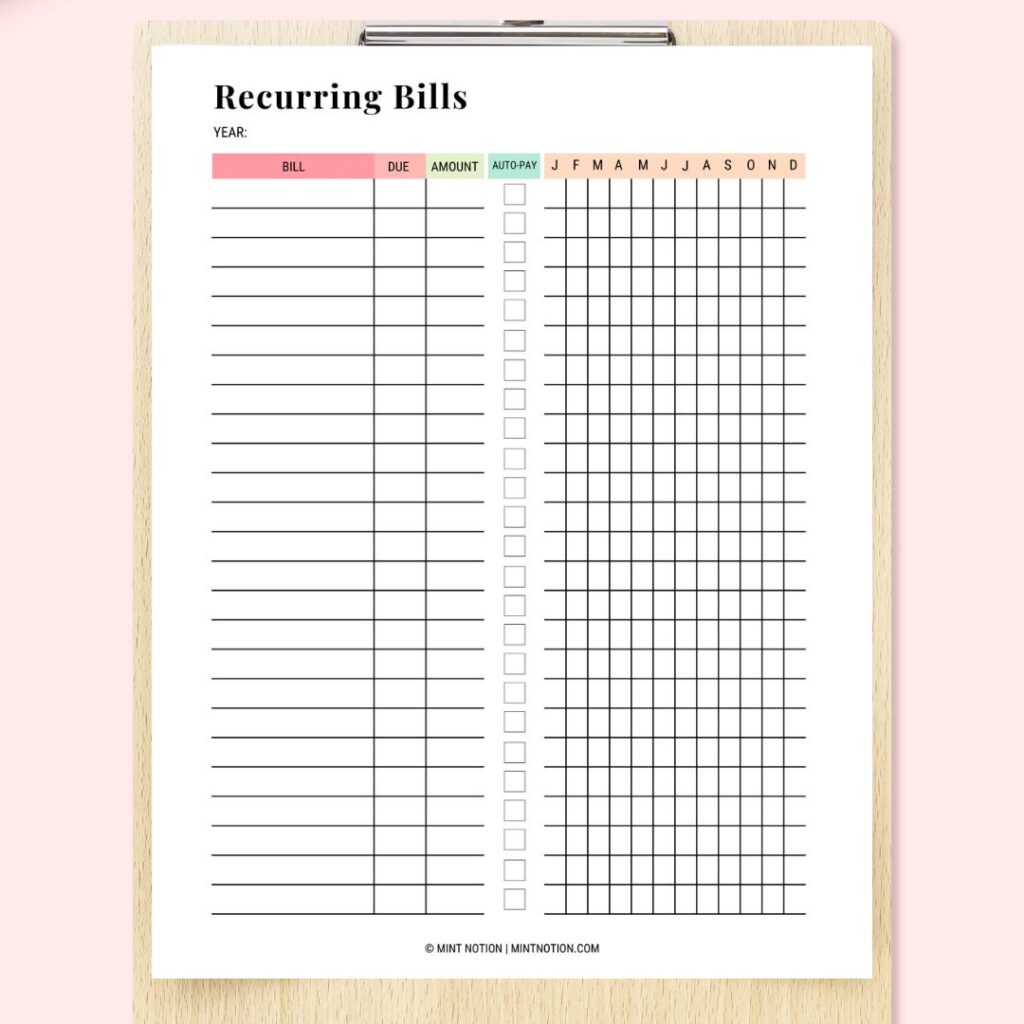

PRO TIP: You may have quarterly or yearly fixed expenses. Use the Recurring Bills worksheet to write down all these expenses to make sure that you never miss another bill payment.

After you’ve written down all your fixed monthly expenses, you’ll want to subtract this amount from your income.

For example, if your Total Monthly Income is $3,000 and your fixed monthly expenses are $2,000, this means you have $1,000 left for your variable monthly expenses.

Read Next: How to use a budget calendar to pay your bills

4. Make a list of all your discretionary spending (variable expenses)

Now that you’ve determined all your fixed monthly expenses, it’s time to write down all your discretionary spending (also known as your variable expenses).

These are non-essential expenses, such as dining out, vacations, entertainment, lunch with friends, gifts, clothes, shoes, and so on.

You can create your own budget sheet, or use my Zero-based budget worksheet to list all your monthly variable expenses under the “Daily Living” section.

This will cover the following expense categories: Personal, Gifts / Donations, Food & Pantry, and Kids & Pets.

If you’re not sure what you’re monthly variable expenses are, I recommend tracking your expenses for a month. This will help you figure out which spending categories to include in your budget.

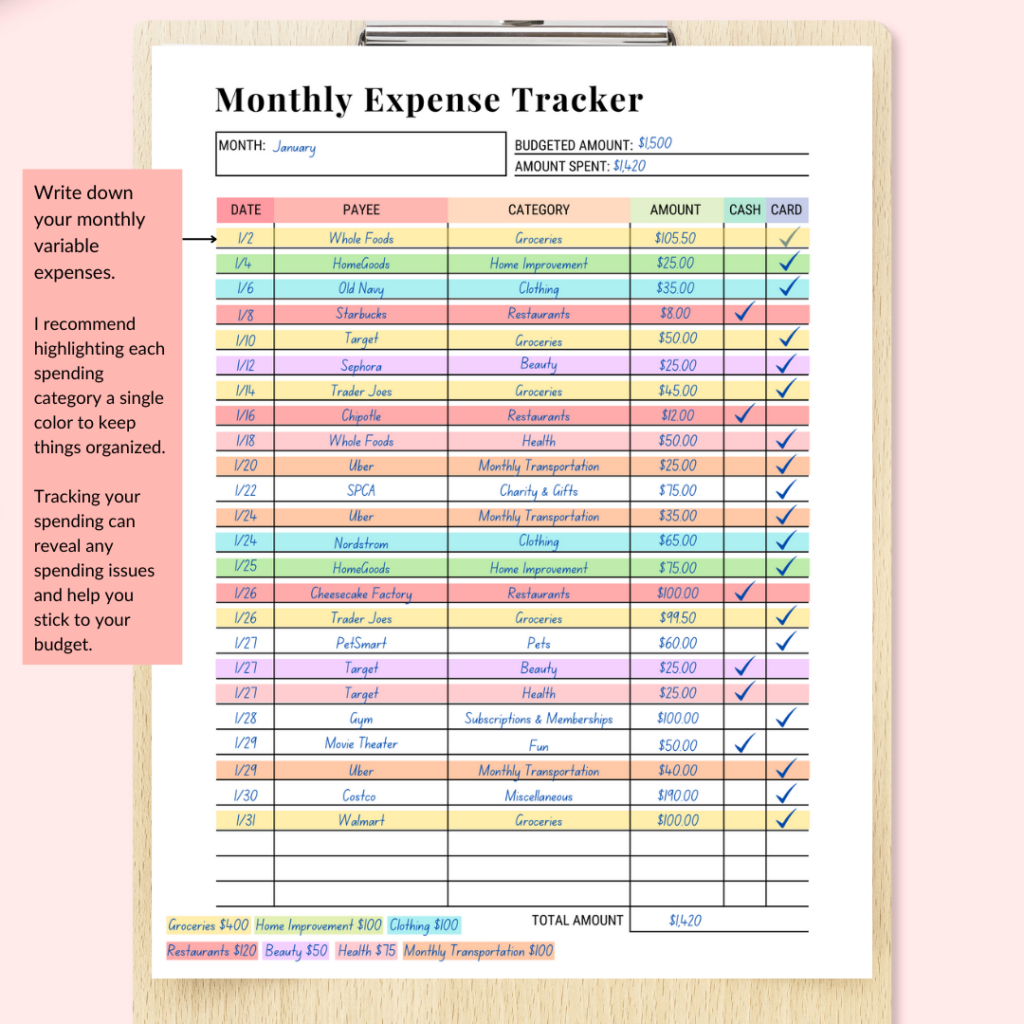

Below is an example using my Monthly Expense Tracker worksheet.

I know creating a budget for the first time can be overwhelming for many people. You’re already half-way through these steps. There’s just a couple more to go. Take a quick break if you need it. You’re doing great!

Notice how your discretionary expenses come AFTER your goals, income, and monthly fixed expenses.

This is because it’s important to prioritize your goals. You may find it’s necessary to temporarily reduce your variable expenses until you can reach your financial goals.

For example, we recently bought a new fridge for our apartment. To make this savings goal a priority, we reduced our monthly eating out budget by cooking more meals at home. This let us save enough money to buy our new fridge.

PRO TIP: You may find that you can reduce or even eliminate an expense. For example, when I moved into my new apartment, I canceled my gym membership because my apartment already had a gym (included in my condo fees). This let me save more money each month.

Read Next: 15 ways to cut your monthly expenses

5. Subtract your monthly expenses from your income

Now it’s time to subtract all your monthly fixed and variable expenses from your monthly income.

You can create your own budget sheet, or use my Zero-based budget worksheet to help you do this under the Budget Summary section.

If you get a positive number, this means you’re spending LESS money than you earn. This is great! You can put this leftover money towards your savings plan or paying off debt. Every dollar should have a job.

If you break even, this means you’re currently spending the EAXCT amount of money you earn.

You may want to take another look at your discretionary spending and see if you can reduce it. This will give you a bigger cushion in case something comes up that you didn’t plan for.

If you get a negative number, this means you’re spending MORE money than you earn. This is not good.

The quickest way to adjust your budget and make sure you break even or get a positive number next month is to reduce your discretionary spending.

If you’ve already reduced your discretionary spending, you may want to find ways to temporarily cut back on your fixed expenses.

For example, we got rid of cable to reduce our monthly fixed expenses. I also switched to a cheaper cell phone plan by negotiating a new rate with my mobile provider.

PRO TIP: You want to make sure your financial goals are being met BEFORE spending on discretionary things. This means you’ll want to prioritize your monthly savings and debt repayment goals first.

After making adjustments and cuts to your fixed and variable spending, the next step is to increase your income. Making extra money each month can be an excellent way to save more and pay off debt faster.

If you’re creating a budget for the first time, this is the part where many people want to run and hide. You may even cry after seeing your number (tears are common at this point). Whether it’s positive, you break even, or you get a negative number, knowing what your number is can help you plan your financial future.

You’ve just completed the hardest part in creating your budget. Congratulations! Now it’s time to make your money work for you!

Read Next: How to budget when you get paid biweekly

6. Make adjustments to your budget to match your goals

This is the final step in creating your budget, but it’s also the most important step! Here, you’ll want to adjust your monthly expenses to make the most of your income.

Once you start reworking the numbers and finding ways to make temporary spending cuts, you’ll feel better. Remember that it’s okay to take baby steps. This is YOUR financial journey.

- Do you need to eat out for lunch every day?

- Do you use your gym membership regularly?

- Do you need an expensive cell phone plan?

- Do you need to buy new clothes each week?

These are some questions I asked myself when creating my first budget. By reducing or eliminating some of these expenses, this let me free up more money which could be applied towards my savings plan or mandatory expenses.

Budgeting is about telling your money where to go, instead of wondering where it went. It involves making some tough choices if you want to reach your financial goals.

PRO TIP: If you’re finding it difficult to manage your monthly bill payments, a helpful budgeting hack you can use is the half-payment method. If you’re interested, you can check out this post to learn more: Will the half-payment method work for you?

Before writing down your budget, it’s important to decide which budget will work best for your lifestyle and financial goals. Here are a few budgeting methods you may want to consider:

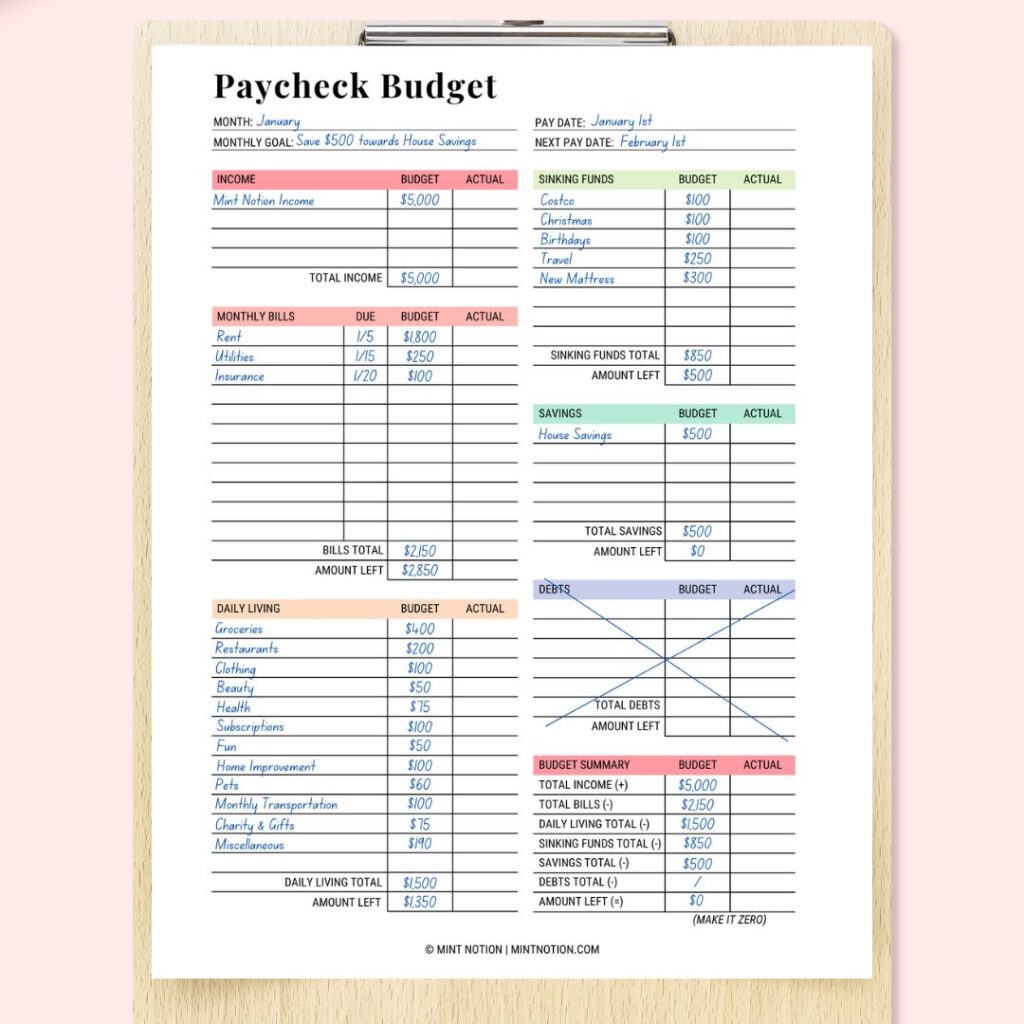

Paycheck Budgeting

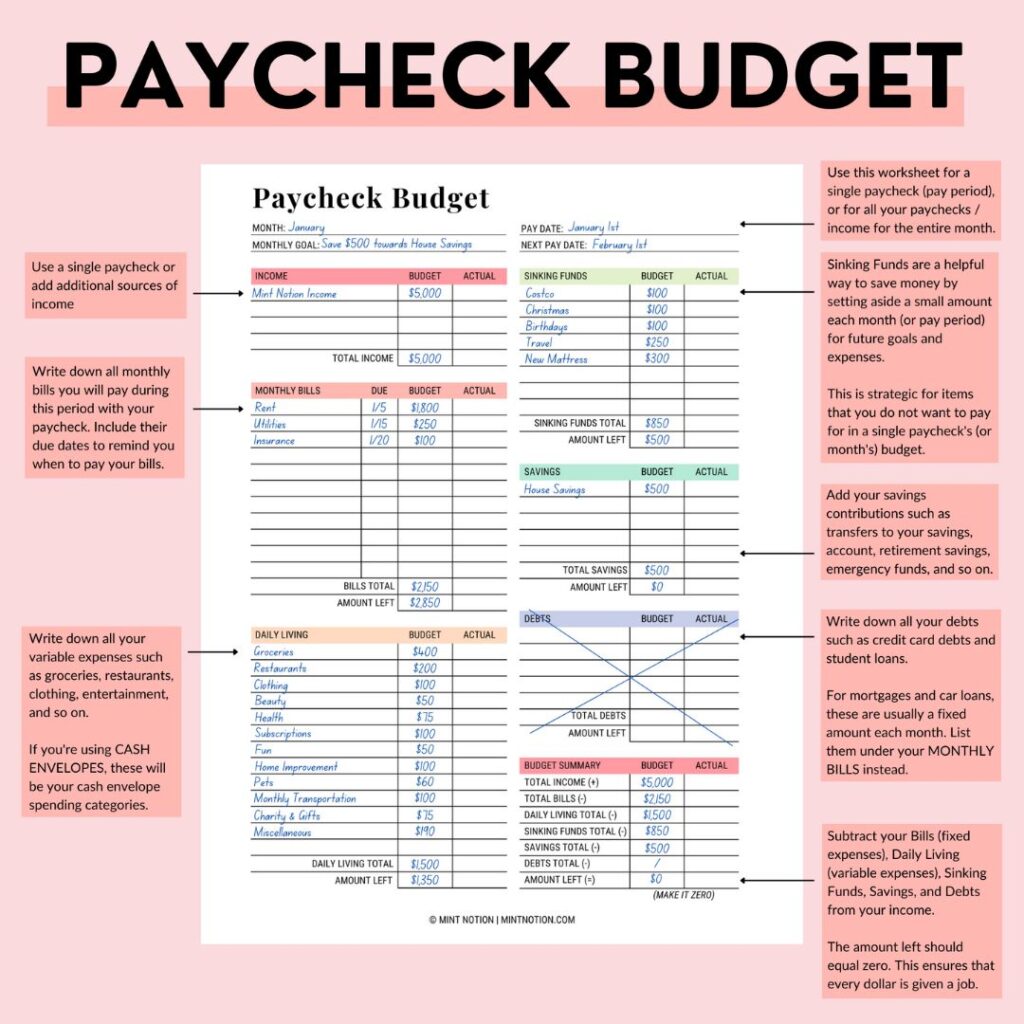

If you’re living paycheck to paycheck, this budgeting method can be a great way to break the cycle. When I was in college, I had two part-time jobs and lived paycheck to paycheck.

The Paycheck Budgeting method was the key to helping me get a handle on my finances.

Instead of looking at your month as a whole, such as with traditional budgeting methods, paycheck-to-paycheck budgeting means you’ll be able to see which paycheck pays for which expenses.

To get started, you can use my Paycheck Budgeting worksheet available in my Budget Binder Printables package. Or feel free to create your own worksheet. It’s up to you!

Read Next: How to budget when you’re living paycheck to paycheck

Zero-Based Budgeting

This budgeting method means your income minus expenses will equal zero. With a zero-based budget, every dollar you have is assigned a job.

Some of your dollars will be assigned to paying expenses, some of them will go towards your savings, investments, or paying off debt. I am a big fan of this budgeting method.

This budgeting method doesn’t mean you have zero dollars in your bank account. It means every dollar has a job and you should have zero dollars left in your budget.

For example, if you earn $3,000 per month, you want to make sure every expense, savings, or investment will add up to $3,000. This budgeting method can help prevent overspending.

Read Next: What is a zero-based budget?

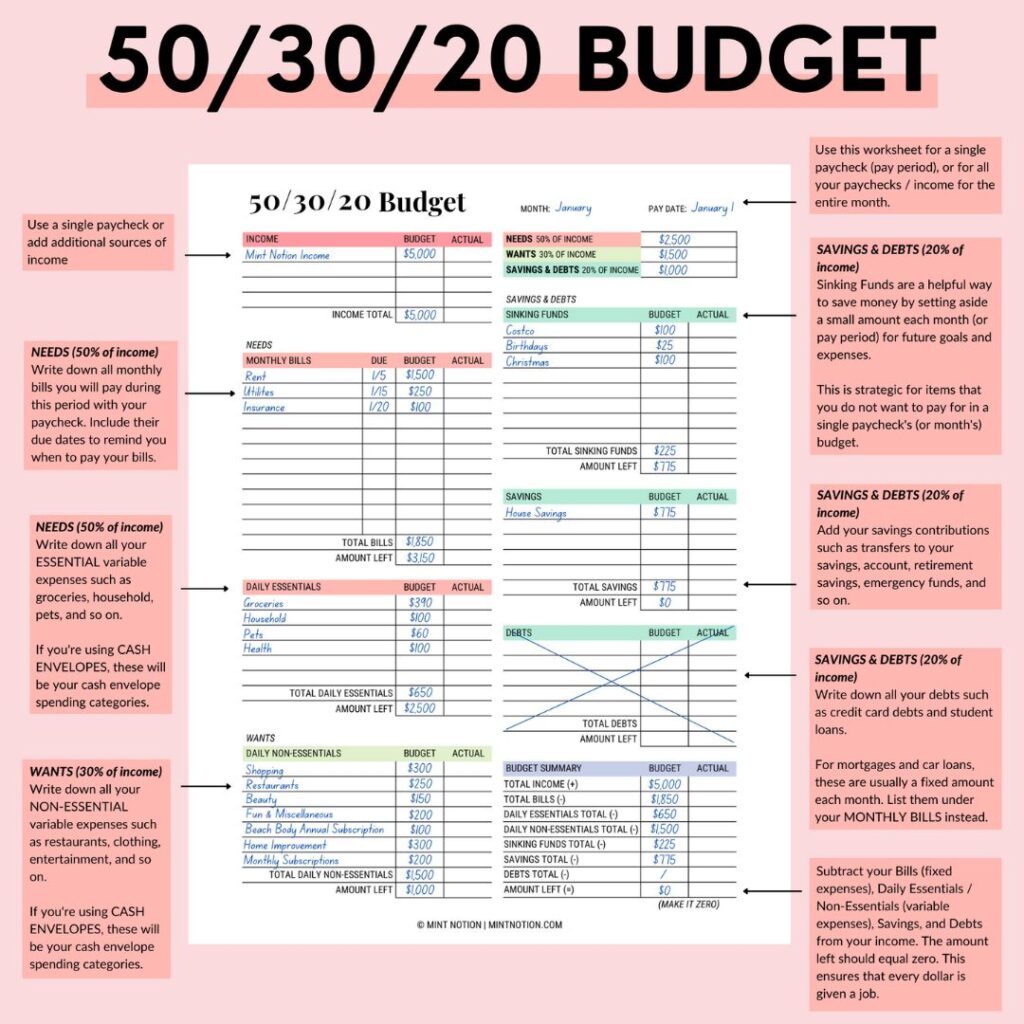

What is a 50 / 30 / 20 budget rule?

With this budgeting method, you’ll allocate your after-tax income as follows:

- 50% towards your needs (rent / mortgage, utilities, minimum debt repayments, groceries).

- 30% towards your wants (dining out, entertainment, clothing).

- 20% towards your savings (bank savings, emergency fund, investments). Your savings can also include extra debt repayments.

This approach is simple and offers lots of flexibility. However, budgeting 30% for your wants can lead to irresponsible spending.

I personally would prefer to spend less on my wants and put more money towards my savings or paying off debt (if you’re in debt).

The key to making this budgeting method work is to automate your savings and debt repayments so you don’t overspend on your wants.

Read Next: How to use the 50/30/20 budget rule

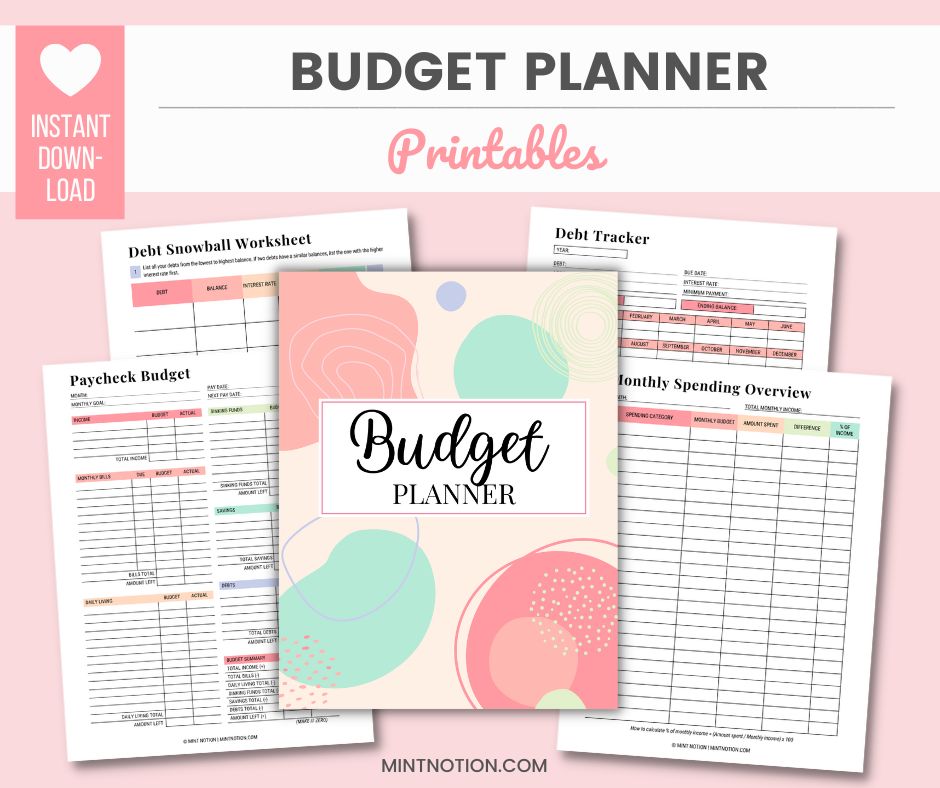

Whatever budgeting method you choose to follow, having the right tools can help you do it with ease. You can use the worksheets available in my Budget Binder Printables package, or you can create your own.

The important thing is to implement your new budget, reflect to see how your budget is working for you, and make adjustments to ensure your budget is aligned with your financial goals.

I also recommend scheduling a “weekly reflection”. If you’re single, then you don’t have to worry about including others in your weekly meeting. If you have a partner or family, then budgeting is a team project.

You can set aside Saturday morning or Sunday afternoon to check-in and see how your budget did this past week.

Then you can make adjustments (as needed) to prepare your budget for a successful financial week ahead. Monitoring your budget is the key to staying on track!

Final Note

Whew! You’ve made it to the end of this post and completed all the essential steps towards creating a successful budget.

Remember the first month or two of budgeting can be overwhelming. But it’ll become easier to stick to your budget once you get the hang of it.

You work hard for your money, so it’s time to start making it work for you. Think about what you want your finances to look like a year from now.

By starting today, you’ll begin planting the right seeds for a successful financial future.

Live the life you’ve always imagined with the right tool at your fingertips. The Budget Planner can help you get there.

These printables were hand-crafted to help you save time when organizing your finances, stop living paycheck to paycheck, save more money, pay off debt fast, and more!

Use these functional sheets to create a budget tailored to your specific needs and goals.